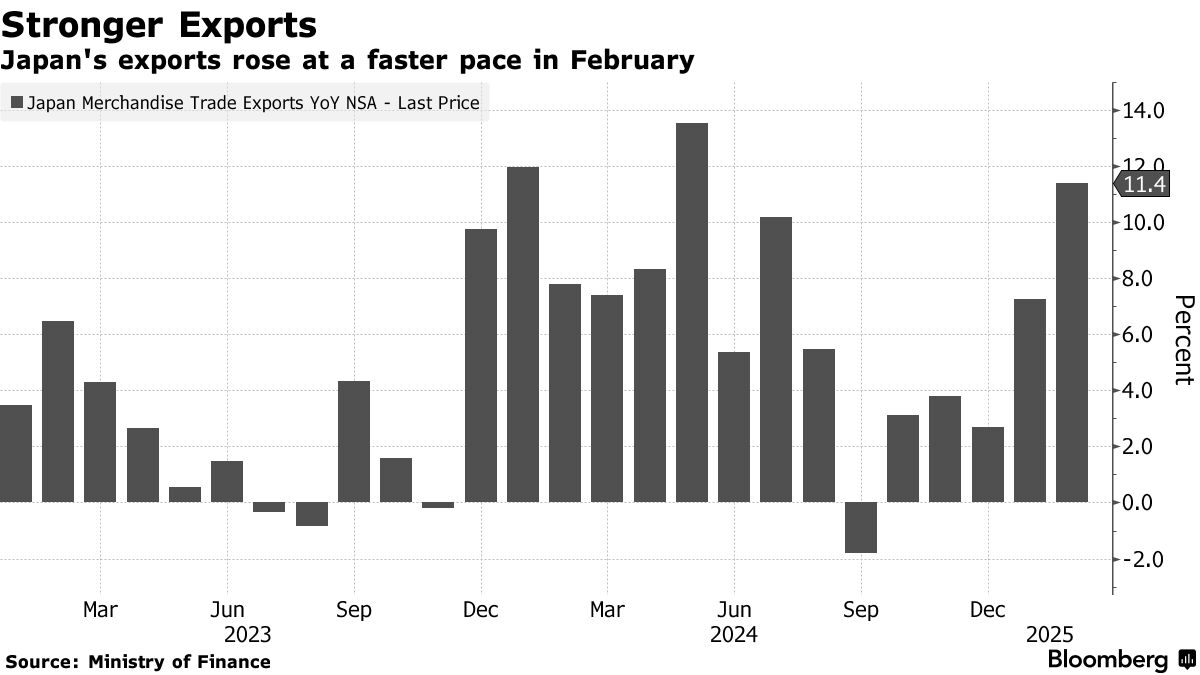

| Japan's trade balance switched back into surplus last month amid several mixed signals — the value of shipments abroad grew while imports unexpectedly fell — during a period of high uncertainty for major exporters worried about imbalances with the US. Yet economists are warning warn that the growth in exports may not be sustainable, citing weak overseas demand and potential disruptions from the escalating trade war between the US and other nations. (Read the full story from Wednesday's trade numbers here.) Fresh tariffs on steel and aluminum started hitting the Asian nation last week, and its manufacturers face the prospect of reciprocal tariffs on a variety of sectors plus a 25% auto levy set to start in early April. Also on Wednesday, the Bank of Japan signaled growing unease over the potential impact on the global economy from escalating trade tensions, while keeping its key policy rate unchanged. The central bank added a reference to trade policies to its list of risks to the outlook. The BOJ's messaging is the latest from a central bank that's signaling concern about disruptions, growth headwinds and a return of inflationary pressures from a trade war between the world's largest economies. To lower the impact from any tariffs imposed by President Donald Trump, Japanese companies are already stockpiling goods in the US, according to a survey by Bloomberg News. Japan has so far failed to get an exemption from direct levies from the Trump administration, despite a seemingly positive meeting between the two nations' leaders in February. Read More: Japan's GDP Growth Imperils 2% Defense Spending Target Japan's trade surplus with America widened 29% last month from a year earlier, with auto shipments increasing almost 14%. Trump has long criticized the US trade deficit with Japan, and the president recently accused Japan and China of gaining an unfair advantage through foreign exchange policy, which Japan has denied. Related Reading: —Brendan Murray in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment