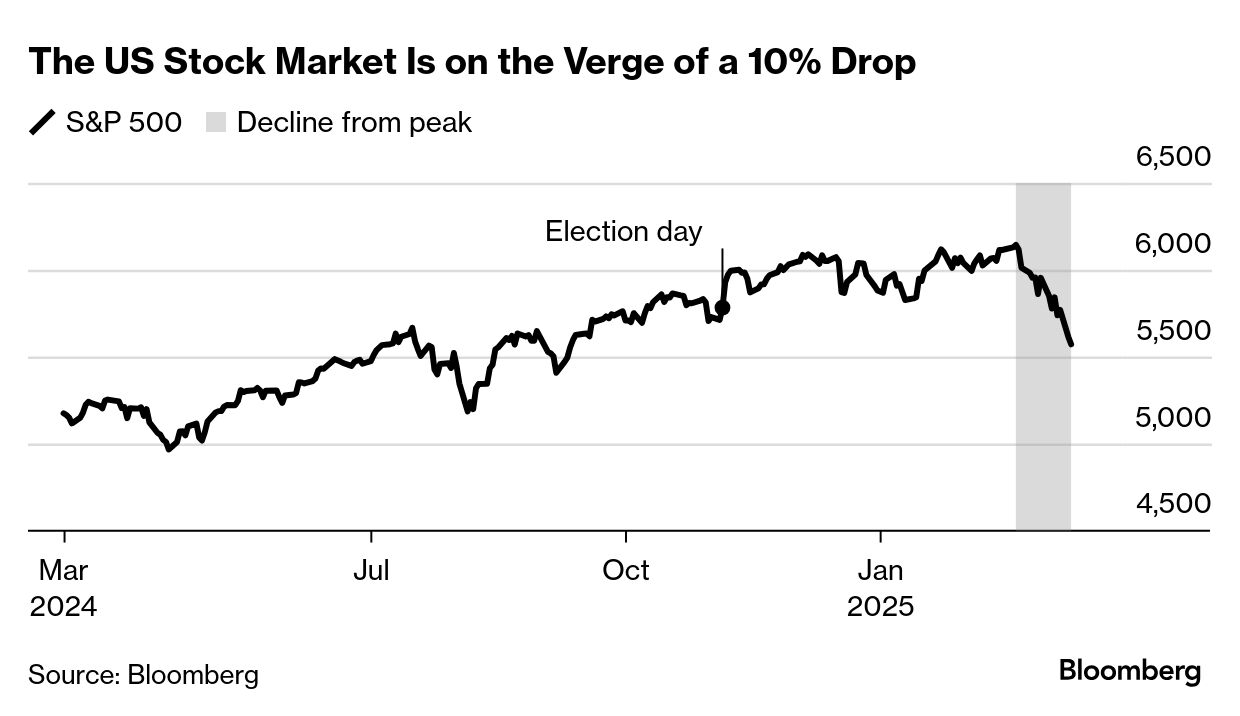

| Less than two months into Donald Trump's second presidency, a new reality seems to be settling in: This time around, the billionaire who has promoted his own gospel of wealth isn't watching the stock market as a barometer of his success. In fact, it seems like he may be willing to sacrifice the bull market — and, in the short term, even the growth of the economy itself — to upend a global order he says has served America poorly for decades. Take yesterday. Just after 10 a.m., a half hour after the opening bell, the S&P 500 had started to steady from the fear-induced selloff that swept across Wall Street on Monday. Then Trump fired off another social-media broadside in his trade spat with Canada, sending stocks lurching downward again. "No one is blinking on the trade war yet and that's troubling to our clients," said Jamie Cox, managing partner at Harris Financial Group. "The market thought Trump was bluffing. Now we're living through the difficulties of it." It's made for a dizzying spell for traders who'd ridden the AI euphoria and swelling corporate profits to one of the strongest runs since the 1990s internet boom. In just a few short weeks, it's given way to a virtually non-stop churn of volatility fueled by the chaotic rollout of Trump's plans in all-capped social media posts or television appearances. The S&P 500 is now down 9.3% from its all-time high from last month, on the verge of the 10% drop that market watchers consider to be a correction in a bull market. And the bulls are tempering their optimism: Goldman Sachs lowered its year-end target for the S&P 500 Index to 6,200 from 6,500, implying an 11% gain from yesterday's close. Trump, for his part, doesn't see a recession in the offing, and says he's not concerned by the selloff. Markets "are going to go up and they're going to go down,'' he said at the White House yesterday. "But you know what, we have to rebuild our country." Some traders aren't so sanguine. "I'm treating this like the Great Financial Crisis or European debt crisis," Peter Tchir, head of macro strategy at Academy Securities. "I think we get a chance to have a small bounce, but I'm beginning to think we might have 20% downside from here." —Carmen Reinicke and Jess Menton |

No comments:

Post a Comment