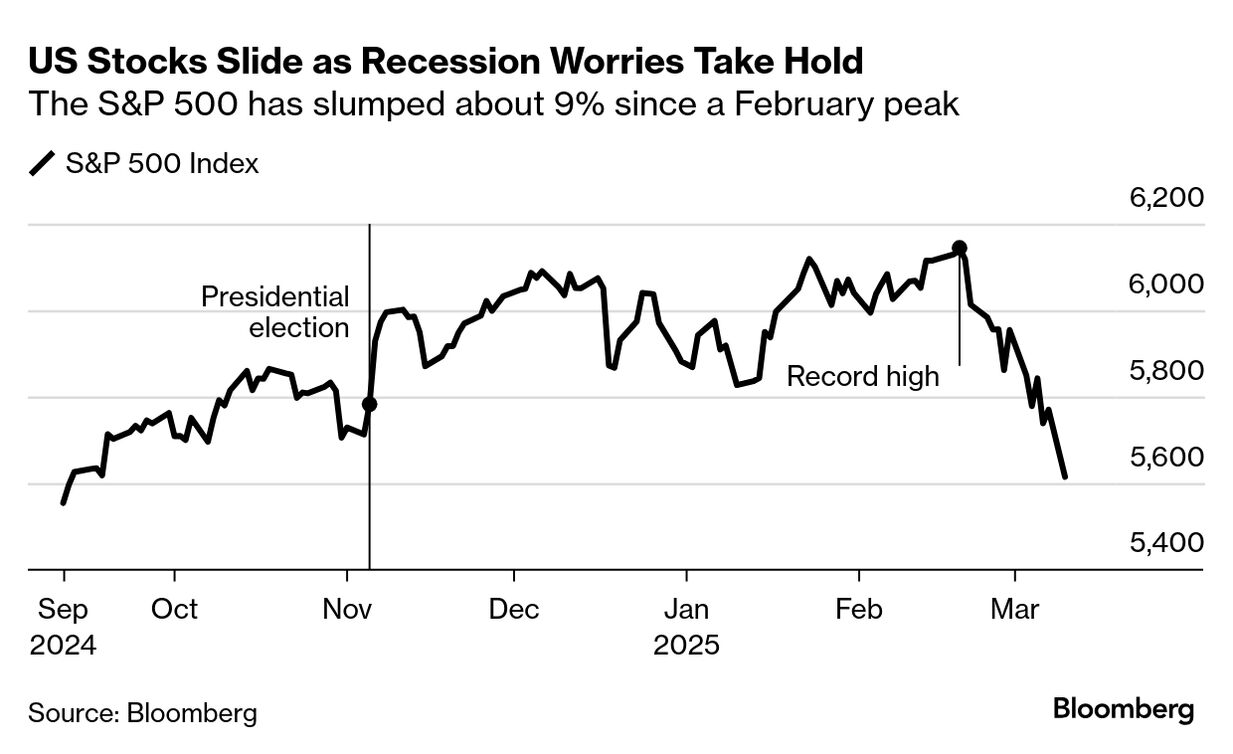

| US stocks have gone from scaling record highs to flashing recession worries in a matter of weeks. What began as a mild decline in expensive tech stocks has morphed into a flight from all US stocks as investors worry Trump's trade war will stall the economy. The S&P 500 has slumped 9% from its February peak, while the Nasdaq 100 sank 12% into a technical correction. The Bloomberg Magnificent Seven Index — which comprises the biggest beneficiaries of the AI trade— has plunged 20% since a December high. "The market's post-election sugar high has turned into a bit of a nasty hangover as the policy realities of Trump 2.0 begin to become clear," Benny Adler, head of equity capital markets trading at Goldman Sachs, wrote in a note to clients. Hedge funds, asset managers and retail investors have all turned into sellers. Among the catalysts making markets shaky: The Federal Reserve has signaled it's slowing the pace of interest rate cuts and Chinese chat-bot startup DeepSeek raised questions about America's lead in AI. And with the Trump administration indicating that it's prepared to handle some distress in the economy, investor expectations of a "Trump put" — policy reversals that can halt a decline in the stock market — are quickly evaporating. "Unemotional sources" such as trend followers and volatility-control funds have contributed to the selloff as they reduced exposure. Short-term levels such as moving averages have also failed to support stocks, suggesting little demand to add risky assets.

Some say that Trump isn't wholly to blame for the pullback. Parts of the economy were weakening when he took office, tech stocks have long been expensive and monetary policy remains tight. "Recent events have not been helpful for equity prices, but there are plenty of other things that have been going on," said Neil Dutta of Renaissance Macro Research.

At the same time, yesterday's $1.1 trillion selloff in the Nasdaq 100 underscores how Trump's America First policies have, paradoxically, spurred a shift away from US assets. Investors are rushing into the relative safety of Chinese stocks, the euro, the yen, Australian government bonds and the offshore yuan: The euro has jumped about 7% from a February low while a gauge of Chinese stocks in Hong Kong is up 20% this year. —Jan-Patrick Barnert and Sagarika Jaisinghani

Do tariffs matter more than the Fed for US stock markets in 2025? Share your views here in the latest MLIV Pulse survey. |

No comments:

Post a Comment