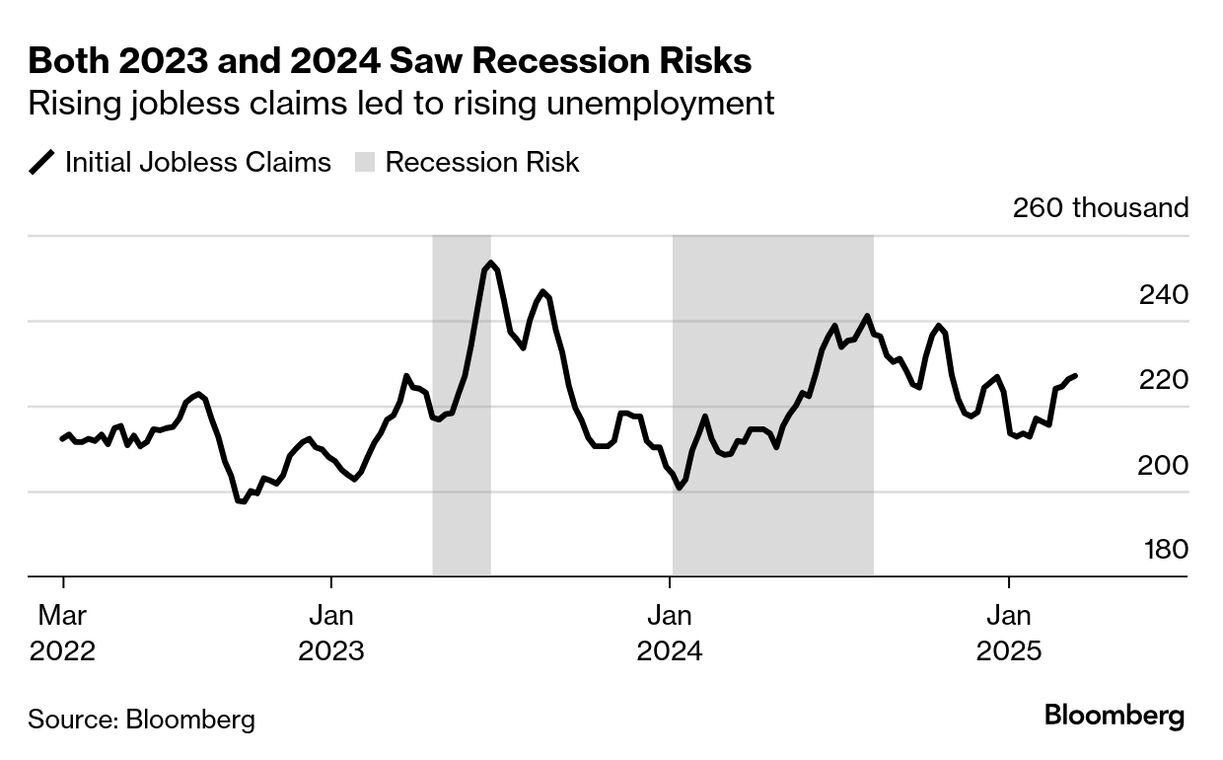

| I've probably said this before but jobless claims are our best high-frequency economic data point. Not only does it tell whether companies in the US are feeling so much risk that they have to lay off workers, it also gives a sense of the potential hit to consumption. And the continuing number of jobless claims give us a sense of how difficult it is to find employment after one has been laid off, something critical for the economic outlook if the federal goverment's layoffs keep going on. The way I think about it is that there's a steady churn in the economy that yields a constant flow of initial claims for unemployment insurance every week. If that flow rises, it's a sign that companies are laying off more people, And if the number of initial claims rises enough, the resulting hit to consumption can help tip the economy into a recession. My rule of thumb is that a sustained rise of 50,000 initial claims in less than a year means recession. Back-testing that rule, it's held in every recession for which jobless claims statistics are available. Here's what the numbers have looked like over the last three years. We've seen two distinct periods of recession risk when the rise in claims was high enough to sit up and take notice. Both coincided with rising unemployment rates. And the second longer rise triggered the so-called Sahm rule, which says a recession was likely to follow because of the rise in the unemployment rate over the last twelve months. Former Fed economist and Bloomberg columnist Claudia Sahm, who invented that rule of thumb, told us last year the rule was meant to be broken. Just as she suggested, we have yet to see a recession. So we've had the risk of recession but no actual recession. And my rule — can I call it the Harrison rule here? — has not been triggered, by the way. Right now, we're right about the same level we were six months ago and only up 15,000 or so from the recent lows. No recession threat. So if you're an investor and the big thing you care about in terms of shuffling your portfolio allocation is inflation and recession, you're kind of in a holding pattern. Inflation is elevated but not horrible. And there are no signs of recession in the hard data yet. Going back to the four potential economic outcomes I handicapped last week, I'd say all are still in play and the odds for more favorable outcomes are slightly better. I thought it was interesting that, in the Signal chat group which the Trump Administration inadvertently opened to a journalist, Vice President Vance mentioned holding off on military action to see how the economy develops. His exact words were: There is a strong argument for delaying this a month, doing the messaging work on why this matters, seeing where the economy is

What that tells you is that the economy-retarding elements of the Trump economic plan are not on auto-pilot. There may be some calibration in order to prevent a recession. So, if I handicapped it today, I'd add 5 percentage points to the two best outcomes and take that away from the two worst economic outcomes. For equities, that means the correction was a blip that won't be validated unless and until we see economic slowing or higher inflation. Shares can trade neutral to higher as long as inflation numbers, economic growth numbers and earnings reports play along. The first potential catalysts I see in the near term is the personal consumption expenditures (PCE) data this Friday. Not only do we get another month's read on how consumption is holding up, we will also get the Fed's preferred inflation metric, which is expected to come in at 2.5%. What's more, this inflation report will help decide whether inflation truly has been moving back to target as the Federal Reserve has claimed. Anything over 2.5% says that not only is the Fed's confidence misplaced but that any price rises associated with the burgeoning trade war will make the numbers even higher. If either that headline figure or the one excluding food and energy surprise to the upside, stocks will get hit, and potentially go back into correction territory. Making matters worse, bonds will get hit too. At the end of next week, we get another jobs report. The unemployment rate is expected to rise again to 4.2%. But it's hard to say how the market will react until we know what the inflation outlook looks like. In that sense, the PCE data are more important and a potentially bigger catalyst. The big takeaway then is not that consumer sentiment doesn't matter. It does matter as it does tend to fall before recessions. But it can also fall a lot without triggering a recession too. So it's just part of the overall picture — and not the one we should be focused on right now. |

No comments:

Post a Comment