| The fragile peace in French politics looks increasingly unlikely to hold |

| |

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The fragile peace in French politics that has allowed Emmanuel Macron's government to pass a budget for 2025 is looking increasingly unlikely to hold in the wake of the French court decision barring far-right leader Marine Le Pen from running in the country's 2027 presidential election. It augurs a new period of turbulence in Paris, possibly undermining efforts to stabilize France's creaky public finances and boosting anti-establishment rhetoric. Le Pen lashed out at the ruling, saying the rule of law had been "totally violated," while Donald Trump offered his backing, likening her legal woes to the prosecutions he faced before retaking power. The court decision also puts a spotlight on the largely untested 29-year-old Jordan Bardella, the de-facto candidate to replace Le Pen on the presidential ticket and the person who could take control of the party she has shaped. — Max Ramsay | |

| |

| Pausing Cuts | Several European Central Bank officials are still wavering on whether to cut interest rates next month, we're told. It suggests the bank's next monetary policy decision remains far more open than investors are betting, with traders pricing a more than 80% chance that borrowing costs will be lowered once again on April 17. Tariff Countdown | The clock is ticking down to President Donald Trump's so-called liberation day, when the US is due to impose tariffs on a broad swath of global trade. Financial markets are already rattled and officials in world capitals are fretting the policies could spark a recession and even hasten the end of a post-war order. Here's our deep dive on what it means for Europe and the global economy. Frozen Assets | Spain is calling on the EU to move ahead with a discussion about seizing Russia's frozen central bank assets. We're told the country wants the bloc to consider legal options that would allow the use of the assets to support Kyiv militarily, as well as to provide compensation for the destruction that Russian forces have wrought. Defense Investments | Allianz Global Investors will allow previously banned defense-related assets to be held in some ESG funds, a move it says reflects the new geopolitical reality gripping Europe. The changes apply to most of AGI's mutual funds classified as Article 8, an EU designation that requires asset managers to "promote" environmental, social and governance goals. | |

| |

| Bright Spot | Polish stocks are set to be Europe's best performers, powered by a big boost in dividends, in what has been a historic quarter of outperformance for the region's equities. Across the continent, defense stocks have dominated the gains, with some investors predicting more to come. Market Meddling | Hungarian stocks and bonds slid after the government expanded its interventions in the economy in a bid to revive growth and curb inflation ahead of next year's election. The country's economy minister proposed to freeze costs that Hungarian banks charge their clients and spoke about "voluntary" price cuts by telecoms companies. Sahel Focus | Spain is urging EU foreign affairs chief Kaja Kallas to strengthen the bloc's engagement with Africa's Sahel region as part of a broader defense review, we're told. Madrid wants more focus on the region, which has seen radical Islamist movements become increasingly active in recent years and Russian mercenaries supporting some military-led governments. Over Budget | Austria won't be able to avoid being reprimanded by the EU for running an outsized deficit, according to the country's finance minister, after it reached 4.7% in 2024. The government is set to abandon ambitions to dodge the EU's so-called excessive-deficit procedure, one of few specific targets set down in a three-party coalition agreement last month. | |

| |

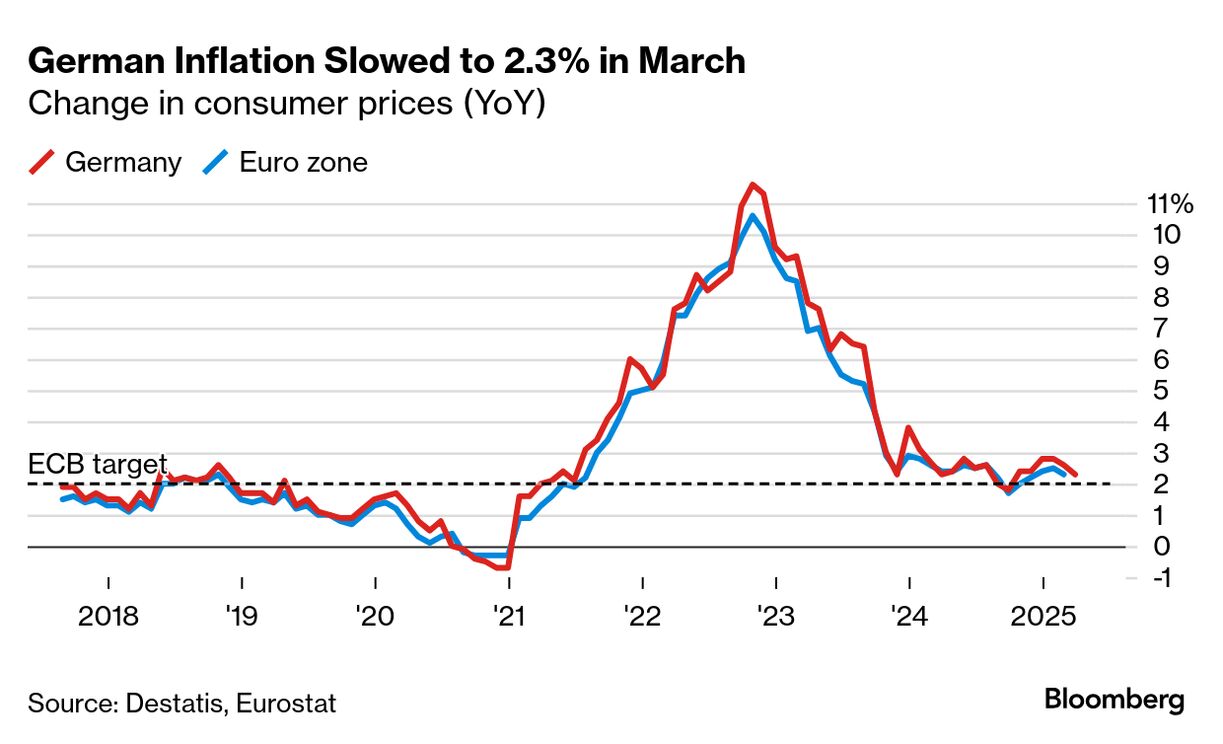

| German inflation slowed more than anticipated in March, advancing 2.3% from a year ago. That brings the rate closer to the ECB's 2% target. Readings last week showed inflation in France and Spain were also slower than analysts had estimated, but in Italy inflation edged above 2% for the first time since 2023, driven by energy and food. Data for the entire 20-nation euro area comes later this morning. | |

| |

| All times CET - 9 a.m. Commission President Ursula von der Leyen, Council President Antonio Costa take part in European Parliament debate in Strasbourg

- 1 p.m. EU foreign affairs chief Kaja Kallas speaks on EU foreign and security policy at the European Parliament in Strasbourg

- 2:30 p.m. National Rally's Jordan Bardella speaks at a press conference in Strasbourg

- 3 p.m. EU Vice President Henna Virkkunen and migration commissioner Magnus Brunner hold news conference on new European Internal Security Strategy

- 3:30 p.m. EU Vice President Raffaele Fitto holds news conference on mid-term review of EU's cohesion policly

| |

| |

| |

| You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment