- February CPI shows the US still has an inflation problem (even if slightly better than expected).

- Market-based inflation expectations for the near term are rising again.

- And trade policy uncertainty is at a record — so don't expect any cuts from the Fed.

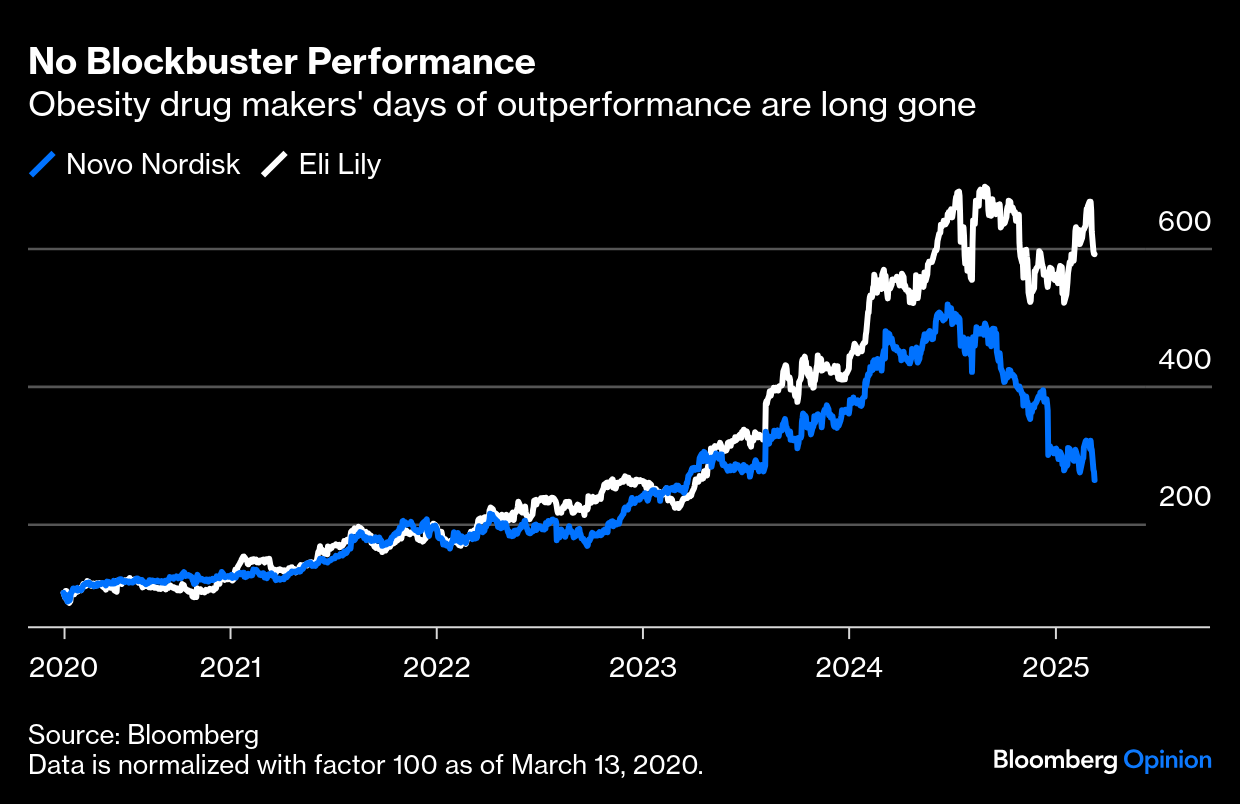

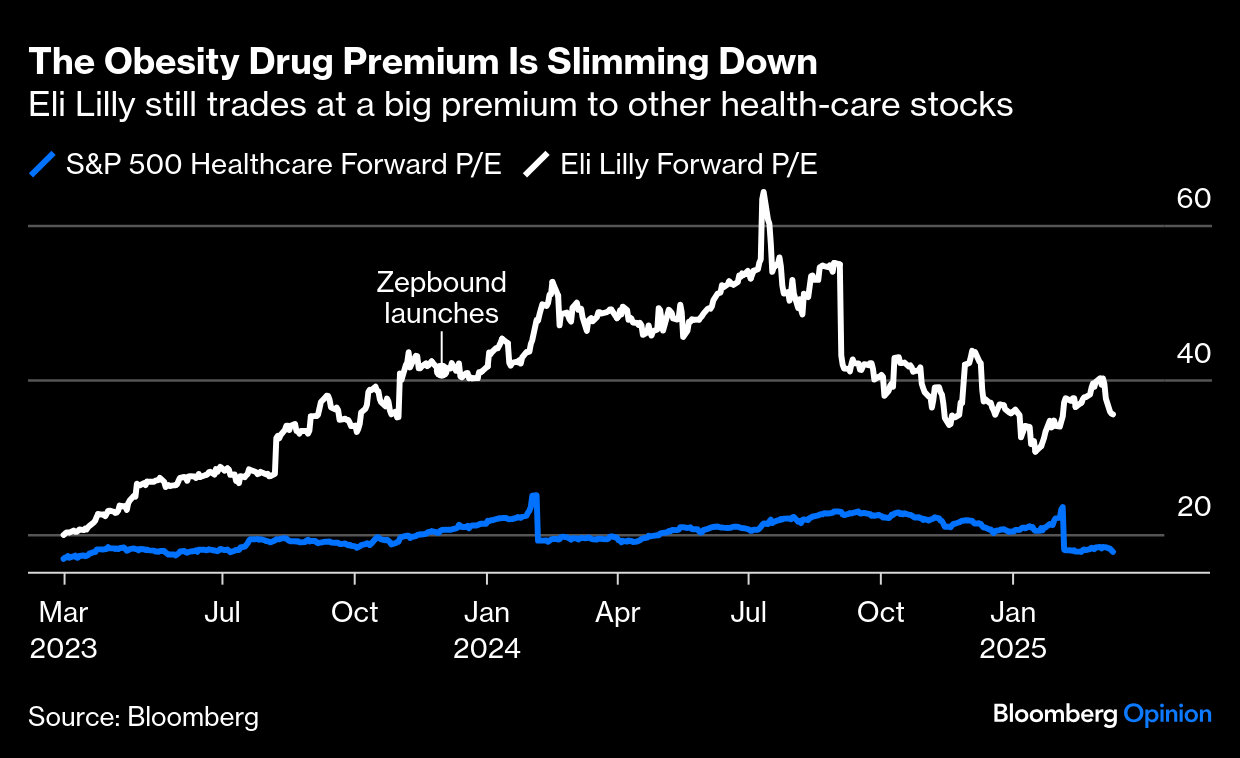

- Weight-loss drugmakers' share prices are slimming down.

- AND some more songs that really help liven up financial commentary.

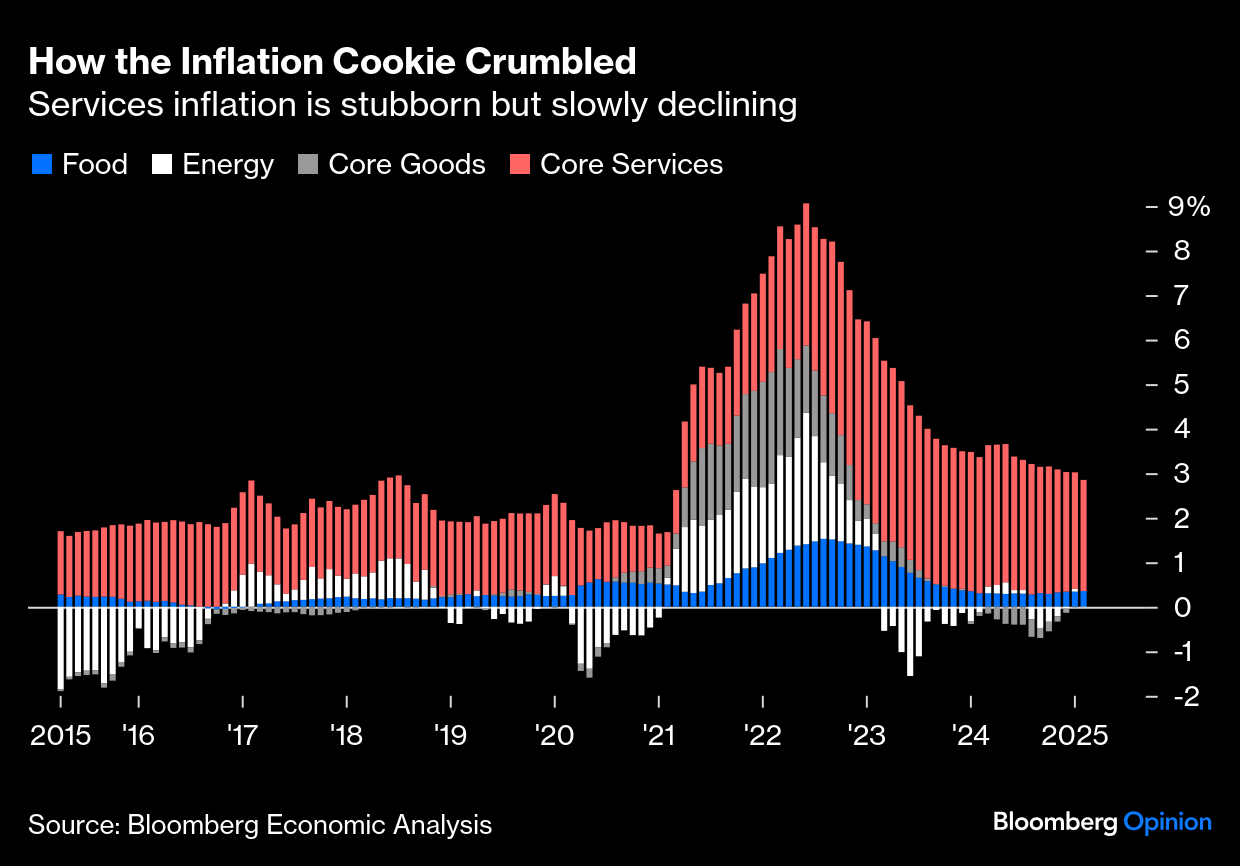

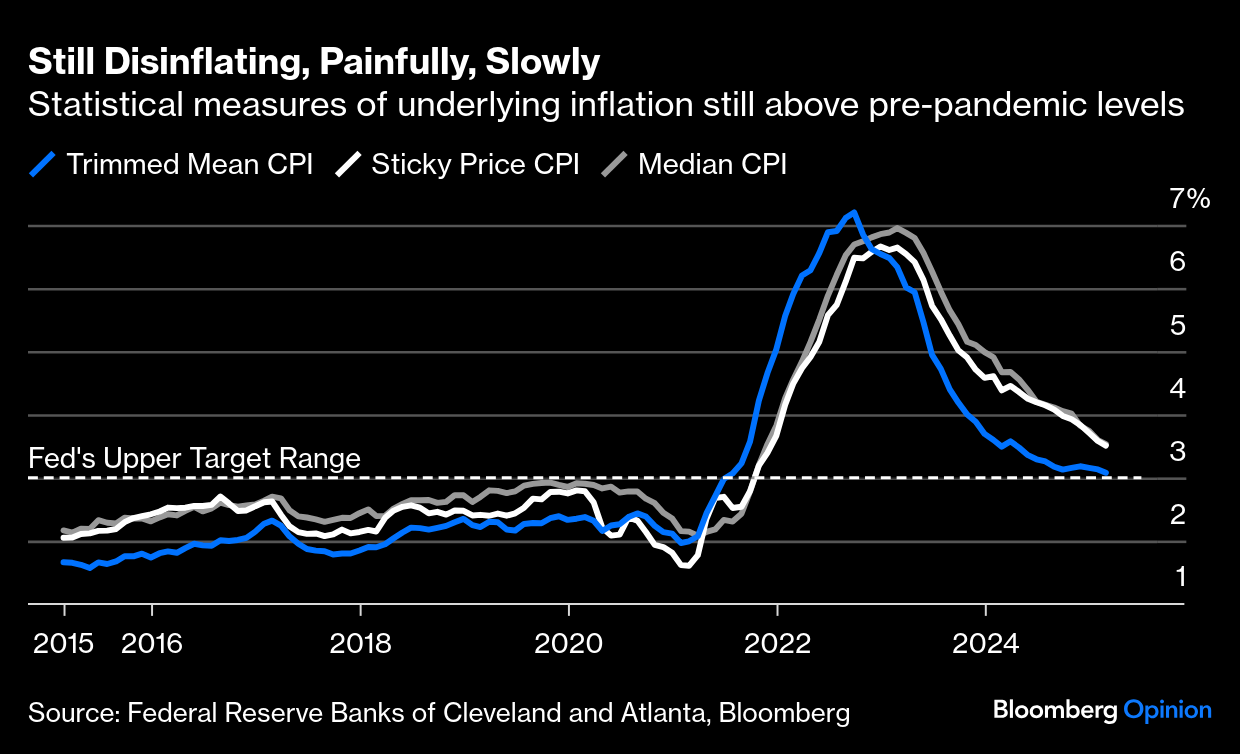

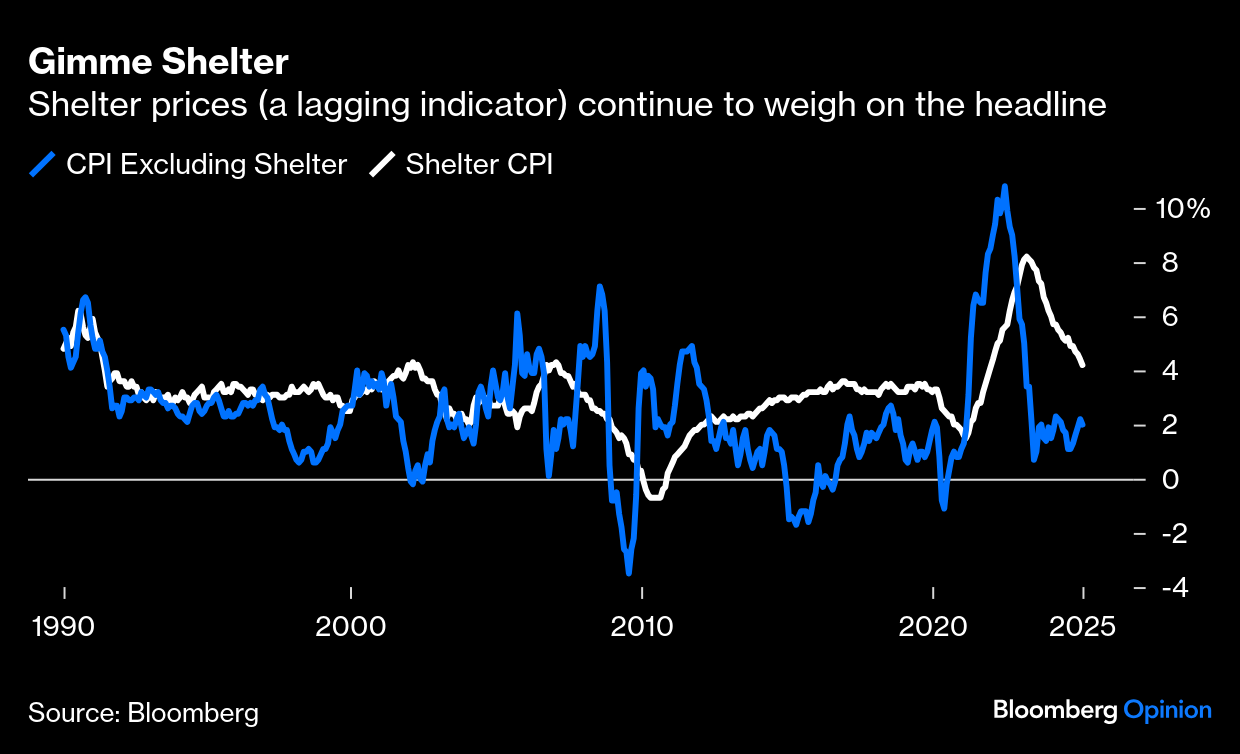

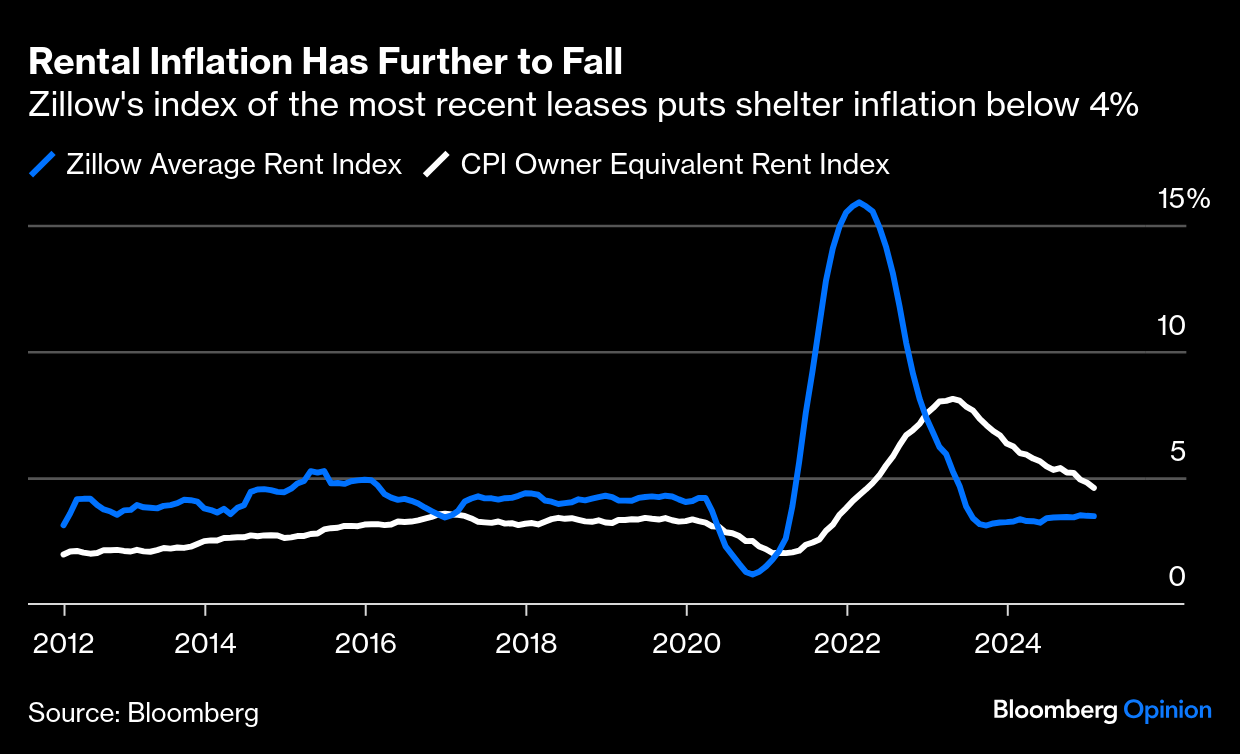

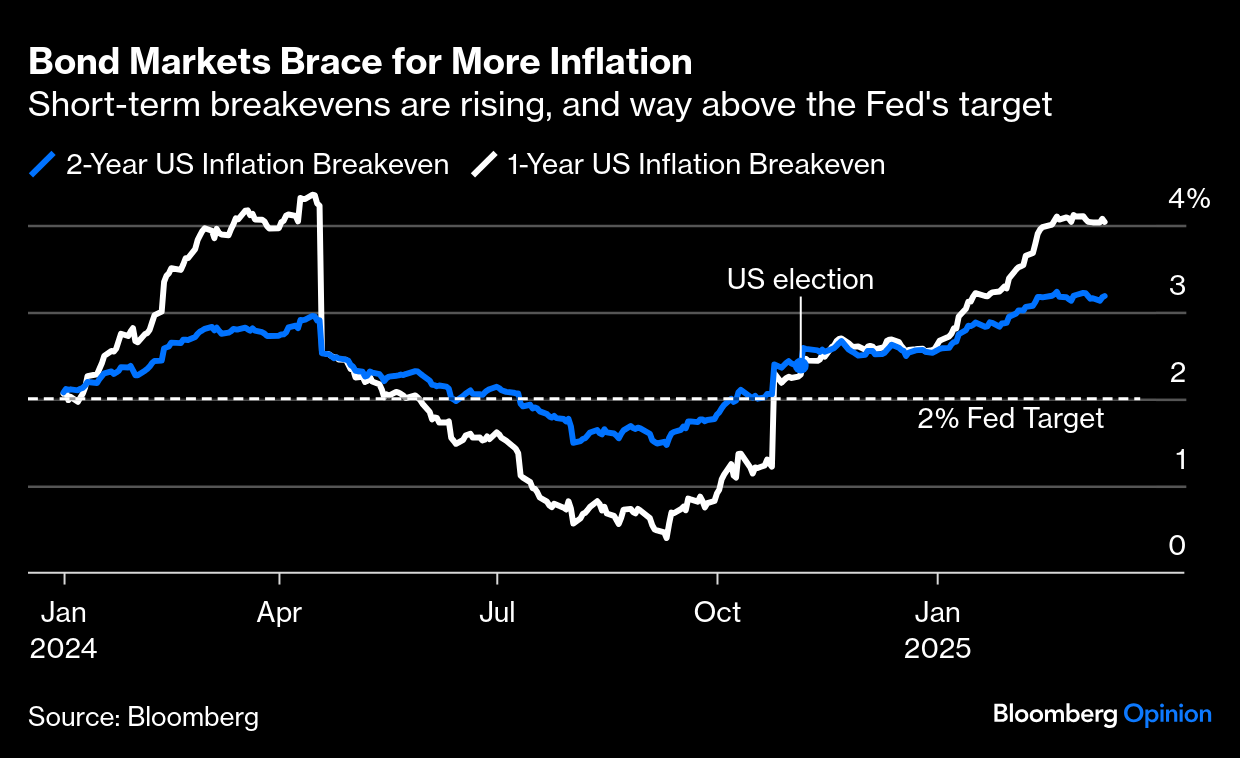

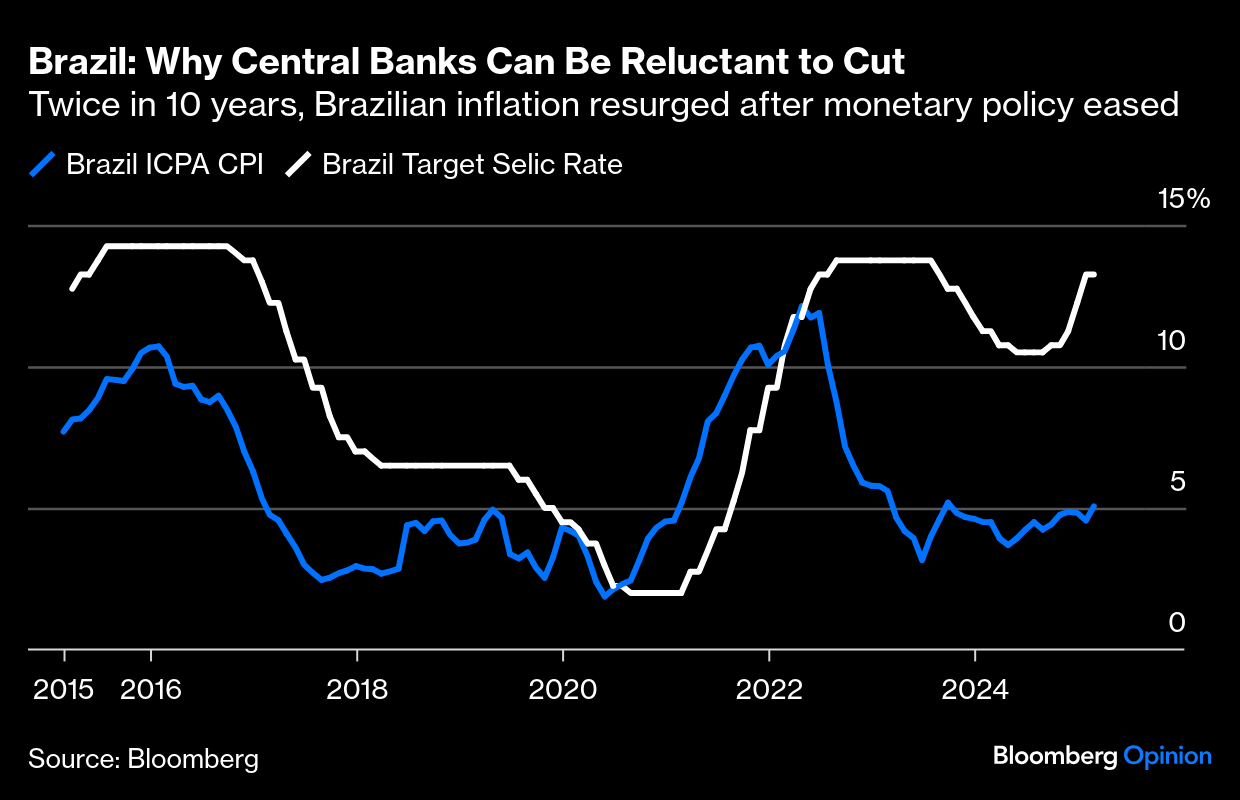

Some Things Are Constant, Like Inflation | Great news to start the day! US inflation had a positive surprise for a change, with the headline consumer price index rising by 2.8% in the 12 months to February, compared to January's 3.0% and an expected 2.9%. Once food and energy are excluded, the "core" measure came in at 3.1%, which was similarly below expectation (3.2%) and January's outcome (3.3%). But there's no pleasing some people. Even if the headline reads easier now within the 3% upper range of the Federal Reserve's target, dealers looked through the entrails and quickly decided that the report was nothing to get too excited about. Expectations for rate cuts by the Fed were reduced very slightly, while short-term bond yields rose slightly. How can this be explained? The overall picture should be familiar by now, as it has been locked into the same pattern for more than a year. Inflation is declining but very slowly because of obdurate services inflation. This is the breakdown of the CPI headline into its four main components, which can be produced using Bloomberg Economic Analysis (ECAN <GO> on the terminal).  The more sophisticated statistical versions of underlying inflation produced by different teams of Fed economists confirm this picture. The trimmed mean (excluding the biggest outliers in either direction and taking the average of the rest) and the median CPI, produced by the Cleveland Fed, are falling slowly but remain above the 3% upper bound of the Fed's target. The inflation of goods and services with sticky prices (which take a while to change and in practice only go upward), as measured by the Atlanta Fed, is also falling, but very slowly. It's still at a level that's too high for comfort. They're all above their highs for the years leading up to the pandemic:  Another reason why the market didn't hold on to the enthusiasm generated by the initial numbers: Much had to do with a fall in air fares, which are highly volatile. They make a bigger share of the index than eggs, but the continuing rise in egg prices (for reasons that have little or nothing to do with monetary policy) will inevitably garner more attention, and continue to create the impression of serious inflation: Controversy continues to surround the official measure of shelter inflation, which is gauged from the average of all leases currently in force. Exclude shelter, and the rest of the index is inflating at almost exactly 2%: While this is probably the most valid measure of shelter costs when the index is used for calculating cost-of-living adjustments to benefits, it moves slowly in a way that arguably distorts the overall picture. Private sector indexes looking only at leases that have started in the latest month and comparing them to 12 months earlier generally predict trends ahead of time. Zillow's index signaled serious inflation and subsequent disinflation, and stabilized more than a year ago: The official measure remains higher, though the gap is now much narrower; it's not clear that the overall inflation picture is any longer being that seriously distorted by shelter. At any rate, in the short term, the market is working on the assumption that inflation is trending up again. One-year inflation breakevens derived from bond prices suggest inflation will touch 4% over the next 12 months, and average 3% over the next 24. If those numbers prove accurate, it would be very difficult for the central bank to cut rates further: For the immediate future, tariffs remain the most critical variable: How widely will they be applied, and at what rates? That story unwinds and grows more complicated with every day. Bloomberg's new Global Trade Policy Uncertainty index confirms intuition that confusion is radically higher now even than it was during Trump 1.0: The practical import is that it's hard for companies to plan or to set prices under these conditions, while it grows very unwise for the Fed to do anything that might play into the rise in the price level that tariffs will initially cause. The bar for cutting rates is now very high. The other reason why Fed cuts are probably a long way off comes from the asymmetry of its decisions. Like everyone else, central banks often make mistakes. But erring on the side of leniency, and letting inflation take off, probably appears a much more serious error at present than the alternative hawkish error of hiking and needlessly sparking a recession. The last mistake the Fed made — in the company of other central banks — was to believe that the inflation of 2021 would prove transitory. It was a dovish mistake. That leads to particular reluctance now to cut without some certainty on tariffs, and on inflationary trends. For a cautionary tale, look to Brazil, where year-on-year inflation rose to 5.06% in February, from 4.56%. The central bank had cut its policy rate, the Selic, earlier than most, starting in 2023, when it appeared that inflation was licked. It's now been forced into a new hiking cycle: The Fed really doesn't want to suffer the same fate. Inflation long since ceased to be the serious issue that plagued the country in 2022. But the latest numbers still aren't good enough to allow the cutting cycle to continue, and markets quickly worked that out. Obesity drug makers are struggling, even though this seems incomprehensible in a world where the condition is so prevalent. Some 43% of US adults are overweight, including those regarded as morbidly obese, according to the National Institutes of Health. That means the market for obesity drugs in the US is estimated to reach as much as $200 billion from about $7 billion presently. The breakthrough blockbuster GLP-1 drugs generated intense excitement when they launched. And yet these pharmaceuticals barely scratched the surface of this massive and lucrative market before losing steam. Of course, their initial rallies were never going to continue perpetually. However, the tumultuous run since their relatively short-lived period of exceptionalism is concerning, as Points of Return previously discussed. Disappointing results from experimental drugs rank high among the possible explanations. The failure of the Novo Nordisk A/S next-generation drug, CagriSema, to deliver at least 20% weight loss in patients fell heavily on the company and its rivals. Its market cap has plunged by almost 50% since June, and CagriSema's latest shortfall, the second after another failure in December, did its share price no favors: Much of this has been driven by valuations. Eli Lilly & Co.'s forward earnings multiple surged to a huge premium over the health care sector as a whole in the months leading up to the launch of Zepbound. That premium is still intact and is wider than two years ago, suggesting there could be further to go, but the loss of confidence is clear: Why did investors get out? Bloomberg Intelligence's Michael Shah explains that with the latest test results similar to rival Zepbound's performance, the new medicine might not be differentiated enough against an existing blockbuster. Nevertheless, Novo says it will press on to seek the first regulatory approval of CagriSema in the first quarter of next year. But Morgan Stanley analysts say the drug, which could reach the market in early 2027, will likely have peak sales of around $10 billion a year, far less than what's expected for Ozempic or Wegovy. Kepler Cheuvreux's David Evans adds that the disappointment over CagriSema raises doubts about Novo's future candidates. Obesity pills, to save patients from having to inject themselves, are regarded as the next big thing, but they're still a long way off. That makes it imperative to improve the efficacy of existing drugs, which Novo is struggling to achieve. The underperformance coincides with the Food and Drug Administration's removal of shortage designation, which curtails access to cheaper, off-brand copies of the popular medications, and should be helpful to the big players. Lilly and Novo have announced plans to fill the void left by these generic drug makers, and also to sell directly to patients whose health insurance plans lack coverage for obesity medications. But these measures haven't moved the market much. Meanwhile, patent expirations over the next six years make a quick turnaround for Novo all the more urgent. Bloomberg Intelligence estimates at least $120 billion of potential sales erosion over the period for big pharma, although the effect on the Danish firm appears low.  A North Carolina foothold may not keep tariffs at bay. Photographer: Rachel Jessen/Bloomberg The company's focus now shifts to Rybelsus, an Alzheimer's drug it is testing. Favorable trial data, expected this year, might stem the stock price's pernicious slide. President Donald Trump's persistent tariff threats on the European Union leave Novo exposed, despite its plans for a $4.1 billion factory in North Carolina. Pharmaceuticals is one of the many sectors at risk from proposed 25% levies, which seem ever more likely as tensions between Washington and Brussels intensify. To be in Trump's crosshairs is terrible for business, as chief executive Lars Fruergaard Jorgensen is very much aware: We still have products moving across borders like most global companies. Of course, there'll be some short-term impacts as we mitigate the impact of tariffs. By far, the largest drug category is generic medicines. If you put tariffs on those, I have a hard time seeing that that is not going to lead to other shortages of medicine or increased pricing in general.

Some Trump policy tweaks might be helpful for big pharma, such as a proposal to modify the Inflation Reduction Act's drug-negotiation provision. Bloomberg Intelligence's Duane Wright argues that key priorities like ensuring negotiation parity for both small and large molecules and broader exemptions for orphan drugs stand a good chance of making it into the Republicans' reconciliation budget. Also, a possible expansion in Medicare coverage for obesity drugs may help. —Richard Abbey I missed some of the songs that come in very handy when trying to lighten heavy doses of financial analysis. You might want to try: Euphoria by Loreen (which won the 2012 Eurovision Song Contest), Default by Django Django (a new one on me and it's really good), Forever Blowing Bubbles by the Cockney Upstarts, Baby You're a Rich Man by the Beatles, It's All About the Benjamins by Puff Daddy (as he was known at the time), Gimme Shelter by the Rolling Stones (see above) and Sell, Sell, Sell by David Gray. Any more? They all help. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Clive Crook: When Economic Chaos Doesn't Have an Endgame

- Jonathan Levin: The Fed Should Correct an Oversight on Food Inflation

- Javier Blas: Trade Wars Won't Make American Farming Great Again

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment