|

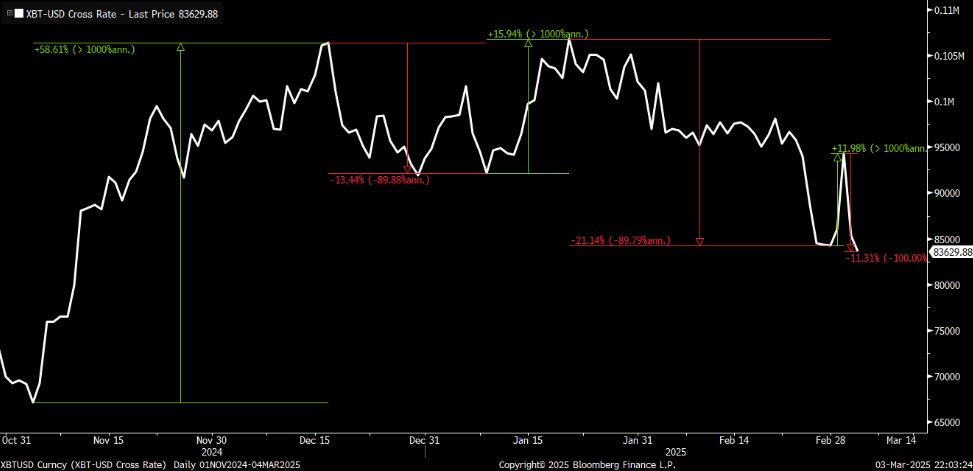

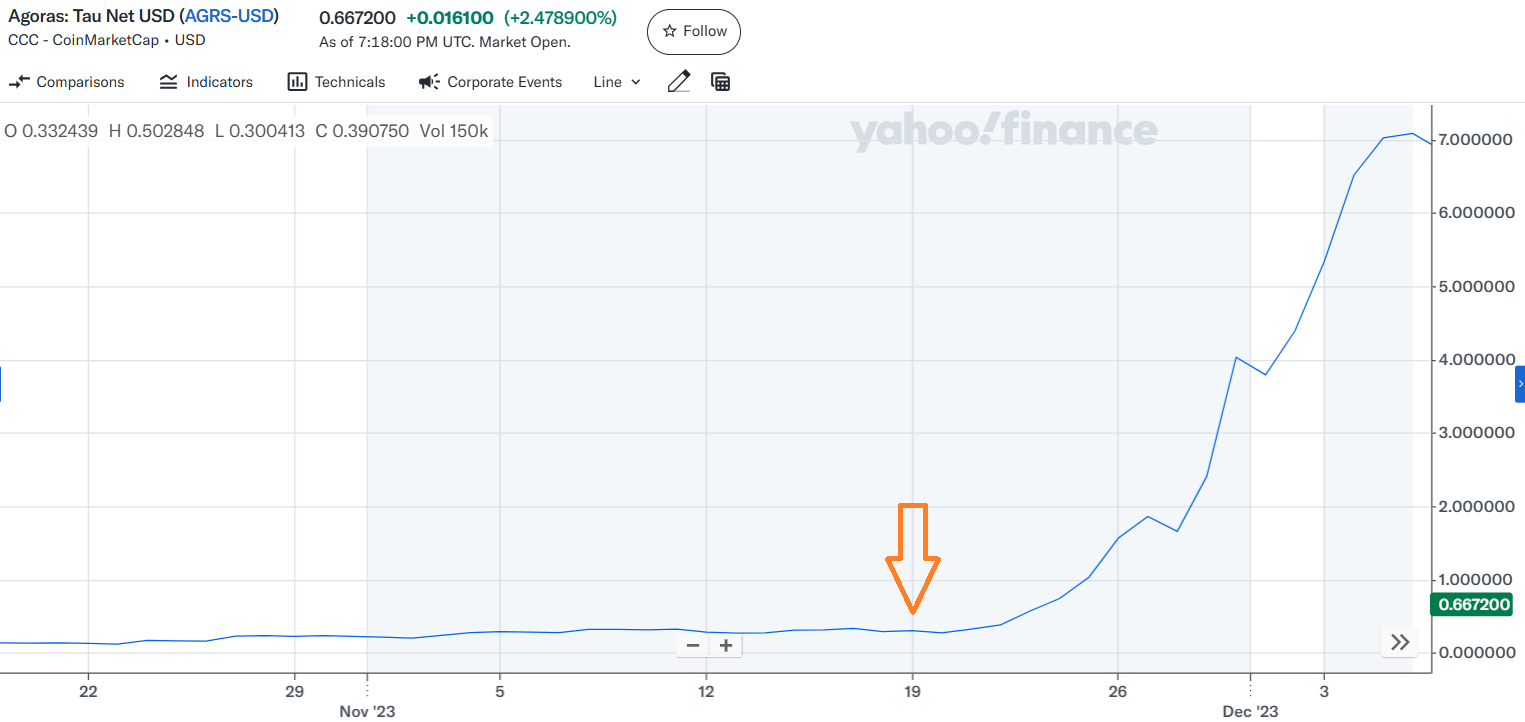

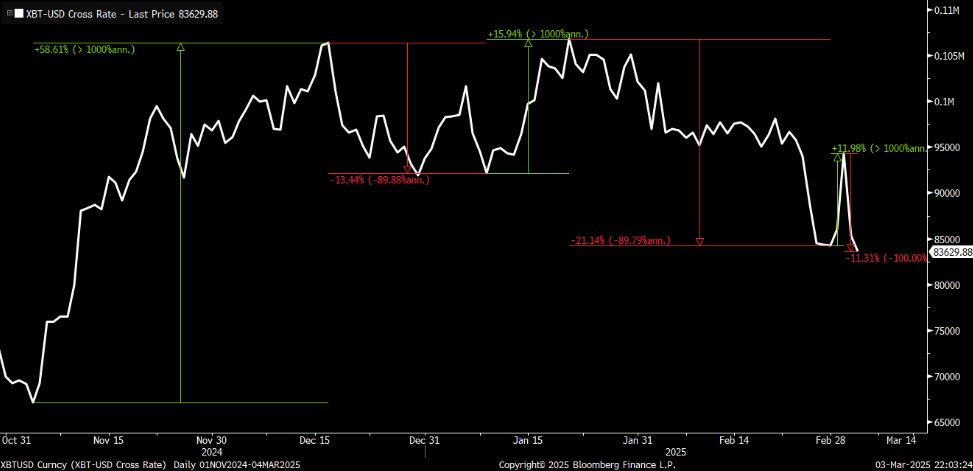

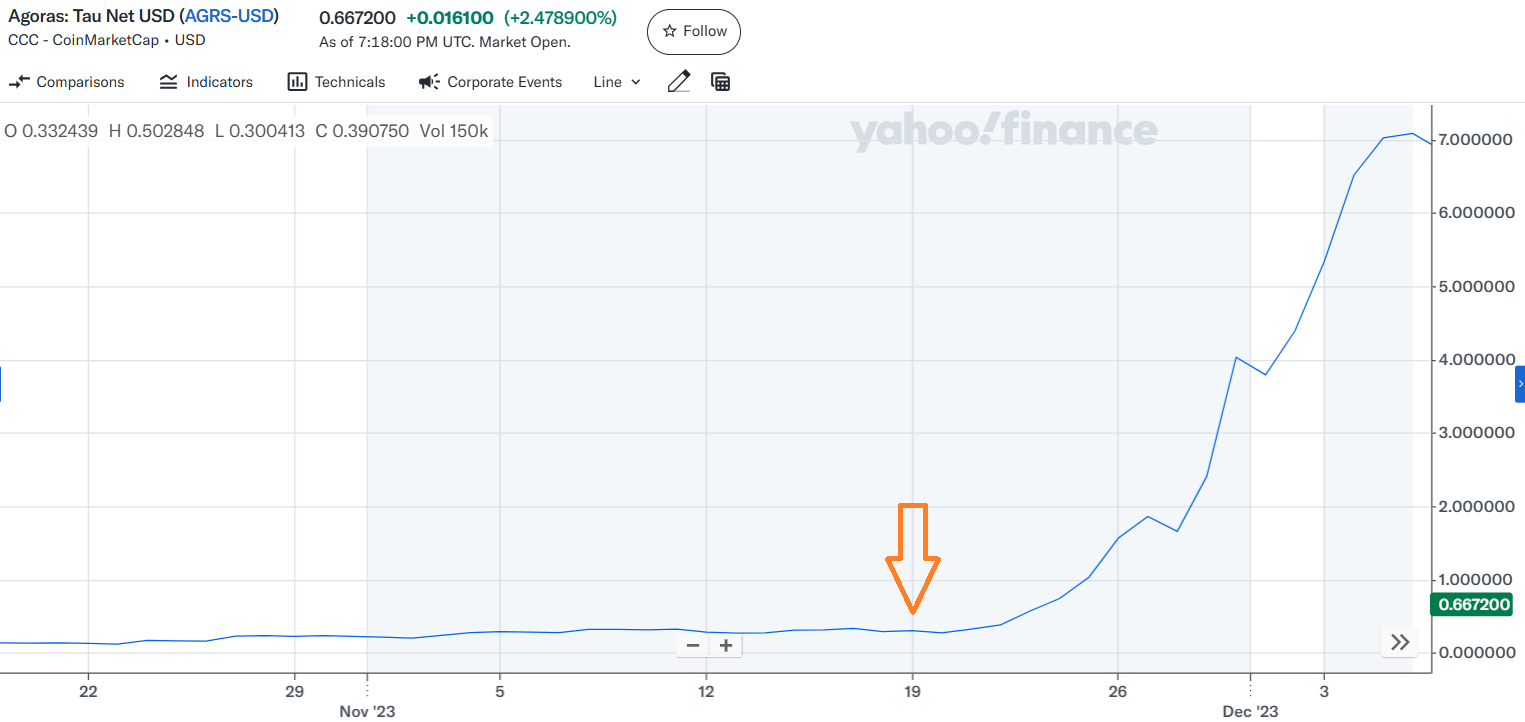

Most investors expected stability, but cryptocurrencies have delivered spectacle… After touting his support all along the campaign trail, President Trump initially had cryptocurrencies tearing higher. But as with the rest of the financial markets, cryptos have been stuck on a rollercoaster that would test even the most iron-stomached investors since November’s election. Indeed, Bitcoin (BTC/USD) rallied 60% in the month after the election on hopes for pro-crypto policies out of D.C. Then, worries about reinflation sent Bitcoin crashing 15%. As those inflation worries abated, BTC rebounded 15%... only to crash 20% on tariff fears.  Most recently – just this past weekend – Bitcoin popped 10% in a hurry on news that Trump is set to create a strategic national reserve for cryptos. But when the president subsequently announced more tariffs on Monday, BTC gave back all those gains. It has been a violent and volatile ride over the past few months. The natural question on everyone’s mind is: What’s next? We think a rally – and a pretty big one at that... This Week's Bullish Developments Perhaps surprisingly, considering what we’ve just outlined, our bullishness stems from Trump. As we mentioned, shortly after the election, Bitcoin surged from $60,000 to $100,000 on the idea that the president would enact a series of pro-crypto policies that would support innovation and growth in the industry. Since then, however, BTC has stumbled on concerns that the president was de-prioritizing cryptos. That is, in his first few weeks in office, Trump hit the ground running with tariffs and federal spending cuts. But he moved rather slowly with his crypto-related promises, creating worries that his action would be less than hoped. That could all change later this week. This Friday, March 7, Trump is set to host the first-ever White House Crypto Summit. Attendees will include prominent founders, CEOs, and investors from the industry. We think he could announce more big things at this summit. Trump is well-aware of how crypto markets have struggled – and of how some crypto investors who supported him on the campaign trail may be disappointed with how the markets have fared so far during his presidency. That’s why we think he tried to ‘save’ the crypto markets with the announcement of a crypto strategic national reserve on Sunday... Stepping Up His Crypto Game That timing was not coincidental. The week prior, cryptos had crashed due to fears about a looming trade war. Bitcoin dropped to a 2025 low and was in the midst of its biggest selloff since 2022. Things looked bleak. Seemingly, Trump tried to rescue cryptos from the brink with the highly anticipated announcement about creating a crypto strategic national reserve, something that industry bulls had been wanting since Day 1. It worked – but only temporarily. Bitcoin surged from $84,000 to $95,000 in a few hours on Sunday. Then, the next day, it crashed all the way back down to $84,000 on renewed tariff fears. Trump’s attempt to save the crypto markets from the brink this past weekend didn’t work. We think he will ‘step up his game,’ if you will, on Friday. We suspect the recent crypto rally didn’t last because Trump’s announcement lacked details. The president said that he would create a strategic national reserve, which would include Bitcoin and some other major altcoins. But that was it. He didn’t say anything about when such a reserve might be created, how big it would be, or whether or not it needed Congressional approval. The announcement lacked substance. So, once traders got past the headline euphoria, they sold – and cryptos dropped. We think Friday’s summit could include some more concrete details on this strategic national reserve. If it does, we suspect traders will latch on and rush to buy the dip. In fact, we could see Bitcoin make a run for $100,000 by the weekend. The Final Word on a Coming Crypto Rally Of course, the big risk here actually has nothing to do with cryptos. That’s all about tariffs. This week, Trump started a global trade war by enforcing new 25% tariffs on Mexico and Canada and rolling out additional tariffs on China. It looks like all three countries may retaliate with their own tariffs on U.S. goods. Anxieties about how this trade war may impact the global economy have weighed on all financial markets, with stock, crypto, commodity prices and bond yields all tanking. The trade war is not over. That story will continue to unfold over the next few months. But when it comes to cryptos, trade war anxieties may ease now that the first batch of tariffs has finally hit the tape – a little “buy the rumor, sell the news” action. Meanwhile, those fears could be replaced by policy optimism if Trump does detail concrete steps about creating the crypto strategic national reserve this Friday. We expect he could also announce a flurry of other partnerships and deals with major crypto firms at this event. Therefore, despite the violent swings we’ve seen in the crypto markets over the past few weeks, we like the setup for cryptos right now. We could see a face-ripping rally into the weekend wherein Bitcoin surges back to $100,000 and some altcoins soar 100%-plus. To help us get positioned for this rally, we’re using a proprietary quant algorithm that helps us find so-called “Stage 2” tokens that could be on the cusp of a big technical breakout. Our backtests show that this algorithm could’ve helped uncover some of the biggest altcoin winners in past boom cycles. For example, this powerful system would have flagged a little-known crypto called Agoras (AGRS/USD) on Nov. 13, 2023. And look what happened next…  In less than a month, AGRS went from 33 cents to over $6. In other words, you could have had the chance to make nearly 1,800% in less than 30 days had you gotten this alert. That's nearly 18X your money in less than a month. We’re confident our system could help us home in on some major winners in the next few weeks, too. Learn more about that algorithm now ahead of Friday’s all-important White House summit. Sincerely, |

No comments:

Post a Comment