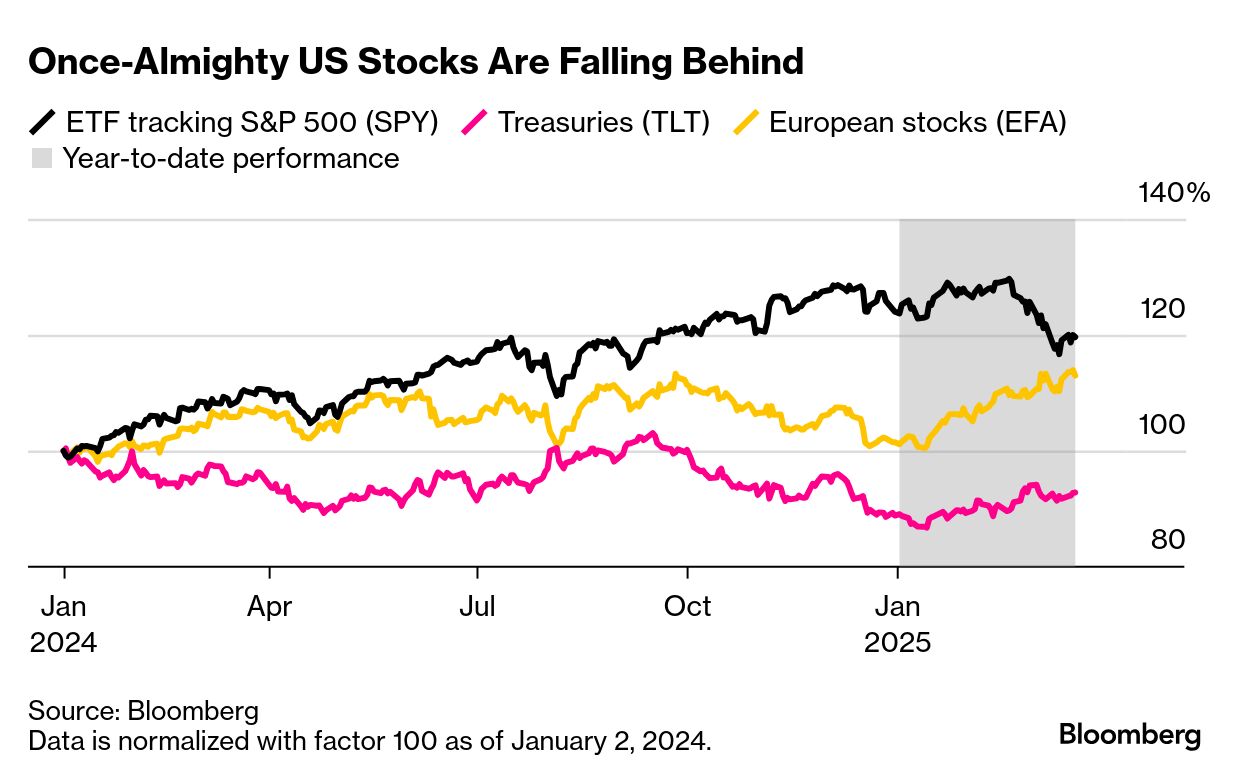

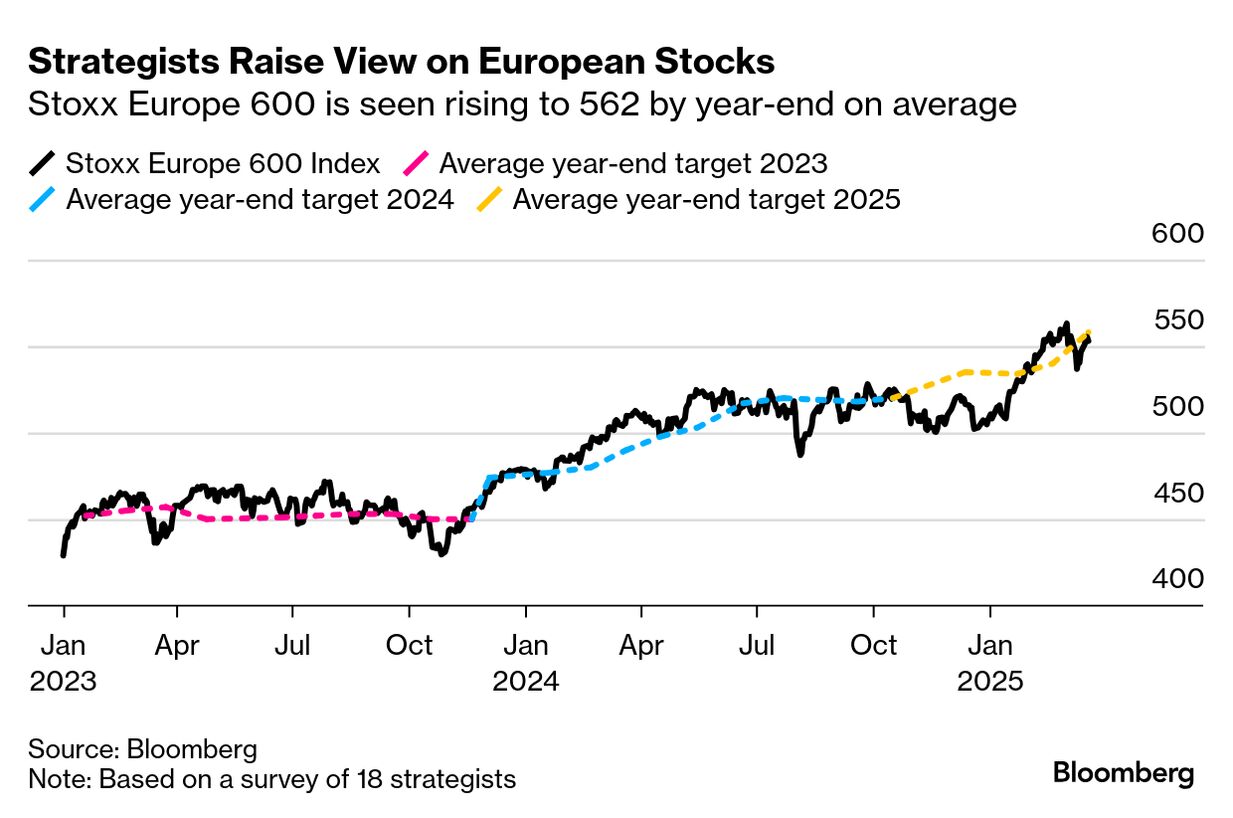

| Market bets that enriched investors heading into this year have been mired in a world of pain recently. It's the case with Bitcoin, Big Tech shares, the dollar and the most time-honored investment strategy of them all: Buying the dip in stocks. Donald Trump's disruptive policy agenda continues to turn markets upside down while pushing once-moribund government bonds, European equities and commodities to the top of the leader board. The result has been a futile stretch for retail bottom-fishers diving back into last year's equity winners. For 16 separate sessions in 2025, day traders snapped up more than $2 billion of stocks, a pace of buying that occurred only four times in the previous two years, data compiled by JPMorgan Chase show. The dip buying has been punishing, because bounces in the stock market have failed to hold. A JPMorgan model portfolio tracking retail's money flows in the market shows they've lost 7% of their capital this year. That's about double the S&P 500's decline. Market watchers keep a close eye on retail traders as they are often the last to cut their exposure to stocks, so the latest bout of aggressive buying from mom-and-pop investors may suggest that equities haven't found the bottom yet. While a painful comeuppance, the struggles are boosting Wall Street's old guard, who love to preach the virtues of diversifying portfolios for the long haul. The idea is that, with a handful of tech giants dominating the S&P 500 like never before, it's prudent to spread out money across regions, asset classes and strategies. The benefit is on display this year, going by an ETF that does exactly that. The Cambria Global Asset Allocation ETF (GAA), which invests across stocks, bonds, real estate and commodities, is up and ahead of the S&P 500 by more than 6 percentage points. It's poised for the largest annual outperformance since the fund's 2014 inception. All told, this year's cross-asset shakeup highlights the dangers of too much money chasing too few ideas, says Alicia Levine, head of investment strategy and equities at BNY Wealth. "All you got to do is 'buy the dip' — I think we need an environment to change that before the psychology of the investor really says, 'maybe I should be more cautious and be more diversified,'" she said. —Lu Wang |

No comments:

Post a Comment