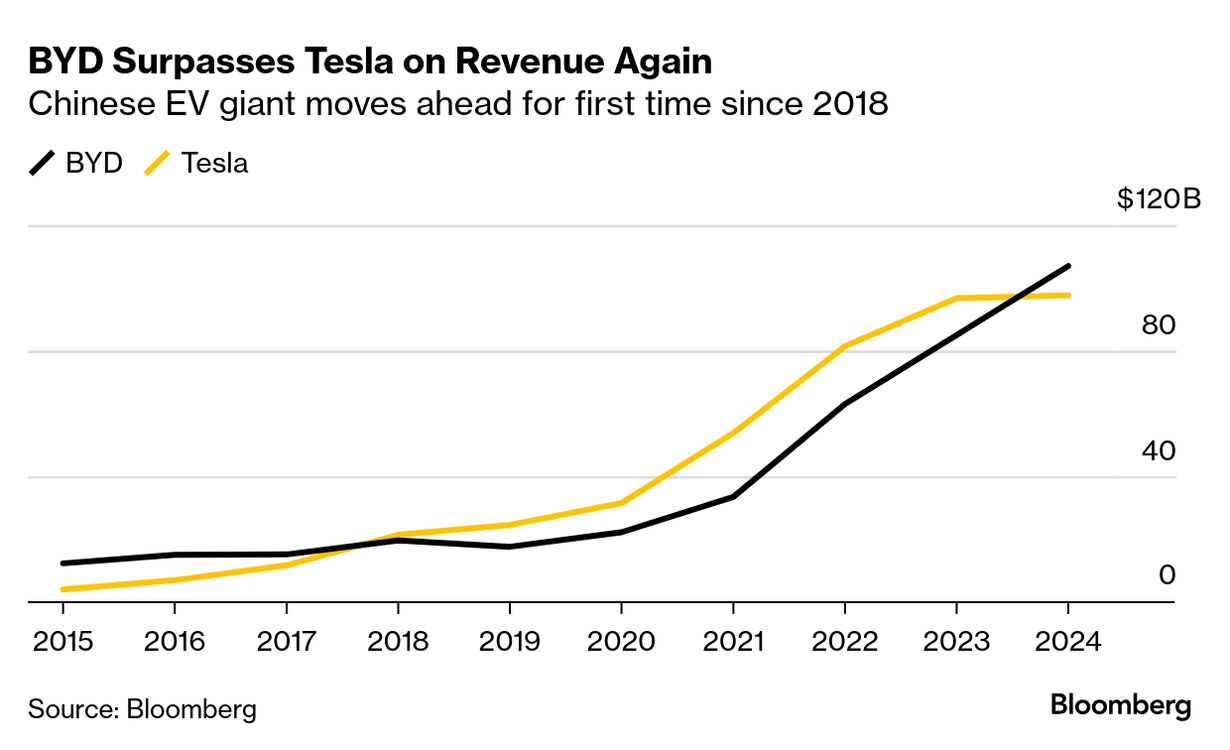

| Hi, this is Colum Murphy, writing from the coastal town of Boao, where China is stepping up its charm offensive and pitching itself as a pillar of global stability in an increasingly volatile world — courtesy of President Donald Trump. While the US hit trading partners with auto tariffs and vowed broader measures next week, the Boao Forum — often called China's Davos — gathered government officials and corporate heavyweights like Xiaomi's Lei Jun, AstraZeneca's Pascal Soriot and Fortescue's Andrew Forrest to push for stronger cooperation across Asia. Forrest led a rendition of Waltzing Matilda at an evening cocktail reception overlooking the South China Sea. The mood was light, but delegates remained concerned about the shifting global geopolitical landscape and the impact of new White House policies on trade and investment. Vice Premier Ding Xuexiang used his keynote speech to advocate for safeguarding free trade and opposing trade and investment protectionism, a veiled jab at the US. "No matter how the external environment changes, China will open wider to the world," he said. The Boao Forum was just one part of China's week-long effort to court international business leaders and foreign officials. It began with the two-day China Development Forum in Beijing, attended by the likes of Apple's Tim Cook, Qualcomm's Cristiano Amon, Pfizer's Albert Bourla and Saudi Aramco's Amin Nasser, where officials highlighted the economy's business potential. The week culminated in a meeting on Friday between Chinese leader Xi Jinping and a group of Western business executives in Beijing. "There is definitely a charm offensive going on," Stephen Roach, the former Morgan Stanley Asia chairman, told Bloomberg News in Boao. Last year, he stirred controversy with a column on Hong Kong's decline as a global financial hub, blaming Beijing's tightening grip and arguing that China's priority should be fixing its own economy. Since then, China has rolled out stimulus measures, shifted focus to boosting consumer spending, and met with key entrepreneurs including Alibaba's Jack Ma — a show of support for the private sector after years of crackdowns. This week, reports emerged that China released five Mintz Group employees detained in 2023, signaling another push to win over foreign firms. So, does this signal a meaningful shift in China's approach and will its charm offensive work? "They can be charming when they want to, and not quite as charming when they want to as well," Roach said. CK Hutchison offers a case in point. Beijing reacted negatively to plans by Li Ka-shing's conglomerate to sell its Panama Canal ports to a global consortium after Trump called for the US to retake control of the waterway. Officials then told state firms to halt new deals with Li's family, Bloomberg News reported. While China's moves to woo nations and executives may be intended to counterbalance US trade policy, Roach remains skeptical of any global reset without Washington on board. "The United States is still by far the largest economy in the world and it's pulling out of globalization," he said. "How can we even talk about a new globalization without the world's largest economy?" What We're Reading, Listening to and Watching: Whammy and double whammy. That's pretty much what BYD has done to Tesla lately. First was the news that BYD is ready to roll out an electric car that can be charged about as quickly as a gas vehicle is refueled. That added to the problems for the US automaker's stock, as it U-turns from Wall Street's hottest trade to its most hated. That coincided with Tesla cars themselves becoming the targets of some vandalism in the US due to Musk's role in the Trump administration. Then came BYD overtaking Tesla in annual sales. The Chinese EV kingpin reported revenue of $107 billion for 2024, torching Tesla's $97.7 billion. Read a breakdown of the sales turning point here. BYD has surged to the top of the Chinese car market, which is the world's biggest and most competitive in terms of EVs. That's largely due to some impressive innovation, an area usually seen as Musk's province. Besides that five-minute charge allowing for a range of 400 kilometers, the Chinese company has rolled out advanced driver assistance technology in even its most basic models. Tech that helps people do things like execute the oft-dreaded parallel parking maneuver is a big draw for new drivers. It's available in both BYDs and Teslas but the Chinese company's autos can be a whole lot cheaper, adding to the attraction. Cathie Wood, the ARK Investment Management LLC founder and long-time Tesla bull, is pretty impressed by the Chinese automaker's line. "We are looking at the BYD cars and they're fabulous from what we can see," she said. "Fit, finish and design." This is not to say Tesla is stuck in the ditch, not at all. The US company actually sold more EVs than BYD last year, though BYD is much larger when autos like plug-in hybrids are included. And Wood is still upbeat on Tesla, predicting its share price will hit $2,600 in five years, about 10 times its current level, touting the outlook for it robotaxis. Read about Wood's prediction here. BYD zipped ahead of Tesla in the sales department last year but the auto industry is a never-ending race on the proverbial two-lane blacktop. Executives at BYD should remember that back in 2018 their company surrendered the sales crown to Tesla. The race between the two giants feels like its just begun anew. |

No comments:

Post a Comment