| I'm Molly Smith, an economics editor in New York. Today we're looking at the hazy outlook for US inflation. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - President Donald Trump said the US would respond to the European Union's countermeasures against his new 25% tariffs on steel and aluminum.

- Canada announced new 25% tariffs on about C$30 billion ($20.8 billion) of US-made products.

- Investors are betting that Russia is about to sweep back into markets — a massive geopolitical gamble that could yet backfire.

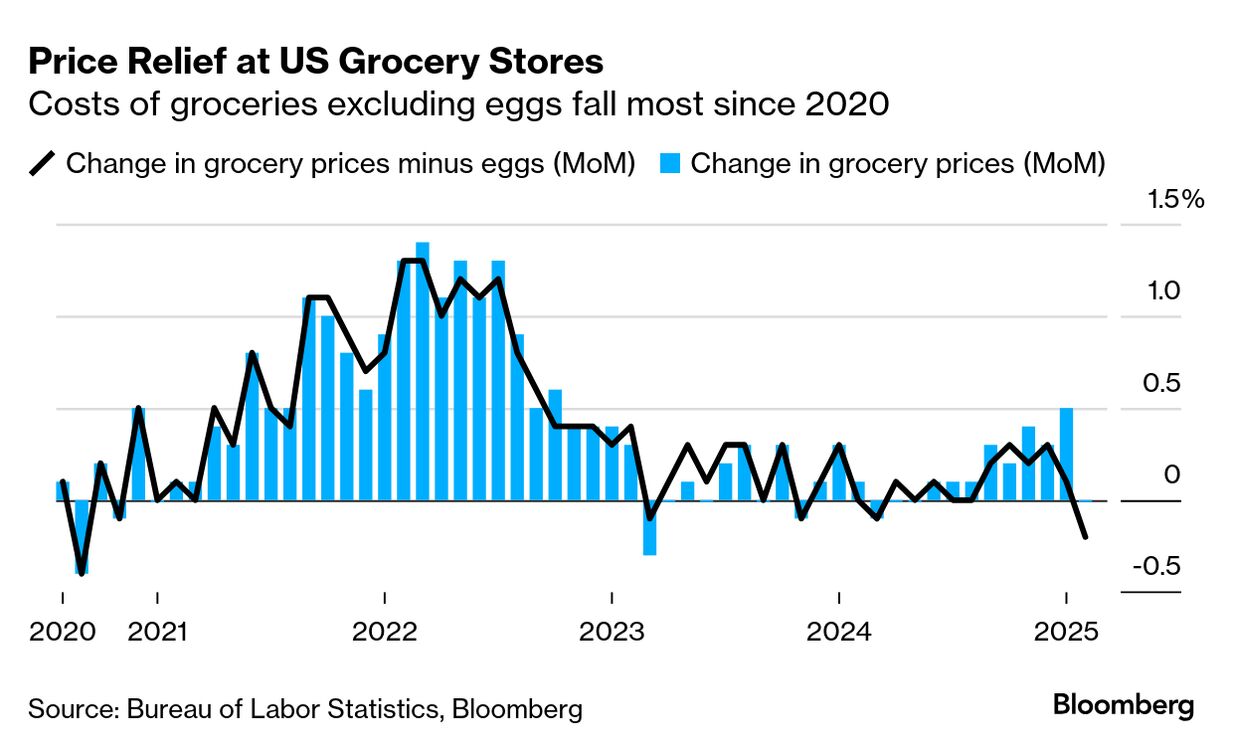

Everyone is so worried about what Trump's escalating trade war will do to the global economy that not even a better-than-expected US inflation report could lift the mood. The February data offered some good news for American consumers — cheaper costs for travel, cars, gas and food — apart from eggs. But it didn't provide any indication about the trajectory of inflation, just as tariffs are expected to drive up prices on a variety of goods and test the resilience of the broader economy. "The headline number was a little bit of a relief, but looking below the surface, the story is not so optimistic," said Derek Tang, an economist at LH Meyer, a policy analysis firm in Washington. "Things are moving so quickly that data can be quite stale. The forward-looking value of this data is not very high." While goods prices were generally tame, economists were still wary of items like furniture, electronics and toys getting more expensive once tariffs fully set in. Also, some categories that inform the Federal Reserve's preferred inflation metric, like restaurants, rose at a firm pace. "Uncertainty remains in the air as the outlook for consumer price inflation remains hazy due to trade policy developments," TD Securities strategists said in a note. The report "is the calm before the storm." The Best of Bloomberg Economics | - China said it has forcefully cracked down on the fentanyl trade and condemned Trump's tariffs.

- Mark Carney will be sworn in as Canada's 24th prime minister on Friday, along with a new cabinet that may be about half the size of Justin Trudeau's executive.

- Senate Democratic leader Chuck Schumer says his party will block a Republican spending bill to avert a government shutdown on Saturday and urged the GOP to accept a Democratic plan to provide 30 days of interim funding instead.

- British workers would be more than $5,000 a year better off if wages had kept pace with their American peers since the financial crisis.

- No tax on tips and overtime sounds great on paper. But beware the unintended consequences.

- New Zealand's prime minister pitched his country as a safe haven in an unstable world as he opened an investor summit aimed at attracting foreign capital.

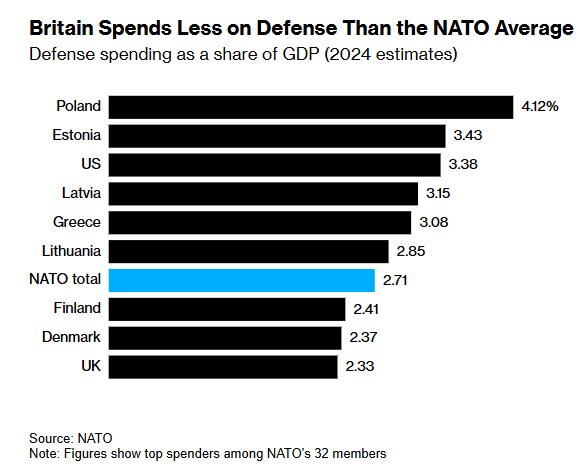

The UK's plan to increase defense spending will have a modest impact on GDP, even though the government said it will be funded with money that would have otherwise gone abroad as foreign aid, according to an analysis from Bloomberg Economics. In theory, this approach should provide a lift to economic growth. "By lowering the amount of aid it sends overseas, in order to pay for defense, it has raised the possibility that a bigger share of the money gets spent in the domestic economy," Dan Hanson, BE's chief UK economist, wrote in a note. Still, Hanson argues that this won't translate into a major boost to the economy. The estimated £6 billion needed to boost defense spending to 2.5% of GDP by 2027 is not a large number, Hanson said, and could be spent to cover higher day-to-day costs and buying equipment from abroad. "So even with the most optimistic assumptions, the growth improvement will likely be little more than a rounding error." Read the full research on the Bloomberg Terminal here |

No comments:

Post a Comment