| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today, Dan Strumpf and Shruti Srivastava look at India's trade policy. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - President Donald Trump threatened auto tariffs and indicated nations will receive breaks from next week's "reciprocal" measures.

- Trump also issued an order allowing a 25% tariff on any nation buying oil and gas from Venezuela. Those "secondary tariffs" mark a new weapon in his trade arsenal.

- German business optimism rose to the highest level since June 2024 as Chancellor-in-waiting Friedrich Merz readies a huge spending spree.

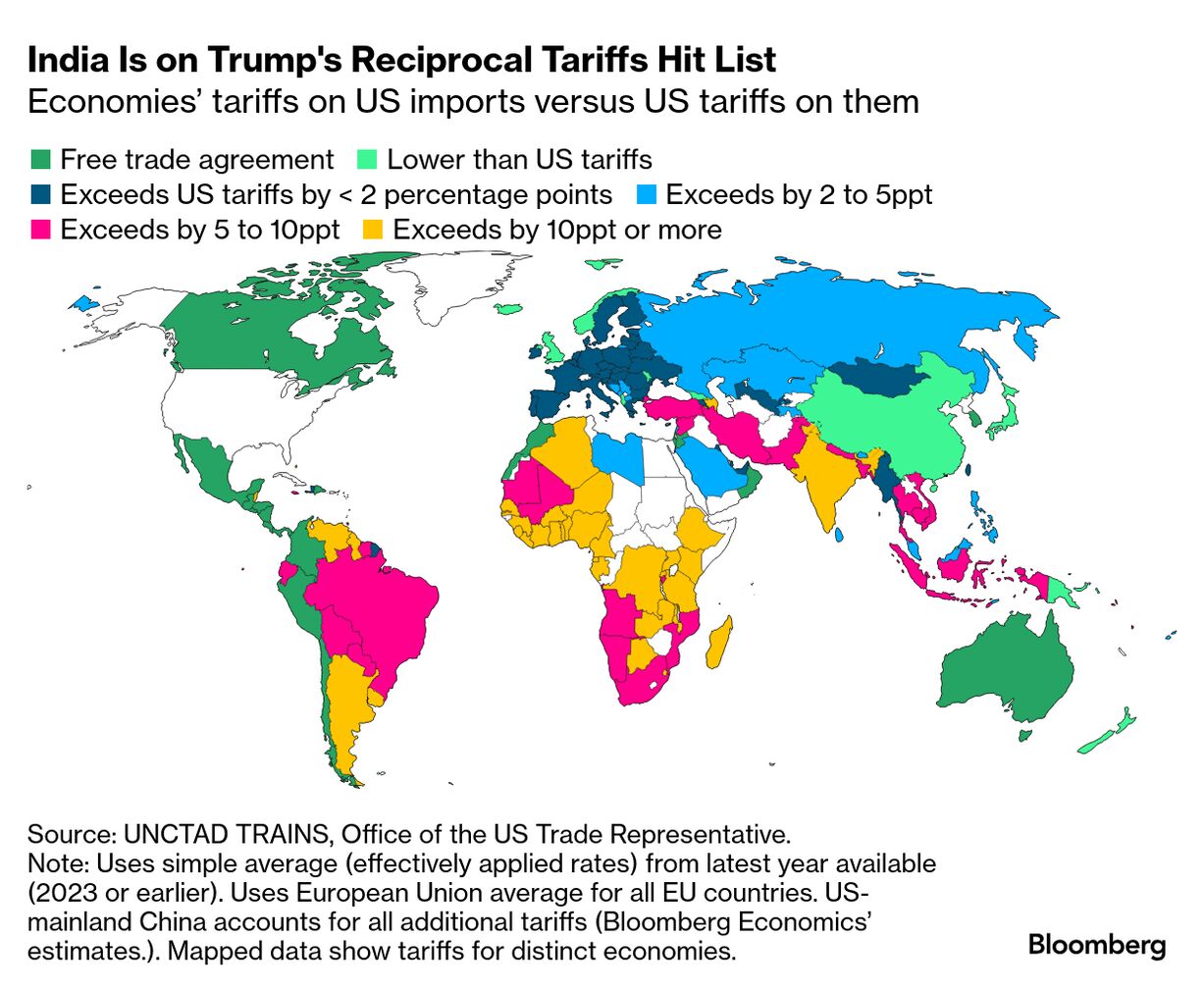

Protected by steep tariff walls erected to shield the small businesses that make up the bulk of India's economy, whiskey maker Radico Khaitan has been producing booze in the northern state of Uttar Pradesh since 1943 — four years before the nation's independence. Now, Donald Trump wants those barriers torn down. The US President has branded India as the "tariff king." That puts the nation of 1.4 billion people and its millions of small businesses squarely in the sights of Washington's plans to roll out reciprocal tariffs on April 2 — despite recent efforts in New Delhi to accommodate Washington with a raft of tariff cuts this year that include a reduction in the duty on imported alcohol to 100% — at least on American bourbon. Long frustrated by the stop-start nature of reform in India's complex web of central and state governments, economists are hopeful that Trump's tariff sledgehammer may just spur a once-in-a-generation overhaul of the nation's protectionist trade policies. In 2023, India's simple average tariff rate — the mean duty applied to fellow World Trade Organization members with which it doesn't share a preferential trade agreement — was 17%, compared with 7.5% for China, 6.8% for Mexico and just 3.3% in the US. While a broad reduction in tariffs could cause short-term pain, over the long term it can lift growth by making imports cheaper and boosting investment. In the 2000s, India undertook broad tariff cuts while posting a GDP growth rate averaging 7.8% per year, according to Pranjul Bhandari, chief India economist at HSBC Holdings Plc. Closing India's tariff differential with the US could shave 0.3 percentage point off India's short-term GDP growth, but "over the medium term — I would say once 2026 starts — I think things can become pretty positive," she said. "New opportunities will arise, new sectors will arise, input costs for many industries will go down and they'll be able to export more," she said. That's the message from Sanjeev Banga, head of the international business at Radico.  Rampur Distillery operated by Radico Khaitan Ltd. Rampur Radico Khaitan Ltd. Radico uses imported scotch to blend into the company's own domestically bottled whiskey, so lower tariffs will reduce costs. And reciprocal reductions could help make his company's exports — like the Rampur brand of single-malt whiskey — more competitive overseas. "I'm all for all these free-trade agreements and globalization because more competition helps the category to grow," Banga said. "If the consumers like it, then let them make a choice." The Best of Bloomberg Economics | - Federal Reserve Bank of Atlanta President Raphael Bostic now sees one interest-rate cut as likely this year, not two, due to tariff hikes impeding progress on disinflation.

- Britain needs a technological breakthrough such as artificial intelligence to counter its weak long-term growth, the Bank of England governor said.

- China's government appears in no rush to implement its budget, as Beijing preserves spending power to counter damage from US tariffs.

- European Central Bank officials are playing for time on what to do at their next meeting amid uncertainty created by global trade tensions.

- Asia will avoid a slowdown this year even as Trump imposes tariffs, according to a report issued at China's premier international conference.

- Australia's center-left government unveiled an unexpected tax cut and an extension of energy rebates in a pre-election budget.

Excessive regulation has contributed to constraints on the growth of housing supply in the US, resulting in a chronic shortage and affordability challenges. "A vast body of work has documented evidence in support of this logic," a new Federal Reserve Bank of San Francisco paper says. Except the argument is wrong, the three authors contend. If it were true, then a jump in income growth in a city where supply was more constrained should lead to a bigger gain in prices than in a city where there was less of a problem with restrictions. Similarly, the response in terms of added quantity of houses should be smaller in a place where supply is less "elastic," as economists say. But that's not how it pans out.  Contractors raise a framed wall at Toll Brothers Redwood, in Folsom, California, on March 6, 2025 Photographer: David Paul Morris/Bloomberg "Our empirical results consistently demonstrate that higher income growth predicts similar growth in house prices, housing quantities, population, and living space per person across more and less housing constrained cities," the authors, Schuyler Louie, John Mondragon and Johannes Wieland, wrote. "This research thus calls for a reevaluation of our understanding of housing supply." |

No comments:

Post a Comment