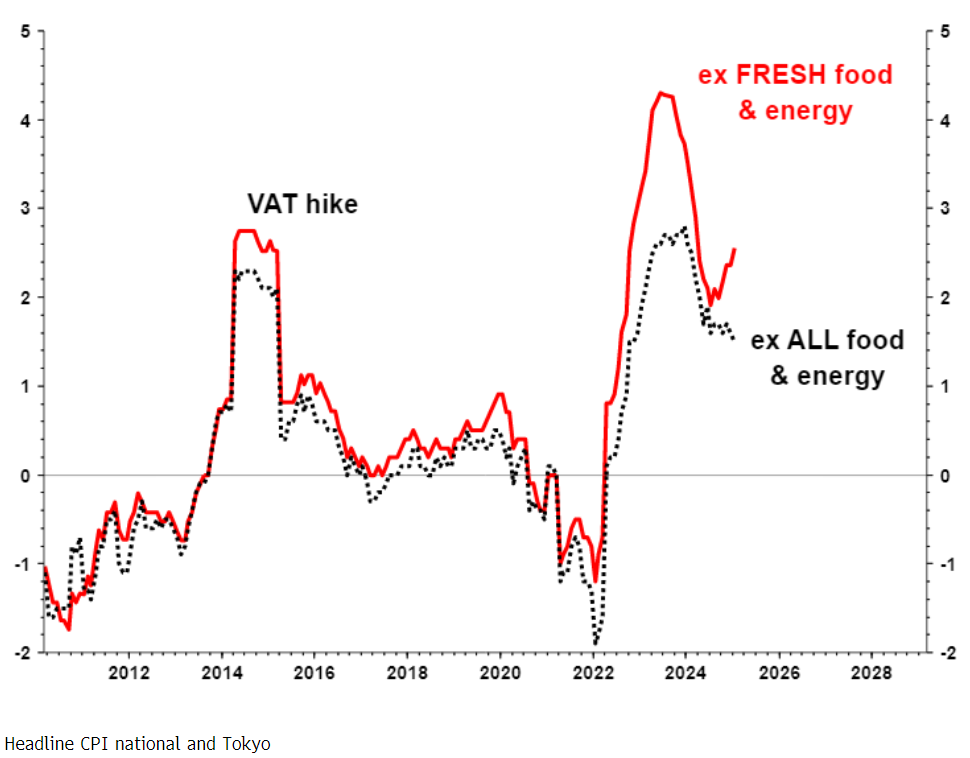

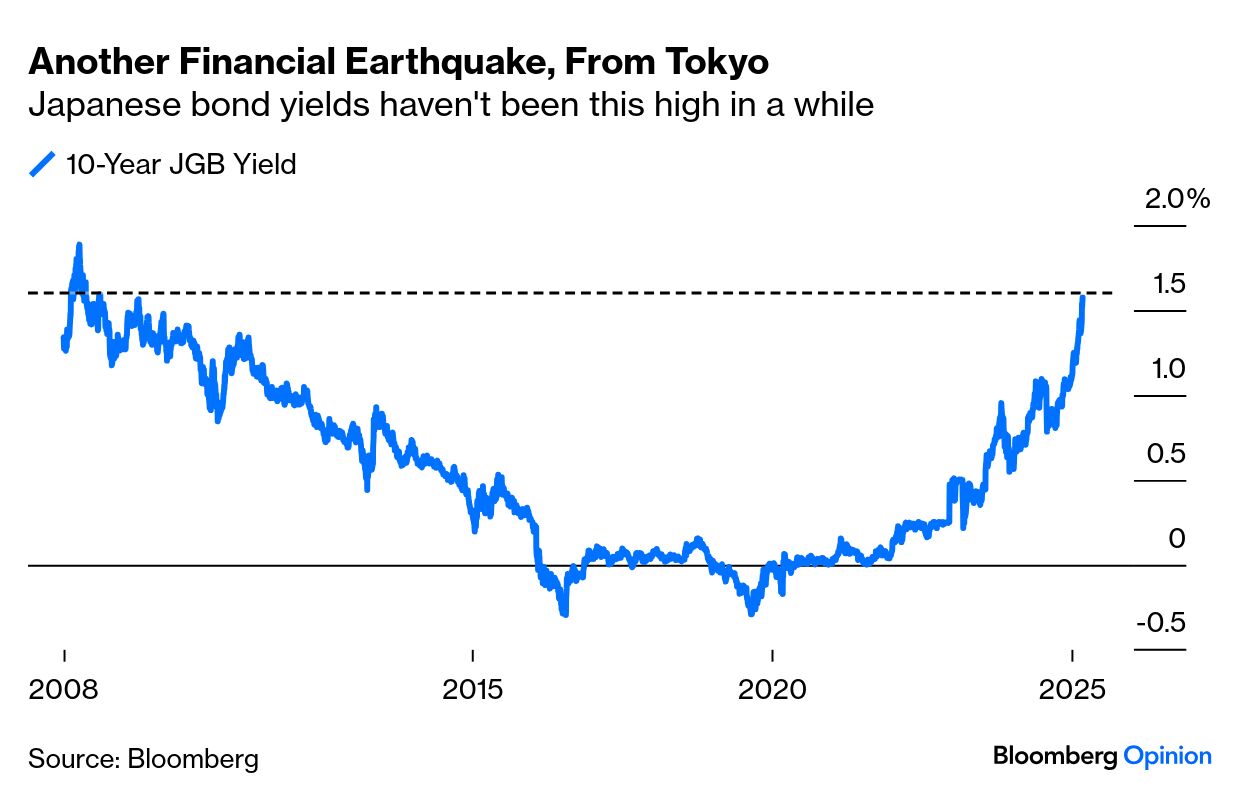

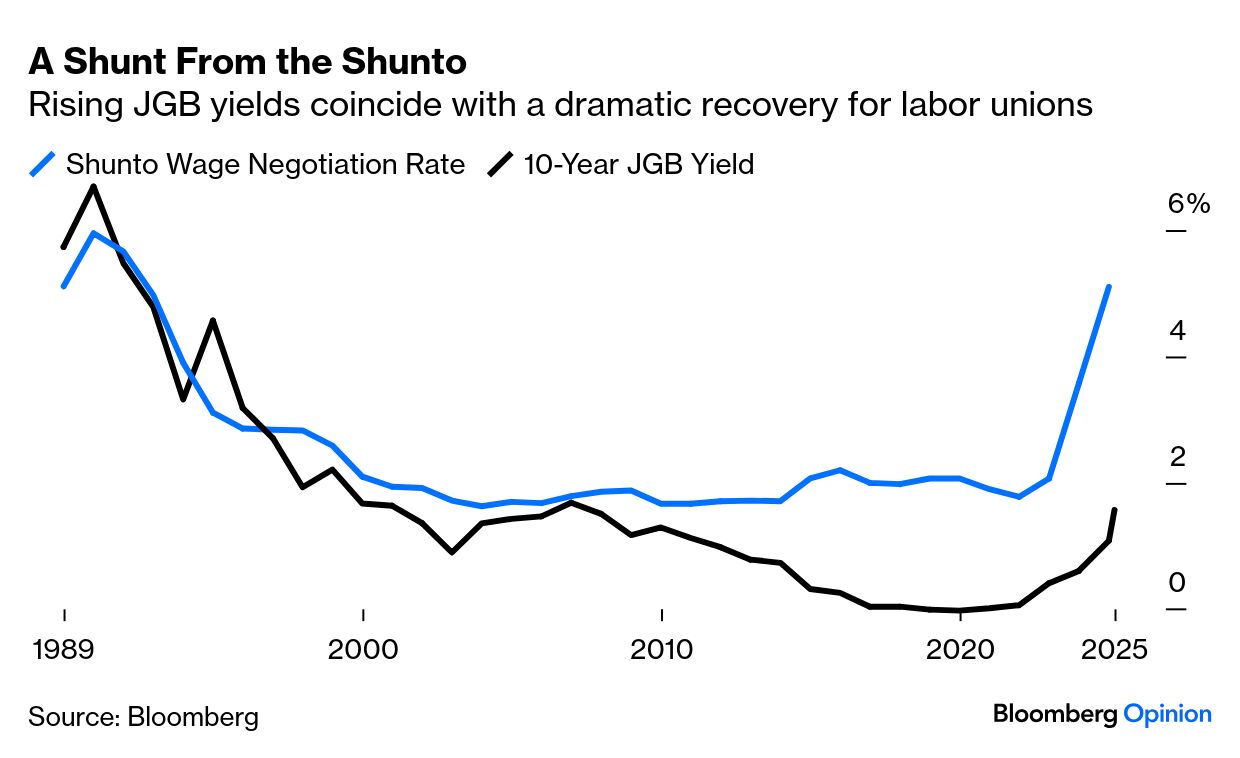

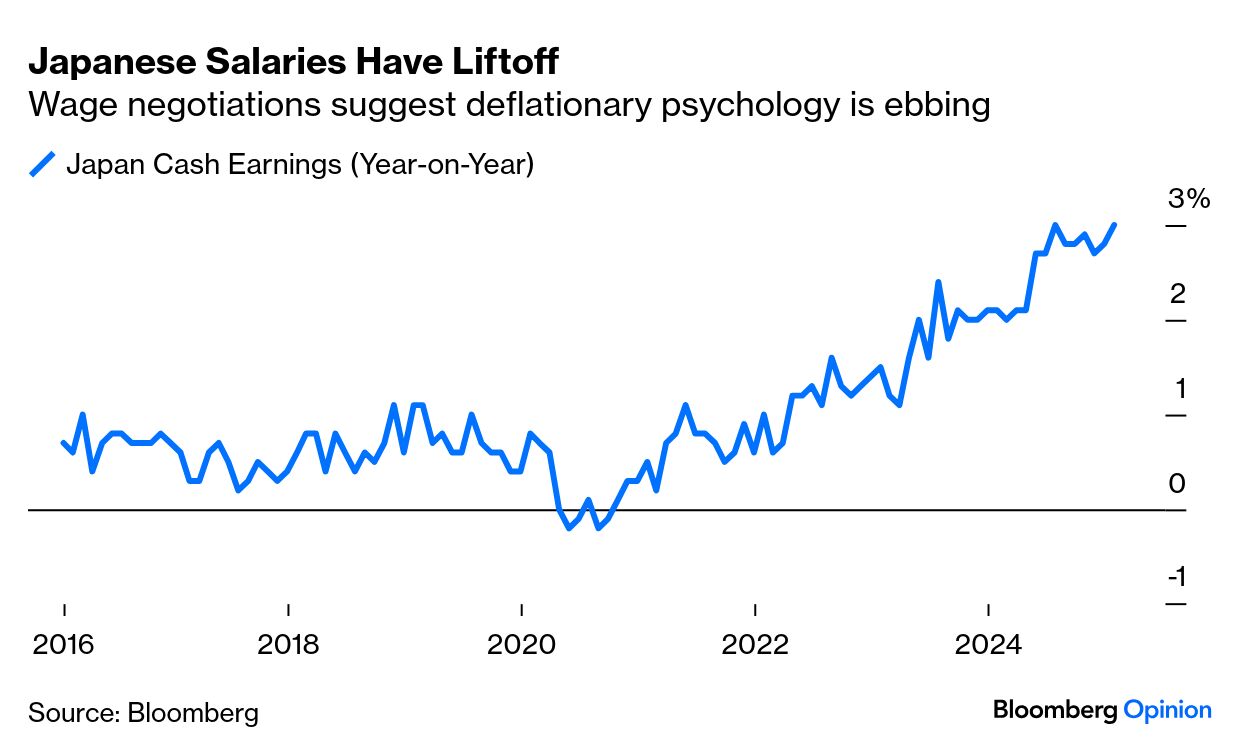

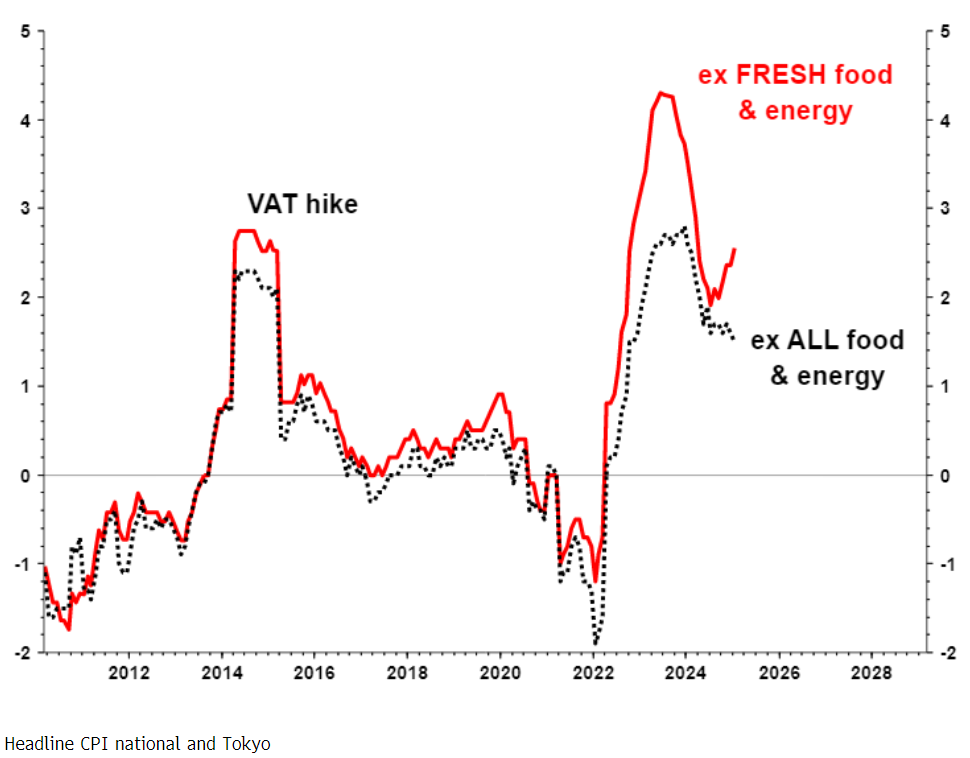

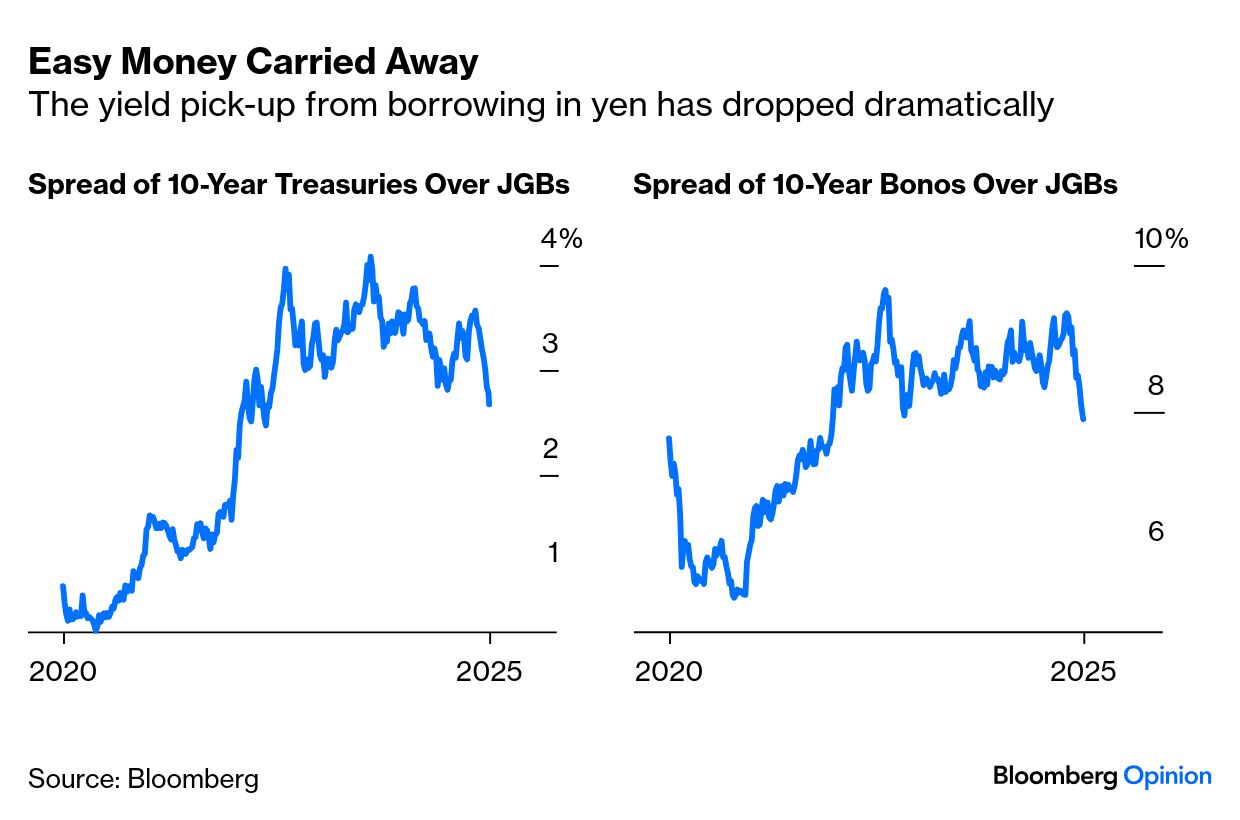

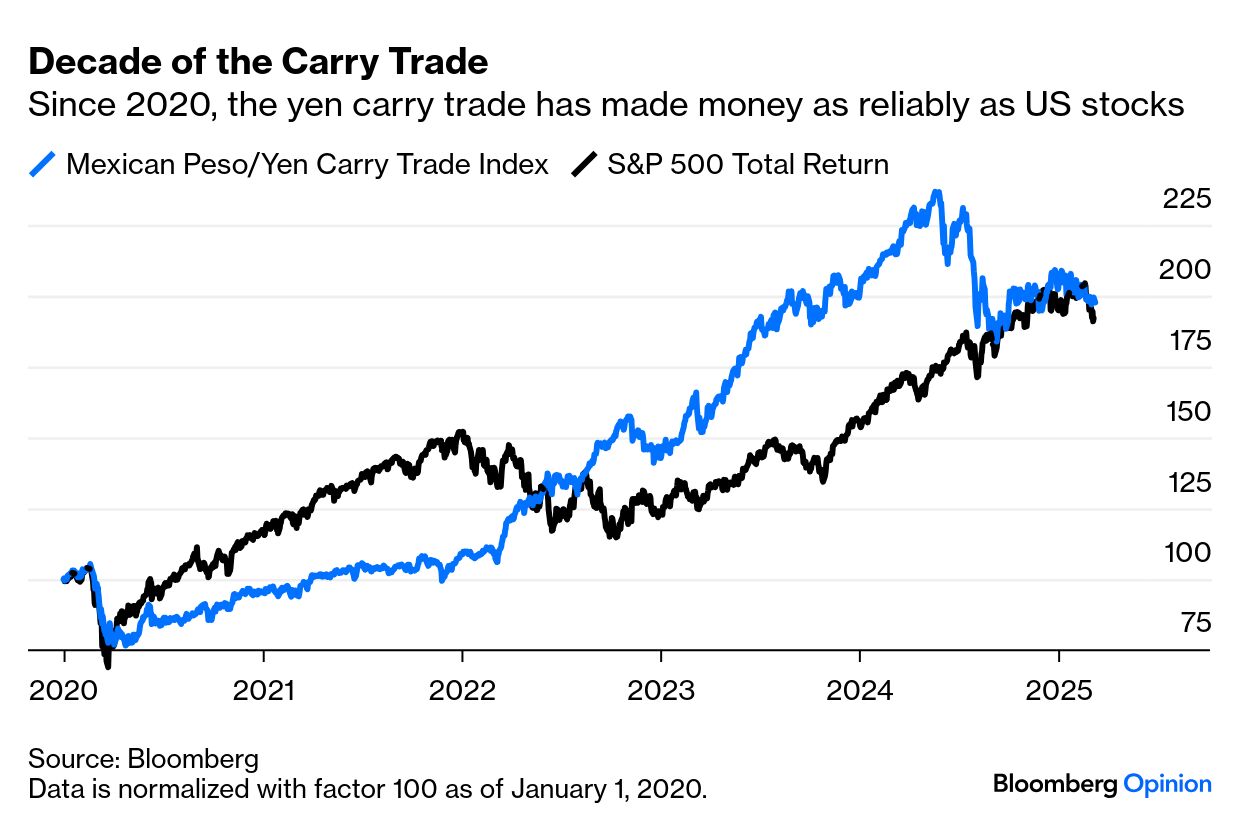

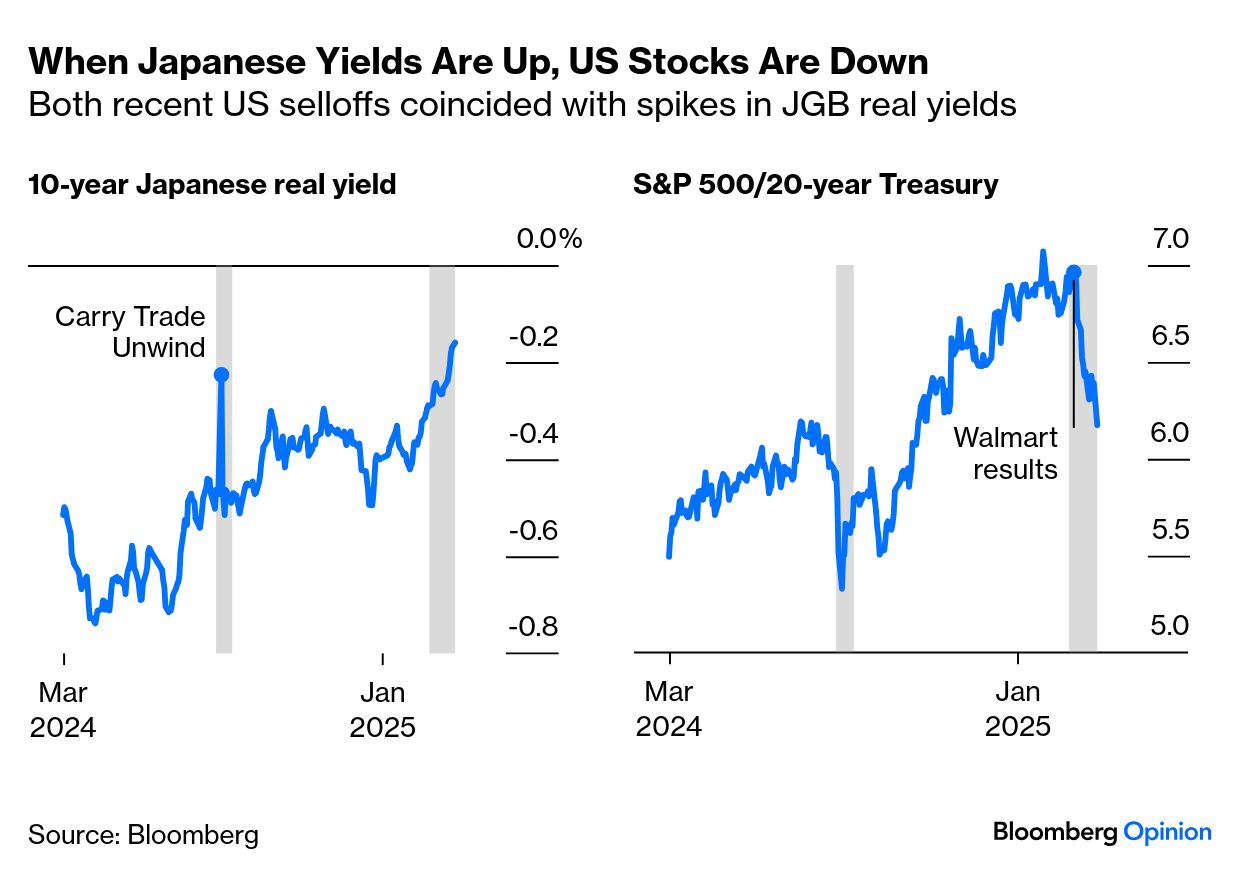

| The tectonic plates of global finance continue to move. Last week, Germany unveiled plans for the most dramatic expansion of fiscal policy since the nation reunified in 1990. Meanwhile, Japan seems to have broken out of a deflationary slump that started that same year — although nobody wants to say this too loudly. The 10-year yield on Japanese government bonds has leapt to 1.6%, its highest since the 2008 Global Financial Crisis: Wage negotiations are driving this. Workers have had paltry increases for a generation. But in the last two years, the annual shunto — the labor negotiations each spring — has brought the highest pay rises since the slump took hold 35 years ago. That buoys JGB yields: The latest numbers on overall increases in cash salaries spurred the latest jump in yields: With their greater incomes, Japan's salarymen are far more likely to buy stuff now, and not leave it until tomorrow. That boosts inflation. It doesn't mean that deflation is licked for certain. Albert Edwards of Societe Generale SA, known as an inveterate bear on equities, formed his views as an economist working in Japan during the early slump years. He points out that core inflation is calculated by excluding only fresh food, not all food. With the former, inflation has picked up in the last few months; exclude all food, however, and inflation is just below 2% and declining. Edwards warns that this indicates "that the battle against deflation is maybe not yet won and BOJ tightening is a bit premature":  Jesper Koll, the long-term Tokyo-based investment banker who publishes the Japan Optimist newsletter, argues that demographic problems are at last helping. With the population declining, the rising generation of workers know that they have negotiating power and are using it. Employers faced with difficulties finding enough staff have no choice but to bid up for the best candidates — and so deflation psychology finally ends. If there's a risk, Koll suggests that the BOJ should be careful what it wishes for. After one-third of a century in slump, it's possible that Japan could lurch straight into a wage-price spiral. This shift affects everyone else. Low Japanese bond yields have provided a source of cheap funding for the rest of the world — simply borrow in Japan at negative rates, park in an investment that actually pays a return, and feast on the difference. The rise in JGB yields has narrowed the differentials with other bonds — particularly Mexico, whose high rates made it a popular carry trade destination: How much does this matter? Circumstantial evidence suggests that the carry trade has been hugely important. Since the turn of the decade, the total return from borrowing in JGBs and parking in Mexico has beaten the total return on the S&P 500. This is true even after the carry trade's dramatic unwind last August, which triggered volatility across the world: As we'll cover next, the US stock market is in the grip of a big selloff. Correlation doesn't prove causation, but it's noticeable that both US corrections of the last 12 months have overlapped exactly with large rises in Japanese real yields: That brings us to a dramatic day on Wall Street. US stocks had a terrible day, probably triggered by Donald Trump's uncharacteristically bearish soundbite over the weekend. Asked if Americans were facing a recession, he replied: I hate to predict things like that. There is a period of transition because what we're doing is very big.

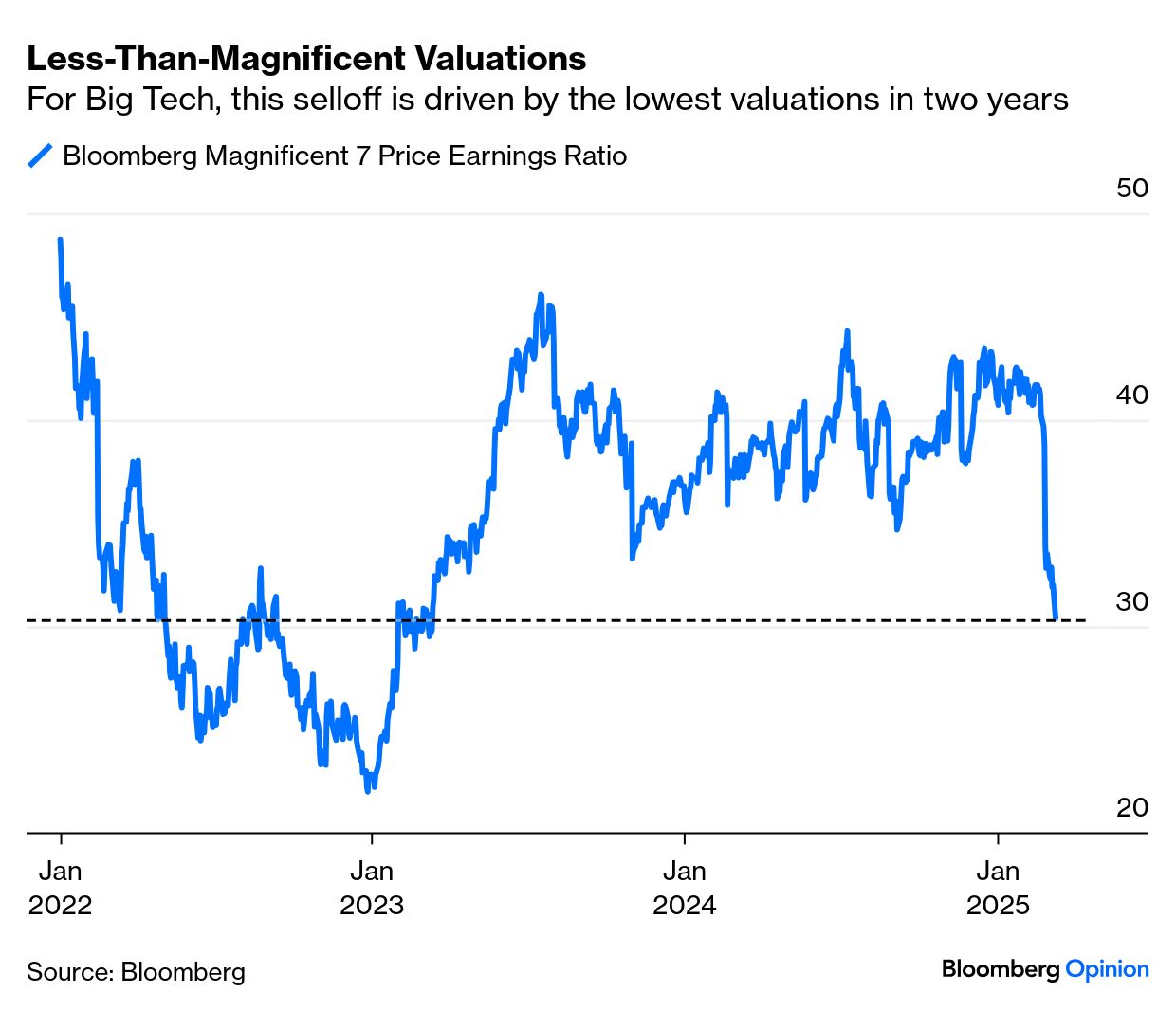

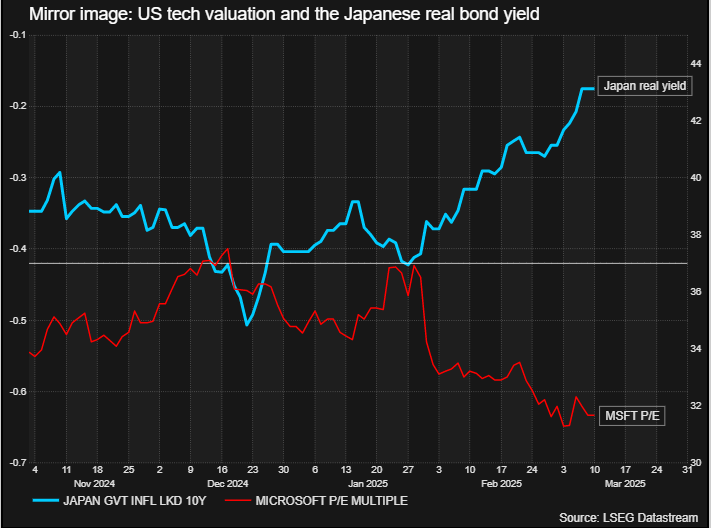

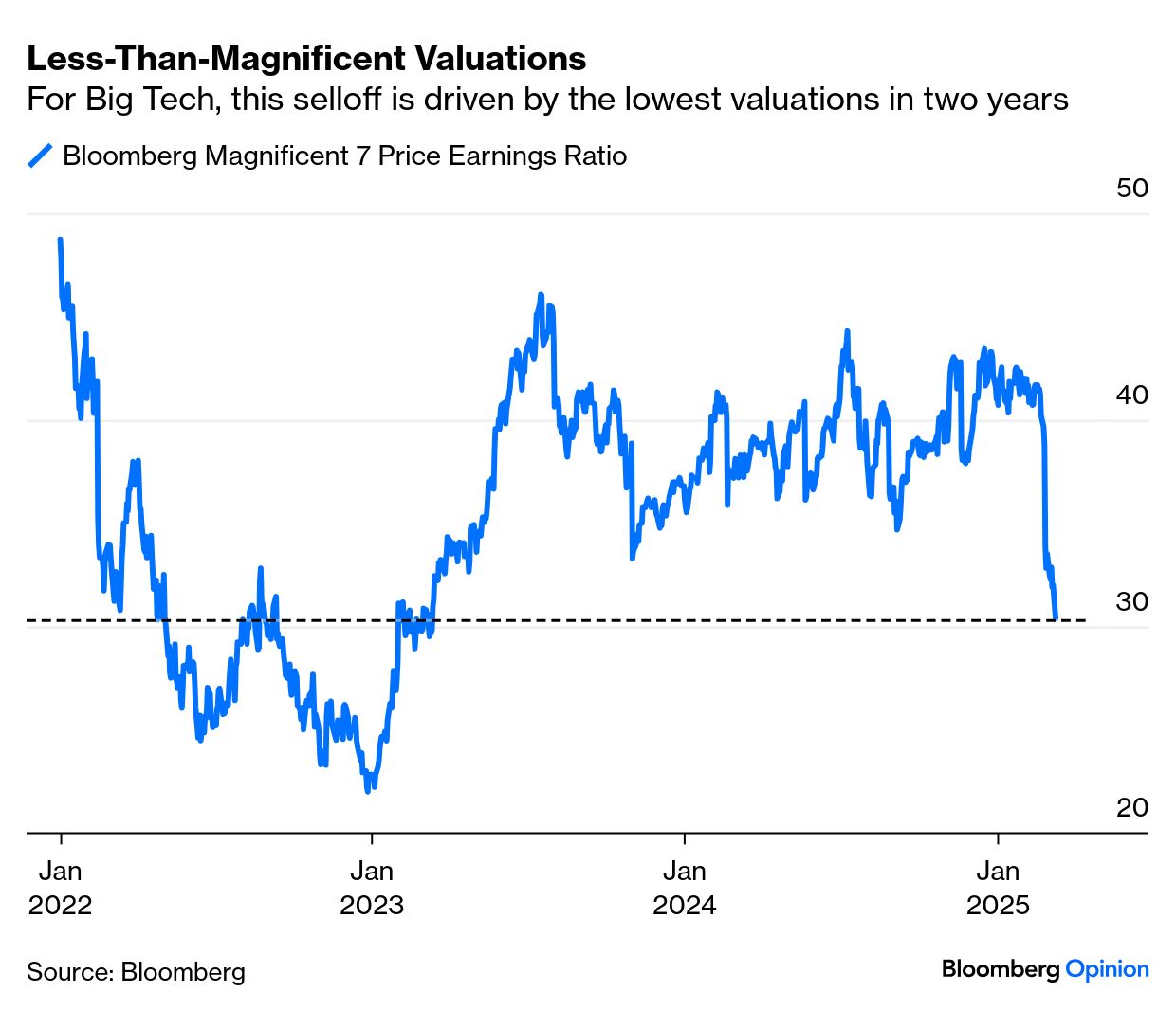

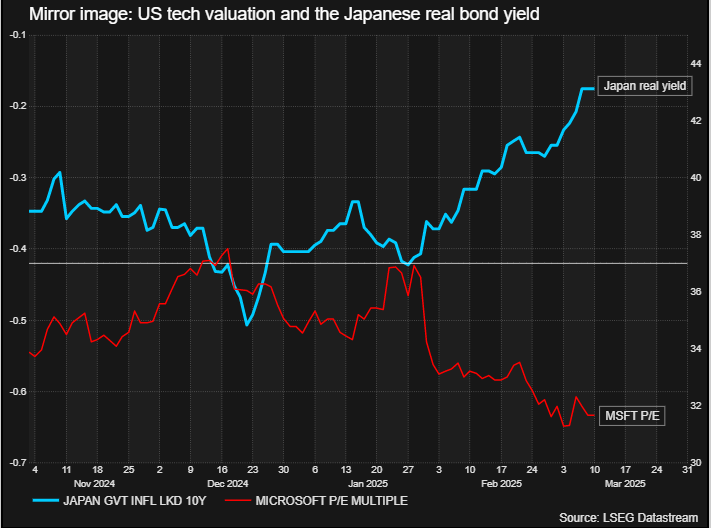

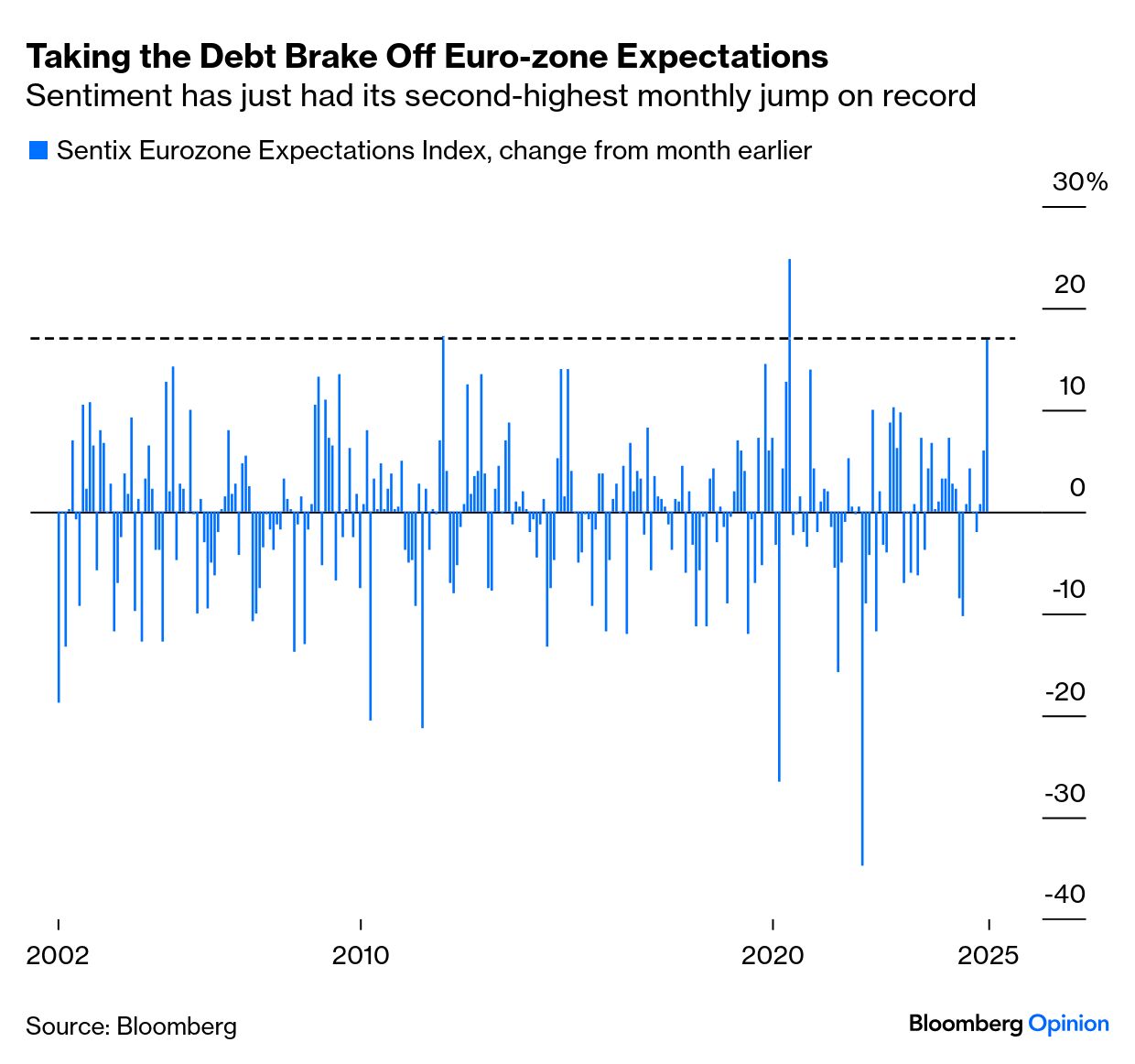

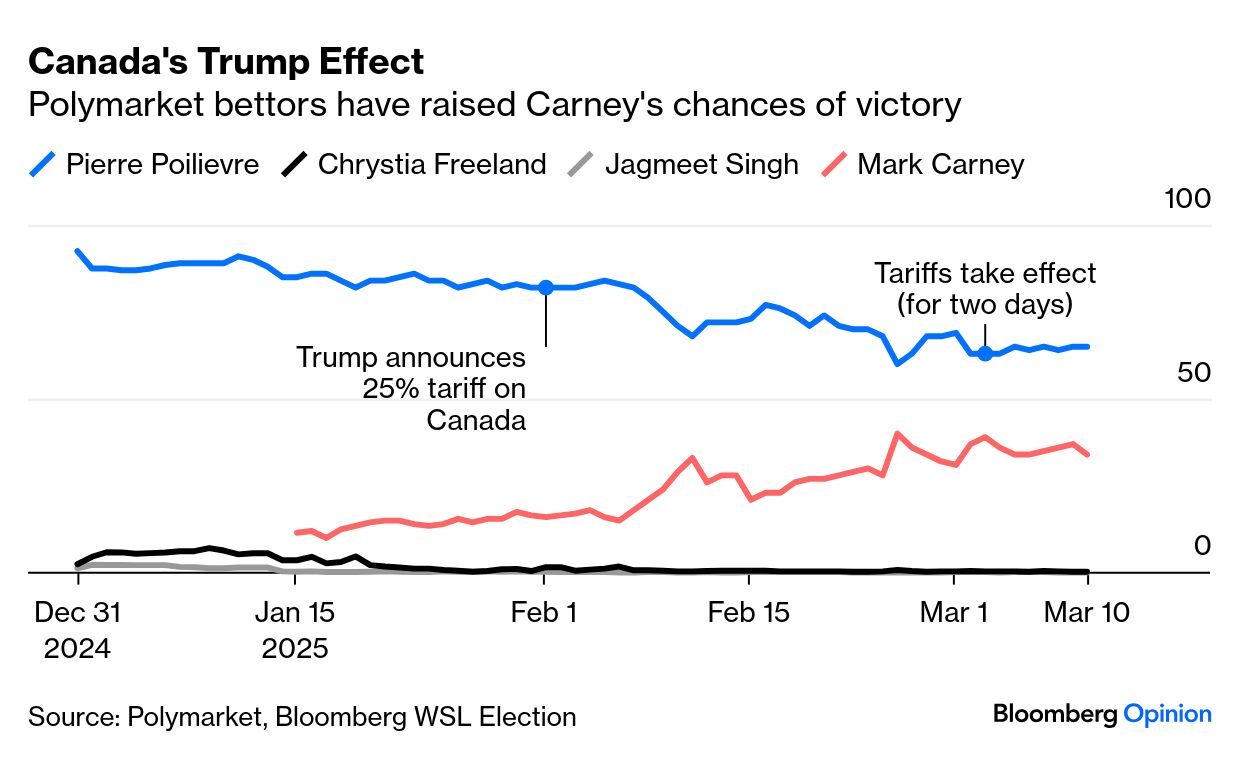

The key implication concerned the so-called Trump Put — the president cares about the stock market, and the belief has been that a selloff would prompt him to reverse unpopular policies. This sounded like he was prepared to weather a market storm — and he even said that "you can't really watch the stock market." It's not what investors in the post-election Trump Trades signed up for, and the result was spectacular: The Bloomberg Magnificent Seven index is now down more than 20% from its recent high, satisfying a popular definition of a bear market. But can this be attributed entirely to Trump, or to bearishness about the economy? The selloff has been driven above all by valuations, as investors have rushed to exit stuff that looks expensive. The Magnificents still trade at a fat multiple of 30 times trailing earnings, but that follows a dramatic fall in the last few days:  The Mag 7 companies are global, but it's not clear that they stand to lose most from a trade war as their operations are so dispersed. What is clear, however, is that surfing on such strong sentiment, they were acutely vulnerable to a withdrawal of liquidity. That's what effectively happened as Japanese real yields surged higher. Dhaval Joshi of BCA Research compares the Japanese real yield with the p/e of Microsoft Corp., arguably the least speculative of the Magnificents. For the last few months, they've looked like a perfect mirror image, with Microsoft's multiple declining every time the Japanese real yield rises:  Source: BCA Research Joshi is clear that causation can move both ways — if investors feel less inspired about the companies pioneering AI, the money they withdraw must go somewhere. And it's obvious from the way the Trump comments were repeated again and again that they were the trigger for this particular selloff. But even if the tariff drama hogs our attention, it's quite possible that the epochal shift in Japan matters more. One other factor is that US stocks suddenly have competition. The rebound in confidence in Europe has shown up in one of the biggest month-on-month increases in expectations from euro-zone businesses ever. Only a rebound during the early days of the pandemic in 2020 was greater: The European euphoria may well prove misplaced. For now, however, European stocks are exciting, and they give investors somewhere to go that's much cheaper than the stratospherically valued US Big Tech companies. The TINA (There Is No Alternative) argument no longer applies. The US selloff already looks a tad overdone. It can still be viewed as a correction of post-election excess and nothing more. But some good news from Trump or from the macroeconomic data to change the narrative would come in useful right now. Canada's next premier, Mark Carney, has an impressive resume that leaves little doubt about his qualifications for the job. Justin Trudeau's successor led the Bank of Canada during the Global Financial Crisis and the Bank of England during the UK's momentous split from the European Union and the early stages of Covid-19. But as a politician, he'll need to dig deeper to stand up to Trump's tariffs and threats to make his nation the 51st state. Somehow, Carney must find a sweet spot in treating Trump both as an adversary and trade partner — all while preparing for an election in the coming months which it begins to look as though he might just win.  Carney's fortunes turn on how he handles Trump, quickly. Photographer: Sean Kilpatrick/Canadian Press/AP The market wants a swift resolution to any trade war between the two allies. The loonie is under tremendous pressure after five consecutive months of declines, the longest losing streak since the oil price collapsed in 2016. The Citi trade-weighted real effective Canadian dollar index (which accounts for different rates of inflation) shows the dark days of nearly a decade ago aren't far off (while also showing, from Trump's point of view, that the loonie is mighty competitive): Carney's victory speech shows where he intends to start. He's in no hurry to remove the existing retaliatory measures of about C$30 billion ($20.8 billion) worth of US imports until Trump eliminates the threat of tariffs altogether. He's also threatening to impose further restrictions on an additional C$125 billion. His landslide margin, with 86% of the some 152,000 Liberal Party members who voted, shows that he has their overwhelming backing to nullify Trump's insurgency. Carney will need to hit the ground running. His first decision is when to call the election, due before Oct. 20. He's expected to do so before parliament reconvenes March 24, meaning Canadians would decide in late April or early May. Relatively untested in electoral politics compared to his central banking experience, the way Carney handles the noisy neighbor will decide whether he has a chance against Conservative leader Pierre Poilievre, who looked unbeatable until recently. The odds have tightened on the Polymarket prediction market in the last two months, largely because Poilievre is perceived as close to Trump: Dealing with Trump well over the next few weeks might just get the Liberals another term in office — but it won't be lost on Carney that this will be difficult, as last month's blowup with Ukraine's Volodymyr Zelenskiy at the White House tells us. Signum Global Advisors' Lew Lukens suggests a less combative, indirect approach to tariff negotiations is plausible: Carney comes from a very similar background to some of the people in Trump's economic circle. He understands the banking and the financial world. His best bet is to have a connection, and I'm sure he already knows people like Howard Lutnick and Scott Bessent. He can use them to try to develop them as allies to help explain to Trump why these tariffs are damaging not just to Canada but also to the US.

Washington's disruptive levies also dominate the monetary policy decisions confronting the Bank of Canada, headed by Tiff Macklem. It is expected to loosen monetary policy further this week to compensate for the pain inflicted by Washington. Bank of America's Carlos Capistran argues that with inflation contained, the uncertainty surrounding tariffs will drive the BOC's decision. If they cut, the weak Canadian dollar can be a buffer. This BofA chart highlights how much tariffs could drag on Canada's economy:  Source: Bank of America Canada's post-pandemic progress is now under immense pressure. If that wasn't enough, the desire to placate Trump has seen Ottawa embroiled in another trade war with China. Carney may seem like a great fit for the job, but with Trump, there are no guarantees. —Richard Abbey As I'm in London this week, and it's Commonwealth Day, let's listen to King Charles III's favorite music. He's produced a 17-track playlist for Apple Music which you can find here, along with his commentary. We already knew he liked the Three Degrees, but it turns out he really likes Bob Marley's Could You Be Loved, Millie Small's My Boy Lollipop, and Kylie Minogue's Loco-Motion (not a song I ever expected to get a royal seal of approval). Perhaps more radically, he suggests La Vie En Rose, Grace Jones' cover of Edith Piaf, and Miriam Makeba's Click Song.

It's always hazardous for the royals to try to come across as normal people, because their lives are not normal at all. In this case, though, I think the monarch did a good job. He's got an interesting and slightly goofy taste in music and has convinced me that he genuinely likes these songs. Thank you, Your Majesty.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment