| Market data as of 06:16 am EST. Market data may be delayed depending on provider agreements. Donald Trump sowed more confusion about his tar |

| |

| Markets Snapshot | | | | Market data as of 06:16 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- Donald Trump sowed more confusion about his tariff plans, pledging levies on cars in the coming days while indicating nations will receive breaks from next week's "reciprocal" duties. He's also proposing a 25% fee on any nation purchasing oil and gas from Venezuela, a move that risks roiling the global energy trade.

- The recovery in US stocks is stalling, with futures ticking lower as traders mulled the latest tariff comments. Oil held an advance after Trump's Venezuela threat. Gold traded above $3,020 an ounce.

- European natural gas prices eased as traders await results of the latest talks between US and Russian officials on a ceasefire in Ukraine. Benchmark futures fell as much as 1.8%.

- Chinese technology stocks retreated from a three-year high to the brink of a correction in just five sessions, fueled by a lack of positive surprises in earnings and Xiaomi's jumbo share sale. Alibaba sank more than 3% following its chairman's warning on a potential bubble in AI data center construction.

- Shell will expand LNG sales, the key driver of profit growth in recent years, by 4% to 5% annually until 2030. This will help the company return as much as half its cash from operations to investors. Its shares climbed to the highest since August.

| |

Wall Street sours on Turkey | |

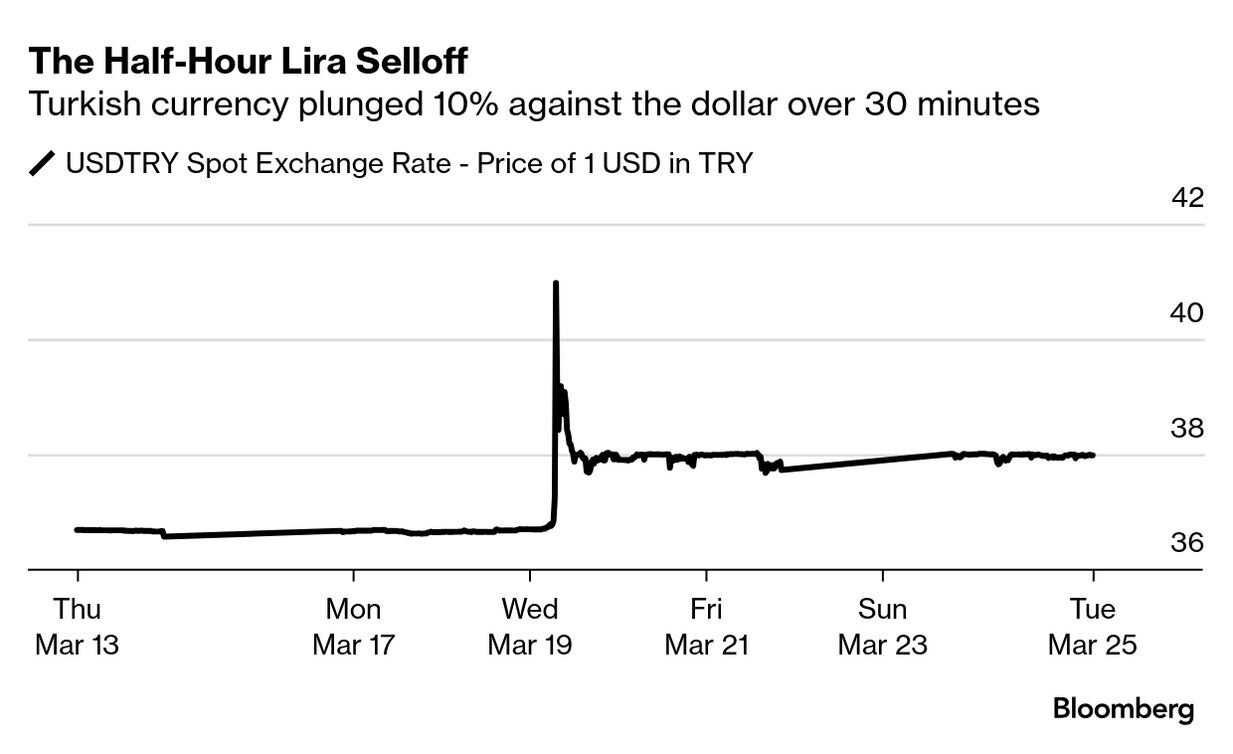

| When Wall Street banks and hedge funds gathered in Istanbul Wednesday with a top Turkish economist, they were prepared to hear about the country's improved stability. Then they glanced at their phones. The Turkish lira was plunging against the dollar, fueled by that morning's detention of Istanbul Mayor Ekrem Imamoglu — the biggest rival of President Recep Tayyip Erdogan. The group, assembled by Deutsche Bank and including clients such as Millennium Partners and Gramercy Funds Management, were shocked and couldn't take their eyes off their screens, people familiar with the matter said. While the economist kept going with the presentation, the guests kept waiting for the country's state-run lenders to start selling more dollars — the Central Bank of Turkey's typical method for supporting the lira. But that didn't happen. Within about half an hour, investors around the world had dumped huge volumes of lira, slashing its value by 10% to a record low. A market participant at one of the biggest Wall Street banks estimated that about $5 billion worth of the currency had changed hands by 9 am in London, about ten times the morning average. Another suggested total outflows over the day neared $10 billion.

For years, hedge funds and other institutional investors had been led to believe that if there ever was a crisis brewing in Turkey, there were enough dollar reserves in the country that local banks could sell to prevent a nosedive in the lira.

That's what traders were waiting for Wednesday morning. But Turkey's state-run banks had already exhausted their daily credit limits with offshore lenders — leaving the lira vulnerable for that fateful half hour, the people said. The turmoil soon spilled over into the broader markets, with a gauge of Turkish banking stocks dropping by the biggest amount since 2013 and 10-year government bond yields topping 33%. "Once you have a move of that magnitude, it takes time to regain confidence," said Brad Bechtel, head of foreign exchange at Jefferies Financial Group Inc. in New York. That's exactly what Turkey's top economic officials will attempt to do later today: Finance Minister Mehmet Simsek and central bank Governor Fatih Karahan are scheduled to speak in a teleconference with foreign investors organized by Citigroup and Deutsche Bank. —Kerim Karakaya, Donal Griffin, William Shaw, Firat Kozok and Tugce Ozsoy | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

- Tesla drops 0.8% in premarket trading after news that the EV maker's sales in Europe plunged 40% in February. The company's sales have dropped in the region in 10 of the last 12 months.

- Trump Media and Technology Group jumps 9% after saying it plans to work with Crypto.com on a lineup of "Made-in-America" investments. That puts the president's social media company in business with a Singapore-based firm that was locked in a legal battle with US regulators last year.

- KB Home tumbles 7.7% after the homebuilder posted disappointing first-quarter results and cut its forecast, saying demand at the start of spring selling season was more muted than historical levels.

- Fevertree Drinks rises 8.8% in London after earnings from the maker of soft drinks and mixers reassured analysts, with results that included robust growth in its US market and an extension of its share buyback.

- Kingfisher slumps 11% in London. The British home-improvement retailer reported a disappointing 2026 outlook, weighed down by its French and Polish businesses. —Subrat Patnaik

| |

| |

A new approach to EM debt | |

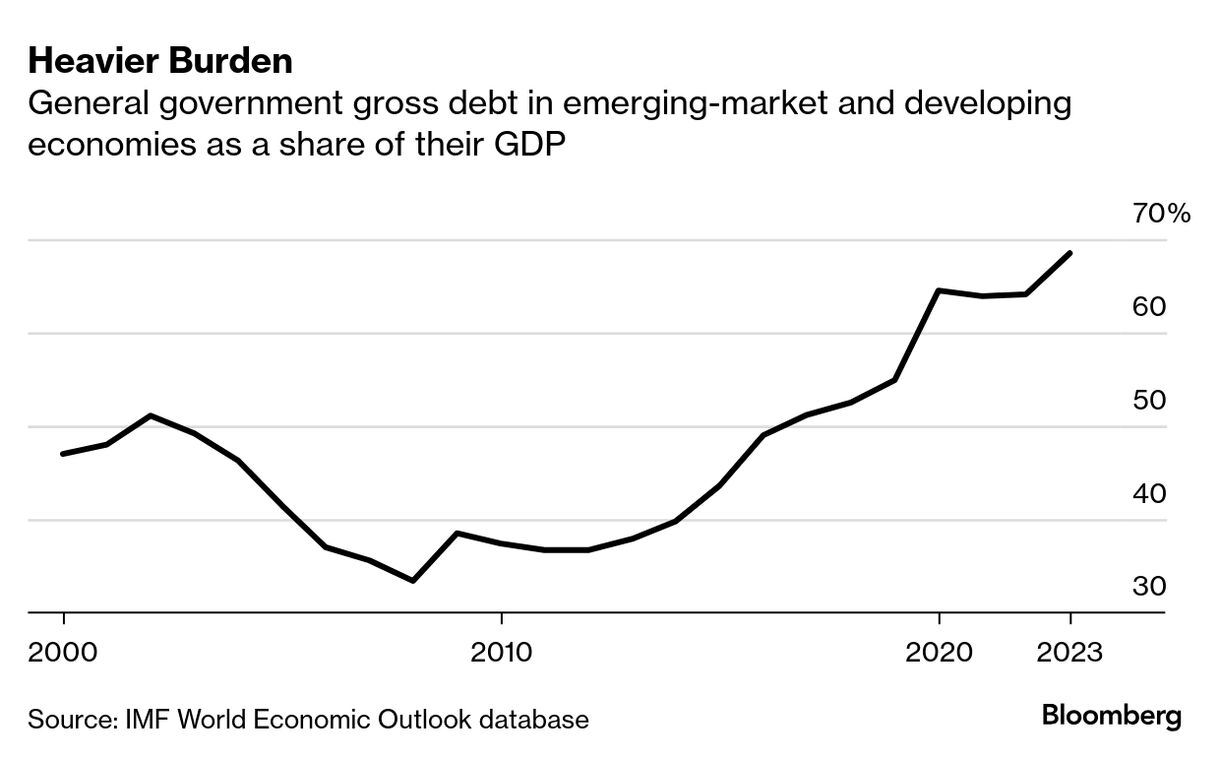

| For decades, globe-trotting financiers have offered a deal to some developing nations drowning in debt. Bond investors take losses up front, accepting a reduction in their principal and lower interest rates. In exchange they get what's called a sweetener, giving them extra payments if the country's economy improves—in some cases, amounting to a multibillion-dollar jackpot. But there's a problem: Governments in poor countries have tended to lose out, because debt payments often rise much more than they expected, leaving taxpayers saddled with even heavier bills. Now Wall Street is making a new pitch: Bondholders still get a crack at those additional payments, but they're taking on some risk, too. If a debtor country's economy tanks, its debt payments will fall as well. No more "heads I win, tails you lose." Macro-linked bonds, as they're known, are the brainchild of French banker Eric Lalo, who's done 40 government debt restructurings and refinancings, most recently at Rothschild & Co., the investment adviser long known for resolving the thorniest emerging-markets deals. Lalo, who's in his 60s, was born in Senegal to French expats who moved the family to Paris when he was 5. "I like to fix chaos," he says. "I have emerging markets in my veins." New approaches are necessary to address the growing, and in some cases possibly unsustainable, emerging-market debt burden. Principal and interest payments on the debt of the world's low- and middle-income countries reached a record of $1.4 trillion in 2023, the latest year of available data, more than twice the amount a decade before, according to the World Bank. —Jorgelina Do Rosario and Ezra Fieser | |

| |

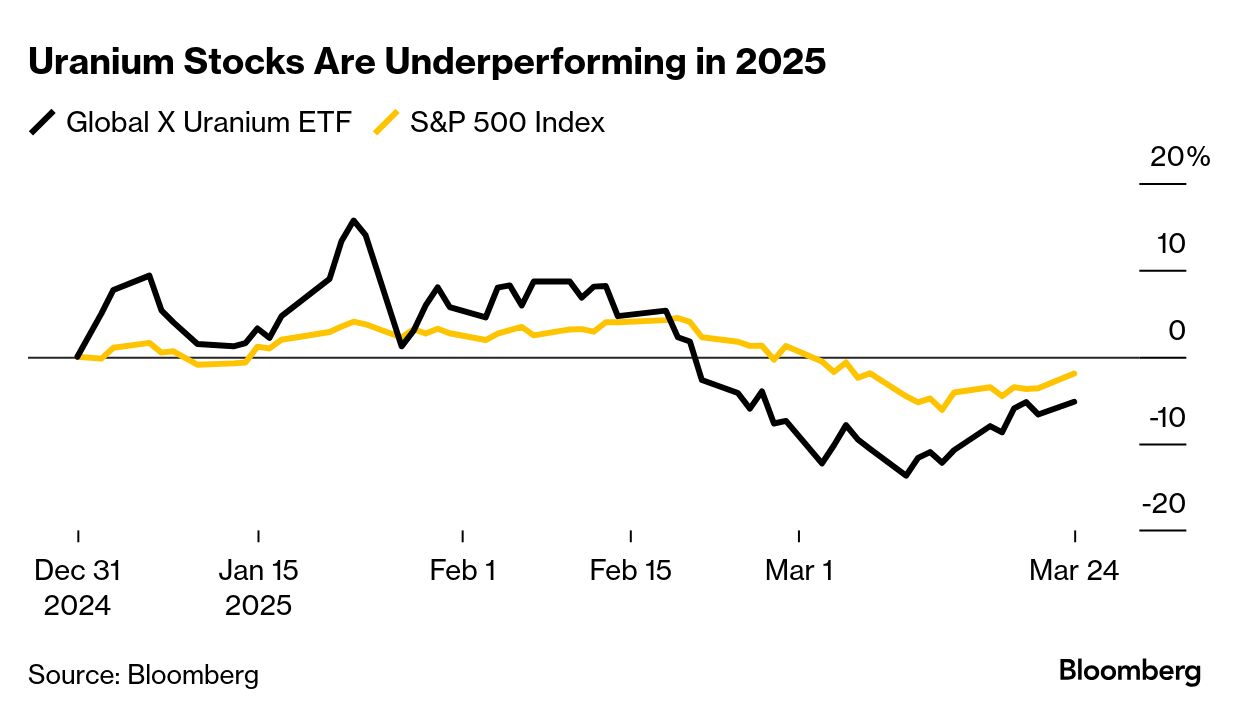

| Once-booming uranium stocks have been veering toward bust mode to start 2025. Escalating trade tensions between the US and Canada, one of the world's key producers of the nuclear fuel, are playing a major part. Lately, so are talks toward a ceasefire in Russia's war in Ukraine, which raise the prospect of looser sanctions on Russian production of the radioactive metal and the potential for more supply. The price of uranium is now down more than a third from early 2024, and has slumped roughly 11% this year alone. The widely followed $2.9 billion Global X Uranium ETF, which mostly tracks mining shares, has declined about 5% in 2025. Meanwhile, Saskatchewan-based Cameco, the largest uranium miner in North America, has dropped 11%, following five years of gains. That marks a turnaround from a little more than a year ago. Then, uranium was booming after roughly a decade in the doldrums. More countries were moving to re-open nuclear reactors, and electricity demand was expected to surge with the growth of AI and data centers. Russia's early 2022 invasion of its neighbor only tightened supplies. —Geoffrey Morgan | |

Word from Wall Street | | "It reflects what really could be seen as a tipping point in the industry" | | Manuela Sperandeo BlackRock's head of Europe & Middle East iShares Product | | BlackRock is launching a Bitcoin exchanged-traded product in Europe, following the success of its $48 billion US fund tracking the cryptocurrency. | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment