| Bloomberg Evening Briefing Americas |

| |

| HSBC is considering outsourcing part of its sprawling trading business as executives struggle to justify making technology investments needed to keep up with larger rivals. Europe's largest lender is said to have held preliminary discussions about directing parts of its fixed income trading order flow to an outside market maker, a move that would allow HSBC to save millions of dollars in IT costs associated with running trading desks around the globe. HSBC is said to be open to a deal with firms including Citadel Securities and Jane Street Group.  Ken Griffin Photographer: Saul Martinez/Bloomberg The bank's willingness to consider such a deal shows that even systemically important banks with huge Wall Street operations—the lender operates one of the world's largest debt capital markets teams—are struggling to make the necessary technology investments to properly compete in trading. Citadel Securities, the market maker founded by billionaire Ken Griffin, has been developing the idea for such a trading service, Bloomberg first reported in July. Under those nascent plans, the market maker would manage the guts of the trading desks—including technology, analytics and order execution—while banks would continue dealing with the customers.—Natasha Solo-Lyons | |

What You Need to Know Today | |

| |

|

| The giants of private equity are preparing to fight for two little letters. The $5 trillion industry is embarking on a campaign to change the way taxes for indebted businesses are tallied. Leading lobbyists want to tack two letters—DA—back onto an earnings formula used to help calculate tax deductions, a change potentially worth billions of dollars. The idea is to account for depreciation and amortization when determining the tax deductibility of a company's debt payments. The maximum amount any company can get in such tax writeoffs is calculated as a percentage of earnings. That's why using Ebitda—which is typically bigger than Ebit—in this process would generate heftier tax deductions. And that means bigger tax savings for heavily indebted companies and—most importantly—increased returns for private equity firms that own them. | |

|

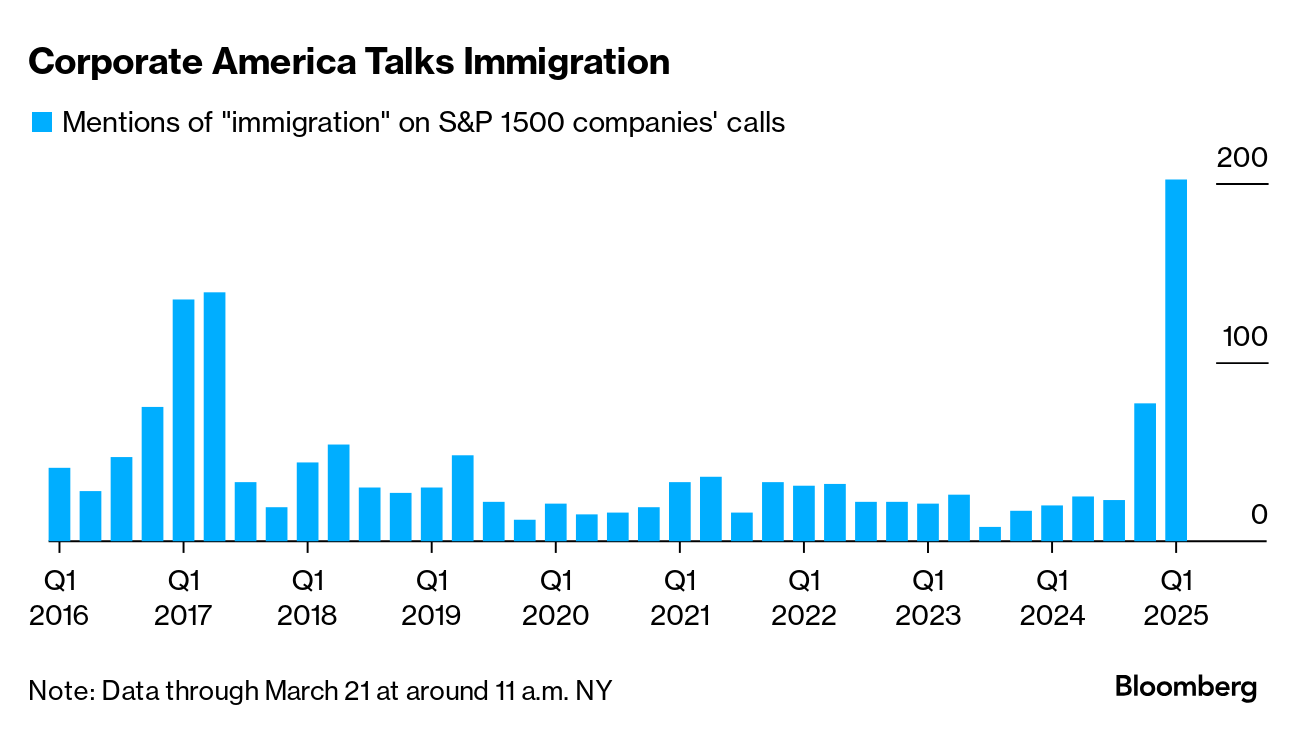

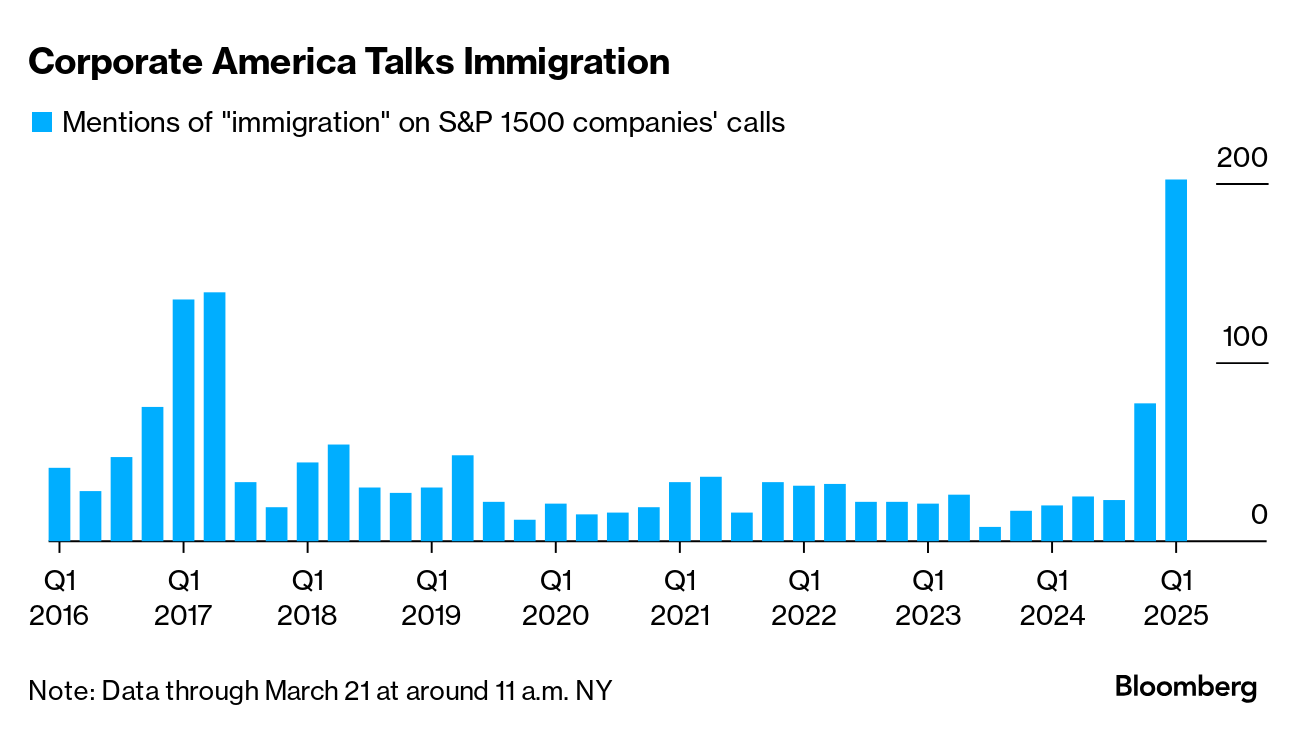

| A federal judge denied for now a Trump administration request to use the two century-old Alien Enemies Act to deport Venezuelan men whom it claims are gang members. US District Judge James Boasberg in Washington, who has been repeatedly vilified by President Donald Trump and members of his administration, ruled his temporary order will remain in effect, restricting such removals until the men are given an opportunity to challenge the government's claims. The ruling came hours before a federal appeals court was to hear arguments on the issue of Trump's deportation initiative. Boasberg and other legal experts have said Trump's attempt to use the wartime law appears illegal based on a plain reading of the statute.  Unsurprisingly, immigration is dominating conversations outside of courthouses, too. In corporate boardrooms across the country, mentions of "immigration" on earnings calls from S&P 1500 companies have surged to a record high during the first quarter, surpassing the early period of Trump's first term, which set a high, according to a Bloomberg analysis of transcripts of earnings calls, presentations and company events dating to 2002. The heightened focus reflects broader anxiety about the labor supply at a time when companies are already navigating the potential costs of an on-again-off-again trade war and signs of strain in the US economy. On Monday though, markets gave some reason for optimism. Here's your markets wrap. | |

|

| Wall Street's embrace of Turkey unraveled in just 30 minutes. When banks and hedge funds including Deutsche Bank, Millennium Partners and Gramercy Funds Management gathered in Istanbul last Wednesday with a top Turkish economist, they were prepared to hear about the country's improved stability. Then they glanced at their phones. The Turkish lira was plunging against the US dollar, fueled by that morning's detention of Istanbul mayor Ekrem Imamoglu—the biggest rival of leader Recep Tayyip Erdogan—on charges decried by Turkey's opposition as a political prosecution. Within about half an hour, investors around the world had dumped huge volumes of lira, lashing its value by 10% to a record low. Erdogan has now reportedly ordered the arrest of more than 1,000 people as his forces also raid the homes of journalists. The US government meanwhile didn't protest his violent crackdown, instead calling it "an internal matter."  Turkish security forces use pepper spray to attack protesters demonstrating against the arrest of Istanbul mayor Ekrem Imamoglu. Photographer: Yasin Akgul/AFP | |

|

| BYD's sales last year surpassed the $100 billion mark, leapfrogging Tesla on revenue, as the Chinese auto giant attracts consumers with a range of electric and hybrid cars packed with high-tech features. Shenzhen-based BYD reported revenue of 777 billion yuan ($107 billion) for the 12 months ended Dec. 31, up 29%, according to a filing late Monday, beating estimates for 766 billion yuan. Tesla's 2024 revenue was $97.7 billion. BYD has risen quickly to the top of China's car market—the world's biggest and most competitive in terms of electric vehicles.  A BYD dealership in Zaventem, Belgium Photographer: Ksenia Kuleshova/Bloomberg | |

|

| |

|

| Hong Kong is seeking to woo wealthy travelers from the Middle East and Southeast Asia as it looks to revive visitor numbers to the city. Hotels and restaurants are adapting to meet the needs of Muslim visitors, including providing halal-friendly options and prayer rooms. The moves are part of the government's push to boost visitor numbers, which are yet to reach levels seen before the 2019 pro-democracy protests. Tourism revenues are also being dented by Chinese travelers spending less on average than they used too due to economic woes in the mainland.  China is trying to boost Hong Kong visitor numbers, which are yet to reach levels seen before the 2019 pro-democracy protests. Photographer: Billy H.C. Kwok/Bloomberg | |

What You'll Need to Know Tomorrow | |

| |

| |

| This month we asked corporate leaders about the snacks that power them through the day. It turns out that a lot of CEOs go nuts for nuts, but there's also an affinity for beef jerky and dark chocolate along with at least one vote for a cup of homemade chai. Read the latest installment of CEO Diet in full. | |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment