| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union.German lawmakers are on |

| |

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. German lawmakers are on the verge of unlocking hundreds of billions of euros in debt-financed defense and infrastructure spending, ushering in a new era of expansive government borrowing in Europe's biggest economy. Barring last-minute hitches, lawmakers in the lower house will back the measures today, paving the way for the upper house to approve them on Friday. The bill pushed by Chancellor-in-waiting Friedrich Merz and the Social Democrats — who are in talks on forming the next government — would effectively remove borrowing restrictions for spending on defense and includes a special, off-budget infrastructure fund that allows for borrowing of as much as €500 billion. Markets have looked favorably upon Germany's pitch to resume its role as Europe's growth engine. While defense stocks are the obvious winners, the spending spree could eventually spur a number of sectors. — Samuel Stolton and Iain Rogers | |

| |

| Trump Talks | Donald Trump will speak with Russian President Vladimir Putin today, as the US jockeys for an end to the fighting in Ukraine. EU leaders worry that Trump will concede more than the bloc is comfortable with. Lithuanian Foreign Minister Kęstutis Budrys said in an interview that it would be "damaging to even consider" restoring relations with Moscow right now. Seizing Assets | The EU and the UK will advance efforts to seize frozen Russian assets. Kaja Kallas, the bloc's top diplomat, and Foreign Secretary David Lammy will review initiatives to collectively step up European defense funding and bolster readiness in a meeting in London today. Military Bucks | Ahead of an EU leaders' summit this week, nations progressed on a new €40 billion military aid package. The move is key to providing Ukraine with essential military supplies in its war with Russia. Inflation Fall | The ECB's Luis de Guindos sees services inflation moderating towards price stability targets. Recent projections put the headline number slowing to its goal in the first quarter. | |

| |

| Trump Jump | As Trump embarks on a global trade war, Germany's Volkswagen is now looking at building more cars in the US. But the company wants clarity on the president's trade policy before making the jump. Crypto Scrutiny | Under scrutiny from EU watchdogs, digital-asset exchange OKX has halted a service used by hackers to launder proceeds from a $1.5 billion heist. OKX is subject to new EU crypto-asset rules. Slovak Shooting | The shooting of Slovakian Prime Minister Robert Fico last year has led to charges against a 72-year-old retiree. The alleged attacker earlier told a judge he disagreed with a range of Fico's policies. Rwanda Sanctions | Three senior Rwandan military officials and a gold refinery have been hit by EU sanctions, as criticism mounts over the government's backing of the M23 militia. The penalties follow a similar US move. Polish Watch | Poland is in talks with Big Tech firms in fears over increased cyberattacks ahead of presidential elections on May 18. Warsaw is on high alert after allegations of foreign interference in Romania's presidential election last year. | |

| |

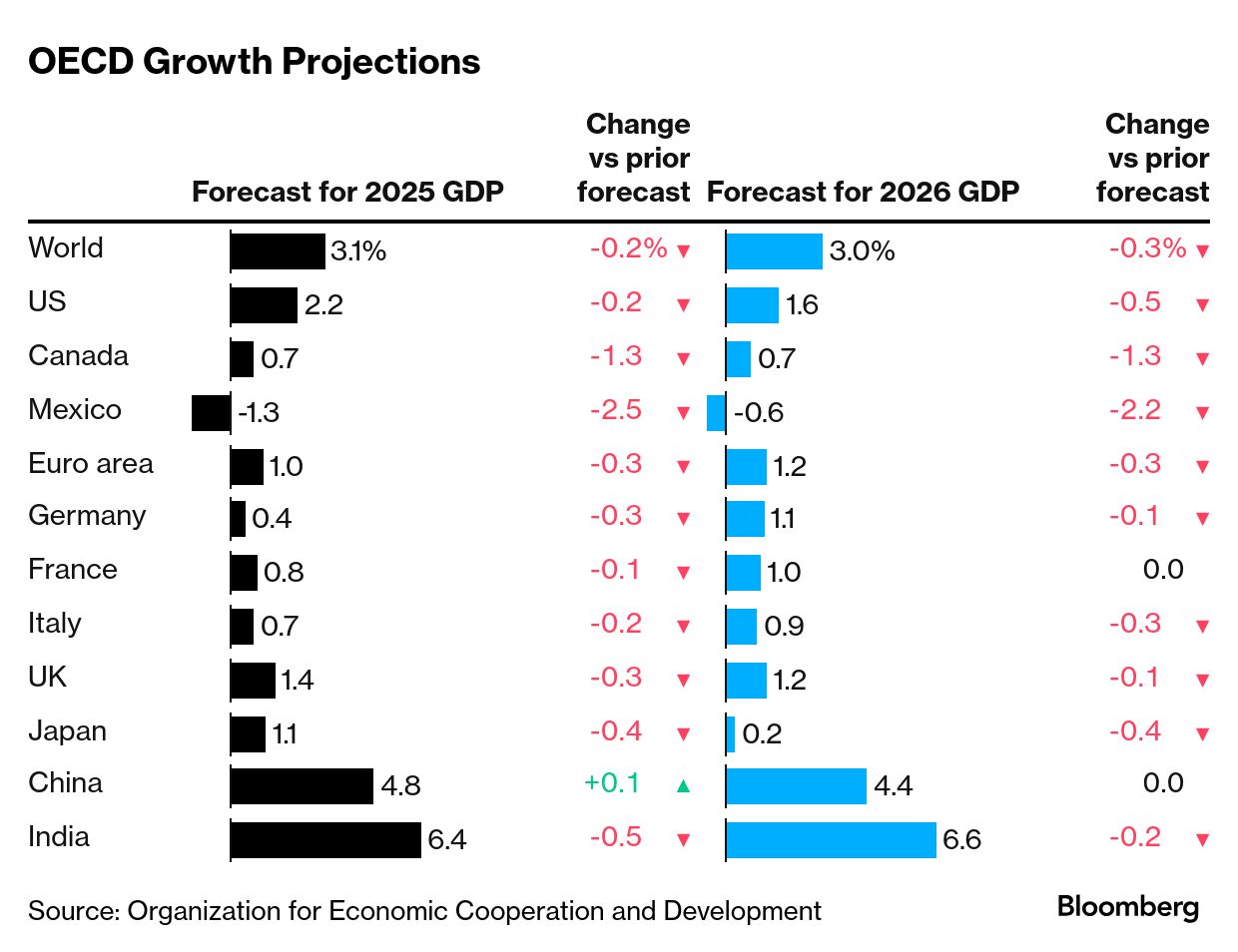

| Trump's aggressive trade policies have set the world onto a path of slower growth and higher inflation that could worsen, the OECD said. The Paris-based organization has cut its outlook across its membership, predicting the pace of global expansion to slow to 3.1% this year and 3% in 2026. The OECD's analysis accounts for measures already taken between China and the US, as well as Washington's broad-based 25% tariffs on steel and aluminum imports. In Europe, higher defense spending could also support growth, although it would add to pressure on government finances. | |

| |

| All times CET - 9:20 a.m. Financial services Commissioner Maria Luis Albuquerque gives keynote speech at Forum Europa event in Brussels

- 9:30 a.m. EU antitrust chief Teresa Ribera speaks on Clean Industrial Deal at EU parliament environment committee

- 10 a.m. Germany's Bundestag starts debate on defense and infrastructure spending package, result of vote expected around 2 p.m.

- 12 p.m. EU Council President Antonio Costa meets former UK prime minister Tony Blair

- 3 p.m. Parliament President Roberta Metsola meets European Council President Antonio Costa

- Commission President Ursula von der Leyen and trade Commissioner Maros Sefcovic meet WTO Director General Ngozi Okonjo-Iweala

- EU European affairs ministers meet in Brussels

- EU transport ministers hold informal meeting in Warsaw

| |

| |

| |

| You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment