| Market data as of 06:21 am EST. Market data may be delayed depending on provider agreements. Russian President Vladimir Putin is demanding a |

| |

| Markets Snapshot | | | | Market data as of 06:21 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- Russian President Vladimir Putin is demanding a suspension of all weapons deliveries to Ukraine during a ceasefire proposed by US counterpart Donald Trump, according to people with knowledge of the matter. The two men are scheduled to speak today.

- US stock-index futures are lower after two days of gains, weighed down by the Bloomberg News report on Putin's demands. Investors slashed exposure to US equities by the most on record in recent weeks as expectations of global economic growth worsened, according to Bank of America.

- Israel launched a series of overnight military strikes across Gaza and a nearly two-month ceasefire appeared to be falling apart. The renewed fighting pushed the price of oil higher, while gold touched a fresh record.

- Alphabet is in talks to buy cloud-security company Wiz for $33 billion, restarting discussions that were called off last summer after extended negotiations, people familiar with the matter said.

- German lawmakers vote on a bill today to unlock hundreds of billions of euros in debt-financed defense and infrastructure spending. Bund yields have soared in anticipation of the move, which heralds a pivot toward more expansive fiscal policy in Europe's biggest economy, and they're higher again today.

| |

| |

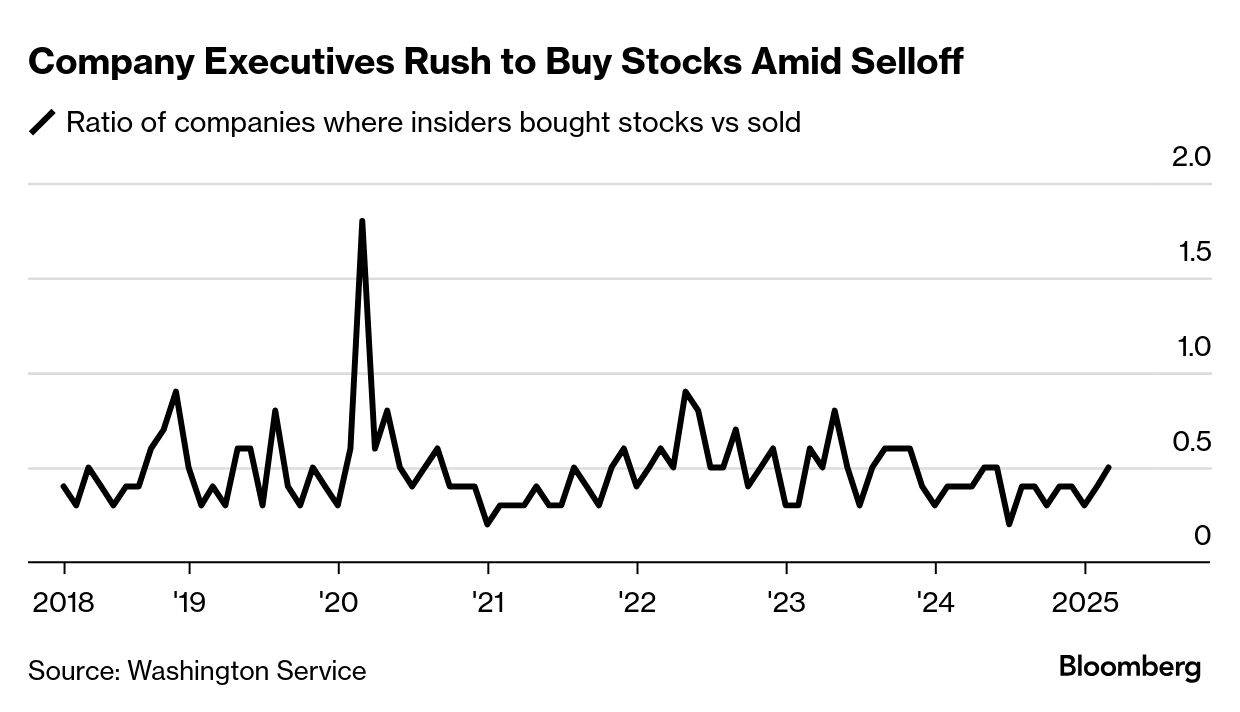

| One group of well-informed investors looked at last week's stock market selloff and decided it was time to buy. When stocks got hammered into a brief correction, erasing some $5 trillion from the value of the S&P 500 Index, corporate insiders stepped in. A gauge of insider sentiment from the Washington Service shows that with two more weeks to go in March, the ratio of buyers to sellers rose to 0.46, up from 0.31 in January. That puts the measure on pace for the highest monthly reading since June and back near its historical average. Moderna CEO Stephane Bancel was one of the buyers, scooping up $5 million of his company's stock in March. Directors at American Express and Marathon Petroleum also snapped up shares during the selloff. Increased buying from the executives who know a company best can be interpreted as a vote of confidence for investors wondering if the the rebound over the past two sessions is a sign that a bottom is in, at least for now. "If we see corporate insiders begin to use the opportunity in their stock prices to purchase shares, that shows that they have confidence in the underlying economy and in their underlying businesses," said Dave Mazza, chief executive officer of Roundhill Investments. "That differs from just the headlines, because the headlines are scary." —Natalia Kniazhevich | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

- Nvidia leads premarket gains in the Magnificent Seven, ahead of CEO Jensen Huang's keynote speech at the company's GTC conference.

- US-listed shares of Grab Holdings jump 7.4%. The Singaporean ride and delivery firm is said to be moving forward with its attempt to take over its Indonesian rival GoTo Group.

- Iveco climbs 6% in Milan after Italian daily Corriere della Sera reports that KNDS, BAE Systems and CSG are among companies with possible interest in the company's defense unit. —Subrat Patnaik

| |

| |

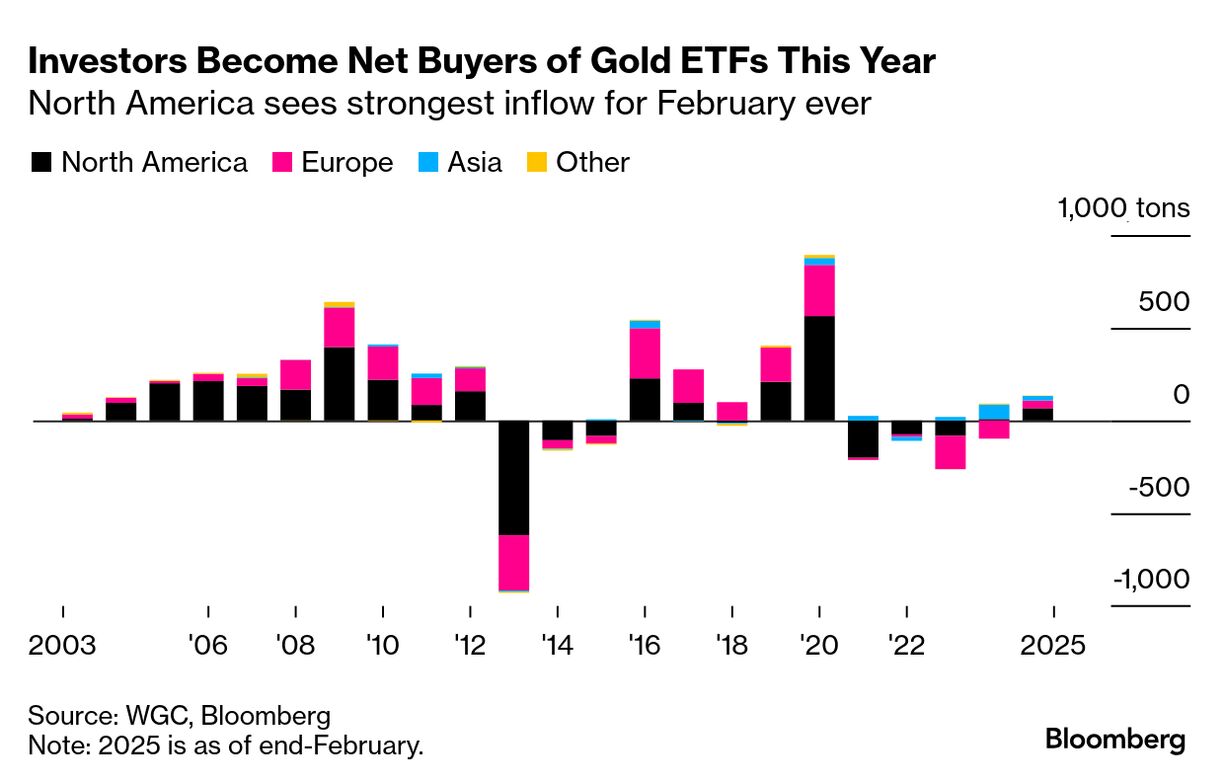

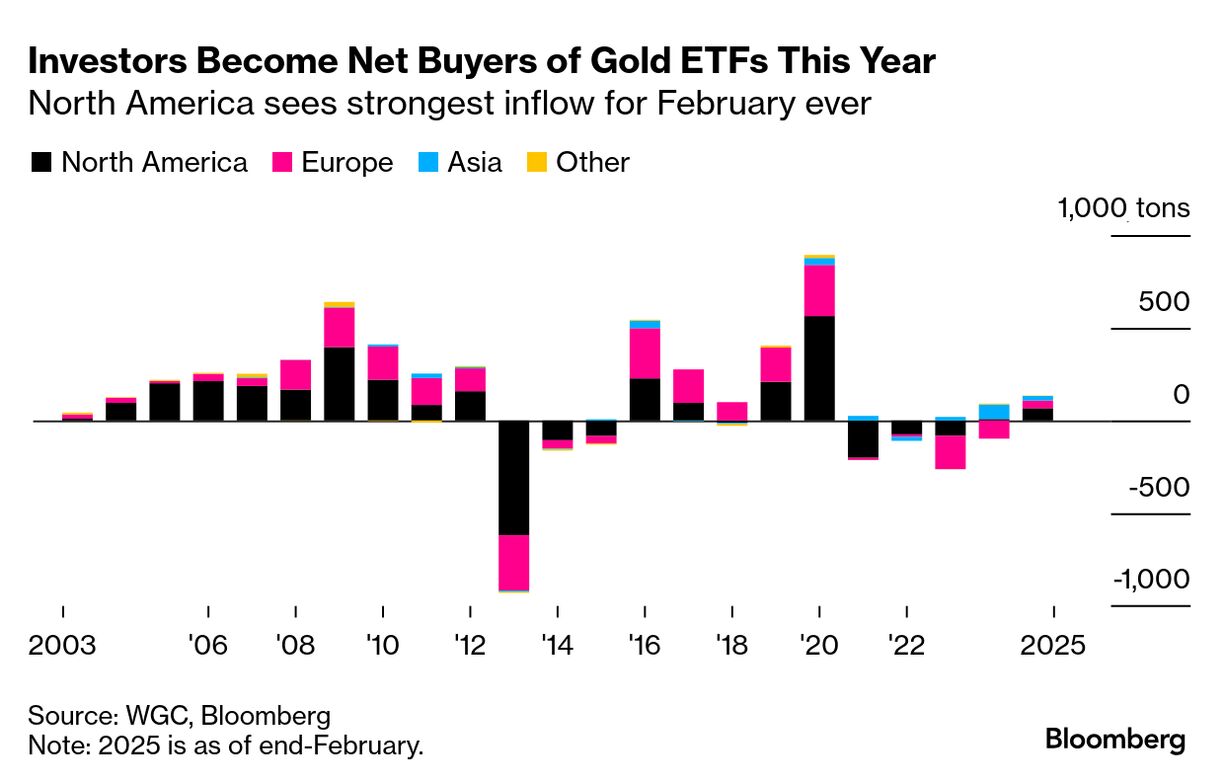

| Bank of America, Citigroup and Macquarie have been vocal cheerleaders for gold during a breakneck rally that has taken prices to record highs above $3,000 an ounce. With anxiety about the global economy growing, they see plenty of reasons to stay bullish: - Household buying. Investors are net buyers of physically backed gold ETFs this year after selling them for the past four years, and concern over a slowing economy may prompt further buying.

- Credit risk. Typically, higher real interest rates like the world has seen over the past few years act as a headwind for gold, because bullion pays no interest, and investors can make safe and attractive returns in government bonds. But higher debt and deficits have meant that some investors are now pricing in an element of credit risk in some developed economy government bonds, pushing some of them to gold.

- Central bank buying. Central banks were the main driver behind gold's ferocious run last year and they continued to buy this year even as prices kept rising. China's central bank, which played a crucial role in gold's spectacular rally last year, expanded its gold reserves for a fourth month in February.

"We do still think there are some materially bullish developments likely to come for gold," said Marcus Garvey, Macquarie's head of commodities strategy, who raised the bank's top-end price target from $3,000 to $3,500 last week. "I don't really see things that would suggest to us that this rally is in an area that's become frenzied or overextended." —Yvonne Yue Li, Mark Burton and Jack Ryan | |

| |

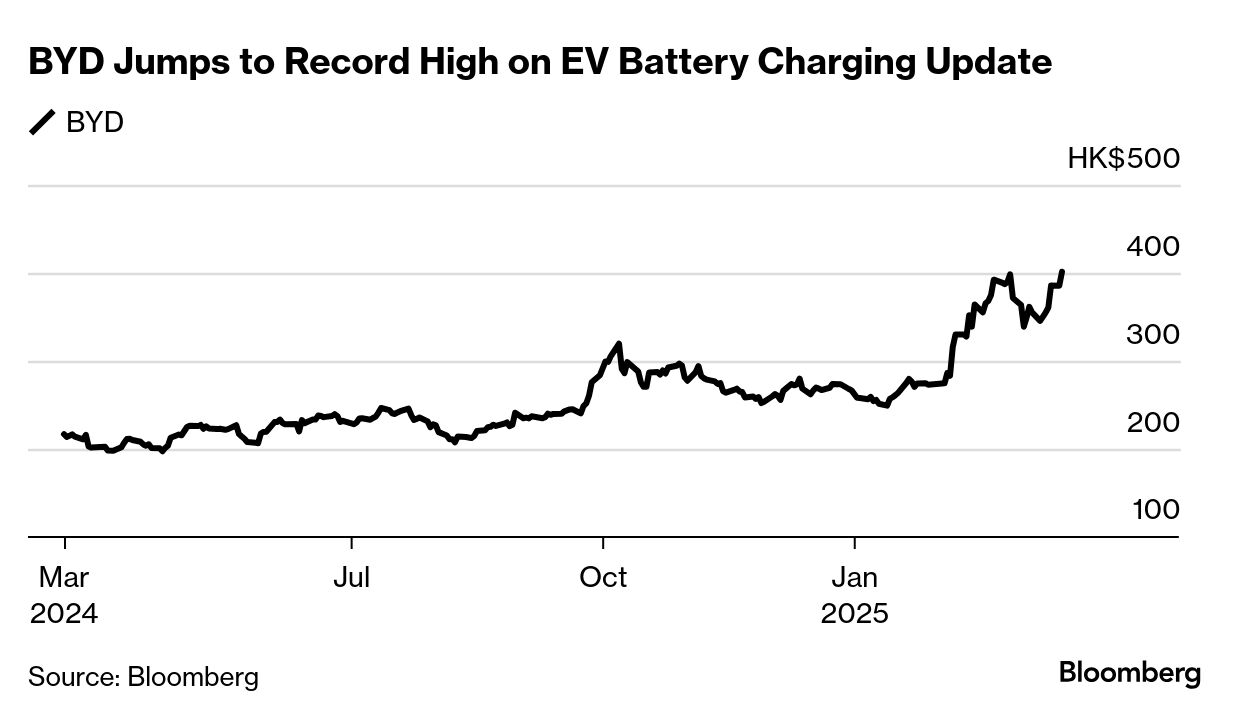

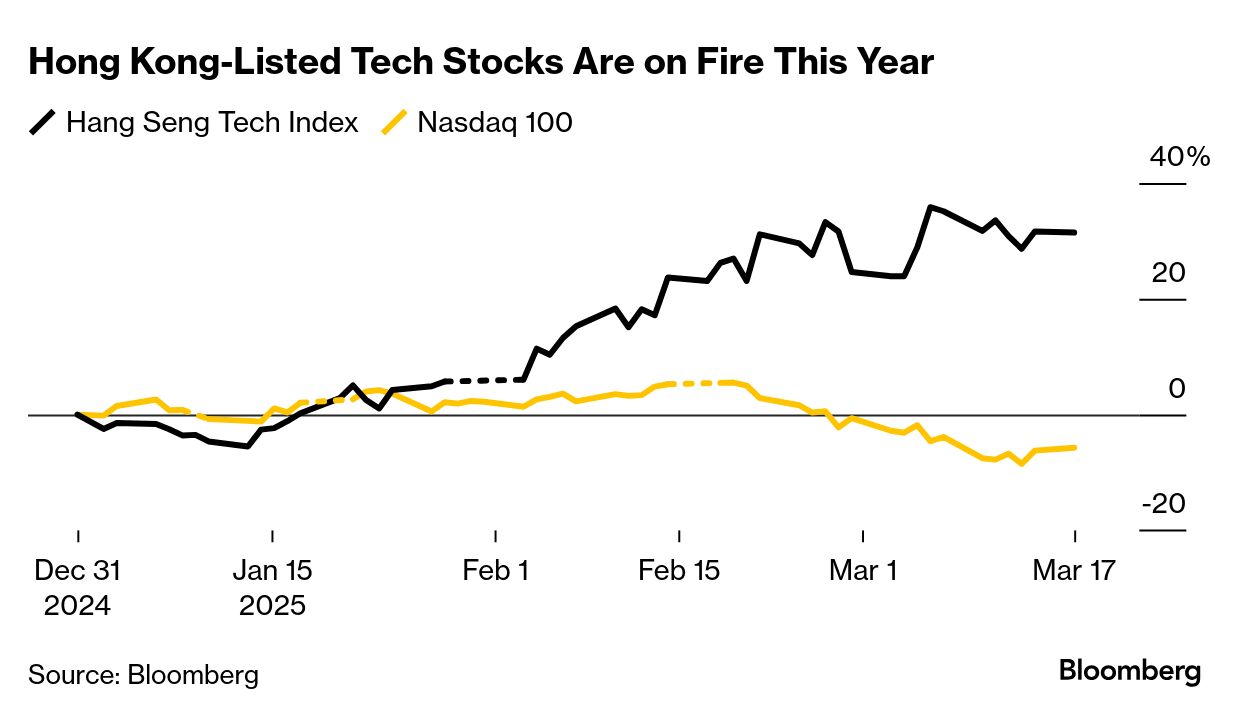

| Back in 2021, Citigroup economist Li-Gang Liu wrote about a possible "Sputnik moment" for Chinese innovation, whereby the country's goal of increased self-reliance would trigger an era of rapid technological progress similar to the US-Soviet rivalry that spurred the 1950s space race. As an investment theme, it didn't exactly get off to a flier. From June 1, 2021, through the end of last year the Hang Seng Tech Index posted a total return of negative 45% while the Nasdaq 100 returned almost 60%. But this year it's a total role reversal, with the Nasdaq handing investors a 5.6% loss while the Hong Kong gauge posted a 32% return through yesterday. All 30 names on the HSTECH rose at least 1.1% today. And little wonder China's industrial prowess is finally starting to show up in equities outperformance when you consider the array of science-fiction-like headlines streaming across the wire. Case in point: BYD is staking claim to a system it says will make it as quick to charge an electric vehicle as to refuel a gasoline car. Xiaomi is boosting its own vehicle-delivery targets, while from Bangkok to Johannesburg to Sao Paulo, the streets are already increasingly jammed with inexpensive compacts, crossovers and SUVs made by Chinese companies. And Tencent has released new AI services that turn text or images into 3D visuals and graphics, the latest in a series of products to emerge from big tech firms since DeepSeek galvanized Chinese AI development. Maybe it's not so surprising, then, that economists are revising up their GDP forecasts for China, and that a survey by Deutsche Bank found consumer sentiment has improved sharply from last year. —Paul Dobson | |

| |

| |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment