| Bloomberg Evening Briefing Americas |

| |

| Jerome Powell weighed in on the state of the US economy Wednesday, and while the Fed is holding rates steady, its chairman's outlook wasn't entirely reassuring. Unsurprisingly, he pointed to Donald Trump's polices as one reason why inflation is reigniting. The central bank sharply reduced its 2025 growth projection and Powell noted that uncertainty around the slowing economy is increasing. "Inflation has started to move up," he said, adding that "there may be a delay in further progress over the course of this year." Investors have reacted negatively to Trump's global trade war and the mounting retaliation from abroad, with the S&P 500 falling close to 10% from mid-February. Trump meanwhile has done little to ease recession fears, with the Republican saying the economy faces a "period of transition" and that his tariffs will eventually mean more US jobs. Some economists have suggested the opposite, dubbing tariffs a "lose-lose." Powell was, as always, more modulated, saying recession odds have moved up but aren't high. He pointed to so-called soft data as a concern, but pushed back against a University of Michigan survey showing a sharp increase in long-term inflation expectations. Inasmuch as markets today looked to Powell for direction, the takeaway was that things could be worse. Here's your markets wrap. —David E. Rovella | |

What You Need to Know Today | |

| |

|

| Benjamin Netanyahu is following up on his sudden ending of Israel's ceasefire with Hamas by sending troops back into the decimated Gaza Strip, with soldiers returning to positions outside population centers as the embattled prime minister vows to continue until all hostages are released. During the short truce, Hamas freed some 38 hostages, most of them alive, in return for more than 1,000 Palestinians imprisoned by Israel. But talks between the warring parties have been at a stalemate. Israel has reportedly killed hundreds of Palestinians in the days since the ceasefire was breached, adding to the more than 48,000 whom Hamas health officials said have been killed since the Oct. 7, 2023, attacks. Israel said 1,200 people were killed by Hamas and other militant groups that day, with hundreds more kidnapped.  Palestinians mourn relatives killed by Israeli airstrikes at the Al-Ahli hospital in Gaza City on March 18. Israel launched overnight airstrikes across Gaza, shattering a nearly two-month ceasefire with Hamas. Photographer: Ahmad Salem/Bloomberg | |

|

| Private equity firm Hellman & Friedman is said to have selected banks to lead the initial public offering of security group Verisure, potentially one of the largest listings in Europe in recent years. Goldman Sachs and Morgan Stanley were tapped as global coordinators for the IPO. Verisure's listing would serve as a much-needed boost to the European market for offerings, which has slowed recently amid market volatility. The private equity owners of German drugmakler Stada Arzneimittel have decided to push back its IPO until September, Bloomberg News reported this week | |

|

| Private equity firms are called that because they own stakes in the companies they buy. These days this assumption is looking outdated, and the reason why could give everyone pause. As buyout funds struggle to sell businesses in a moribund M&A market made worse by America's tariff war, many are turning to cash-rich credit investors for money to pay dividends to themselves and their backers. A few are getting back as much as they first invested, if not more—in effect leaving them with little or no equity in some of their biggest companies. Already this year, more than 20 businesses in the US and Europe have borrowed to make payouts to their owners, according to Bloomberg-compiled data, meaning they have less financial "skin in the game" if things ever go sour. | |

|

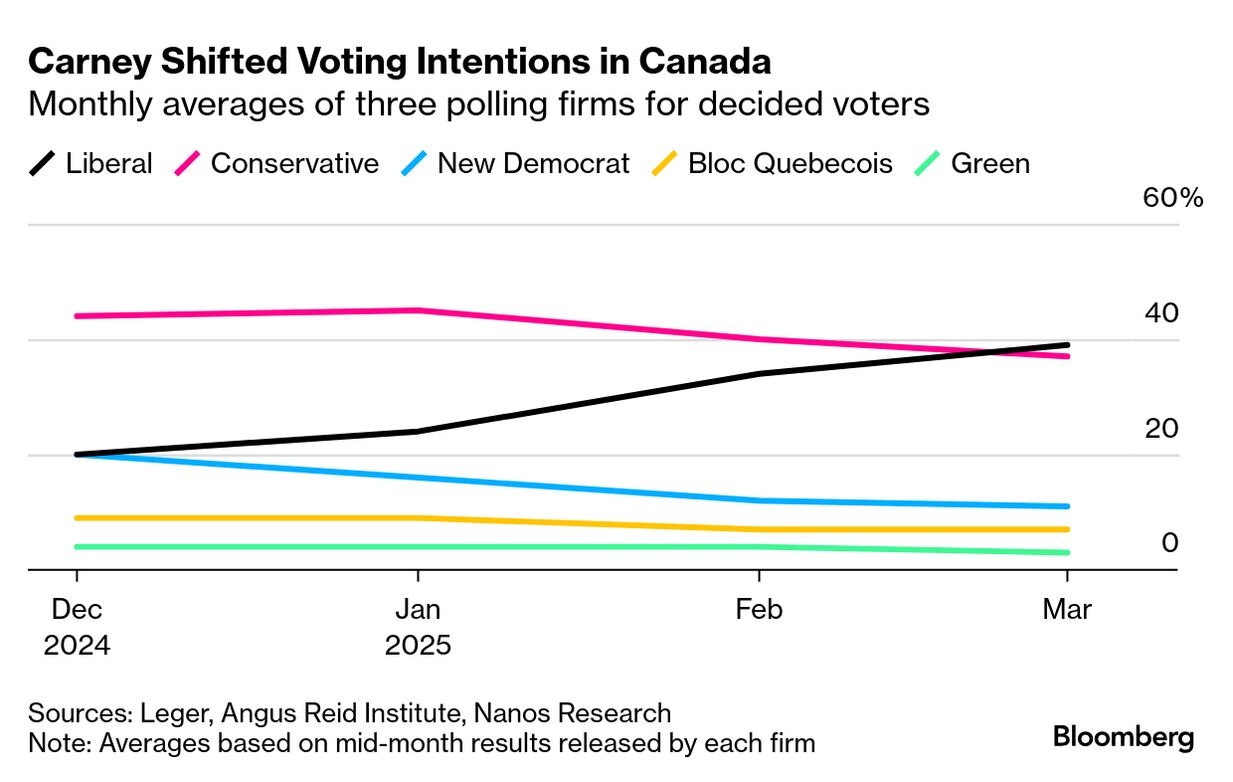

| Canada's Liberal Party has jumped into a lead in some public opinion polls on the eve of the election, accelerating the sudden change in fortune for the party and its new leader, Mark Carney. Leger Marketing has the Liberals at 42% among decided voters, compared with 39% for Pierre Poilievre's Conservative Party. No other party is in double digits in the survey, which was taken from March 14 to 16, the first few days of Carney's tenure as prime minister. The survey comes on the heels of a poll published Monday by the Vancouver-based Angus Reid Institute that also has the Liberals at 42%, with the Conservatives at 37%. Support for Carney's Liberals in that poll has doubled since December. If those numbers were to hold in a national vote, the most probable outcome would be a majority of seats for the Liberals in the House of Commons. | |

|

| An Abu Dhabi sovereign investor is forging a $25 billion US partnership to invest in power generation for data centers and artificial intelligence projects. ADQ, a fund from the capital of the United Arab Emirates, and investment firm Energy Capital Partners will initially put in a combined $5 billion. The partnership ultimately plans total investments of more than five times that, mainly on US assets. The deal was unveiled soon after Trump hosted Sheikh Tahnoon bin Zayed Al Nahyan, the UAE's national security adviser and a brother to its president, at the White House. The Abu Dhabi royal chairs ADQ, which is a $249 billion sovereign wealth fund. "This is only the start," Hamad Al Hammadi, ADQ's deputy group chief executive officer, said in an interview. "We don't have an issue of increasing the capital if opportunities arise." | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment