| Bloomberg Evening Briefing Americas |

| |

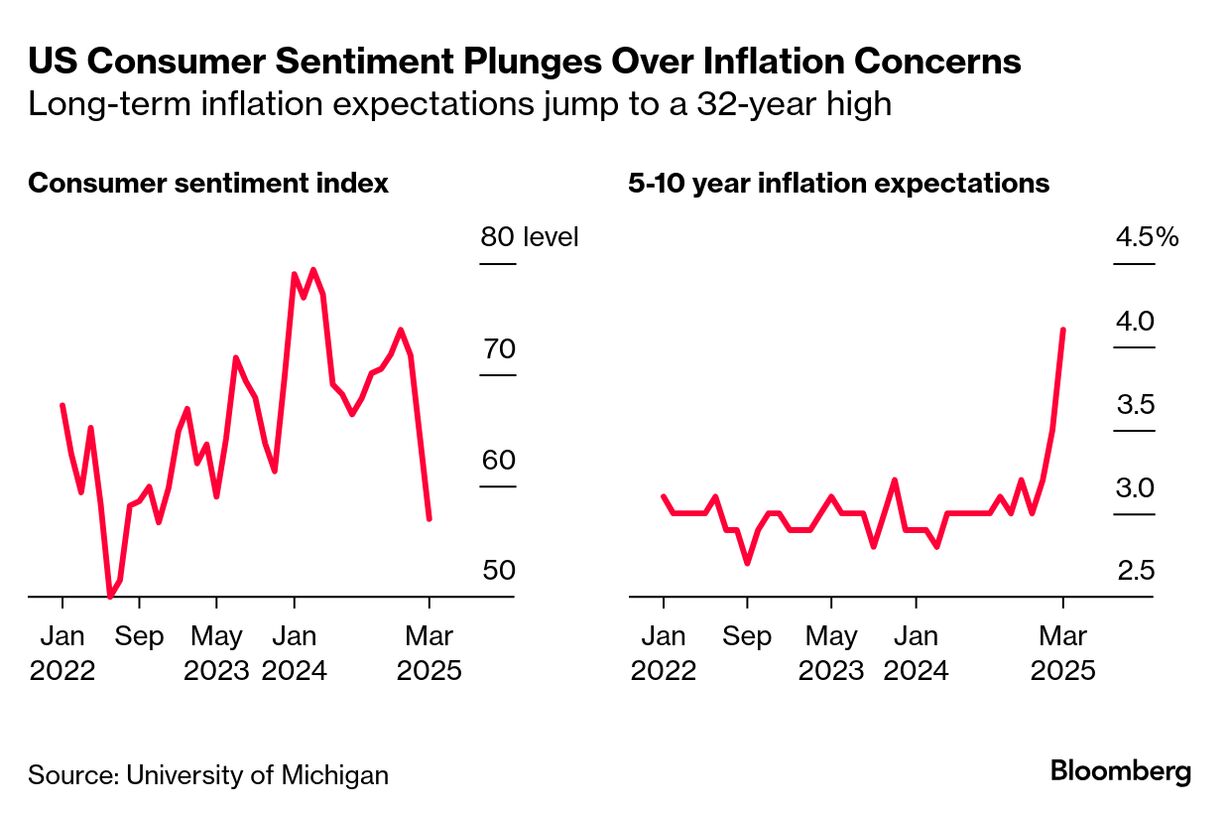

| The Trump administration's continuing barrage of tariff threats, as well as the Republican president's looming deadline for automakers next week, sent investors running for the exits again on Friday. With just one session left until the end of a quarter that's set to be the worst for the S&P 500 since 2022, the gauge slid another 2%. It also didn't help that the latest data showed US consumer sentiment tumbled to a more than two-year low while long-term inflation expectations jumped to a 32-year high as American anxiety over Trump's handling of the economy continues to build. The final March sentiment index declined to 57 from 64.7 a month earlier, according to the University of Michigan. The latest reading was below both the 57.9 preliminary number and the median estimate in a Bloomberg survey of economists. Consumers expect prices to rise at an annual rate of 4.1% over the next five to 10 years, the data released Friday showed. That's the highest since—wait for it—1993. Consumers also see costs rising 5% over the next 12 months, the highest since 2022. But even more foreboding is what Americans see for the country's jobs market. For years, the US has left the rest of the post-pandemic world behind with low employment levels not seen since the 1960s, when Richard Nixon was president. "Notably," said Joanne Hsu, director of the Michigan survey, "two-thirds of consumers expect unemployment to rise in the year ahead, the highest reading since 2009." —David E. Rovella and Jordan Parker Erb | |

What You Need to Know Today | |

| Economists dialed back their expectations for US growth this year, envisioning softer consumer spending and more limited capital investment amid mounting uncertainty created by Trump's scattershot trade and tariff attacks. Gross domestic product is now set to grow 2% in 2025, according to the latest Bloomberg survey of economists, down from the 2.3% estimate in last month's poll. Their projection for first-quarter growth was marked down a full percentage point to 1.2%. "The 'negatives' from President Trump's policy thrust of government austerity and trade protectionism have taken an early toll," said ING economist James Knightley. He cited "weaker consumer confidence and spending at the same time as importers look to front run the threat of tariffs." | |

|

| |

|

| A gauge of credit market fear rose to a fresh seven-month high after those economic reports suggested inflation is staying stubbornly high while consumer spending is showing signs of weakness. The spread on the Markit CDX North American Investment Grade Index jumped as much as 0.0223 percentage point, or 2.23 basis points, on Friday, to 61.4 basis points. The index rises as perceived credit risk climbs, and reached its highest reading intraday since August. The high-yield gauge, which falls as credit risk climbs, declined as much as 0.7 point, also an intraday low since August. | |

|

| Myanmar was struck by its biggest earthquake in a century, shaking buildings and triggering evacuations in neighboring Vietnam and Thailand, with at least one tower collapsing in Bangkok and reports of several casualties. The quake on Friday measured 7.7 in magnitude, according to the US Geological Survey, which said it was 16 kilometers (9.9 miles) northwest of Sagaing, Myanmar, and at a depth of 10 kilometers. It struck at about 1:21 p.m. in Bangkok and was the strongest worldwide since 2023, according to USGS data compiled by Bloomberg. There was a second temblor of 6.4 magnitude around the same area, the USGS said. The death toll was at 154 as of this afternoon according to the Associated Press and is expected to rise.  Emergency workers at the site of a collapsed building in Bangkok, Thailand, on Friday evening. Photographer: Andre Malerba/Bloomberg | |

|

| CoreWeave fluctuated between gains and losses in its market debut after the cloud-computing provider raised $1.5 billion in a downsized initial public offering. The cloud-computing provider sold 37.5 million shares at $40 apiece, down from an initial plan of 49 million shares at $47 to $55 each that might have raised as much as $2.7 billion. CoreWeave was started in 2017 as a crypto mining firm. It was an early adopter of Nvidia's graphics chips for data centers, getting ahead of a wave of demand for powerful processors to run AI applications. It's building out data centers based on Nvidia's chips to offer AI-related computing. | |

|

| Law firms Jenner & Block and WilmerHale sued to challenge Trump's executive orders targeting them. The separate suits filed in Washington federal court asked a judge to declare the orders unconstitutional. Trump, as part of his unprecedented effort to amass power in the executive branch and repeated threats of retaliation against perceived enemies, has threatened government contracts with the firm's clients and to revoke lawyers' security clearances and limit access to federal buildings. The orders are an "undisguised form of retaliation for representing clients and causes he disfavors, or employing lawyers he dislikes," WilmerHale said. Meanwhile, the major US law firm Skadden Arps Slate Meagher & Flom, following in the footsteps of Paul Weiss Rifkind Wharton & Garrison, made a deal to avoid the ire of the the 78-year-old president. Skadden promised to do $100 million of work on Trump's favorite causes — for free. "Firms differ in how committed they are to the rule of law principals — WilmerHale has a deep commitment there," said Leslie Levin, a professor at the University of Connecticut School of Law. "Skadden doesn't have a deep history of being concerned with the role of lawyers in society. Even though they have some pro-bono, they have always been about making money." | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment