| I'm Chris Anstey, an economics editor in Boston. Today we're looking at the big question raised by US vehicle tariffs. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Chinese President Xi Jinping met with a group of global business leaders in Beijing in an effort to boost investor sentiment.

- Inflation in France and Spain undershot expectations, supporting calls for more interest-rate cuts by the European Central Bank.

- Coming up: the Federal Reserve's preferred measure of underlying US inflation, due today, may turn out to be disquieting for officials.

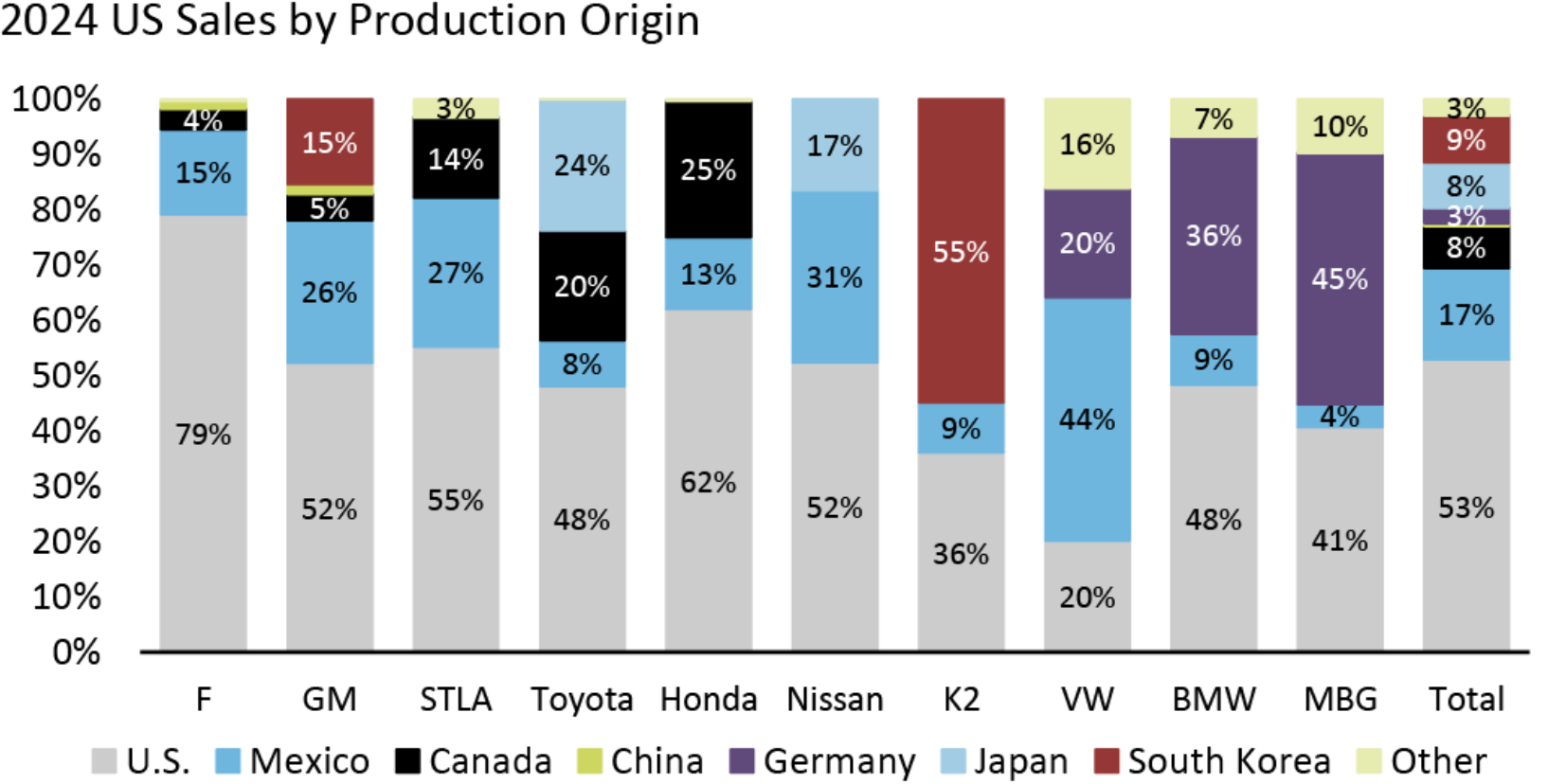

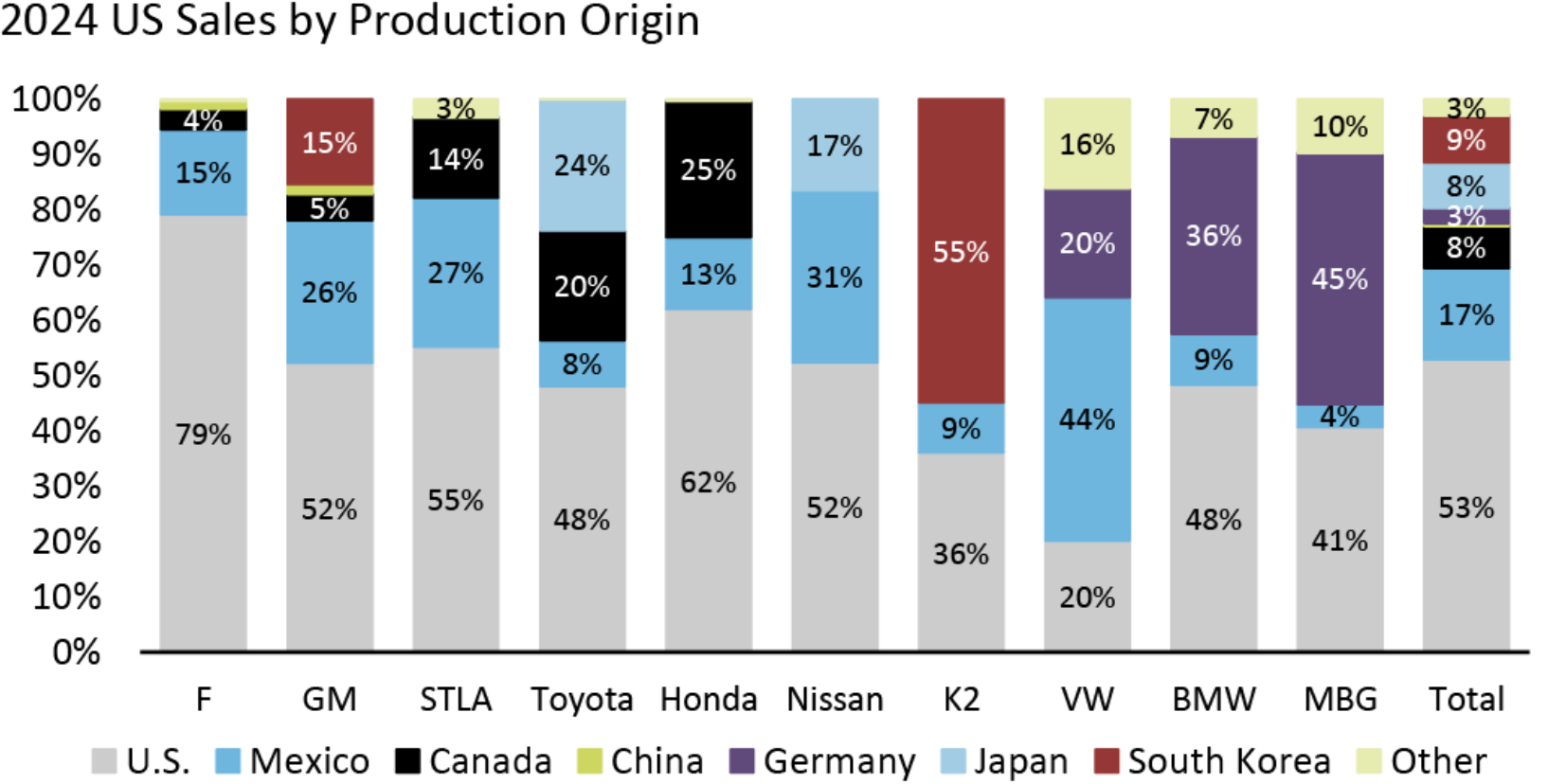

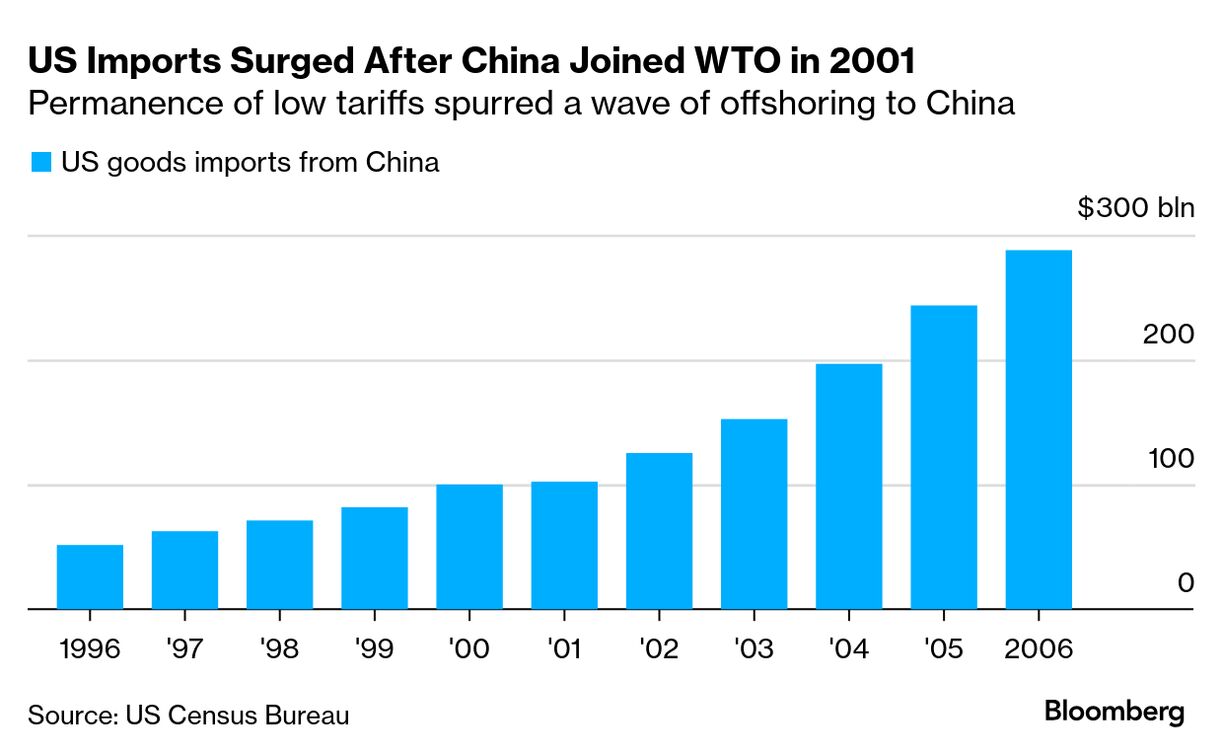

The US last year imported roughly half of the vehicles sold in the country. With President Donald Trump now set to impose a 25% surtax on autos — and major parts — economists and industry analysts alike are rushing to sketch out the implications. Complete analysis will need the details of the duties being imposed, which are expected to be entered in coming days into the federal register, the official record of government regulations. But the initial read of Trump's Wednesday executive order is that the levies are more hawkish than many anticipated. That in turn raises the potential for tougher reciprocal tariffs on April 2, though Trump played that down. "As with most of his tariff agenda, this looks like a play for long-term reindustrialization at the cost of short-term pain," Tobin Marcus, head of US policy and politics at Wolfe Research, wrote in a note. From a short-term perspective, the auto levy bodes for weaker growth and faster inflation. Bloomberg Economics, using a 2018 Fed frame of analysis, estimated a GDP hit of 0.2% and a bump in core price levels by 0.1%. (See the full note on the Bloomberg terminal here. The bigger question is, will the 47% of the market that's now made up of imports move onshore? This isn't a flip-of-the-switch sort of thing. Moving final assembly, let alone full supply chains, is a multi-year process.  Source: Wards Intelligence, UBS estimates Even for Ford and General Motors, which, according to UBS analysts including Joseph Spak, have excess capacity in the US, the issue isn't such a quick and easy call. The duo could "eventually" move production of some vehicles currently made in Canada and Mexico to the use, the UBS team wrote. But, "that capacity is not tooled to make those vehicles. So, some potential capital investment might be needed for tooling, and this could take time." There's something else, besides — the question of "would same policies be in place for beyond this administration," Spak and his colleagues wrote. Indeed, because Trump is pursuing the tariffication initiative via executive orders, not legislation, he's leaving these measures open to change once he's gone in a few years. How influential might that consideration be? Possibly crucial. Before China entered the World Trade Organization in 2001, US law provided for an annual review of whether the country should continue to have "most favored nation" status, which authorized it for lower tariff rates. Washington didn't revoke MFN, even after the Tiananmen massacre of 1989. But companies knew it was possible. The chart above shows what happened when the US granted permanent MFN to China as part of its acceptance to the WTO: a steady pace of increase of Chinese imports turned into a massive surge. Assured of MFN, US companies had the confidence to invest in outsourcing production en masse to China. (As noted in this newsletter, US tariffs on China are now close to MFN-revocation rates.) Today, there's no assurance about US tariff rates. That leaves the reshoring question outstanding. For their part, UBS analysts caution that they see auto suppliers as "less likely to shift production." The Best of Bloomberg Economics | - Australian premier Anthony Albanese called an election for May 3, heralding what may be a closely-fought campaign centered on the cost of living.

- UK consumer data showed mixed signals, with retail sales rising strongly so far in 2025, though after households saved more in a sign of caution.

- The cost of living in Tokyo rose more than anticipated from the previous month, keeping the Bank of Japan on track for further interest rate hikes.

- Mexico lowered borrowing costs by a half-point as inflation continues to slow and the economy faces the threat of more US tariffs.

- Amid Trump-induced turmoil, some of Europe's policy elite sense an opportunity for the euro to come of age as part of a broader resurgence.

- Brazil's central bank, the second-largest of the Americas, faces a brain drain that's impairing its capacity for mission-critical tasks.

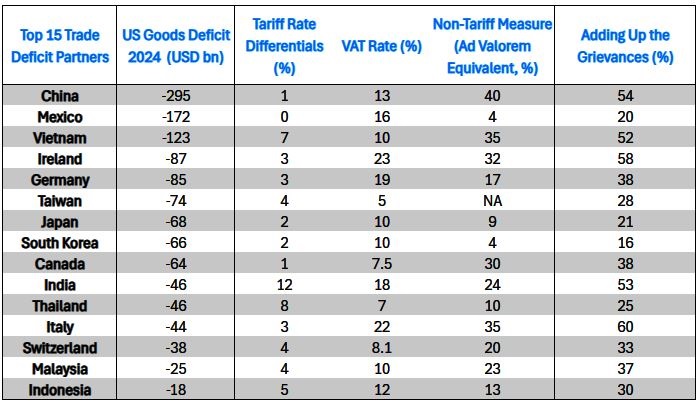

Bloomberg Economics has run the numbers on Trump's reciprocal tariffs planned for April 2. Taking into account tariff differentials, value added taxes and so-called non-tariff barriers, they've come up with theoretical numbers that the president could apply on the economies that account for most of America's trade deficit. If additional tariffs listed in the table above were implemented, the shock to the US average tariff rate would be huge, lifting it from just under 2.5% when Trump started his second term all the way up to 35%, the BE research finds.

Models show that huge increase in tariffs could translate to a 4% hit to US GDP and add close to 2.5% to prices in "a shock that we think would play out over a two to three year period," economists Maeva Cousin, Eleonora Mavroeidi and Rana Sajedi wrote. |

No comments:

Post a Comment