| Market data as of 05:35 am EST. Market data may be delayed depending on provider agreements. President Donald Trump said he plans to start h |

| |

| Markets Snapshot | | | | Market data as of 05:35 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- President Donald Trump said he plans to start his reciprocal tariff push with "all countries," curbing speculation that he could limit the initial scope of the levies. He said he "couldn't care less" if carmakers raise prices in response.

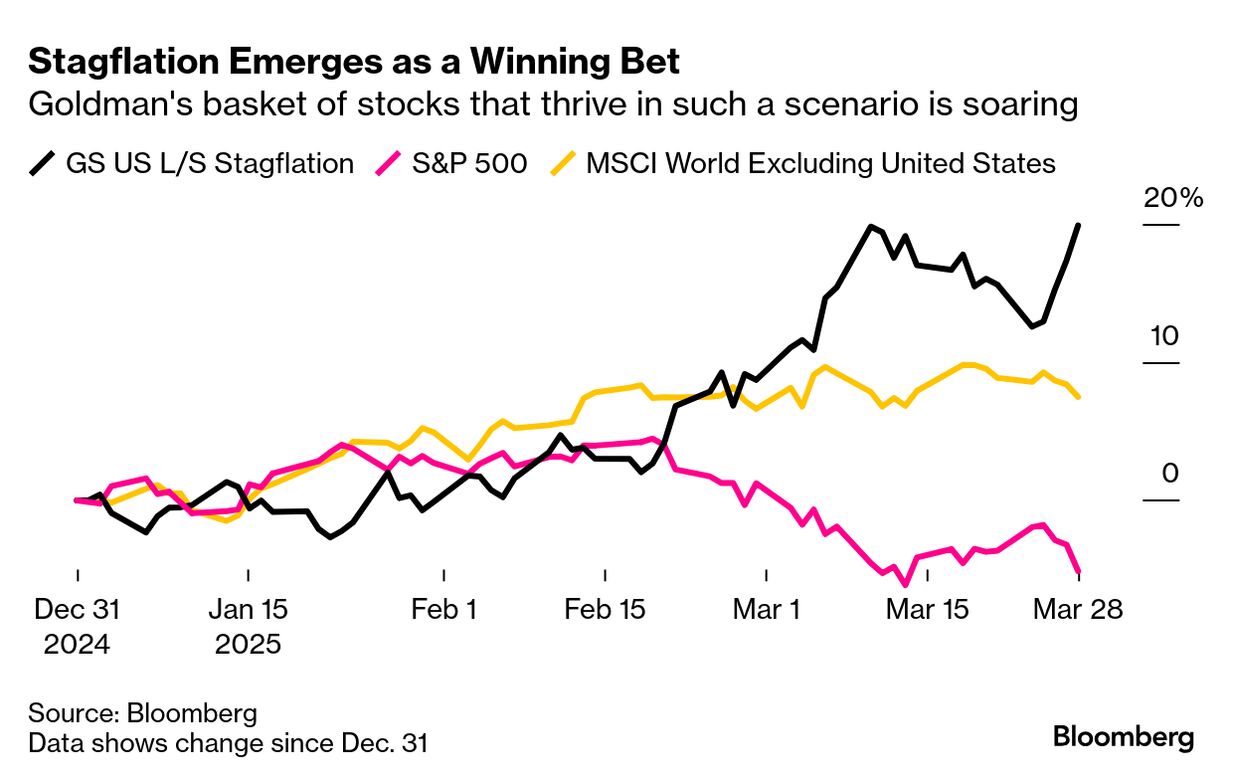

- Stocks are sliding anew as a roller-coaster quarter for markets comes to an end. Trump's policies and stagflation fears are driving investors out of riskier assets. European stocks are beating US equities by the most on record, Japanese stocks are in a correction and gold is at a fresh record high.

- Goldman Sachs strategists cut their S&P 500 target for a second time this month, citing a higher recession risk and the effect of tariffs. They see the benchmark ending the year around 5,700 versus their previous estimate of 6,200. The new target implies gains of 2% from Friday's close.

- Trump said he was "very angry" at Vladimir Putin and threatened "secondary tariffs" on buyers of his country's oil if the Russian leader refuses a ceasefire with Ukraine.

- Huawei posted its first quarterly net loss in years after the Chinese telecom-equipment company spent aggressively on research in areas from EVs to chips while the business as a whole slowed.

| |

| |

| President Donald Trump says he's looking forward to Wednesday. Global equities investors, not so much. The administration is expected to unveil a broad slate of so-called reciprocal tariffs against US trading partners, and it's looming as the next potential body blow for markets. "Everything is at stake, everything," said Mark Malek, chief investment officer at Siebert. "Inflation is on the rise, consumption is showing signs of weakness, consumer sentiment is slipping, all stemming from the administration's tariff policy." Some key sectors to watch: - Reciprocal tariffs could add to the pain for autos, which have already been hit. German carmakers send more vehicles to the US than to any other country, including some higher-margin models from Porsche and Mercedes-Benz. In Japan, Toyota is the world's largest carmaker by delivery and Honda gets more than half its revenue from North America.

- Chipmakers, like car companies, have a global supply network and are vulnerable at a time when the industry is already struggling with signs of trouble with data-center growth and the pace of capital expenditure. South Korea and Taiwan are the world's powerhouses, so all eyes will be on Taiwan Semi and Samsung Electronics. Shares such as Nvidia, Advanced Micro Devices and Intel will also be in focus.

- Pharmaceutical giants such as Pfizer, J&J, Merck and Bristol Myers Squibb will be exposed as reciprocal tariffs could impact everything from drug sourcing to distribution. As one of Europe's largest listed companies, the fortunes of weight-loss drug maker Novo Nordisk have big implications for the region's stock market.

- Trump's threat of a 200% tariff on alcoholic products shipped from the EU is already a headache for the region's producers of wines and spirits. Aperol maker Davide Campari-Milano has said even a 25% tariff would result in losses of at least €50 million.

- Trump has already hit aluminum and steel producers with 25% tariffs. Following Europe's countermeasures, eyes now are on whether the US president will respond. Among companies to watch, Rio Tinto is the biggest supplier of aluminum to the US market, with about half of production manufactured last year in Canada. — Esha Dey, Kit Rees, Sangmi Cha and Abhishek Vishnoi

| |

| |

-

The tech-heavy Nasdaq 100 Stock Index has not had a great start to 2025. The benchmark index has fallen 8.2% in the first three months of the year, putting it on track for its worst quarterly showing since 2022 as heightened trade tension, US spending cuts and recession fears loom. Nasdaq 100 futures fall 1.1%  -

Apple falls 1% in premarket trading. France's antitrust regulator fined the iPhone maker €150 million after a lengthy probe into how the technology company asks to collect iOS users' data and the impact on advertisers. -

AB Foods fell 4.6% in London trading after Paul Marchant, the CEO of its flagship brand Primark, resigned following an investigation into an allegation about his behavior toward a female employee in a social environment. -

Aston Martin rises 9.7%. The automaker expects to raise at least £125 million ($162 million) by selling more shares to Canadian billionaire Lawrence Stroll and its minority stake in the Formula One racing team. -

Pets at Home plunges 15% in London, the biggest drop in four months, after the midpoint of the retailer's profit guidance for 2026 came in below expectations. -

Grieg Seafood jumps 12% in Oslo after the salmon producer said that Andreas Kvame has agreed with its board of directors to step down as CEO after 10 years. -

Wood Group sinks 39% in London after the oil-field services company said it expects to adjust its income statement and balance sheet after an independent review uncovered "material weaknesses" in the business. —Subrat Patnaik | |

| |

| |

| The week will be dominated by just what Trump does with tariffs on Wednesday, which he has dubbed "Liberation Day." Other highlights include Friday's US payrolls report for March and a subsequent speech by Federal Reserve Chair Jerome Powell. Click here for a full rundown on the week ahead. Tuesday: Australia's central bank is expected to leave interest rates unchanged, euro-area inflation data is due and the US's ISM manufacturing and JOLTS reports are out. European Central Bank President Christine Lagarde speaks. Wednesday: Trump makes his announcement on reciprocal tariffs with Canada among those promising to retaliate. The US publishes ADP and factory orders data. Thursday: US jobless claims and ISM services data. US tariffs of 25% on car imports are set to take effect. Fed Vice Chair Philip Jefferson speaks. Conagra reports earnings. Friday: Germany releases factory orders numbers and the US and Canada see payrolls data. Powell speaks. Microsoft streams a 50th anniversary event from Redmond, Washington. | |

| |

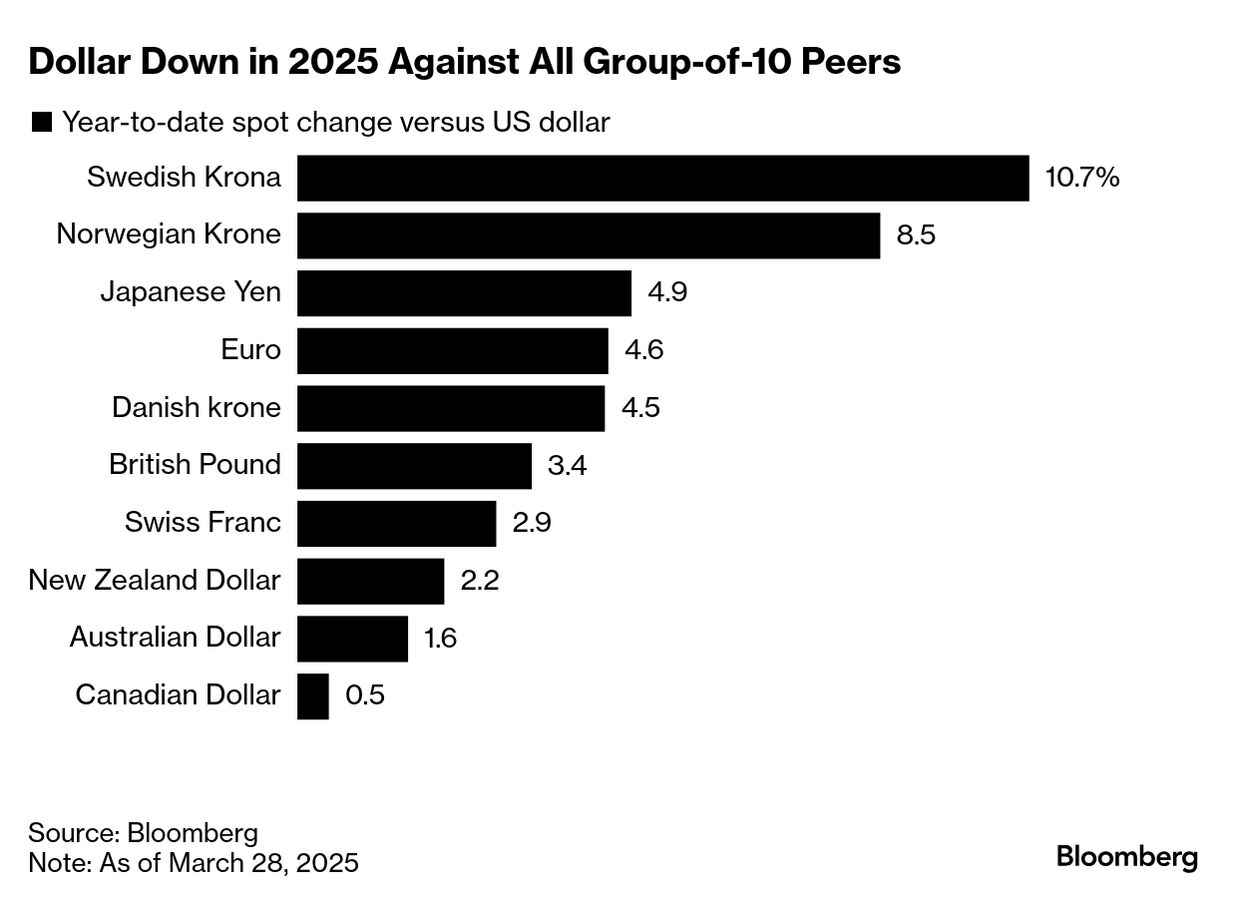

| Just two months into Trump's second term, his escalating tariffs and bid to roll back decades of globalization is shaking confidence in the dollar, a currency that has had a privileged place at the heart of the world financial system for eight decades. The dollar has dropped against all but a handful of the 31 major currencies over the last three months, sending Bloomberg's dollar index down almost 3%, its worst start to a year since 2017. The price of gold — a rival haven — has surged to a record high of more than $3,100 an ounce. By mid-March, speculative traders started betting against the dollar for the first time since Trump's election amid fear his policy shifts could drive the world's largest economy into a recession. "It's unusual and very telling," said John Sidawi, who helps oversee bond investments at Federated Hermes. "The dollar, in an environment where it should be acting like a safe haven, is not." —Carter Johnson and Naomi Tajitsu | |

| |

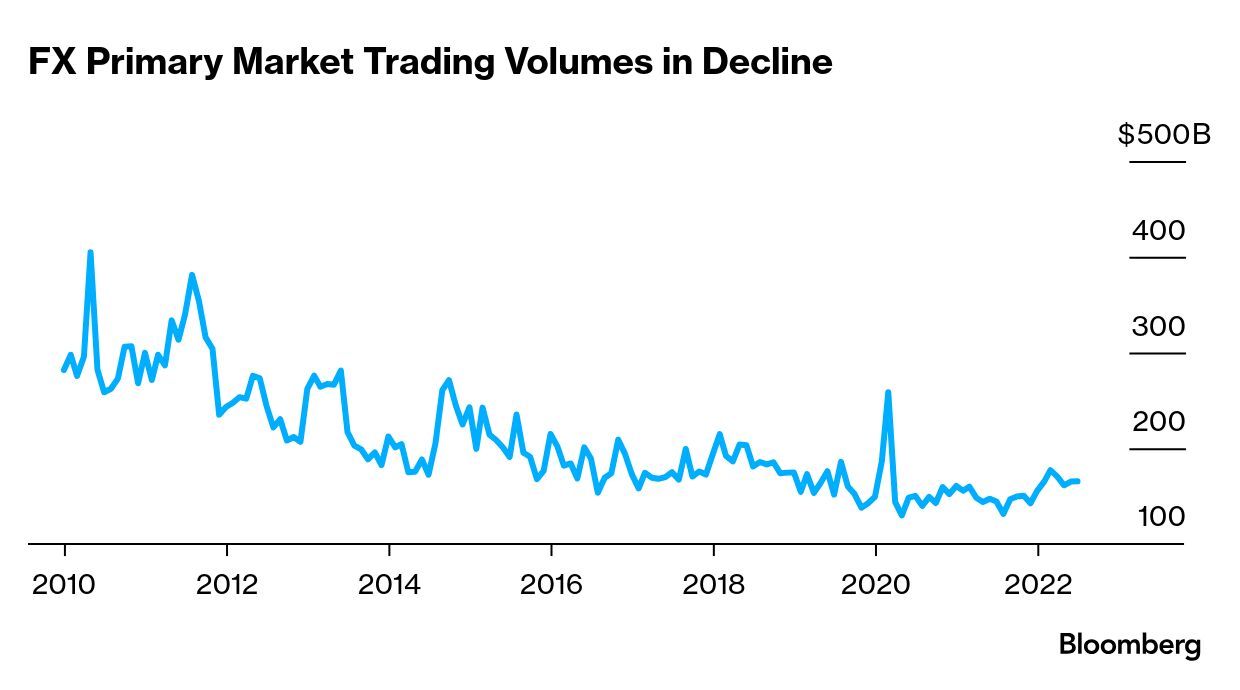

| The global arena for currency trading appears to be a giant pool of cash in constant churn, generating $7.5 trillion of transactions per day. But lately key names from the industry have begun to fret about just how deep the pool really is. They fear a proliferation of trading platforms and the widespread use of automation are creating the illusion of market depth, while a retreat of big institutions has actually drained liquidity away. The symptoms are subtle, including things like rising trade rejections, declining volumes at key venues, and volatility in the gaps between what buyers offer and sellers ask. But they all point to what's known as liquidity mirage, a phenomenon that can ramp up risk for market participants without them even knowing. "Liquidity on the face of it might look quite robust," says Mark Meredith, head of FX e-trading and algo execution at Citigroup. "But actually in extreme events it's more and more fragile." —Alice Atkins | |

Word from Wall Street | | "It's costing me a lot to be in this job. My Tesla stock and the stock of everyone who holds Tesla has gone, went roughly in half. Long term I think Tesla stock's going to do fine, so maybe it's a buying opportunity." | | Elon Musk CEO, Tesla | | Click here for more of Musk's comments about his role as head of Donald Trump's effort to cut the size of government. | | |

| |

| |

| |

| | Unlock full access to all markets stories, create unlimited watchlists and track the stocks you care about by becoming a Bloomberg.com subscriber. For a limited time as a Markets Daily reader, you can get half off a full year's subscription – don't miss out. | | | | | | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment