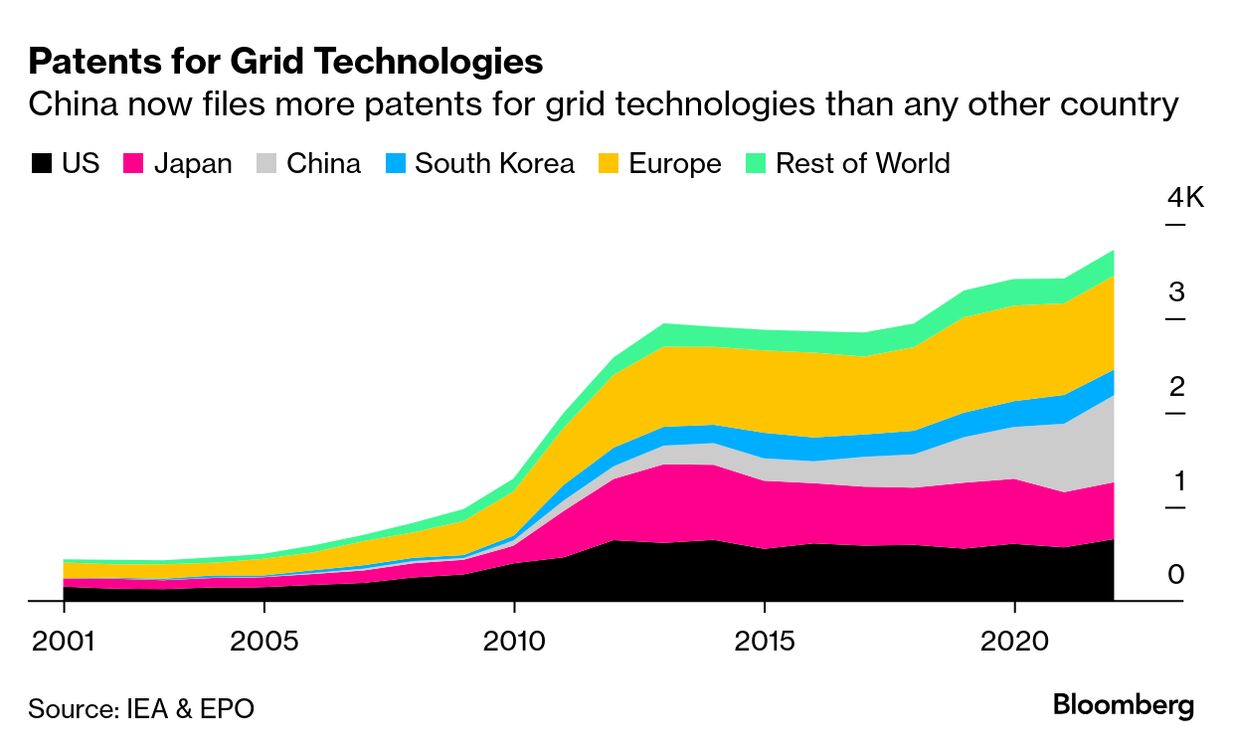

| The electrical grid is the world's biggest machine, and it's remarkable that it rarely breaks down. When it does, it can have spectacular impacts, as the shutdown of London's Heathrow airport last week clearly showed. One electrical transformer exploded, and the airport went dark. A preliminary investigation narrowed the explosion's causes to human error or equipment malfunction. But the backdrop to Heathrow's charred transformer is the aging of electrical grids in Western countries. In the US, for example, a government report published last year found that more than 70% of grid equipment is over 25 years old. Electricity demand in these countries has been flat or falling for decades, which has led the industry to delay capital spending on new equipment and push existing equipment to sweat harder and run for longer. Now that calculus is changing. Utilities are seeing a rapid rise in electricity demand spurred by electric cars and heat pumps, along with massive buildout of data centers for artificial intelligence. That's on top of extreme weather impacts causing more outages, and flukes like Heathrow highlighting how quickly an equipment failure can become catastrophic. Upgrading grids for 21st century demands in one go would require trillions of dollars of investments — a tough sell for utilities that are either state-owned or regulated monopolies with capped profits. That means much of the near-term action will be in retrofitting old equipment with new technologies. To start, utilities are likely to make small investments in software or minor equipment upgrades, says Conor Murphy, vice president of engineering at grid technology firm Novogrid. They'll also look to new tech: from deploying monitoring equipment that's linked up to real-time data analytics to replacing small portions of the grid, such as cables, with higher electrical capacity. There is no shortage of solutions, as the growing list of patents filed on grid technologies shows: Some of these solutions can be retrofitted on existing infrastructure, improving resilience and performance. But the eventual goal is still a complete overhaul, which will depend on whether executives are willing to take chances. "Utilities are risk averse," says Rena Kuwahata, power-system analyst at the International Energy Agency. "There are a lot of pilot projects that test new concepts. The question is how to integrate them systematically and make a business case." The growing risk of not upgrading may help force the issue. The transformer that shut down Heathrow was worth a few million dollars; one estimate puts the shutdown's damage to the airline industry at more than $70 million. After hundreds of thousands of passengers were stranded, UK Prime Minister Keir Starmer vowed that it will never happen again. Utilities around the world are listening. — Akshat Rathi, Bloomberg Green Read more: The Device Throttling the World's Electrified Future |

No comments:

Post a Comment