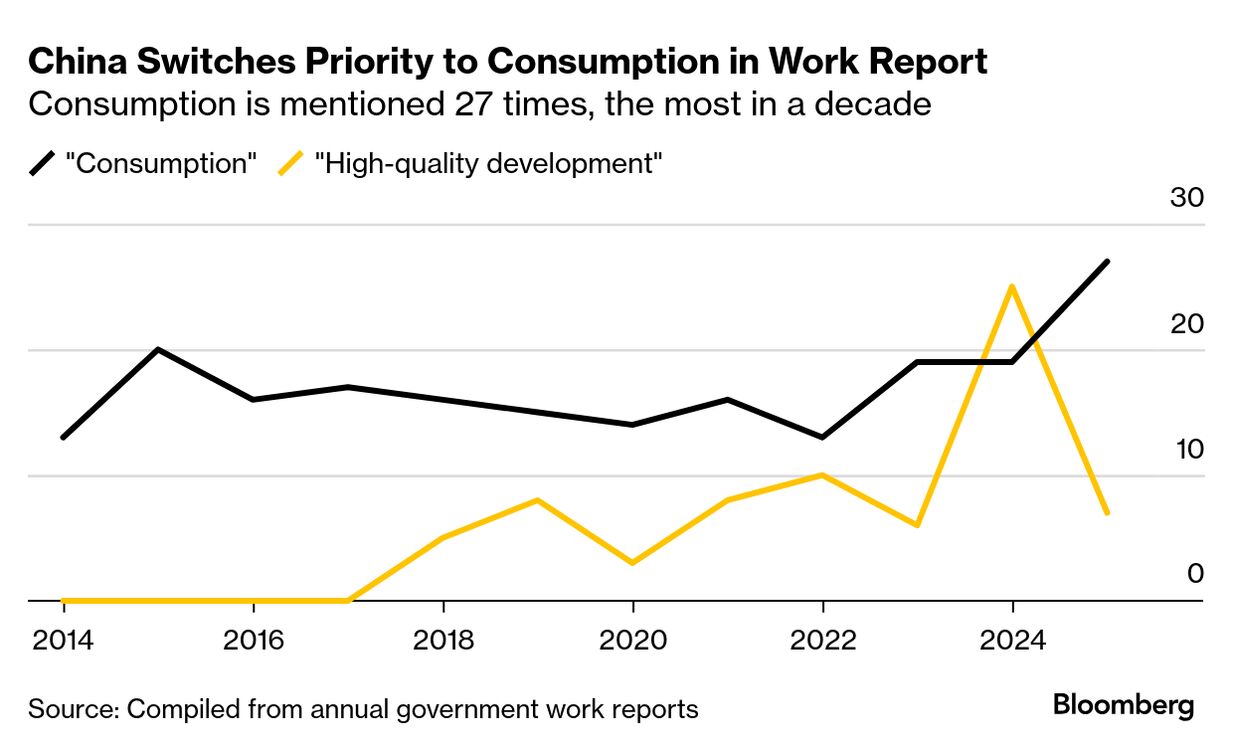

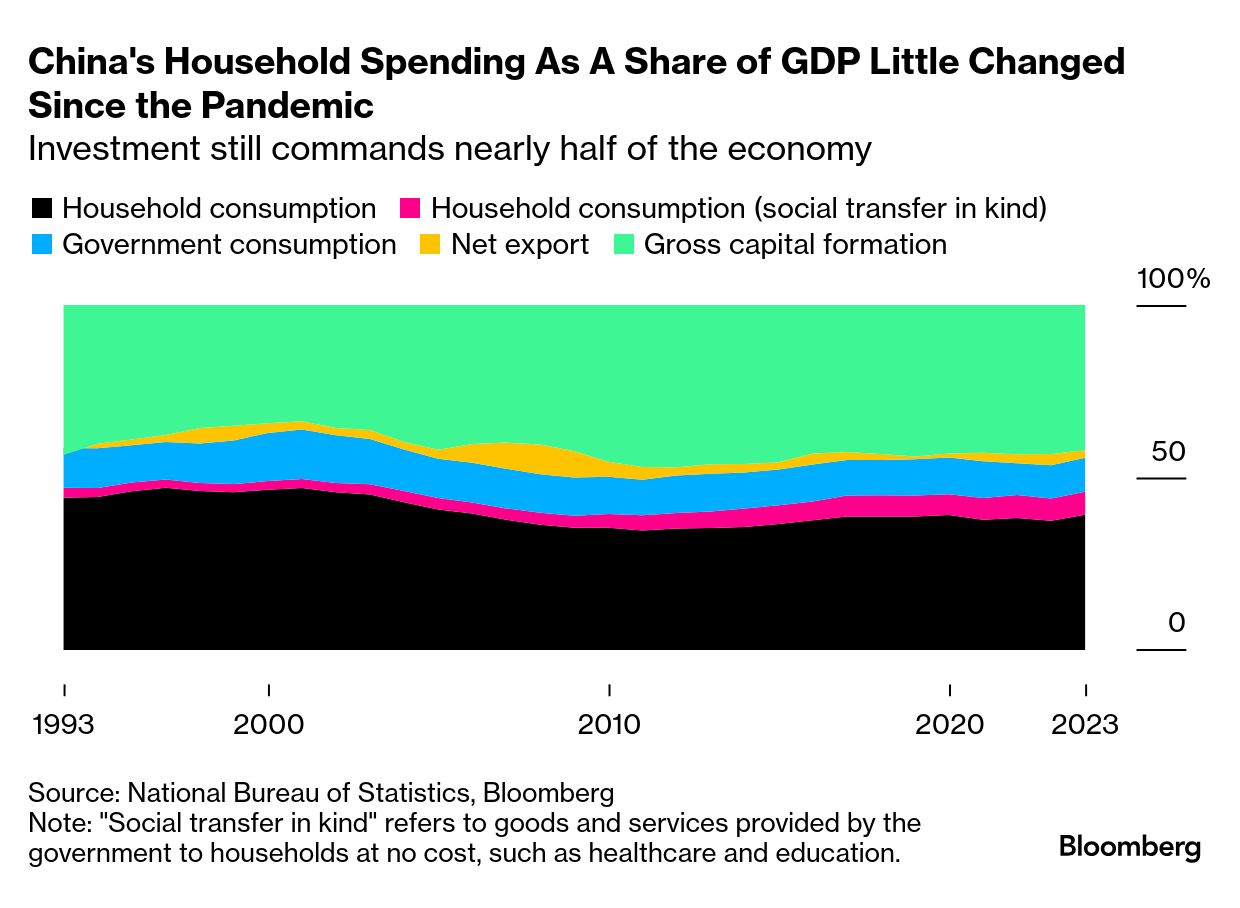

| Hi, this is John Liu in Beijing, where Premier Li Qiang kicked off the annual plenary session of the National People's Congress today, laying out the government's strategy to pull China out of its economic rut. But first, if you need to catch up on all that was announced, including China's GDP target for 2025, these stories will get you up to speed. My biggest takeaway from Li's Work Report — essentially a state-of-the-nation address — is that China's leaders see consumers as the key to fixing the economy. Li made it clear that the government's No. 1 priority this year is getting households to spend more, aiming to make "domestic demand the main engine and anchor of economic growth." As a result, the development of "New Productive Forces" — the phrase du jour of last year's NPC — was pushed to second place, while improving China's innovation capabilities dropped to third. This shift wasn't wholly surprising. The emphasis on domestic demand was well-telegraphed before the NPC. And for over a decade, policymakers in Beijing have been espousing the need to rebalance the economy by shifting away from investment and exports toward consumption. But rebalancing the economy and raising the share of consumption in a sustainable way is no easy task, as can be seen in Japan, which over the years has relied on overseas demand to make up for a weak domestic economy. That's what makes Beijing's latest push to expand domestic demand so significant. It's key to reviving economic growth. Intense Covid lockdowns and a plunge in property prices have shaken household confidence, leading to reduced spending. In turn, companies are forced to compete more aggressively for business, mainly by slashing prices. This leaves firms with less money for their employees, further deepening the sense of uncertainty for households. To boost consumption, policymakers will first need to restore confidence among households. According to Premier Li's address today, Beijing plans to do this through a mix of government subsidies, better consumer protections and a push to increase household earnings, particularly for low- and middle-income groups. If successful, this could reverse the deflationary spiral and create a much more positive cycle where consumer spending drives corporate profits.  A user interface message on the DeepSeek artificial intelligence app on a mobile phone. Photographer: Na Bian/Bloomberg It also matters for innovation. Weak demand and corporate profits mean less money for R&D, especially in the private sector, which has driven many of China's recent notable innovations, like DeepSeek's large-language model and Unitree's dancing robots. Perhaps the biggest near-term reason for China's pivot to consumption is US President Donald Trump. China's economic rise has been powered by its role as the world's factory, with globally-integrated supply chains helping to drive jobs and profits at home. But this makes China vulnerable as globalization reverses. A robust domestic market could shield the economy from that threat. While these reasons explain why Beijing wants to boost domestic demand, there's no guarantee it will succeed. Take, for example, the need to reform the incentive system for regional governments, as outlined by prominent Chinese economist David Daokui Li. The former adviser to China's central bank pointed out in a recent Bloomberg TV interview that local authorities receive tax revenue when companies produce goods but nothing when households buy goods. This, he argues, highlights the need for tax reform to incentivize local governments to promote consumption. Beijing's track record on tax reform, however, is not promising. For instance, after introducing property taxes on a trial basis in the cities of Chongqing and Shanghai in 2011, progress on that reform has stalled ever since. Listening to Premier Li today, it's clear that Chinese leaders are now talking the talk when it comes to shifting the economy toward domestic consumption. That's an important first step — but what comes next is the hard part.

If you're not yet subscribed to Next China, please sign up to get this newsletter every week for dispatches from Beijing on where China stands now — and where it's going next. |

No comments:

Post a Comment