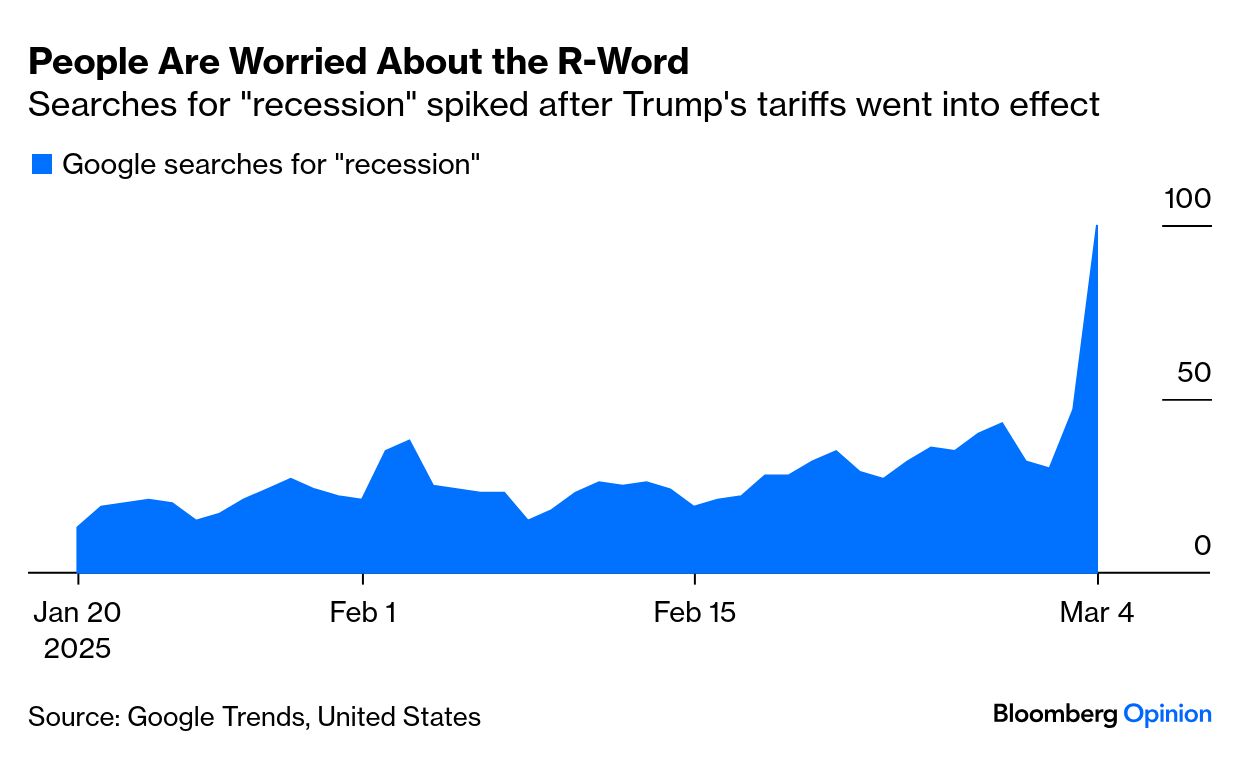

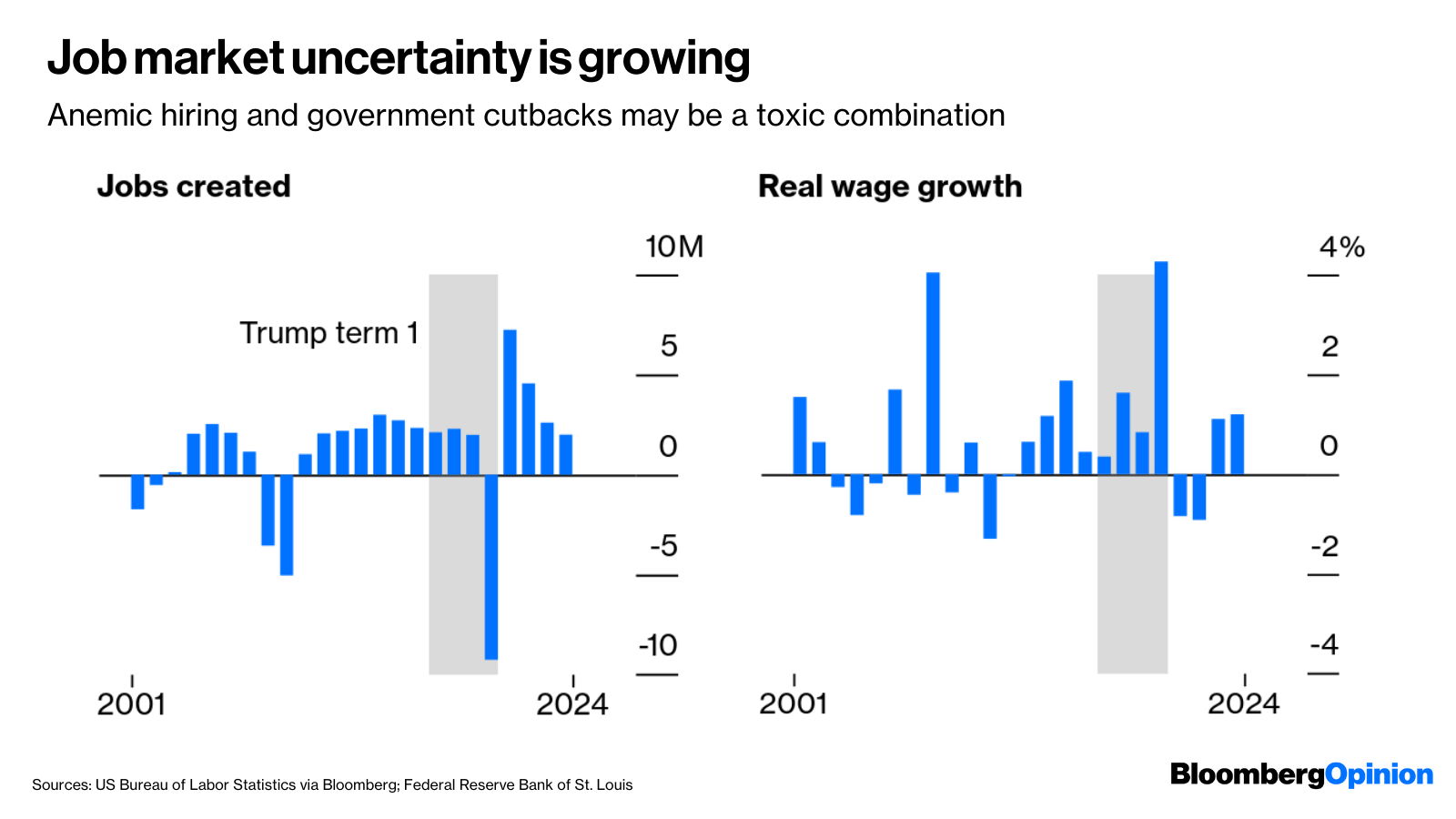

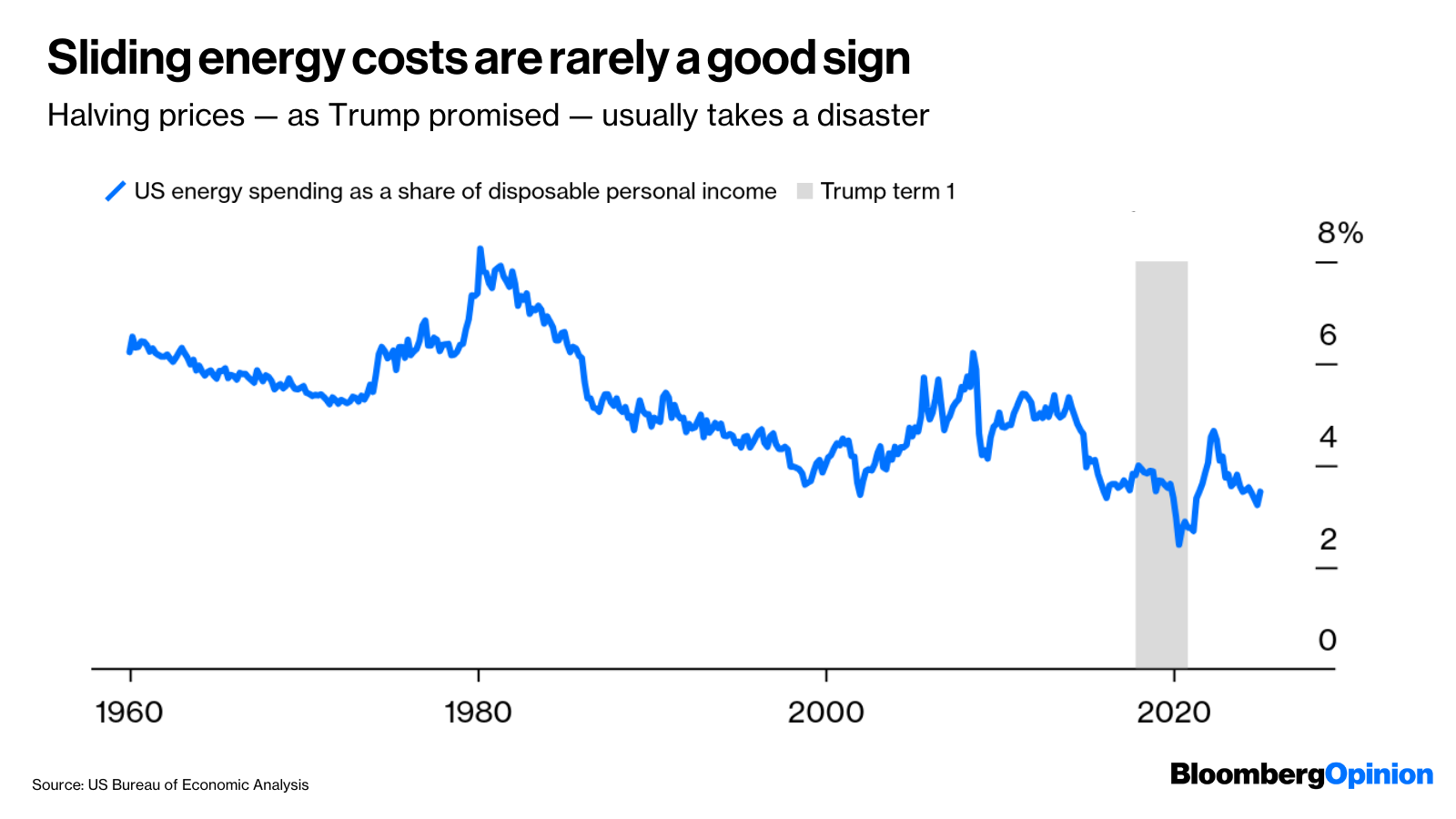

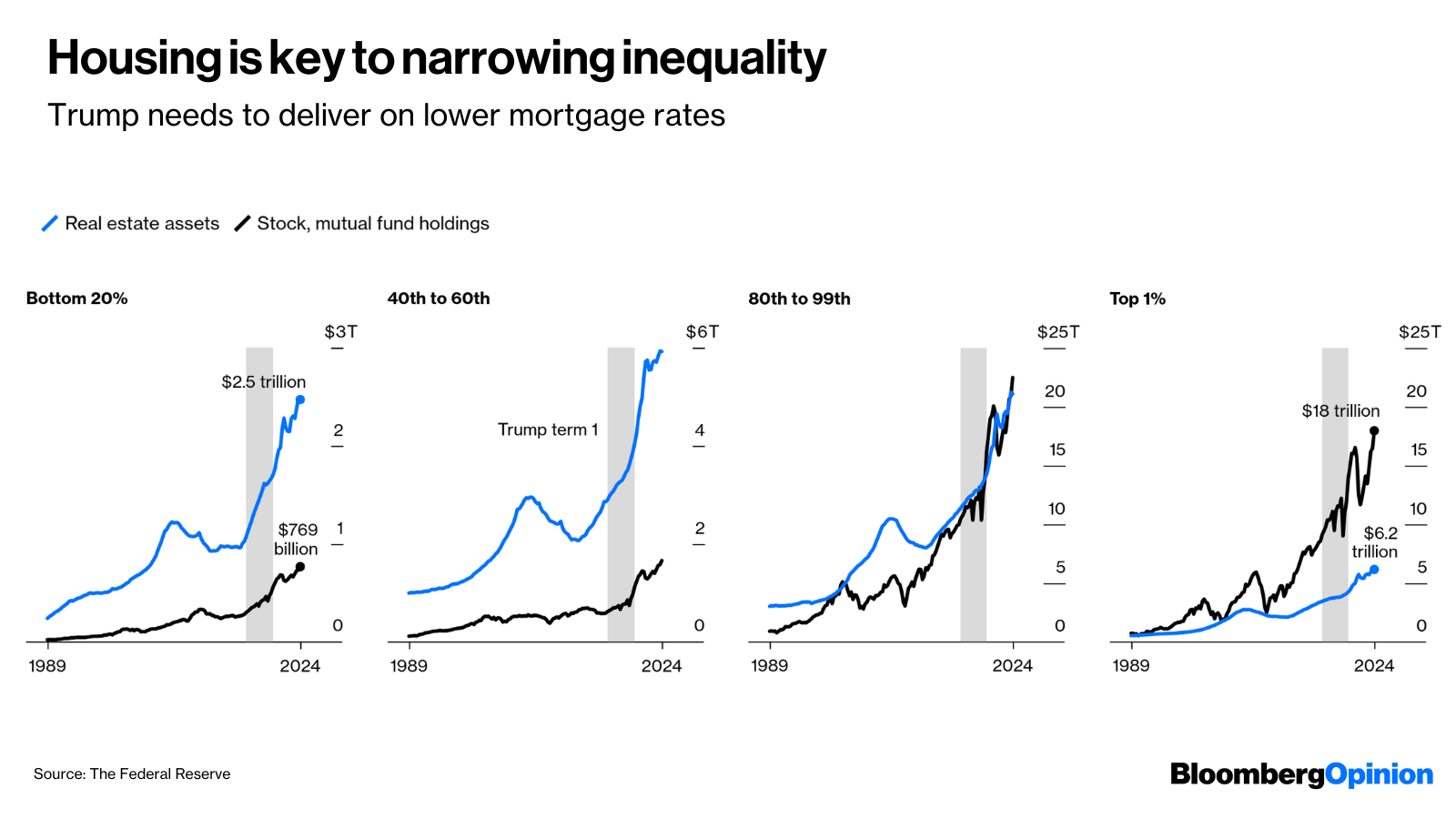

| This is Bloomberg Opinion Today, the most plausible outcome of Bloomberg Opinion's opinions. Sign up here. One Trade War, Coming Right Up | He actually did it! I don't know why I'm surprised. President Donald Trump said he was serious about the tariffs. But it's kinda like when your eternally messy and unreliable roommate tells you they're gonna take out the garbage the next morning and then they really do it? Anyway, now we're here: But we might not be here for long: "Both the Mexicans and the Canadians were on the phone with me all day today trying to show that they'll do better, and the president's listening, because you know he's very, very fair and very reasonable," Commerce Secretary Howard Lutnick told Fox Business this afternoon. Even if we end up seeing some tariff relief, as Lutnick suggested, everyone and their mother ran to Google to search "recession" today. That's something no president wants to happen on their watch: The stock market famously isn't the economy, but giving portfolios whiplash like this can't be good. "Stock market gains have become an increasingly important driver of consumer spending," as Conor Sen points out in his recent column. And the consumer psyche is a delicate thing. Back in January, Claudia Sahm said mere talk of tariffs could lead to inflation. So you can only imagine how people are reacting now that they're actually here. It feels as if we've gone from worrying about the price of eggs to fearing a full-blown cost-of-living crisis overnight. Mohamed A. El-Erian is rattled by the rapidly increasing odds of a downturn: "While still relatively low, my probability of a recession has increased from 10% at the beginning of the year to 25% to 30% today," he writes. "This is a consequential and quite unsettling development for an economy with high potential and aspirations." It's certainly an awkward day to be that blonde lady from the White Lotus who probably voted for Trump "because of the economy." But hey, maybe this is all by design! Maybe the Trump administration is purposefully crashing the economy to lower mortgage rates. Or at least, that's what they want you to think. But as Jonathan Levin warned last week, Treasury Secretary Scott Bessent's admirable goal of bringing down 10-year Treasury yields could backfire and "torpedo growth." His control over the narrative might not last for long. Speaking of controlling the narrative: Canadian Prime Minister Justin Trudeau went after Trump Tuesday morning: "You're a very smart guy. This is a very dumb thing to do." How dumb? Well, let's see: Trump wants farmers to "have fun" and increase production when his tariffs on external agricultural products begin on April 2. But the US gets 80% of its potash — a key ingredient in farm fertilizer — from Canada. Come spring, the crops of the "Great Farmers of the United States" could be doomed. But April is a long way away and Trump has more pressing concerns. Like the joint address he's delivering to Congress Tuesday night. While it's not technically a "State of the Union" speech — he's only been in office for 43 days — it may offer us a window into how the Trump administration is navigating its self-made chaos. Or, more likely, his speech will only add to the noise. The thing is, Americans deserve real answers to their questions: How might this trade war shake out? Will the DOGE exodus help balance the budget? And how will all that affect inflation? To get some idea of where we're headed, Bloomberg Opinion looked back to see what Trump did the last time he was in office, as well as what he inherited from former President Joe Biden. In a new, free-to-read data feature, our columnists analyzed a dozen metrics that lay out the challenges and opportunities for this administration. To give you a taste, here's three stand-out charts that speak to our current moment.  | | | "Trump is inheriting an economy where a record stretch of job creation has left just 4% of the labor force unemployed, a rate most presidents would be thrilled with," Jonathan Levin writes. But cracks are starting to appear, thanks to the all the tariff talk and economic uncertainty: Resignations are plummeting. Executives are stalling. And the federal payroll is shrinking with each new day. "Future phases of the Trump agenda — namely, deregulation and tax cuts — should be more labor-market friendly," he writes. "The risk is that it will be too little, too late." In the eyes of Trump, America is in the midst of a full-blown "energy emergency." But Liam Denning is wondering whether the emergency is in the room with us, because he sure isn't seeing one. "Gasoline, other fuels and utility bills swallowed an average 3.4% of disposable personal income in December. That's far below levels during actual energy crises of the past and lower than the average across Trump's first term, which included a pandemic-related crash in energy consumption and prices," he writes. "Such disasters, along with recessions, do occasionally cause pump prices, the most prominent energy cost for most Americans, to plunge suddenly — but they hardly benefit the presiding government." On top of all that, tariffs on Canadian energy are expected to raise — not lower — prices, which Patricia Lopez has previously said could be a gut-punch to Michigan and Wisconsin residents. In the event that tariffs eventually lead to a downturn, don't be surprised if Trump starts bragging about falling gas prices. He did that during a literal pandemic. Chances are, he wouldn't treat a recession any differently. A cool thing that happened during Trump's first term? Low earners got a major money boost, thanks to housing. Allison Schrager says the cohort experienced a "31% increase in net worth, in part, because their portfolios are dominated by real estate (if they own at all), which appreciated for that group more rapidly than stocks." That wealth bump happened under Biden, too, but Trump's gains were slightly more impressive. If he wants to repeat that success, he'll need to expand access to homeownership. One way to do that? Unfreeze the market by lowering mortgage rates — a move that, as we know, could come with negative trade-offs for the economy. An economy, remind you, that John Authers says is already flashing red in the face of tariffs. Hungry for more? Check out our Tuesday livestream or join Candice Zachariahs, Robert Burgess and Jonathan Levin for a live Q&A on Wednesday, March 5, at 10:00 a.m. EST. |

No comments:

Post a Comment