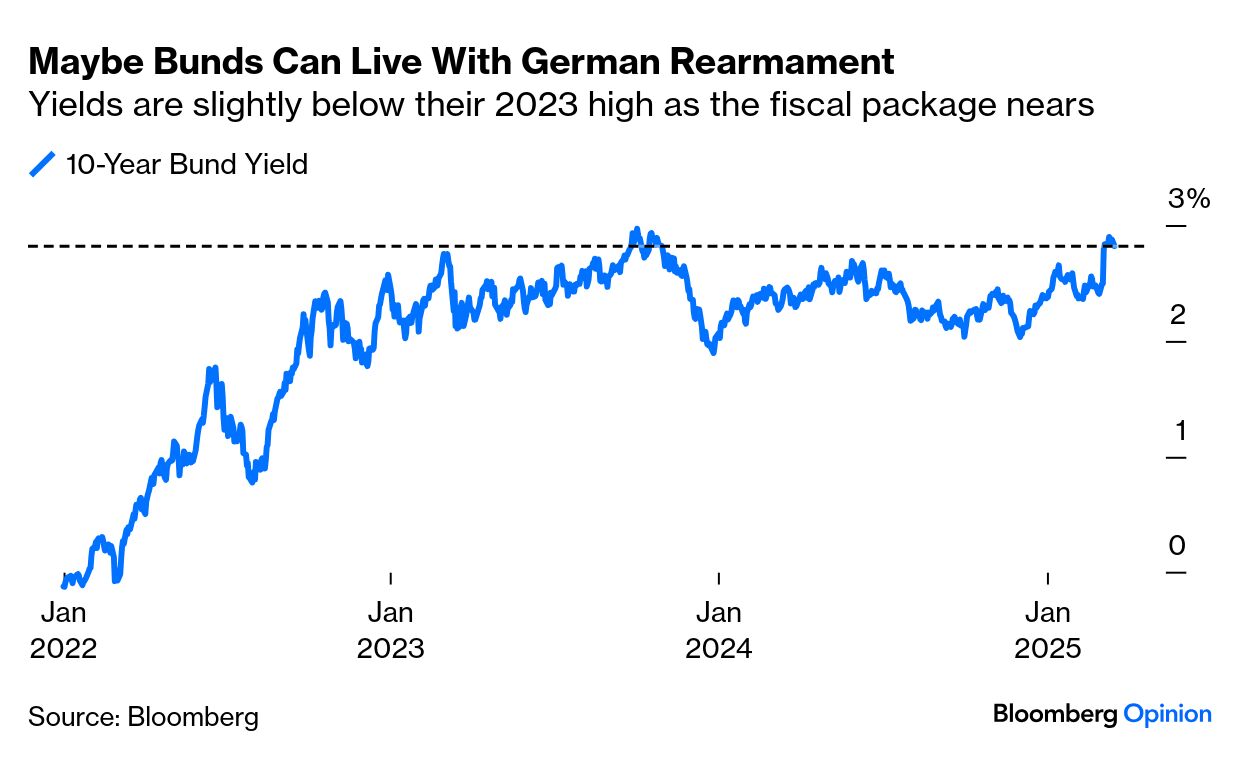

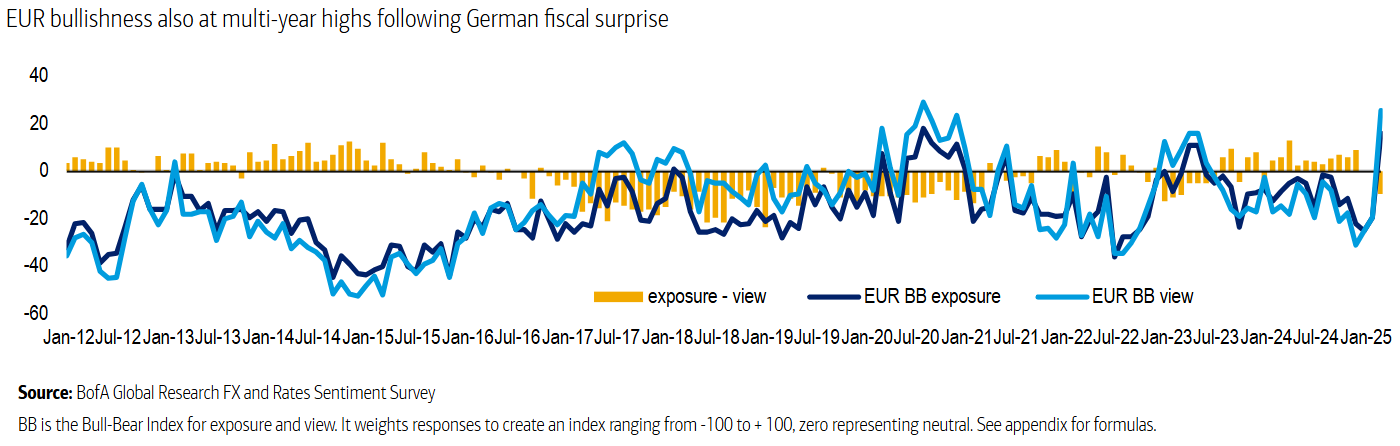

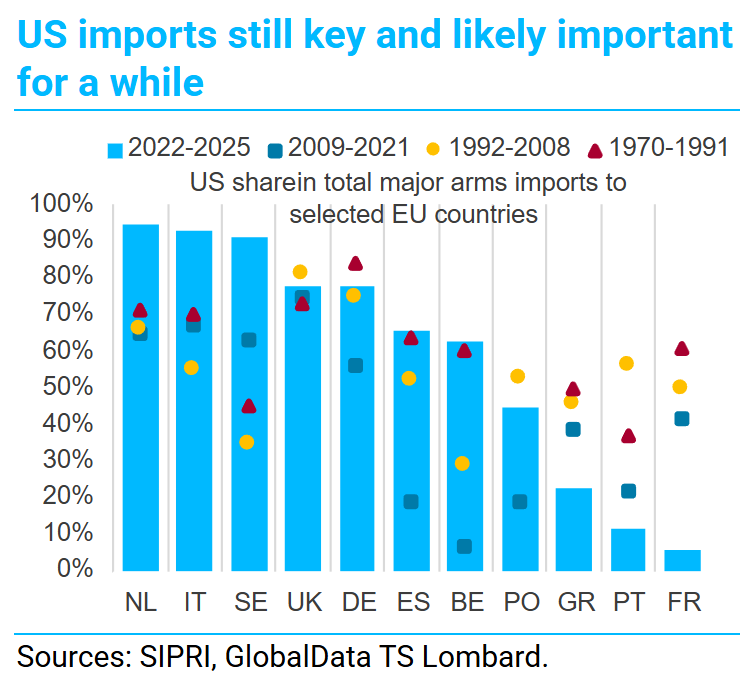

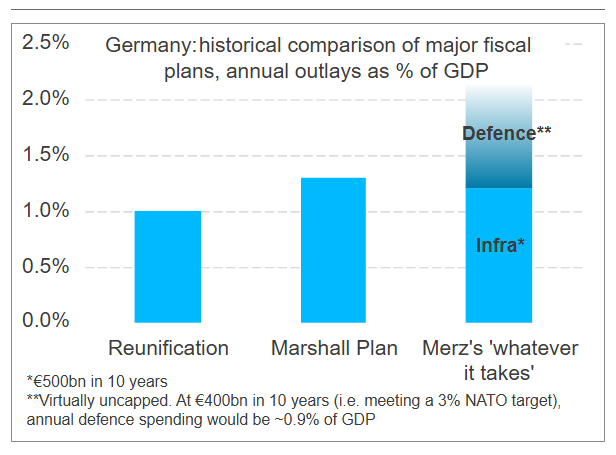

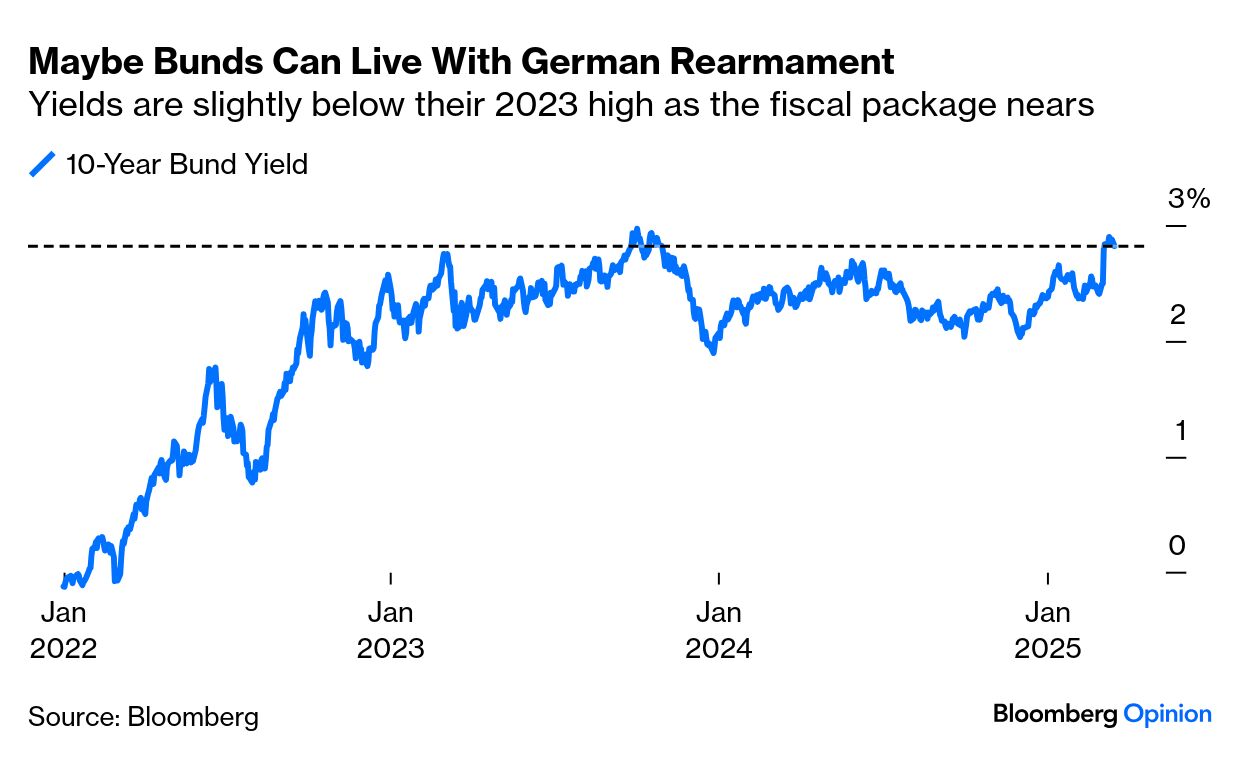

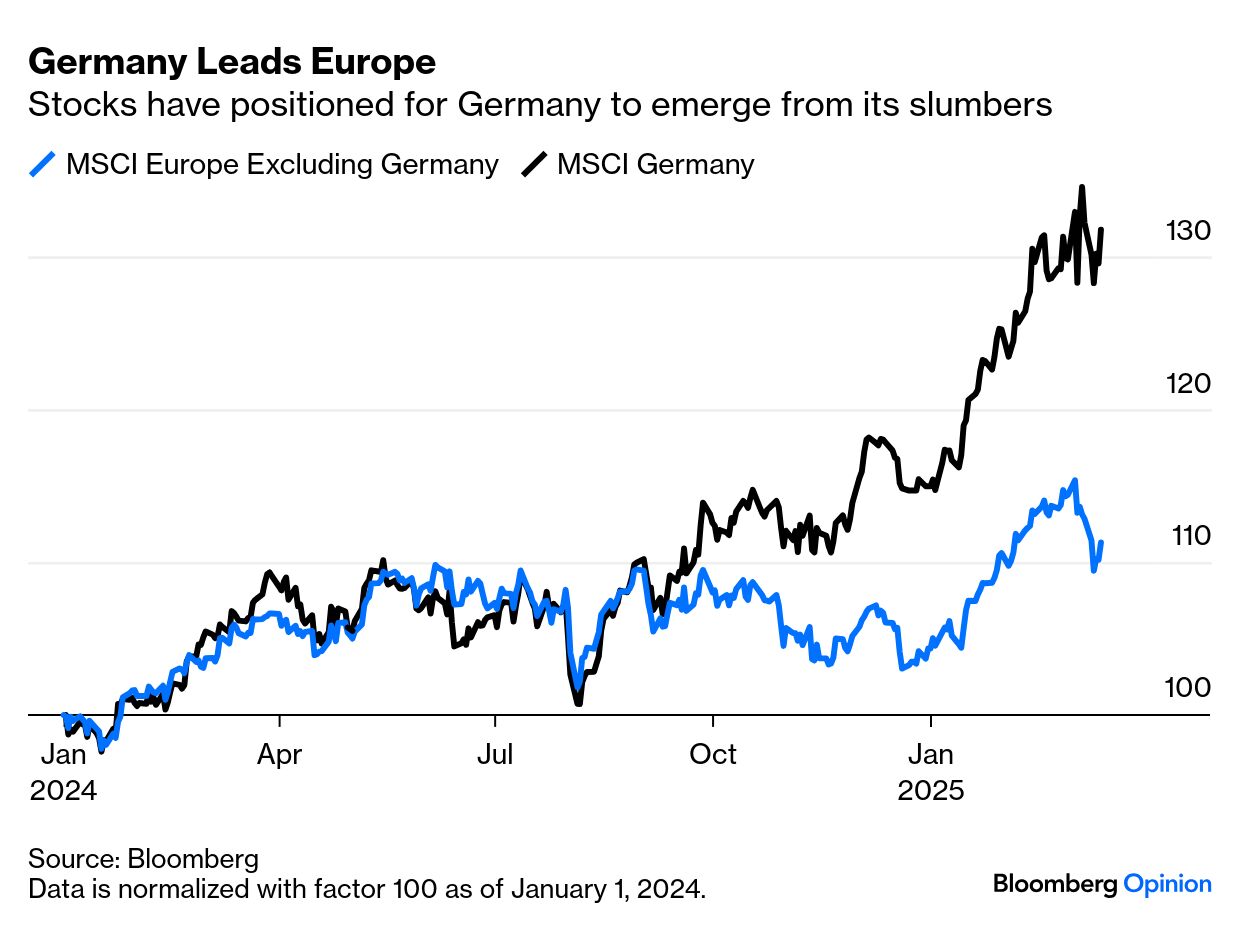

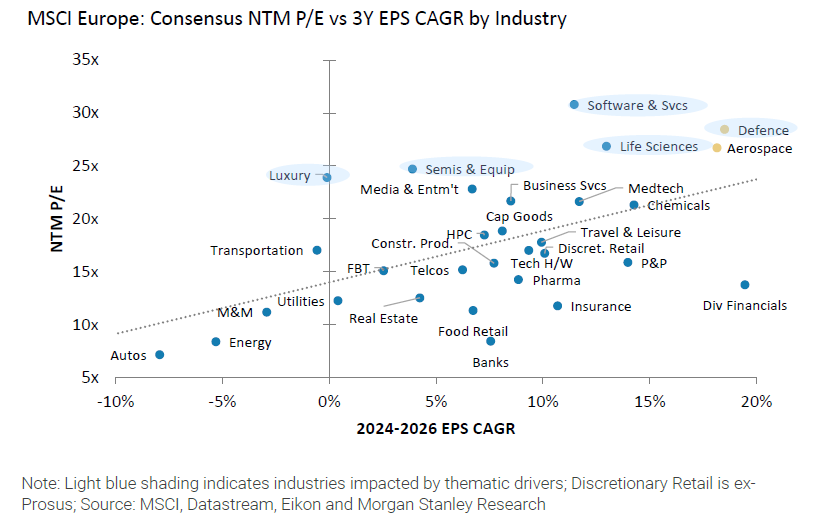

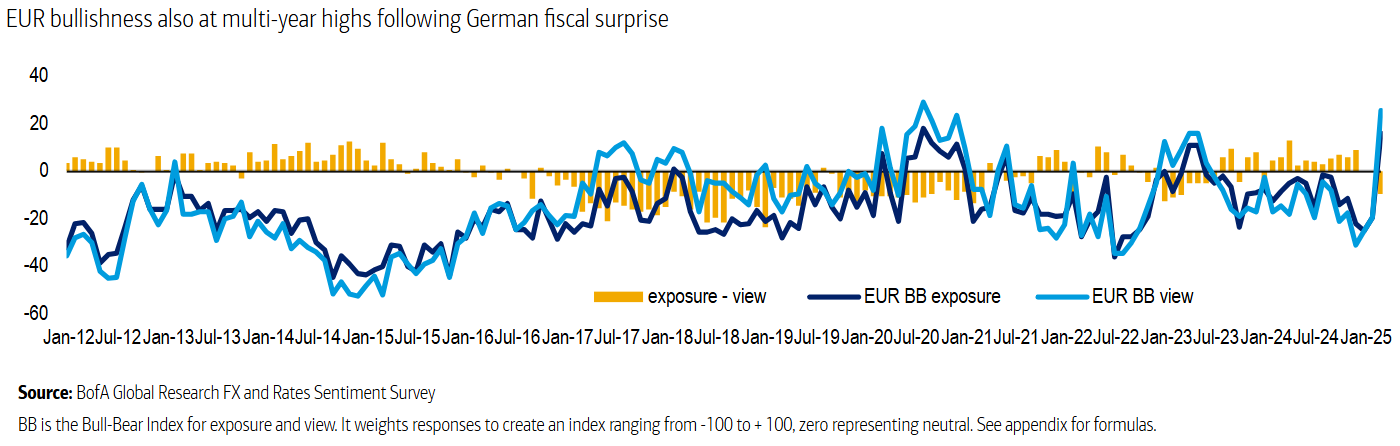

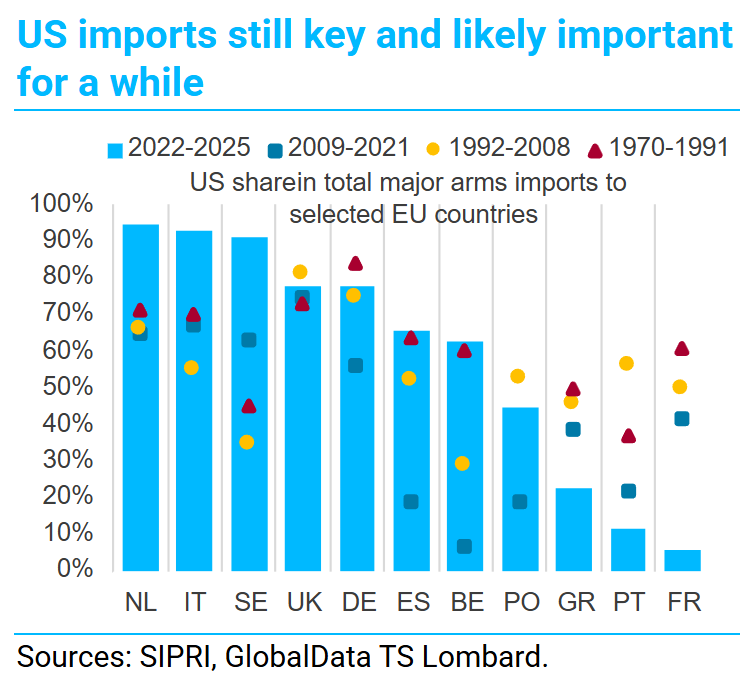

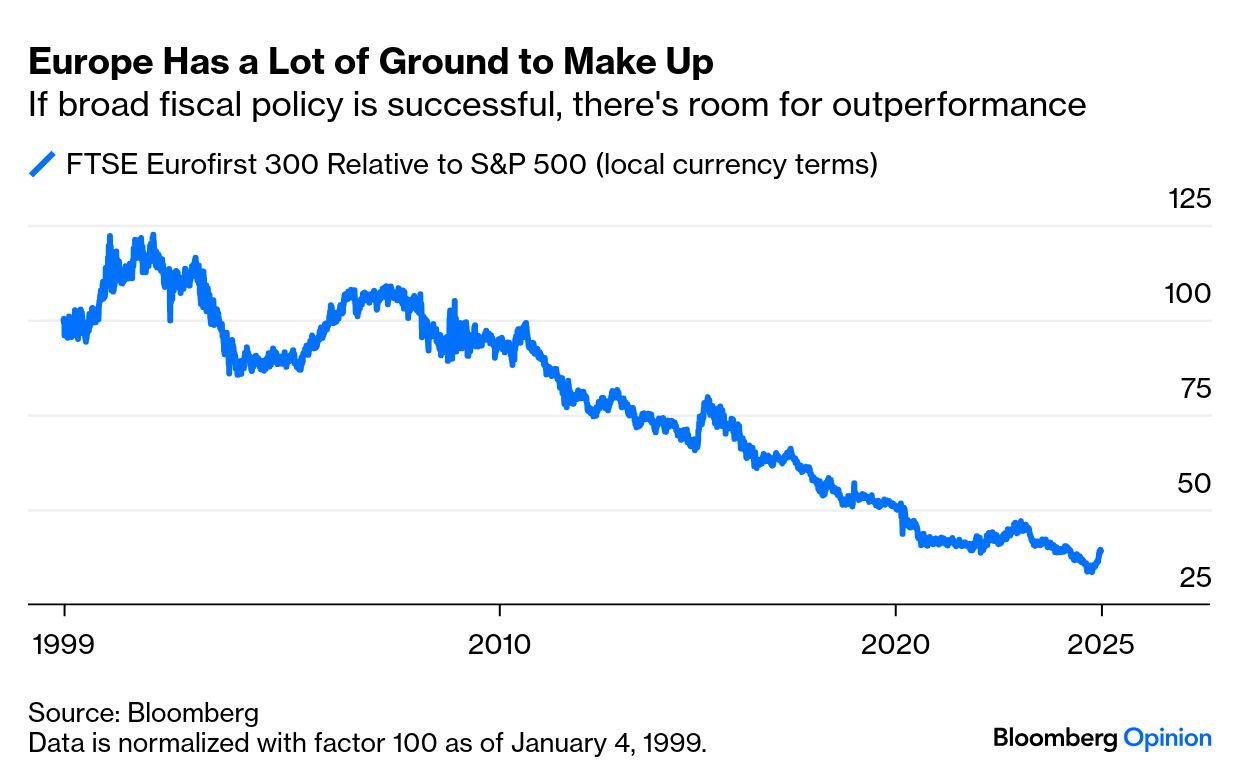

Everyone Loves German Rearmament | Germany's big day is finally here. The Bundestag is due to vote on a massive package of fiscal stimulus that will revoke the constitutional brake on how much debt the government can take on, and green-light borrowing up to about $1 trillion to spend on defense and infrastructure. It's an extraordinary moment, and all the more so because these radical changes are being voted on by a "lame duck" lower house, many of whose members will be replaced next week after losing seats in February's election. How big a deal is this? TS Lombard's Davide Oneglia suggests that it outstrips the spending booms that came with the postwar Marshall Plan and with German Reunification in the early 1990s: This is an epic change of direction, which brings profoundly held historical views into question. The last time Germany rearmed, in the 1930s, the result was global disaster, and German politicians had assumed for decades that the world would not countenance their return as a military power. And yet now, German militarism is welcomed. Even the bond market seems cautiously OK with it. There was a huge leap in 10-year bund yields when plans for this package were unveiled two weeks ago. Since then, as the greatest political obstacles have steadily been overcome and the package has if anything grown more ambitious, the bond vigilantes have been largely silent. Bund yields are still below their recent peak from 2023:  The response in stock markets has also been emphatic. The belief is that Germany's move solidifies the shift that the new US administration was hoping to engineer: Europe will pay much more for its defense, enabling the Americans to pay less. That's clear from the spectacular outperformance by European weaponry stocks of their US counterparts since Vice President JD Vance shocked the continent at the Munich security conference a month ago: The news that Germany is at last going to try borrowing to invest — a policy that the market has been urging on it for generations — has had an extraordinary effect on its stocks compared to the rest of Europe. As Germany had far more space to expand spending than anyone else, its market has radically outperformed since Donald Trump's victory began to look likely last autumn: Stock valuations have already moved fast to catch up with the news. Morgan Stanley offers this chart of European sectors, with price/earnings ratios for the next 12 months on the vertical scale and projected earnings growth rates on the horizontal axis. Defense and aerospace now have the highest projected growth rates, and the earnings multiples this optimism would imply. The beleaguered automobile sector is at the other end of the scale. So the internal market has already adjusted significantly for the new political reality: The optimism spreads beyond stocks and bonds. The latest Bank of America survey of rates sentiment among traders, which looks at both dealers' exposures and their views on a currency (whether bullish or bearish), shows a dramatic shift toward the euro:  Is this justified? The package looks close to certain to survive after Friedrich Merz, the likely next chancellor, brought the Greens on board last week. This guarantees the two-thirds needed to get through the Bundestag, while the package has if anything been strengthened. The Greens negotiated that €100 billion of the infrastructure spending would be devoted to environmental goals but perhaps more importantly extracted guarantees that all the money in the package would be truly additional, and couldn't be balanced against tax cuts or other priorities. It still needs to clear the upper Bundesrat, which seems likely, and to pass muster with the constitutional court — which now appears to have ruled out intervening. Give or take some abstentions by MPs, the biggest shift in German fiscal policy since the war is about to happen. The next pressing question will be whether all of the extra money will be spent in Europe. This chart from TS Lombard shows that many European countries, including Germany, are heavily reliant on the US for arms. This is unlikely to change quickly. However, the experience of France, always the least enthusiastic Atlanticist in the EU, in drastically reducing reliance on the US over time does suggest that an increasing share of Europe's defense will be provided by Europe. There's certainly overwhelming political will to reduce dependence on Washington:  What effect can all of this have on markets? It's sobering that in the short term, predictions for economic growth remain muted to say the least. For example, Morgan Stanley reacted to the news by revising its forecast for euro zone gross domestic product to grow 1.0% this year from 0.9%, while the 2026 estimate has risen to 1.1%. from 0.9%. There are ample political pitfalls and opportunities for bad implementation. But against this, Europe's biggest economy is embarking on the policy that the market has long wanted. If it works, there's scope for European outperformance to carry on for a long time. This is how badly stocks have lagged since the inception of the euro in 1999: There are risks as is inevitable in any military buildup, but this transformative policy change has also transformed the case for investing in Europe. It's not only Europeans who are determined to do "whatever it takes." In China, the Communist Party's "special action plan" to shore up consumption is also supposed to fall into that category. A recent gathering of policymakers reiterated a commitment to encourage consumer confidence and spending. The well-timed explicit communication comes with Beijing under a barrage of tariffs from the US and its "unwilling" allies. It seems to have enthused US investors, as the Nasdaq Golden Dragon China index gained 4.03% Monday, rising to its highest in three years:  Some consumer stimulus package was a given; the question is about size and impact. China's repeated efforts at a turnaround have so far failed to demonstrate the necessary urgency required in typical recovery efforts. Last September's big rollout of stimulus plans briefly fueled the belief that the era of pussyfooting was over. That wasn't the case. Capital Economics' chief Asia economist, Mark Williams, points out that the talk of prioritizing consumption is only encouraging on paper. In reality, the latest plan doesn't include any significant new measures or suggest that there has been any shift to the underlying priority of boosting China's supply potential. Without one, Williams argues that overcapacity and deflationary pressure will continue. At best, the plan reiterates the existing approach to shoring up consumption, such as the trade-in program for consumer goods, as well as an effort to lift household income growth and strengthen the social safety net. Discretionary stocks have drastically underperformed staples for a long time, as this chart of CSI 300 indexes demonstrates, so boosting spending is a tall order:  This doesn't mean that the new plan can be jettisoned as unfit for purpose. Officials argued that most previous consumption policies started from the supply side, while the current ones address demand. The plan pledges to increase childcare subsidies to boost fertility, which Gavekal Research's Wei He argues could result in meaningful transfers to some households. However, He argues that the plan still falls short: Supply-side measures can sometimes make a difference; relaxed visa requirements for certain foreign nationals have led to a substantial pick-up in inbound tourism. But in general, such supply-side policies have not proven especially effective at stimulating consumption.

Other policies include an interest subsidy for individual consumer loans, and making it easier for homebuyers to access financing using the housing provident fund. These might have only limited impact as, for instance, only about 170 million people have access to housing provident fund loans, He points out. Since September, officials have shown their preference for incremental adjustments rather than wholesale changes. So why aren't they going the full mile? Capital Economics' Williams argues that this could be because policymakers believe that consumer spending weakness has no deep, structural roots — instead, they see it as a soft patch to be managed. Williams adds that they also have an attitude to borrowing that sounds very much like Germany's for many decades: "That it is inappropriate to borrow to support consumption — borrowing should instead be used to boost the economy of the future."  Shanghai needs its swagger back. Photographer: Raul Ariano/Bloomberg Then, China must confront the impact of US tariffs. The most recent consumption, investment and industrial production exceeded estimates to start the year. Still, Societe Generale estimates Trump's 20% tariffs will likely knock 0.8 percentage points off GDP growth. SocGen's Michelle Lam says that effective and forceful implementation of policies, such as encouraging fertility, reducing inventories in low-tier cities, and mobilizing long-term funds to support the stock market are crucial to ending deflation woes. Ultimately, Gavekal's He makes an interesting observation that's not beyond the reach of the Communist Party. The intervention could nudge officials to give consumers the feeling of concrete government support for improving their lives, in turn leading them to spend some of their savings. As Germany has been stung into long-delayed action by the sudden change in US policy, it's just possible that the same will happen in China. —Richard Abbey One more song I unforgivably forgot to include that I've frequently linked when trying to liven up market analysis: Helter Skelter. Here's the original version by the Beatles, Paul McCartney performing it at Live 8, and later with Ringo Starr, and U2 stealing it back from Charles Manson. I was also going to link to some of the many heavy metal bands who've covered it, but having listened to a few of them, I think they merely showed how good the Beatles were, so I won't. With political uncertainty this high, the odds are that "Helter Skelter" will be getting a few more airings in the months ahead.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment