|

Brought to you by: |

|

|

Cryptography research is unlocking new pathways to expand Bitcoin's utility without the need for soft forks or opcode changes. Starknet expands to Bitcoin via Xverse and Bitcoin PIPEs is competing with other innovations like ColliderScript and BitVM to unlock DeFi. |

|

|

Remember EigenLayer? |

|

Someone told me last week that EigenLayer is like the "turducken" of crypto — a chicken stuffed in a duck stuffed in a turkey. Basically a way to take your Thanksgiving holiday to new caloric heights. |

Anyway, EigenLayer's concept of restaking capital was what gripped Ethereum land in 2023, sending its TVL to absurd heights of $20 billion TVL in June 2024. Today, that TVL number pales in comparison at $8.27 billion — about a 59% decline. |

So who's actually carving the turducken today? Ironically, EigenLayer itself. The largest operating AVS by ETH restaked is EigenDA (4.3 million ETH), EigenLayer's own data availability service. This is followed by eOracle (4 million ETH), an oracle service actively used on the Linea L2 and Berachain L1, and Witness Chain (3.8 million ETH), an Ethereum L2 that serves a niche use case in DePIN by using zk proofs to verify real-world metrics. |

— Donovan Choy |

|

Brought to you by: |

|

Accurate crypto taxes. No guesswork. Tax season doesn't have to be a headache. With Crypto Tax Calculator, you can generate accurate, CPA-endorsed tax reports fully compliant with IRS rules — quickly and effortlessly. |

3,000+ integrations to support your wallets, exchanges, and on-chain activity Reports you can import directly to TurboTax or H&R Block Easily share with your accountant

|

Exclusive offer: Use the code BW2025 to get 30% off all paid plans. But hurry — this offer expires on 15 April, 2025! |

|

|

Cryptography over forks |

Bitcoin programmability is evolving fast — without waiting for a single line of Bitcoin Core code to change. As debates over additional opcodes such as OP_CAT continue, new solutions are proving that Bitcoin can enable zk-rollups, covenants and even full DeFi ecosystems right now. |

Xverse, a popular Bitcoin wallet, today announced its upcoming integration with Starknet — the Ethereum-native L2 now expanding to Bitcoin. Starknet, which struggled to attract users in the crowded Ethereum L2 rollups market, is positioning itself as "Bitcoin's execution layer." The goal is to scale Bitcoin to thousands of transactions per second while introducing all the DeFi trappings like yield farming, staking, and lending — but without waiting for Bitcoin's meandering governance process. |

The idea has growing proponents. A broader push to unlock Bitcoin's smart contract potential without protocol changes started with research breakthroughs in the form of BitVM, followed by Starknet-backed ColliderScript, and most recently Bitcoin PIPEs. |

Enter PIPEs |

Bitcoin PIPEs (Polynomial Inner Product Encryption) is one of the more ambitious projects in this space. The Polychain Capital-backed project has developed a cryptographic method to verify zk-SNARKs on Bitcoin without new opcodes — offering a trust-minimized alternative to existing solutions. |

They key promise of PIPEs is to reduce the process to checking Schnorr signatures, as Misha Komarov of cryptography research and development company [[alloc] init] explains: |

"What can we verify on Bitcoin? We can verify signatures," Komarov told Blockworks. "We turn the zk verification into a signature verification," thus sidestepping Bitcoin's script limitations using cryptography. |

This approach avoids contentious opcode upgrades, proving that zk rollups and covenants don't need a protocol change. The tradeoff is that it's expensive to compute — for now. |

Komarov sees PIPEs as a potential replacement for BitVM, which relies on challenge-response mechanics to provide trust-minimized bridging to off-chain layers. While innovative, it lacks the instant finality of PIPEs, which offer a single-transaction verification method. |

ColliderScript and Starknet's push |

Bitcoin PIPEs is also an alternative to ColliderScript, developed by Starknet researchers to enable covenants on Bitcoin without a fork. Starknet has pitched this as a stepping stone to its broader Bitcoin expansion, which now includes the impending Xverse integration. |

StarkWare CEO Eli Ben-Sasson calls Bitcoin PIPEs "an interesting approach" that "has the potential to be cheaper than ColliderScript, but its feasibility is much less certain." |

"ColliderScript has a complete proposal and security analysis, whereas PIPEs rely on more cryptographic conjectures," Ben-Sasson told Blockworks. "In other words, it requires more leaps of cryptographic faith." |

Starknet's integration with Xverse is the latest step in the Bitcoin L2 race. While it involves some trust assumptions, the goal is similar: deliver a seamless DeFi experience to Bitcoin users without protocol changes. |

As Ben-Sasson sees it, Bitcoin's power as a store of value is cemented. Now, it's time to unlock its utility. |

With Bitcoin PIPEs v2 unveiling in April, and the Starknet Xverse integration also launching in the second quarter, 2025 is shaping up to be a pivotal year for Bitcoin — whether it upgrades or not. |

"Functionally speaking, Bitcoin can now ossify," Komarov said. "We can even start simplifying it, to be honest." |

— Macauley Peterson |

|

|

Berachain farming season |

The DeFi "trenches" right now are apparently the Berachain L1. Based on Artemis data, Berachain is topping out at net flows on a month-to-date basis at a ridiculous $214 million. So what are farmers actually farming? |

|

Well, a pseudo version of BGT. BGT is Berachain's non-transferrable governance token. But of course, nothing is really non-transferrable on a blockchain. By providing WETH and stablecoin liquidity via Infrared Finance, Infrared is giving farmers "iBGT," a liquid version of BGT. |

That iBGT in turn can be staked at Infrared Finance for a whopping 86% APY, and ups your chances at Berachain's future BERA airdrops. |

Infrared is not a lending protocol — it's simply an aggregator layer of other Berachain apps (like Kodiak, Bex, Dolomite) that serves to support Berachain's somewhat complex "proof-of-liquidity" mechanism. See here for a brief summary of how Berachain works. |

Other popular farms on Berachain include the BYUSD-HONEY (14.5% APY) and USDC.e-HONEY stablecoin pools (13.3% APY), both of which are on the BEX DEX with currently $153-$303 million in TVL. |

If you're willing to stomach the volatility of BERA (that is Berachain's gas token), you can also LP in a WBERA-HONEY BEX pool for 99% APY. |

— Donovan Choy |

|

|

Blockworks is hiring a VP of sales! This role would be responsible for the design, implementation, and execution of all things finance, accounting, and reporting. |

Remote US | $200k Base & OTE $300k |

Apply for the position if you are: |

|

|

|

|

| matthew sigel, recovering CFA @matthew_sigel |  |

| |

Deutsche Bank highlights positives of US Strategic Bitcoin Reserve... | |  | | | 11:46 AM • Mar 10, 2025 | | | | | | 577 Likes 101 Retweets | 18 Replies |

|

|  | Zeneca 🔮 @Zeneca |  |

| |

Most people wish they had more time to devote to crypto — more time to research, more time to hunt for alpha, more time to be online at the right time for the next big memecoin win, and so on. The reality is that more time is just more time to make mistakes. More opportunities… x.com/i/web/status/1… | | | 6:08 AM • Mar 11, 2025 | | | | | | 278 Likes 17 Retweets | 62 Replies |

|

| |

|  | Honey @honey_xbt |  |

| |

gm | |  | | | 6:28 AM • Mar 11, 2025 | | | | | | 15.5K Likes 570 Retweets | 310 Replies |

|

|  | Ian @Ian_Unsworth |  |

| |

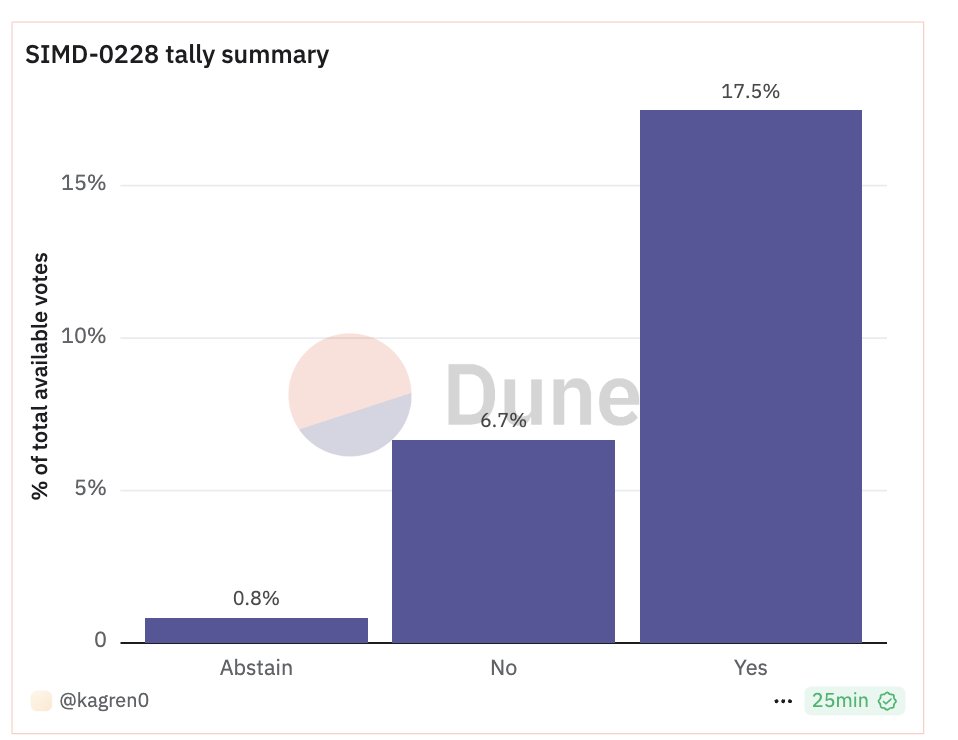

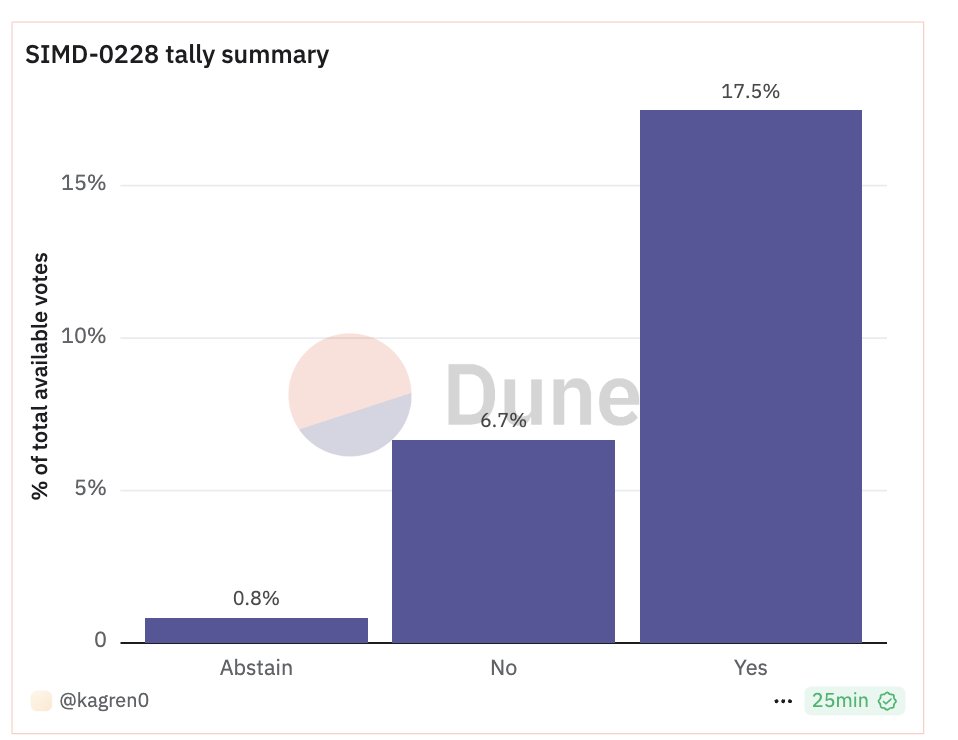

SIMD-0228 is currently at 25% quorum, with >33% needed for a vote to pass. currently, 17.5% have voted yes, 6.7% have voted no, and 0.8% have abstained 359 of 1,327 validators have voted thus far The vote concludes at the end of Epoch 755, which will be in roughly ~62 hours | |  | | | 10:45 AM • Mar 11, 2025 | | | | | | 9 Likes 0 Retweets | 2 Replies |

|

| |

|

|

No comments:

Post a Comment