| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union.Germany's likely incomin |

| |

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. Germany's likely incoming chancellor Friedrich Merz is already facing a major political test after the Green party initially rejected his flagship plan for a massive boost to defense and infrastructure spending. Without the Greens, who are heading into opposition, Merz doesn't have the two-thirds majority needed to change the German constitution to override current borrowing restrictions. And without Germany, the EU's plans to take ownership of the continent's defenses would suffer a major blow just as US President Donald Trump upends transatlantic relations. Merz's team still sees scope for a deal with the Greens, who late yesterday demanded tougher rules for defense spending in a move that raised hopes that the sides may eventually compromise. In the next bloc-wide step, EU finance ministers will discuss today gradually easing fiscal rules. Still, plenty of obstacles remain. Left-wing coalition parties are already speaking up against higher defense spending in countries like Spain, while bond and stock market selloffs are raising doubts over the cost and feasibility of Europe's rearmament. — Jorge Valero | |

| |

| Italian Pitch | Rome proposed a new financial vehicle to mobilize up to €200 billion of private capital for strategic defense and aerospace projects. The initiative, modelled after the bloc's InvestEU tool, would leverage €16.7 billion of public money without raising national debt levels, we're told. Defense Bonanza | Europe's push to accelerate military spending has unleashed a rally in defense stocks so strong that tank maker Rheinmetall surpassed high-flying luxury names like LVMH. It's a shift that turned an historically low-growth corner of the stock market into one that has the potential to rapidly expand. ECB Caution | The ECB isn't lowering interest rates "on autopilot" amid rising uncertainty, including those caused by US tariff plans, Governing Council member Joachim Nagel said. The ECB kept cut borrowing costs last week but kept all options open for the future rate path. Looming Tariffs | The US is not "engaging" with the EU to make a deal and avoid fresh metals tariffs this week that could affect up to €28 billion of EU exports, the bloc's trade commissioner Maros Sefcovic said. "We will always protect European businesses, workers and consumers from unjustified tariffs," he said yesterday. | |

| |

| Green Flop | Once the crown jewel of Europe's largest onshore wind project, this Swedish wind farm near the Artic suffered hundreds of millions in losses and a reputational blow. The reason is the power purchase agreement that guarantees electricity to clients bought in the spot market if the weather fails. Nationalists Regroup | Romania's largest far-right party signaled it may seek an alternative candidate in May's presidential election after the front-runner it backed was barred from the race. Calin Georgescu, an ultranationalist sensation whose cause has been taken up by Trump's team, was rejected by the country's electoral bureau. Climate Payouts | The cost of climate disasters in France may double in the 30 years through 2050, to €143 billion, according to a government study presented yesterday. The French insurance industry has faced increasingly costly claims due to extreme weather, raising concern that some insurers will withdraw from high-risk areas. Broadening Crackdown | Prime Minister Viktor Orban's latest pre-election target is people with dual citizenship. Hungarians with multiple passports may be expelled if they're deemed a "national sovereignty" risk, according to draft legislation. Orban has pledged to "sweep out'' those working for foreign-funded civil society groups or media. | |

| |

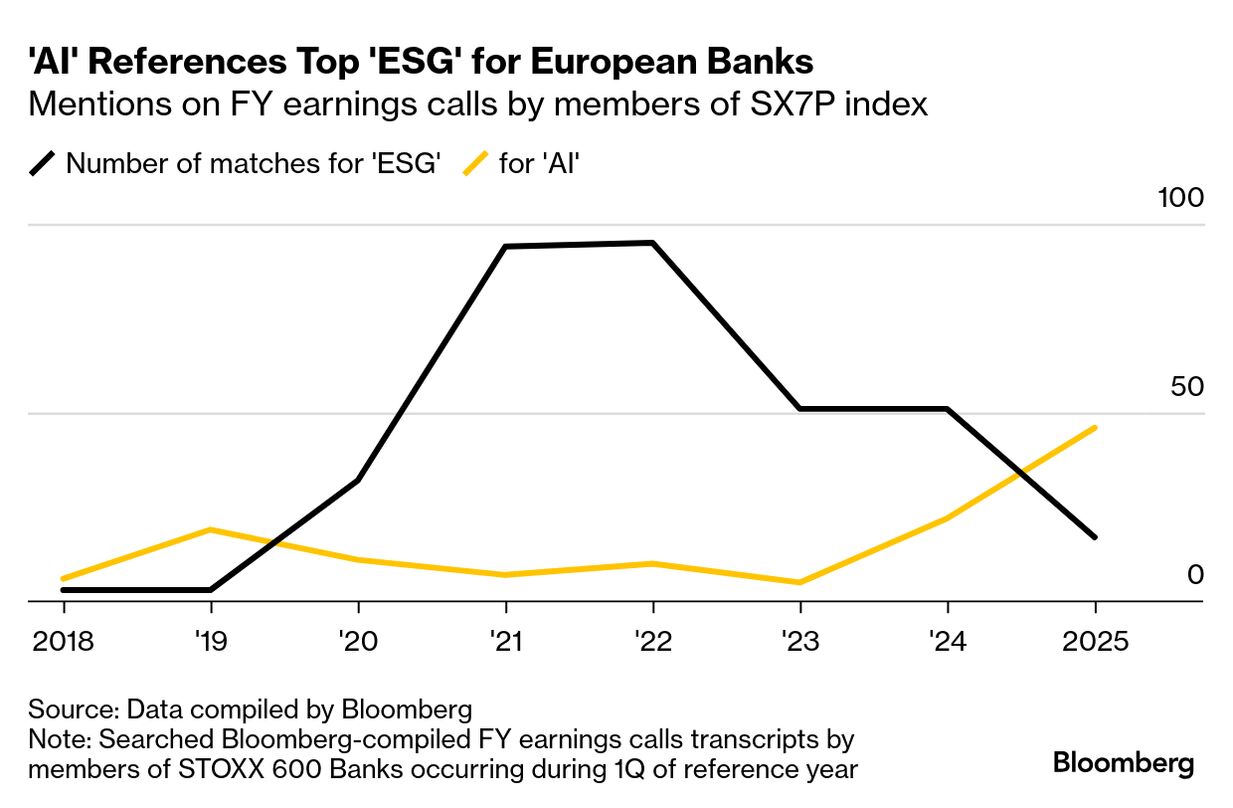

| AI is the new buzzword in European banking. Executives referred to artificial intelligence more frequently than "ESG" in discussing their results for the first time in six years, according to a Bloomberg News analysis. While "AI" references more than doubled, "environmental, social and governance" (ESG) mentions tumbled by two-thirds compared with the previous year. The change illustrates how banks are giving increasing importance to boosting their AI capabilities, while a US-led backlash against ESG criteria has prompted several US lenders to scale back support for such initiatives. | |

| |

| All times CET - 9 a.m. Commission President Ursula von der Leyen, Council President Antonio Costa take part in debates on future of European defense and council meetings at parliament plenary in Strasbourg, France

- 1 p.m. Parliament President Roberta Metsola and Belarusian opposition leader Sviatlana Tsikhanouskaya hold joint press point in Strasbourg

- 2:50 p.m. NATO Secretary General Mark Rutte holds joint press conference with Kosovan President Vjosa Osmani while on a visit to Kosovo

- 5:20 p.m. Press conference following a meeting of the prime ministers of Luxembourg, Belgium and The Netherlands in Senningen, Luxembourg

- EU finance ministers meet for ECOFIN in Brussels

| |

| |

| |

| You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment