| Market data as of 06:33 am EST. Market data may be delayed depending on provider agreements. The stakes are rising over a possible US govern |

| |

| Markets Snapshot | | | | Market data as of 06:33 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- The stakes are rising over a possible US government shutdown this weekend. Senate Democrats said they will block a Republican spending bill. Instead, they're urging the GOP to accept a Democratic plan to provide funding through April 11.

- US stock futures steadied as investors waited to see if wholesale inflation data due later would confirm signs that price growth is slowing. JPMorgan strategists say the worst of the stock market pullback may be over.

- President Donald Trump says the US will respond to the EU's countermeasures against his new 25% tariffs on steel and aluminum, raising the risk of further escalation in his global trade war.

- Global oil demand is under pressure from the escalating trade war at the same that OPEC+ is reviving output, threatening to deepen a supply surplus, the International Energy Agency said. Oil prices last week sank to the lowest since 2021.

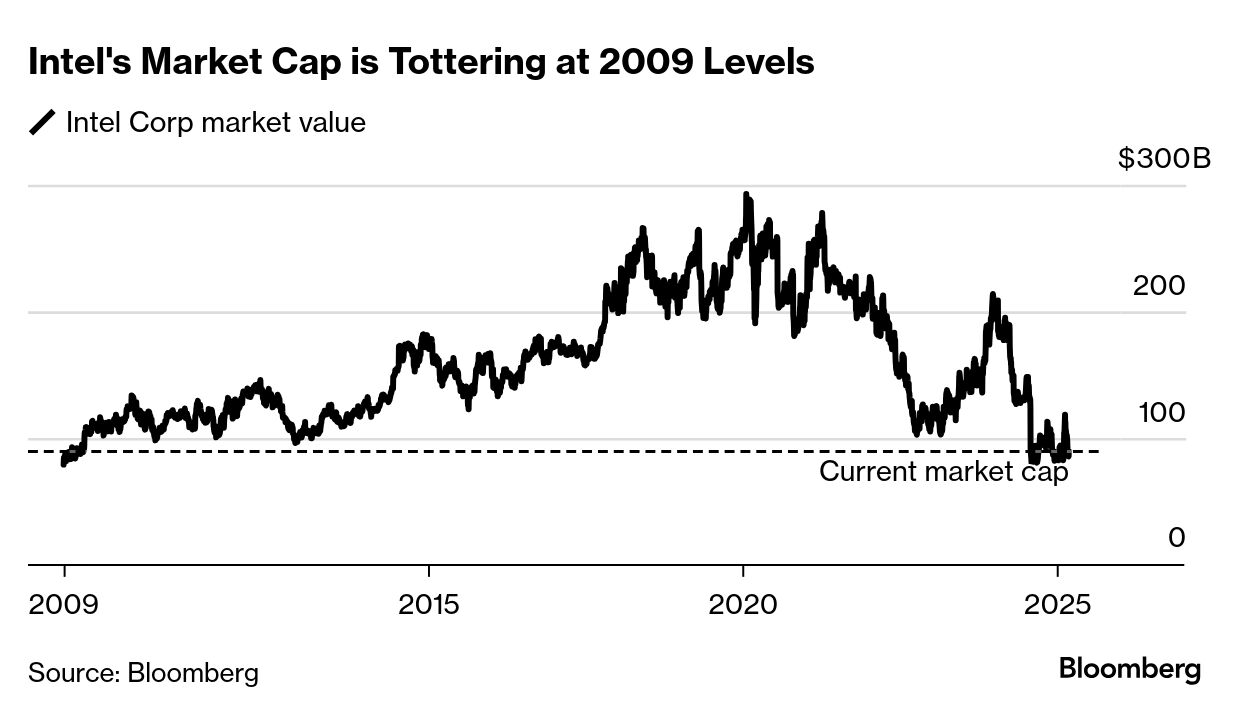

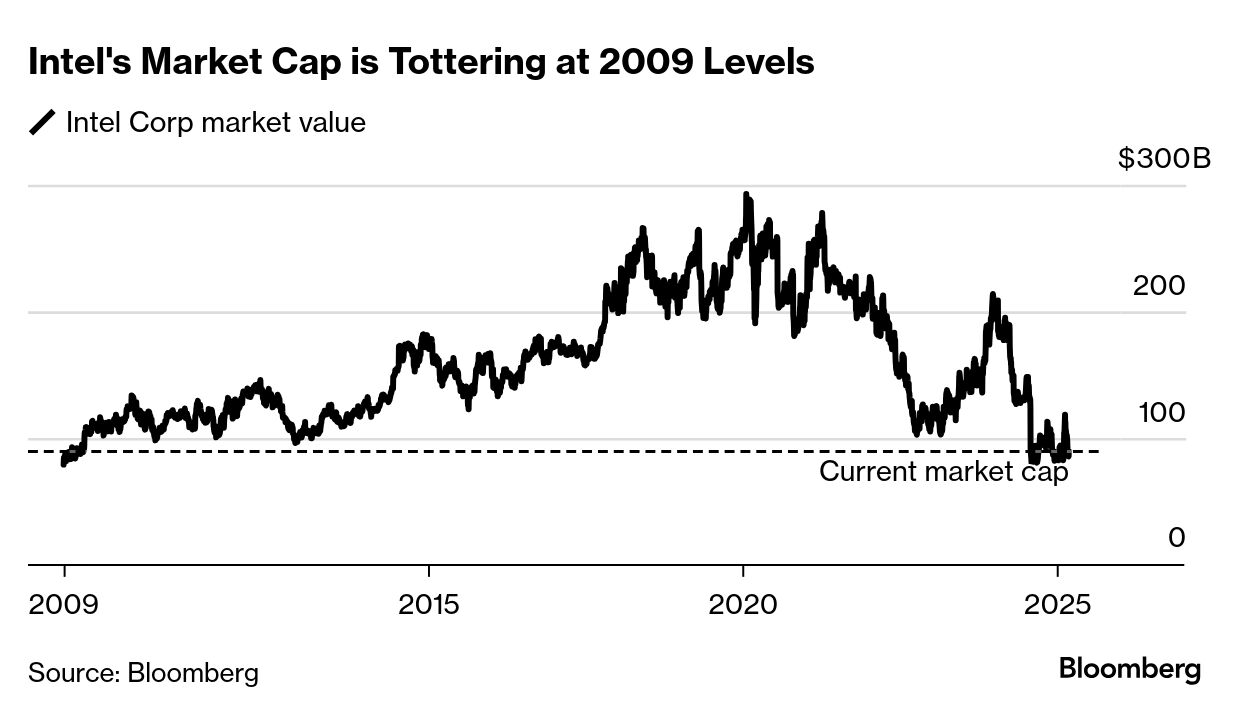

- Intel's new CEO, Lip-Bu Tan, is signaling he'll stick with his predecessor's plan to make chips for other companies, even as he vows to learn from past mistakes. The stock, down by more than lost half over five years, is up 11% in premarket trading.

| |

| |

| There's a massive geopolitical gamble under way right now: Investors are quietly betting that Donald Trump's overtures to Moscow for a deal to end the war in Ukraine will eventually translate into Russia's return to the global financial markets. As we report in today's Big Take, traders at one London brokerage have been scouring the world in recent weeks for Russian debt, an asset almost untouchable for the past three years. They've been looking for owners of dollar-denominated bonds issued by Gazprom to meet demand from Middle Eastern family offices. Buyers are wagering that the deeply discounted securities could soar in value if the sanctions imposed on Russia after its invasion of Ukraine in 2022 are lifted. Money managers, too, say they are receiving approaches from sales teams gauging their interest in making bets on the ruble through non-deliverable forwards — derivatives that because they don't involve a physical Russian asset or individual person aren't subject to sanctions.  Russian and US officials at a meeting in Riyadh, on Feb. 18. Source: Anadolu/Anadolu "There's an aggressive search for securities of Russian issuers around the world," said Evgeny Kogan, a Moscow-based investment banker who runs his own advisory firm. "Investors in general are asking how quickly they can enter the Russian market." But these wagers come with multiple risks — reputational if an investor moves too early to restore ties with a country responsible for Europe's largest conflict since the Second World War; and legal, if sanctions aren't lifted or are later re-imposed. — Kerim Karakaya | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

- Intel's premarket rally got a boost from Bank of America. The bank was the first to upgrade the stock after the chipmaker appointed Lip-Bu Tan as CEO, citing his "solid track record."

- Adobe falls 4.7%. It gave a disappointing outlook for revenue growth in the current quarter despite a recent focus on monetizing its new generative AI features.

- American Eagle drops 17%. The teen-apparel retailer's profit forecast missed estimates due to weak consumer demand.

- Hugo Boss falls 5.1% in Munich after its sales outlook trailed estimates.

- Daimler Truck falls 15% in Munich, leading the rest of European truckmakers lower, after the new head of the EPA announced a regulatory change that could deter purchases of new trucks. The agency potentially will roll back emissions regulations starting in 2027; those rules had been seen as a catalyst for new truck purchases.

- Trainline falls 8% in London after the e-ticketing platform reported sales that were lower than analysts had estimated.

- Dollar General is slated to publish results before the opening bell, with Bloomberg Intelligence saying the discount retailer probably posted solid revenue growth. —Subrat Patnaik

| |

| |

| For years, investors have talked of Apple as a potential port of safety in times of market turmoil. That hasn't been borne out this time around. The iPhone maker has tumbled in recent sessions amid a growing number of risks that are increasingly overshadowing its traditional high-quality characteristics. The shares have dropped 13% this year versus a 6.7% drop for the Nasdaq 100 Index. While it offers steady earnings growth and sits on a mountain of cash, the stock faces plenty of headwinds: Apple is heavily exposed to tariff uncertainty and China, its AI offerings have repeatedly fizzled, and a lucrative partnership with Alphabet is potentially at risk. And the shares trade at a premium price-earnings ratio, suggesting that even if other big-tech stocks can be considered safe havens, the case is harder to make for Apple. "People like to park in Apple, but right now the stock is expensive, and not only is growth slow, but the catalysts for growth are absent," said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder. —Ryan Vlastelica | |

| |

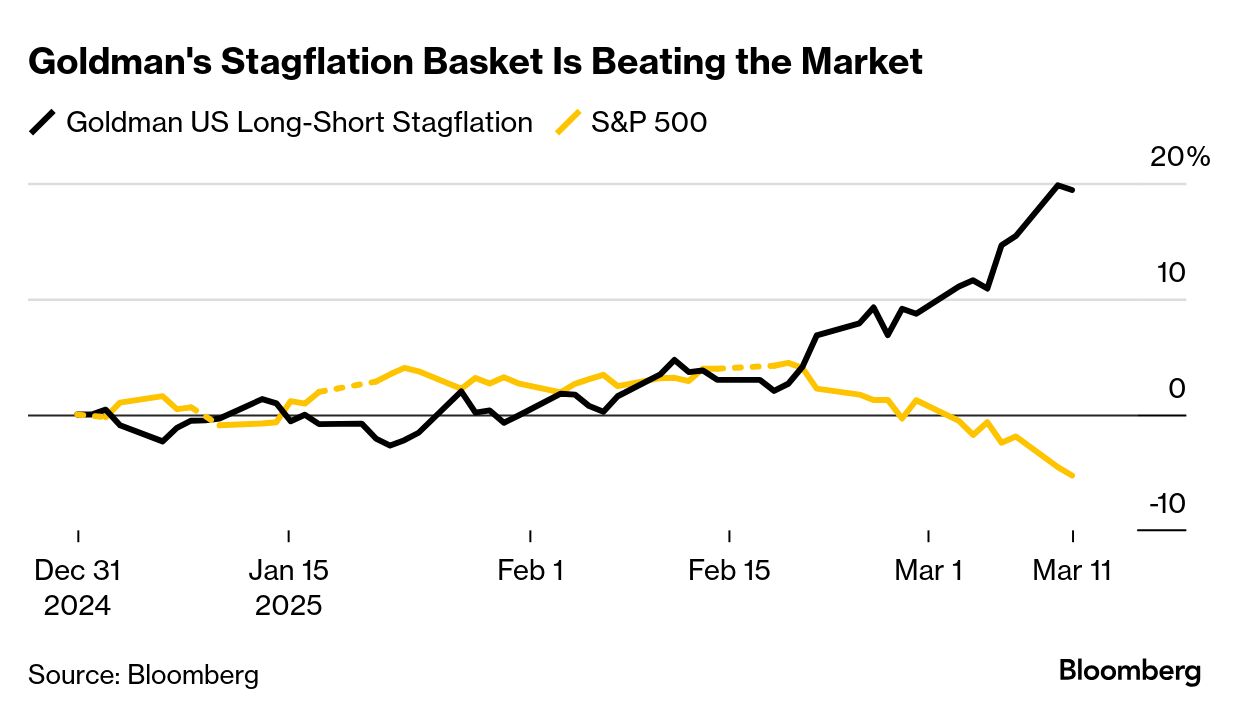

| With Donald Trump's start-stop tariff war dragging on stocks this year, winning strategies have been hard to come by. One, though, is soaring right now: a pair trade that thrives in an economy sinking into stagflation. Goldman Sachs is pushing a basket that bets on strength in commodities (inflation beneficiaries) and defensive sectors like health care (which should outperform in a weak economy). At the same time, it's short consumer-discretionary, semiconductors and unprofitable tech stocks. As of Tuesday, it's up almost 20% this year compared to the S&P 500's 5.3% decline. Market watchers like Evercore ISI's Julian Emanuel say the pieces are in place for a weaker economy yet higher prices. "All our policy analytical work says that if you get tariffs for any length of time on the order of what is already being proposed and considered, that's a recipe for much slower growth and much higher inflation," said Emanuel, the firm's chief equity & quantitative strategist. Evercore defines stagflation as when US economic growth falls below 1.5% while inflation rises above 3%. That scenario would trigger the firm's bear case, where the S&P 500 could fall to 5,200 by year-end from about 5,600 now. Souring sentiment has already prompted a number of economists to cut their outlooks on the US economy. Goldman's Jan Hatzius on Monday slashed his GDP forecast for 2025 to 1.7% from 2.4% and boosted his inflation outlook. —Natalia Kniazhevich | |

| |

One number to start your day | | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment