| I'm Vince Golle, an editor in Washington. Today we're looking at gold imports driving the US goods-trade deficit. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - US tariffs on copper imports could be coming within several weeks, months earlier than the deadline for a decision.

- Republican leaders are getting close to agreeing on a plan to pass an extension of President Donald Trump's 2017 tax cuts and an increase to the debt ceiling.

- UK inflation unexpectedly cooled, bolstering the case for interest-rate cuts and giving a boost to Chancellor Rachel Reeves's economic statement Wednesday.

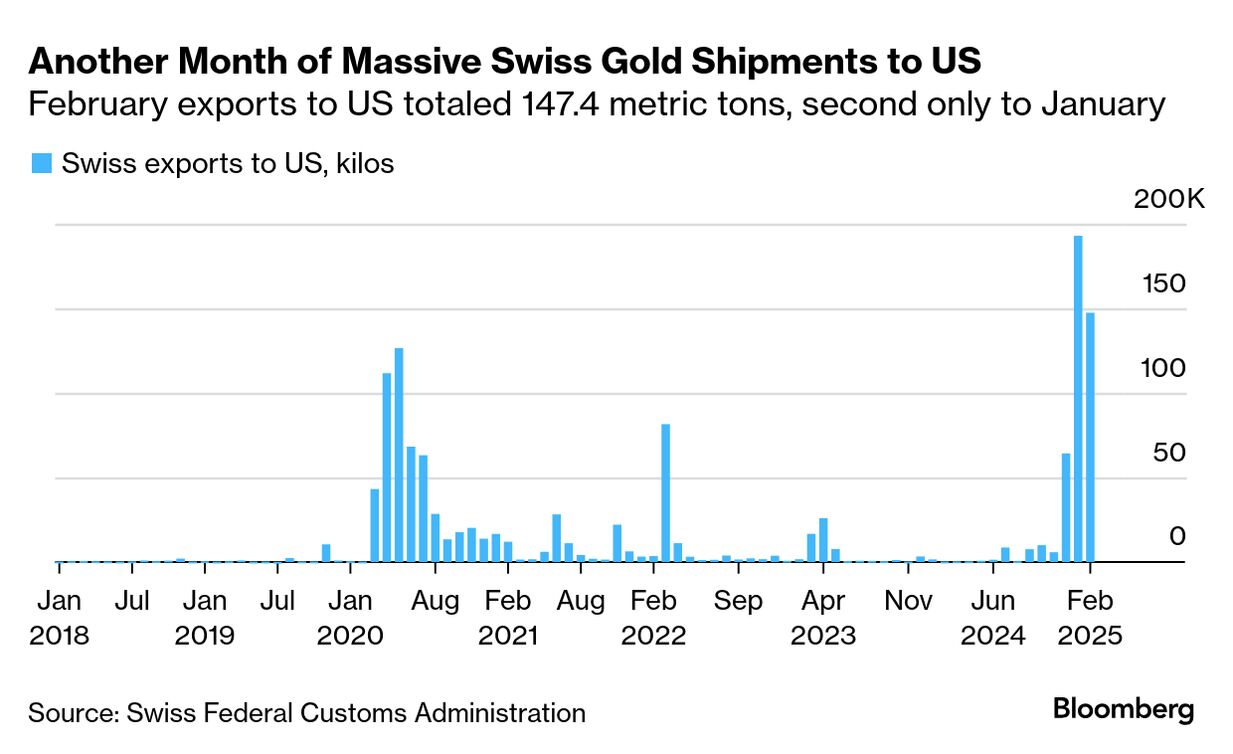

Gold bars that were rushed from London to New York with a stop in Switzerland helped drive the US trade deficit to a record in January and the flood of bullion has showed no sign of abating since. Swiss customs figures show that 147.4 metric tons of gold worth more than $14 billion were shipped to the US in February. That was second only to the record 193 tons that were sent at the start of the year, based on data back to 2012. The recent flow of gold imports into the US was largely in response to heightened concerns the precious metal could get caught up in sweeping US import duties. Also due to safe-haven buying, gold futures in New York have climbed above $3,000 an ounce. Early in the months-long rally, futures moved well north of the price for spot gold. The New York commodities exchange is the destination for the massive inflow of gold from overseas. Much of it originates from London, the world's largest trading hub for physical bullion. But, in an interesting twist that has large consequences on imports data, traders send the bullion first to Swiss refiners to get melted down and recast into the 100-ounce bars required by the US commodities exchange. As a result, a surge in Swiss imports pushed the US merchandise trade deficit to a record in January, and economists estimate the gap narrowed only modestly last month. Gold for investment purposes is excluded from the US government's calculation of gross domestic product. But soaring imports and the widening of the trade gap have nonetheless added to the anxiety about the economy, making it challenging for economists to ascertain exactly how much net exports will impact first-quarter GDP. Don't Miss the Latest Trumponomics Podcast | What happens when US economic data can't be trusted? With President Donald Trump firing independent regulators and killing off advisory committees, David Wilcox, director of US economic research for Bloomberg Economics, and Molly Smith, editor on the US economy, discuss why reliable data is at risk. Listen here and subscribe on Apple, Spotify, or wherever you get your podcasts. The Best of Bloomberg Economics | - China's economy got off to a good start this year and authorities are ready to deploy more stimulus if growth loses momentum, a center bank adviser said.

- A former US top trade official said that China is running a trade surplus that the world economy can't "live with."

- Bank of Japan Governor Kazuo Ueda indicated he aims to keep his options open ahead of the bank's next policy meeting.

- Former European Central Bank President Mario Draghi said Germany's decision to ramp up defense spending is a "game changer" but warned of implementation risks.

- Brazil's central bank said it was important to signal that its cycle of rate hikes will continue in the face of an adverse inflation outlook.

- Coming up: Czech officials may pause rate cuts in their decision today, while early tomorrow their Norwegian peers may hold off on their first reduction in five years.

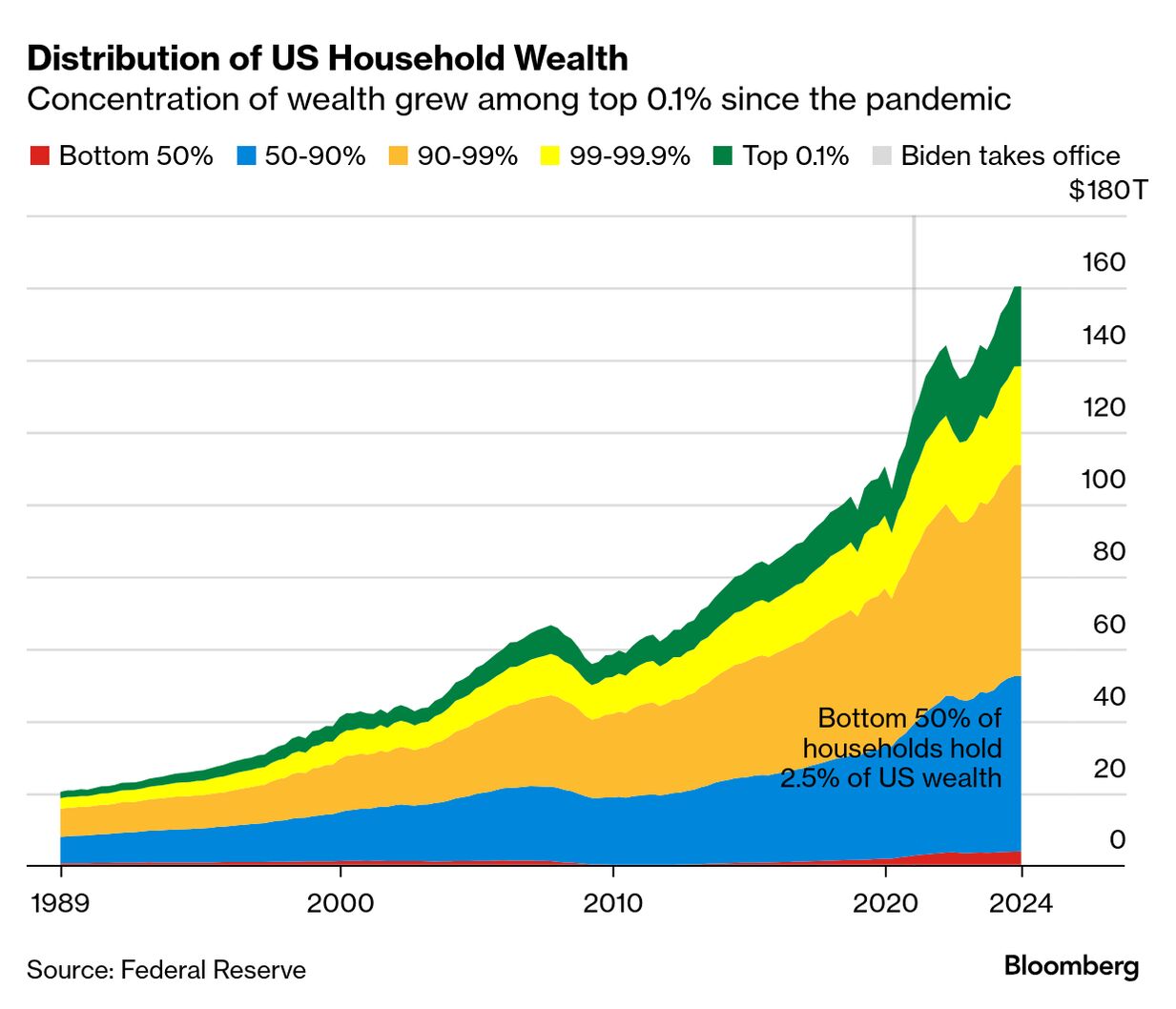

Trump is upending international markets with his aggressive and unpredictable escalation of tariffs on allies and enemies alike. What's really the message behind his trade wars? Join us for a Live Q&A on March 27 at 10 a.m. EDT. The US government's debt burden has surged since Covid, but the household portion of the national balance sheet is in good shape, Stephen Stanley at Santander US Capital Markets points out. Relative to GDP, household debt has dropped for 14 straight quarters, and in the final three months of 2024 reached a two-decade low, Stanley wrote in a note this week. And households' debt-servicing costs — the percentage of disposable income needed to stay current on debt payments — remains below 2019 levels (helped by the prevalence of fixed-rate mortgages). "Credit card delinquencies have levelled off after rebounding from historically low levels during the pandemic but are still running lower than the 2018 and 2019 levels," Stanley wrote. "Healthy finances should help to limit the stress for households as the labor market cools," though those at the bottom of the income scale "have seen their liquidity position deteriorate and could be particularly vulnerable." |

No comments:

Post a Comment