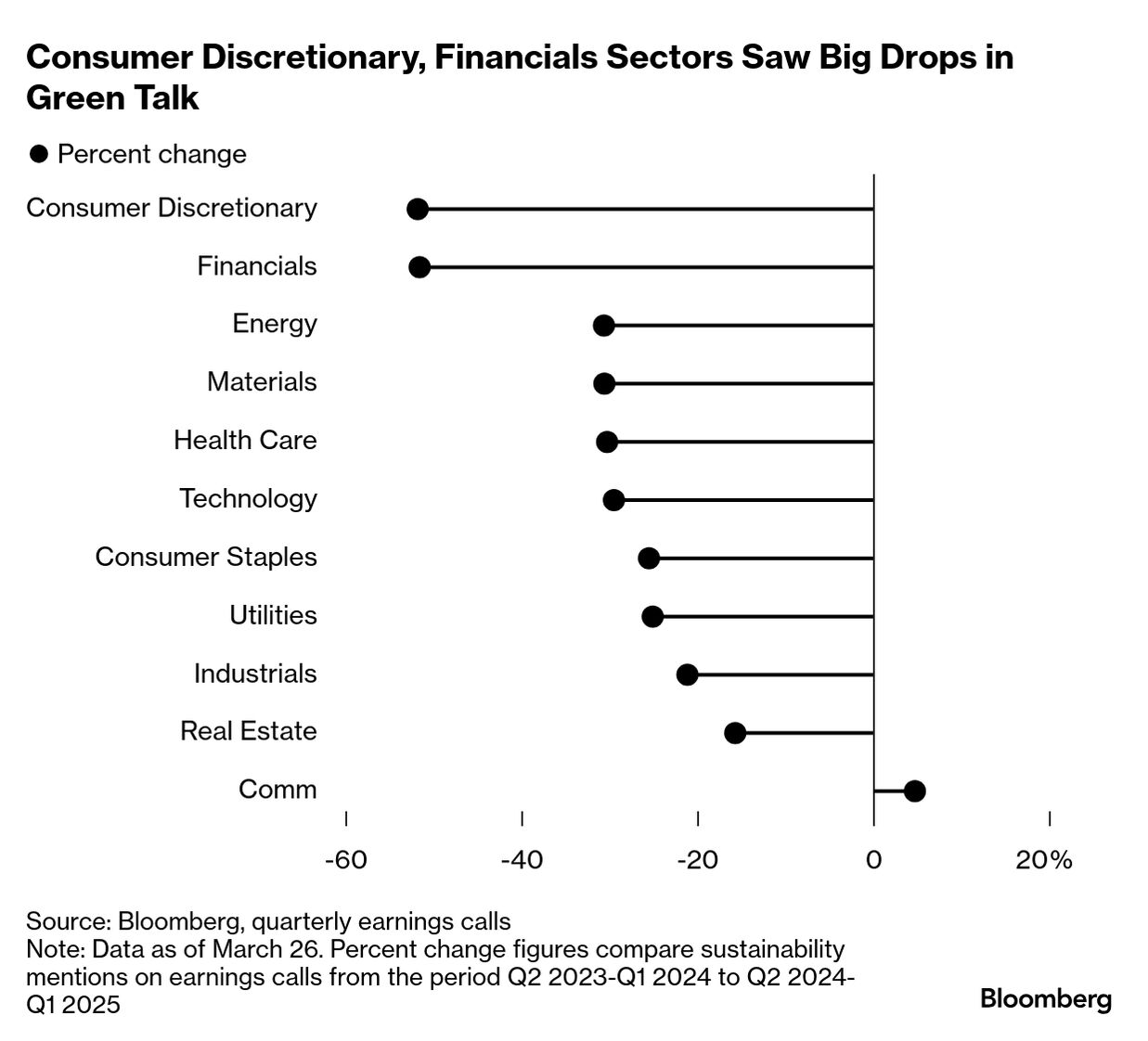

| By Olivia Raimonde In boardrooms across America, mentions of sustainability and related terms on earnings calls have dropped steeply as public companies see less to gain from associating themselves with environmental goals. Bloomberg Green analyzed transcripts of S&P 500 company earnings calls going back to 2020, tracking mentions of more than a dozen terms including climate change, global warming, ESG, clean energy and green energy. On average, companies are talking about the environment 76% less than they were three years ago. Green chatter on quarterly calls peaked at the beginning of 2022, months before passage of then-President Joe Biden's landmark climate law, the Inflation Reduction Act. In 2025, it has dropped to the lowest level since the second quarter of 2020, at the onset of the Covid-19 pandemic. The dearth of green talk comes as President Donald Trump pivots the US away from climate action. Trump has pulled the country out of the Paris Agreement for the second time and has targeted environmental programs and jobs for elimination. Agencies have flagged climate terms as words to avoid. "You have this new administration that is anti-climate and wants all of this to disappear," said Hortense Bioy, head of sustainable investing research at Morningstar Inc. So for many executives, she said, "the climate story needs to disappear," even if some investors want to hear it. Read More: Trump's Return Prompts Companies to Stifle Climate Talk With 'Greenhushing' Declines in earnings-call climate talk occurred across the S&P 500, with the biggest drops in the index's consumer discretionary, financials and energy sectors. Sustainability mentions by companies in the first two categories were down more than 50% during the last four quarters — a period that coincided with the US presidential election and Trump's and return to office — compared to the four quarters prior. Earnings calls are part of a larger pattern on Wall Street: Citigroup Inc., Bank of America Corp., Goldman Sachs Group Inc. and Wells Fargo & Co. all pulled out of a global finance pact meant to help lenders reduce their carbon footprints. Oil giants like BP Plc that attempted to switch away from fossil fuels have been rethinking their green plans. Walmart Inc. said in December it would likely miss its 2025 and 2030 emissions reduction targets. Todd Cort, senior lecturer in sustainability at the Yale School of Management, says companies navigating the current political climate are trying to stay under the radar. "Now climate change is one of these terms that is on the list, 'Should we talk about that or not?' because there is that federal pressure," Cort said. "ESG becomes this loaded term." But what hasn't changed, he said, is investors' interest in knowing businesses' exposure to the effects of climate change. Read More: Why ESG Faces Backlash and Its Future Under Trump 2.0 Despite the increase in "greenhushing," more than 90% of corporate finance chiefs surveyed by Kearney, a management consulting firm, last year said they wanted to increase their green investments. Nearly 70% expected sustainability initiatives to yield a higher return than more traditional types of investments. PwC's 2025 State of Decarbonization report noted a nine-fold increase in companies reporting climate commitments to the Carbon Disclosure Project in 2024, compared to five years earlier, and found that only 16% of companies are decelerating their goals. "We are entering an era of quiet progress," the report's authors wrote, "where companies avoid publicizing climate pledges that can open them up to unwanted scrutiny and instead focus on making progress far from the spotlight." One of the authors, David Linich, sustainability principal for PwC US, says that while use of traditional terms related to the green energy transition may have been scaled back, "terms like 'resilience' are becoming more important." Investors "want to understand: Do companies have a plan in place?" he said. But further corporate efforts to combat climate change will be hindered by the lack of conversation around the topic, according to Morningstar's Bioy. "Progress is going to be slower as a result of people not talking about what they do," she said. "Climate risk is investment risk." Note: the terms searched for in earnings-call transcripts were sustainability; climate change; changing climate; clean energy; climate agreement; climate emergency; ESG; global warming; green energy; ocean acidification; Paris agreement; SDG/SDGs; socially responsible; and sustainable development goals. |

No comments:

Post a Comment