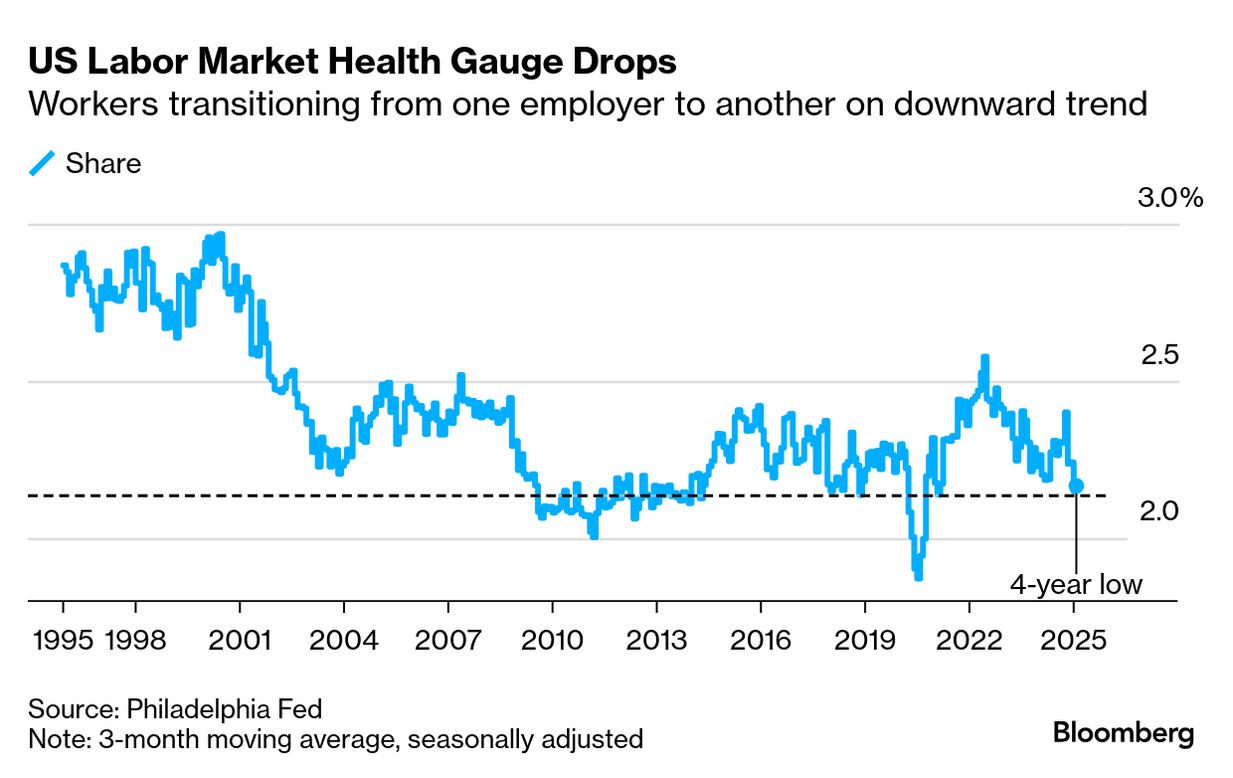

| I'm Chris Anstey, an economics editor in Boston. Today we're looking at Alex Tanzi's reporting on cracks in the US job market. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. US payroll gains have averaged 200,000 over the past three months, not very far off the pace sustained since the hole from Covid was filled in as of June 2022. The unemployment rate, at 4.1% last month, remains historically low — the mean over the past three decades is 5.6%. But still waters can be deceiving, masking worrying currents underneath. One development of concern is a gauge of dynamism that measures the number of workers transitioning directly from one employer to another. If lots of people across the economy are able to go straight from one job to the next without a period of unemployment, it suggests strong demand for employees. The Federal Reserve Bank of Philadelphia keeps tabs on this measure, and the latest readings marked the lowest levels since 2021, back when the economy was still reeling from the pandemic. Whether they're poached by recruiters or competing firms or are simply seeking a better situation for themselves, direct job switchers are often able to command a higher salary when they move. Research has shown that over the career life-cycle, the ability to make direct moves is a major source of earnings growth. But the wage premium for job-switchers over those who stay put has been declining too, and in fact it's now disappeared. Wage trackers published by the Atlanta Fed show that pay growth is now higher for the stayers than for the switchers, something that's rarely been the case in the period since the Great Financial Crisis. These tea leaves were already floating in the job-market cup before the Trump administration got going on some of its economic-policy program. Tariff hikes and an immigration crackdown are likely to have an impact, economists say. As for migration curbs, former New York Fed President Bill Dudley warns that they likely have caused labor-force growth to have "collapsed." A Bloomberg Opinion contributor, Dudley said last week that "top speed for the US economy in terms of keeping the unemployment where it is is probably 50,000 payrolls a month." That would mark quite a slowdown indeed. The Best of Bloomberg Economics | - America's top trade negotiator is attempting to inject order into sweeping new tariffs expected next month, after previous announcements roiled markets.

- Trump picked Federal Reserve Governor Michelle Bowman to serve as the central bank's vice chair for supervision.

- US births declined in 2023 to the lowest level in more than 40 years, continuing a decades-long trend toward smaller American families.

- The Bank of Japan is expected to keep its benchmark interest rate unchanged this week as concerns over global economic prospects mount.

- Virtual reality headsets will be added to a list of products used to measure UK inflation, while local newspaper adverts and DVD rentals are out.

- The Swiss National Bank largely kept out of currency markets at the end of 2024 despite the franc's rally after Trump was elected.

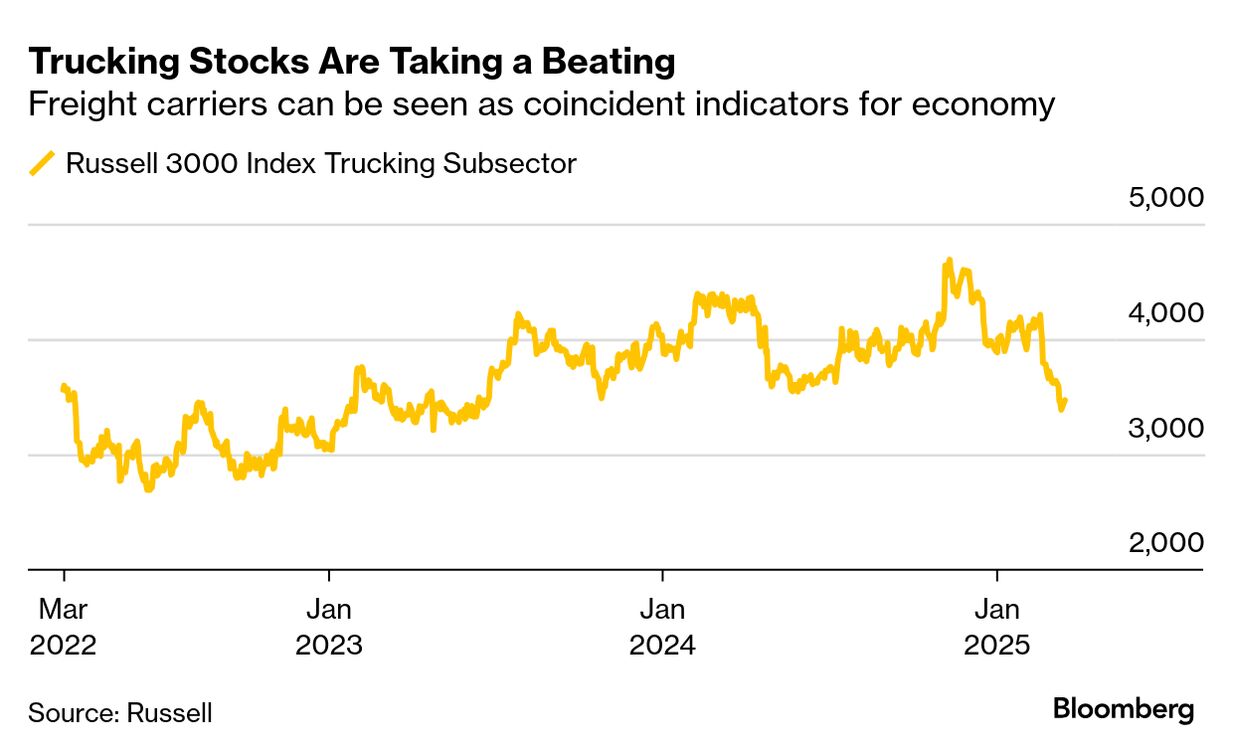

US trucking company shares have lately been doing something other than — as the saying goes — keep on truckin'. They've slid, and that's helped put Joseph Brusuelas, chief economist at RSM US LLP, on watch for downgrading his growth forecast. The Russell 3000 Index's trucking gauge, which includes firms such as Old Dominion Freight Line and XPO, has plunged some 26% since reaching a record high back in November. Transportation stocks more broadly have also tumbled, with the Dow Transportation indicator almost hitting bear-market territory last week. "The economy is experiencing a late-cycle slowdown," Brusuelas wrote Monday. "But should demand for goods ease further, a broader bout of risk aversion will dampen outlays on capital expenditures, hiring and durable goods subject to import taxes. In that case, one should anticipate transportation and trucking indices to capture that in near real time and we will have to revisit our growth forecast for this year." |

No comments:

Post a Comment