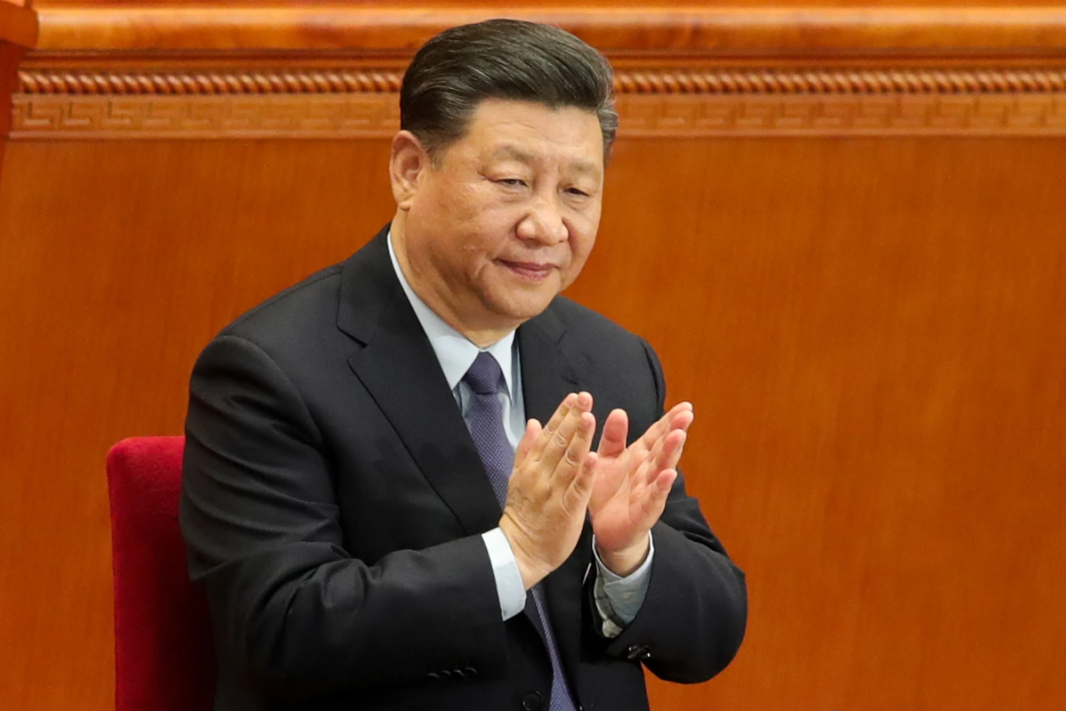

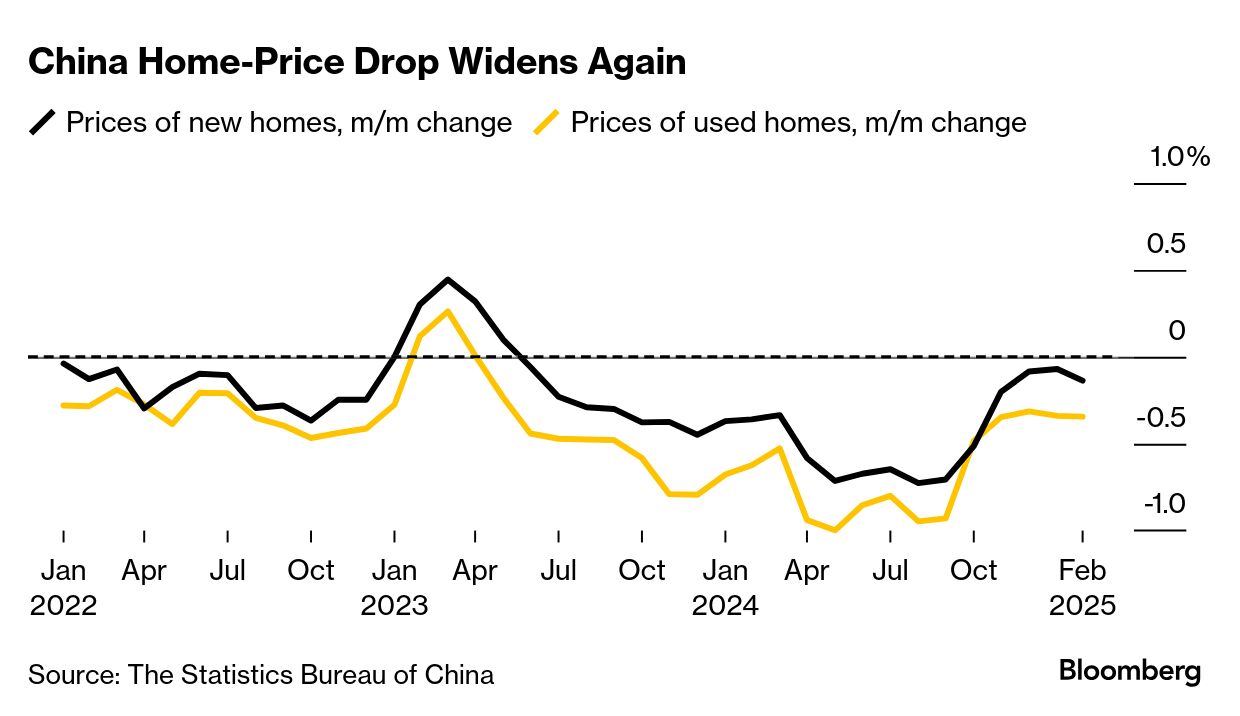

| Hi, this is John Liu writing from Singapore, where I had the pleasure this week of participating in our first in-person event in Asia for Bloomberg's digital subscribers. I was joined for a panel discussion by four amazing colleagues: Nancy Cook, senior US national political correspondent; Shuli Ren, who writes fantastic columns about markets in China and beyond; Tim O'Brien, who leads Bloomberg Opinion and the author of TrumpNation: The Art of Being the Donald; and K Oanh Ha, the host of our flagship Asia audio offering, the Big Take Asia Podcast. Our topic was of course Trump and China. Having the chance to hear from my colleagues, especially from Nancy and Tim who watch President Donald Trump closely, really crystallized for me the idea that Trump's second administration is opening up immense opportunities for China and its leader, Xi Jinping.  Xi Jinping has sought to expand China's influence around the world. Photographer: Lintao Zhang/Getty Images The most obvious reason that's happening is the alienation of some of America's longest-standing allies. Canadians are boycotting US products, the Trump administration's pivot on Ukraine has left Europeans shocked and Taiwan is "praying" for better ties with Washington. But Nancy and Tim talked about two other factors that I had underappreciated. The first is that it's still unclear which adviser has Trump's ear on which issues. Instead, there are different voices competing for the president's attention on topics like immigration and trade, creating an environment that is short on predictability and long on surprise. Tim compared Trump's foreign policy process to how a screenwriter he knows likes to write scenes out on index cards, throw them onto the floor and then rearrange them to see what works. The second is Trump's propensity for isolationism. Nancy, who interviewed Trump at Mar-a-Lago last year, described the US president as really wanting to focus on domestic issues and not seeing why America needs to police the world. Tim spoke about Trump having a worldview in which if the US doesn't isolate and put up walls that it will get ripped off by others. This combination of Trump administration actions, its policy process and the president's worldview has helped to reinforce China's position that it is the responsible superpower on the world stage, not the US. The more countries that agree, the greater the opportunity for Beijing to advance its interests. That said, there's a world of difference between having opportunities and taking advantage. While there are plenty of reasons to believe Beijing's influence will grow over the next four years, there are also reasons to believe those gains may be limited. China, for one, is embroiled in tensions with several of its neighbors, from Japan in the East China Sea to its border with India high up in the Himalayas. While these disputes are not insurmountable, they will push the bar higher when it comes to how quickly and wholeheartedly these countries are willing to embrace Beijing. More broadly, no nation wants to be dominated by either the US or China. They'd much rather see one power offset by the other. So if countries become overly reliant on Chinese electric vehicles, solar panels and AI, it would motivate them to strengthen their relationships with the US. That assumes, though, that Washington would be interested in reciprocating. What We're Reading, Listening to and Watching: The officials charged with running China's economy had a decent week, one that added to signs that the recovery they've been trying to engineer since the pandemic is finally firming up. Consumer sentiment has hindered an economy that's been reliant on exports — annoying many nations, who have hit back with tariffs. Read a Big Take about the implications of China's export push here. But retail sales growth in the first two months of the year was the best since October, a sign that the world's second-biggest economy is holding up as a trade dispute with the US escalates. Read more about the better economic picture here. China has set a fairly ambitious 2025 growth target of around 5%, and even a somewhat more exuberant consumer would go a long way toward making that happen. Underscoring the push to get households spending, China just rolled out a special action plan aimed at reviving consumption. A key aspect of policymakers' remedy for dour consumer spending is a trade-in program for a range of goods. The latest data indicated that the scheme is working, with sales of products from furniture to appliances rising. Holiday makers also seem to have splurged over Chinese New Year, which this year ran from late January to early February. That's a marked difference from previous breaks, when people limited their spending. Meanwhile, a survey by Deutsche Bank suggests that consumer sentiment is a whole lot better than it was last year. Some 54% of respondents said they felt financially better off, up from 44% on average. The research is helpful because similar indexes by the central bank have been dormant since the second quarter of last year. Read about Deutsche Bank's findings here. Still, there's cause for concern about the economy. The property market remains a headache for many people, the survey by the German bank suggests. That's because a bigger share of participants said volatility in the real estate market was a reason to cut spending. This week, fresh data showed that prices of new homes fell at a faster pace in February. That's the first time they've worsened in six months, meaning the government's bid to prop up the market is struggling. It also suggests deflationary pressure is likely to linger considering property is the main store of wealth for people in China. Read about the current state of the real estate sector here. In a pretty worrying sign, used-home prices dropped slightly from January in the biggest cities, retreating for the first time since September when Beijing rolled out a major stimulus program. Those prices matter because they face less intervention by local officials and sales of secondhand homes have surpassed ones in the primary market. China has good reason to be confident in the economic recovery. Persistent property pain means officials are by no means out of the woods. |

No comments:

Post a Comment