| I'm Chris Anstey, an economics editor in Boston. Today we're looking at the Fed's policy meeting. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Central banks in Japan and Indonesia kept interest rates unchanged, and Iceland slowed easing. Brazil may hike today and early tomorrow Sweden could stay on hold while Switzerland might cut.

- Euro-area inflation slowed more than initially reported, strengthening the case for the European Central Bank to lower borrowing costs.

- Data centers are booming in the US, but tariff hikes threaten to make the AI-linked build-out that the Trump administration wants more costly.

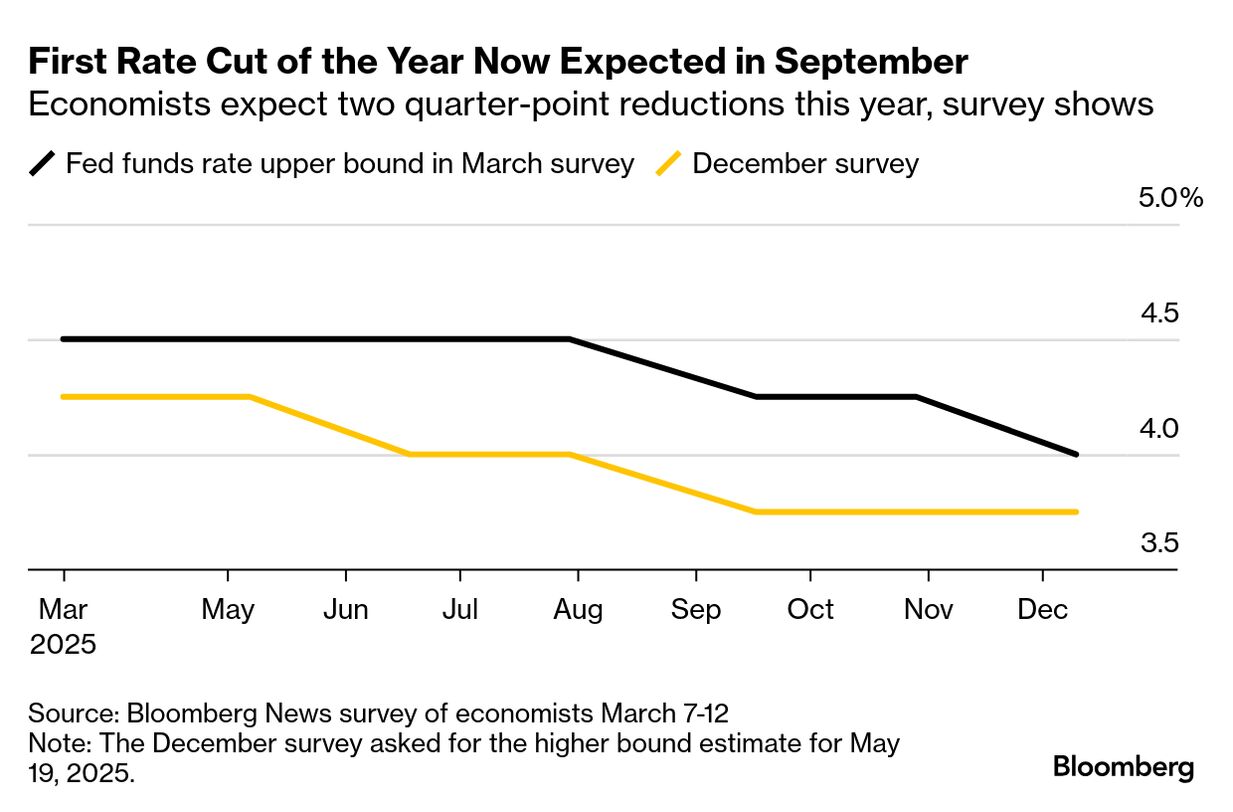

With so many elements of US government policy in flux at the moment, millions of Americans are holding off on economic decisions. The Federal Reserve's rate setting panel is set to join them on Wednesday. Every single forecaster among the 108 surveyed by Bloomberg forecast the 12-member Federal Open Market Committee to keep policy on hold, with 4.5% as the upper bound of the target range. That would mark the second straight meeting of standing pat, after Chair Jerome Powell and his colleagues implemented three cuts late last year totaling 1 percentage point. Confronting the Fed — and the economy as a whole — is an unusual amount of uncertainty about the outlook for growth and inflation in coming months and quarters. President Donald Trump is planning to add to his tariff hikes with a major announcement on April 2, but even Bessent said Tuesday he hasn't seen the numbers yet. Then there's the DOGE-led cutbacks to federal spending and payrolls, alongside an immigration crackdown that's spurred legal battles. The wave of deregulation that was expected after Trump returned to the White House has yet to materialize, or at least to materialize enough to spur an acceleration in economic activity. Small businesses, whose optimism surged after Trump's win, have lately pared back their capital-spending plans toward a five-year low. Consumers, too, are pulling back, as February's disappointing retail sales release illustrated. Their sentiment deteriorated further in March, a University of Michigan report showed. "Frequent gyrations in economic policies make it very difficult for consumers to plan for the future," Joanne Hsu, director of the Michigan survey said. Private-sector economists have been trimming their economic growth forecasts, and modestly boosting recession-risk estimates. Bessent himself said there may be some sort of "pause" as the nation transitions away from an "unsustainable" level of federal spending. Fed policymakers will need to decide whether, and by how much, to trim their own GDP forecasts — their updated quarterly projections are due Wednesday alongside the rate decision. Back in December, their median estimate was 2.1% for this year. Then there's the inflation side. Tariff hikes have stoked concern about a fresh impulse to consumer prices — with the Fed not having completed the job of getting things back to its 2% target. The latest reading for the core PCE gauge, which strips out food and energy, was 2.6%. The previous year-end median Fed forecast was 2.5%. As for the Fed's new policy-rate outlook, the question is whether the median of officials' forecasts sticks with two cuts for 2025, as in December. Diane Swonk, chief economist at KPMG, said, "There's going to be a fairly wide dispersion on the trajectory for rate cuts." "Because of the uncertainty." Don't Miss the Latest Trumponomics Podcast | On this week's episode, we take the long view on market upheaval caused by Trump's economic policies. Host Stephanie Flanders speaks with Tom Orlik, chief economist for Bloomberg Economics, about what could happen over the next few years. Orlik offers some historical perspective on Trump's moves and whether — despite all of the damage inflicted over the past two months — this bumpy road may still take the economy to a better long-term destination. Listen here and subscribe on Apple, Spotify, or wherever you get your podcasts. The Best of Bloomberg Economics | - Most UK regions are set to fall further behind London over the next three years, highlighting the government's challenge to improve living standards.

- Colombian Finance Minister Diego Guevara resigned after only three months in office.

- India, the world's second-biggest steel producer, is planning to impose duties of 12% on most imports of the metal, to protect the domestic industry.

- South Africa's inflation was unchanged on the eve of a widely expected rate pause by the central bank amid a contrast of policy across the continent.

- France's political instability, high taxes and economic malaise have prompted international banks in Paris to quietly shelve expansion plans.

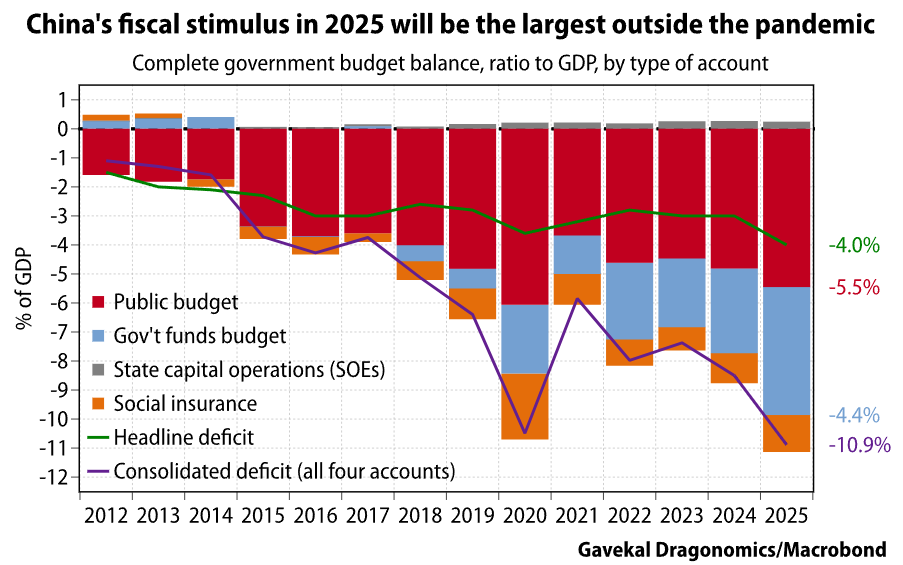

Thanks to multiple, separate budget accounts maintained by China's Ministry of Finance, the nation's fiscal picture is murky — making it tough to tell exactly how much stimulus the government is implementing and leading to widely differing interpretations of what's going on. Andrew Batson at Gavekal Research reckons the true 2025 fiscal deficit will come in at 10.9% of GDP, after adding up all government revenue, subtracting outlays and netting out transfers between accounts. That's way more than the 4% official figure, and amounts to a 2.4% of GDP fiscal impulse, more than double what Beijing is targeting, Batson says. Beyond its big size, China's stimulus "involves some shift of expenditure toward larger household income transfers," including through pension outlays, Batson wrote in a note Tuesday. There's no guarantee this will all be enough to offset China's downside risks, but "these long-awaited changes are meaningful and directionally positive," he said. And given the large underlying deficit, there'll be a need for consolidation down the line. |

No comments:

Post a Comment