| Is there a Trump Put or isn't there? Throughout his first term in office, the president put great store by the stock market, and seemed to regard any climb as validation. He wanted to be judged by the rise and fall (especially the rise) of share prices. That made the market the most important "guardrail," in the eyes of many commentators. If it didn't like what he was doing, there would be a selloff and he'd change course. That theory is being put to the test. On Tuesday, Trump followed the S&P 500's worst day in years by announcing that he would immediately increase tariffs on Canadian steel and aluminum imports to 50% — exactly the kind of move that the market didn't want to see. But after the close, the tariffs were were lifted again when Ontario withdrew its levy on electricity supplied to the US. That will be taken as good news as far as it goes, but ratchets up uncertainty still further. And what does this incident tell us about the existence of a Trump Put?  On-off switch for electricity levies. Photographer: Bill Pugliano/Getty Images Some argue that maybe Trump shouldn't and wouldn't do anything to bail out the stock market. One intervention came from Chamath Palihapitiya, a well-known financier. He argued on X: 1. Trump is more popular with young people than old people. Most young people don't own stocks or homes (aka they are asset-light).

2. Trump is also more popular amongst working and middle class folks. Most of these folks are also asset-light. It stands to reason that a fall in asset prices (stocks down or home prices down) have very little impact on his core constituents. To that end, I won't be surprised if Trump has little reaction, then, to an equity or home price market correction.

He added that a correction might allow these people to buy assets and profit from the next upward wave. It could also correct the inequality that has come from protracted low interest rates and asset price inflation. Palihapitiya went so far as to suggest that Trump would now prefer the stock market to go down, rather than up. If that's really what the administration wants, it must regard Trump 1.0 as a failure: Growth in both house prices and shares outstripped wages in Trump's first term, putting them further out of reach — a trend that worsened significantly under Joe Biden. Charles Gave of Gavekal Economics also argues against a Trump Put, but from his interpretation of what Trump 2.0 wants to do, rather than the interests of his base. As Gave puts it, the administration seeks to move from the US globalized "empire" to a defined nation-state, which means downgrading the importance of the big multinationals who rely on globalization: In the transition from empire to nation-state, the performance of the US stock market is the very last concern of the current US administration. There is no Trump Put on the S&P 500 or the Nasdaq. This is because the shares which have gone up the most and which dominate the indexes are the shares of the companies which have benefited most from the existence of the empire.

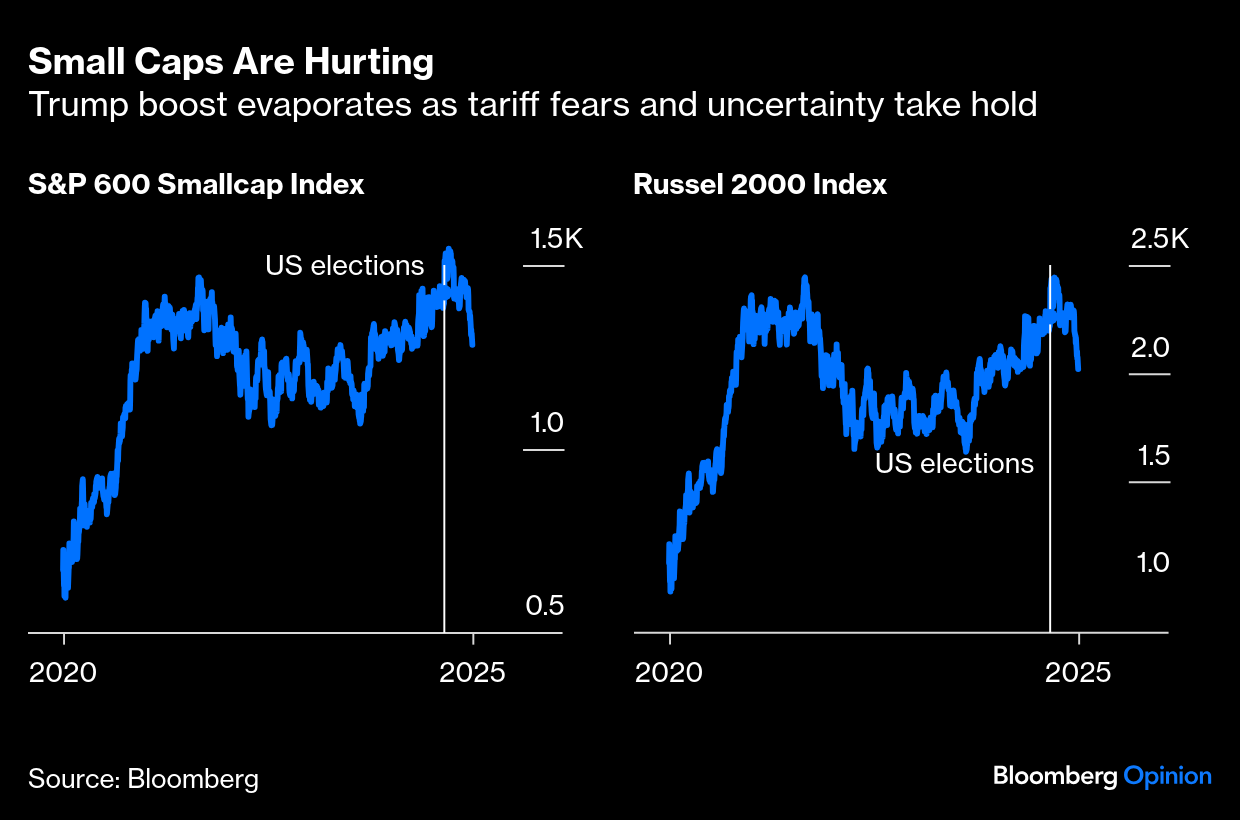

So a strong stock market doesn't deliver much in the way of goods for the Trump base, and if anything suggests that it's not making enough progress in reversing globalization.  Less sensitive than expected. Photographer: Samuel Corum/Sipa/Bloomberg All this said, a lot of Americans hold equity investments in retirement plans, and monthly statements make them painfully aware of any downturn. Beacon Research suggests there are limits to the pain that Trump will put the financial markets through: "He is just less sensitive than previously expected." Also, that some in the administration believe that there will be a window of six months or so where tumult can be blamed on Biden, and intend to take advantage of it. That means the Trump Put may not be operative for a few months yet, but still leaves the question of where to draw the line. Beacon suggests that the put will be a moving target. The key question is "Trump's motivation" behind each tariff, whether permanence or leverage for something else. The latter are much more likely to be suspended or delayed. Meanwhile, CPI data for February are due not long after you receive this. They would be unwise to ignore. If there is a Trump Put, it may prove to come from inflation rather than the stock market. The administration can tolerate a selloff, within reason. But the political lesson of the last four years is clear — no one could tolerate a reignition of inflation back above 3% and beyond. It's all about the sequencing. Barely two months into Trump 2.0, markets are grasping that history might not repeat itself. Or even rhyme. Deregulation and lower corporate taxes, which propelled the post-election Trump trades, are far from reality, while disruptive trade policies, an immigration clampdown, and government layoffs have all battered investor confidence. Trump 1.0 provided the sugar of tax cuts before moving on to the policies that risked breaking things. This time, hopes were high that abolishing tax on tips, a big talking point during the campaign, would be one of the first big policy wins. But tax cuts of any kind seem to have disappeared from the agenda. This chart shows how the perceived chances have dwindled, according to the Polymarket prediction market: Small caps are particularly exposed. They benefited from corporate tax cuts in 2017, but have slumped since the election: Without tax cuts, worries about the economy intensify. Joe Lavorgna of SMBC Nikko Securities, who served in the first Trump administration, warned that capital expenditures rose less than overall activity in the last quarter for the first time in three years. While some of the recent deterioration in investment spending could have been due to election uncertainty and should organically rebound, concern about the extension of the 2017 Tax Cuts and Jobs Act (TCJA) could soon become a dampening factor... While we remain optimistic on 2025 growth prospects, this assumes there will be more clarity around tax policy soon.

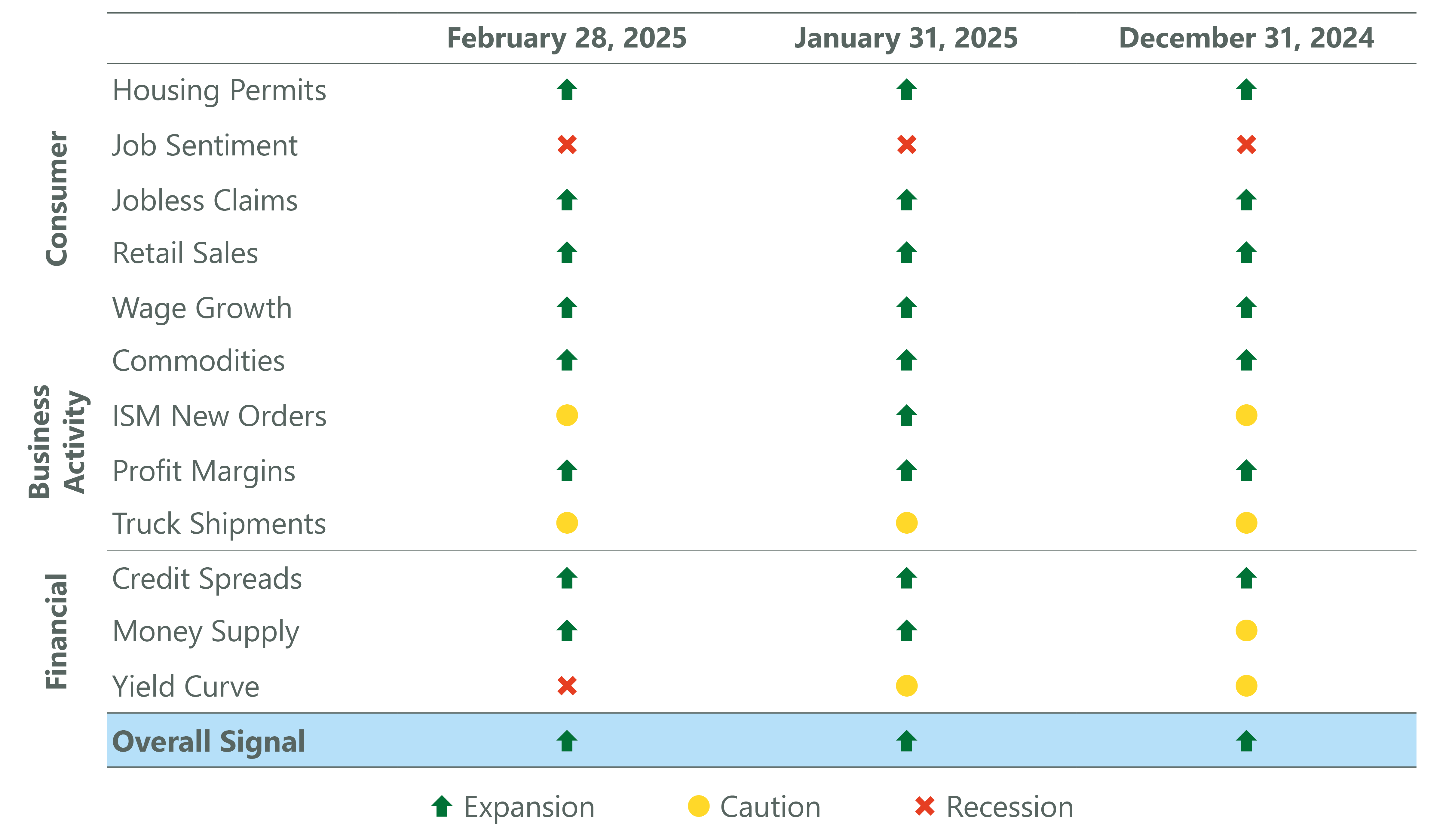

ClearBridge Investments' Jeff Schulze and Josh Jamner argue that economic conditions do not move in a straight line. Their dashboard shows overall recession risks are low for now: Janus Henderson Investors' Jonathan Coleman suggests that the policy backdrop is not so different from Trump 1.0. On both occasions, Trump used tariffs to try to advance policy priorities, creating challenges and opportunities for small caps. What's still lacking is the enactment of business-friendly policies to spark a rebound. And the macro backdrop is tougher: High interest rates in 2025 may temper the "animal spirits" that drove the previous small-cap rally in Trump's first term. Additionally, the market is more focused on supply chain resilience and inflation risks than in 2016.

Trump pledged to extend his first-term tax cuts for households, which would cost some $4.5 trillion over a decade, as well as slashing charges on tips, overtime earnings, and Social Security payments. He's now under increasing pressure from pro-business conservatives to prioritize these over tariffs. Progress on these aims might reverse the unfolding damage. However, it requires a single "big, beautiful" reconciliation package, which looks increasingly likely to fail given disagreements among Republicans.  Still subject to tax. Photographer: Yuki Iwamura/Bloomberg Schulze and Jamner believe policy uncertainty should ebb in coming months, giving way to the more investor-friendly policies, while the fundamentals aren't as dire as headlines suggest. For example, the 77,000 federal workers who've accepted the offer to leave the payroll in six months "is roughly one-third the number of workers in the US who file for unemployment benefits for the first time in any given week." BCA Research's Marko Papic argues that although deregulation is beneficial, its impact will not come soon enough compared to the immediate havoc caused by tariffs: He is trying to change immigration, which is impacting the labor supply and growth. He probably doesn't also need to impact its trade relationships with the rest of the world. That's a lot to do at the same time.

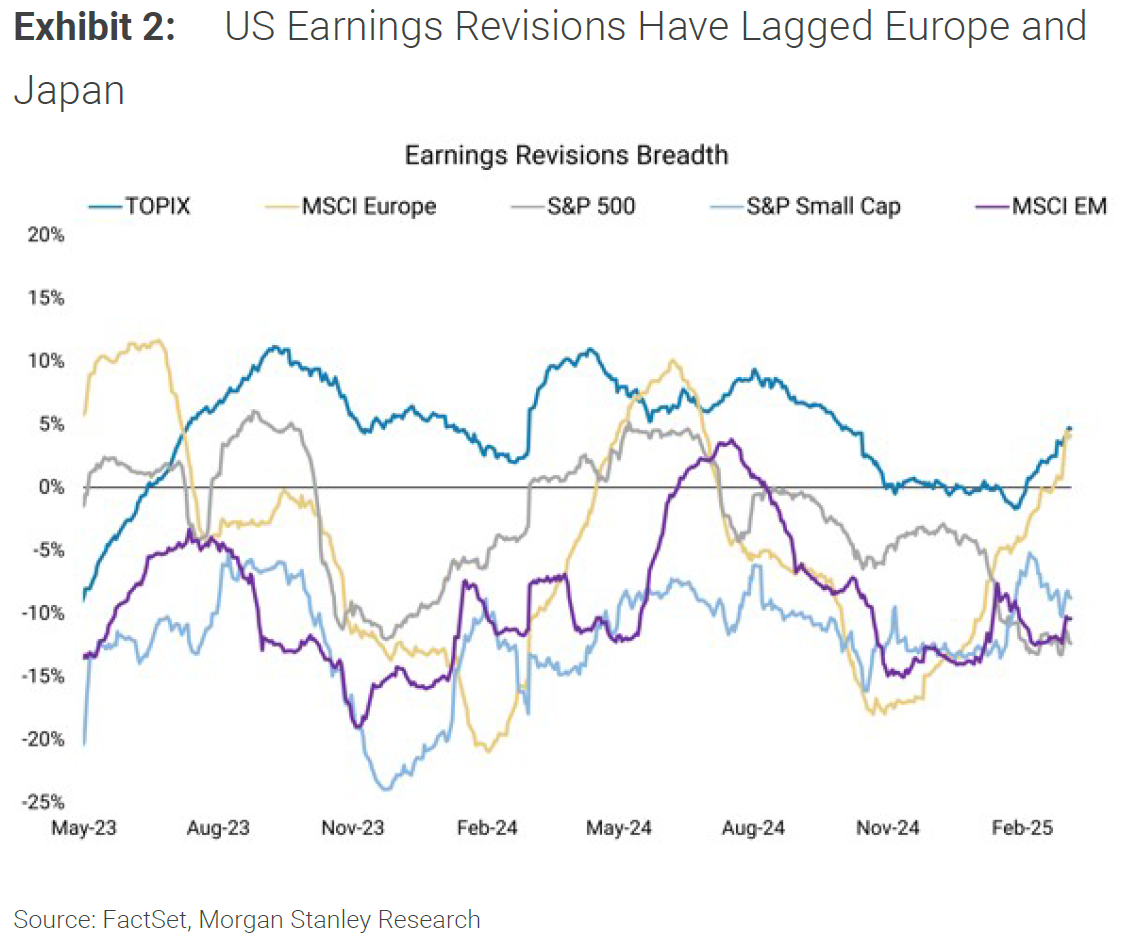

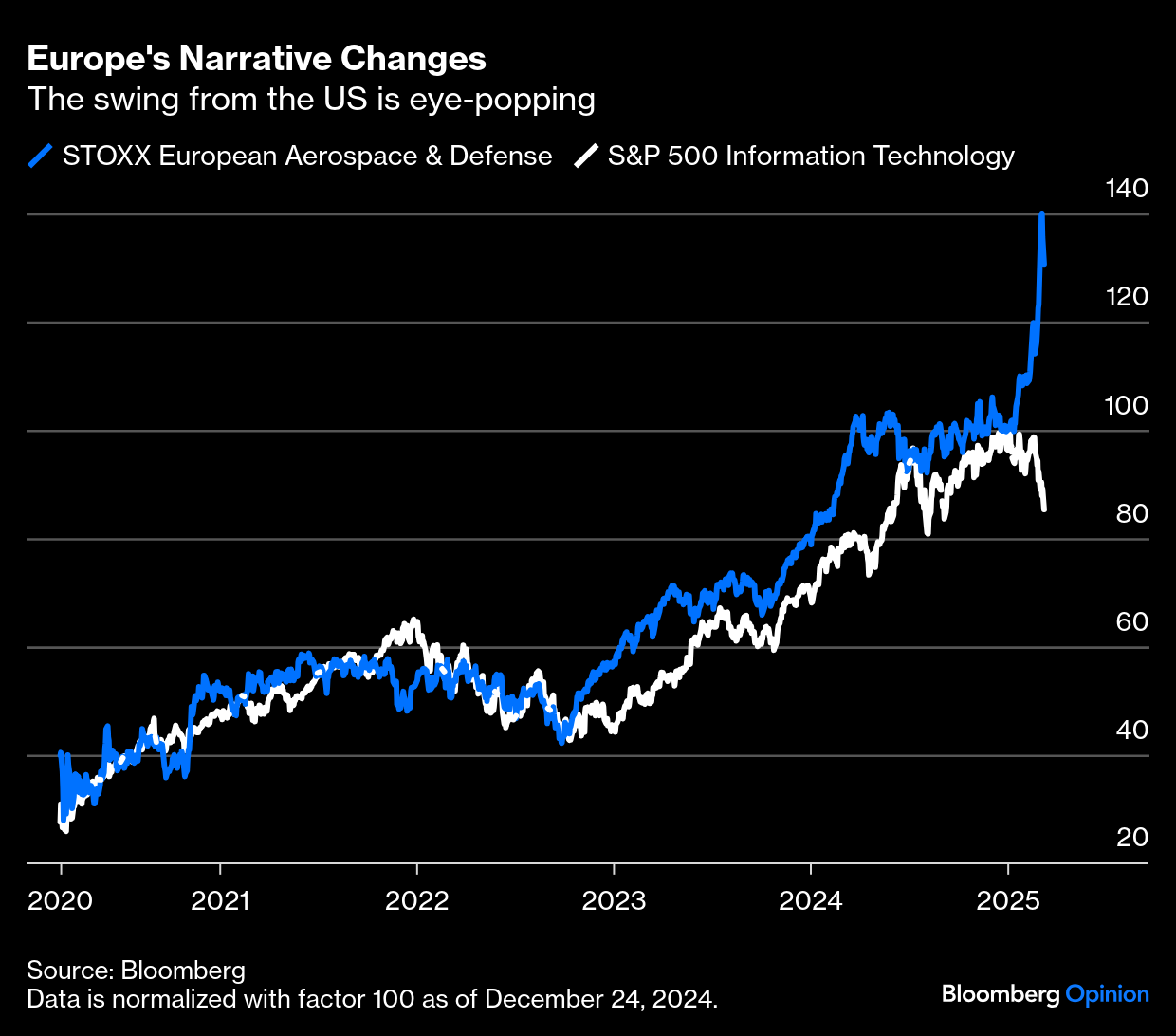

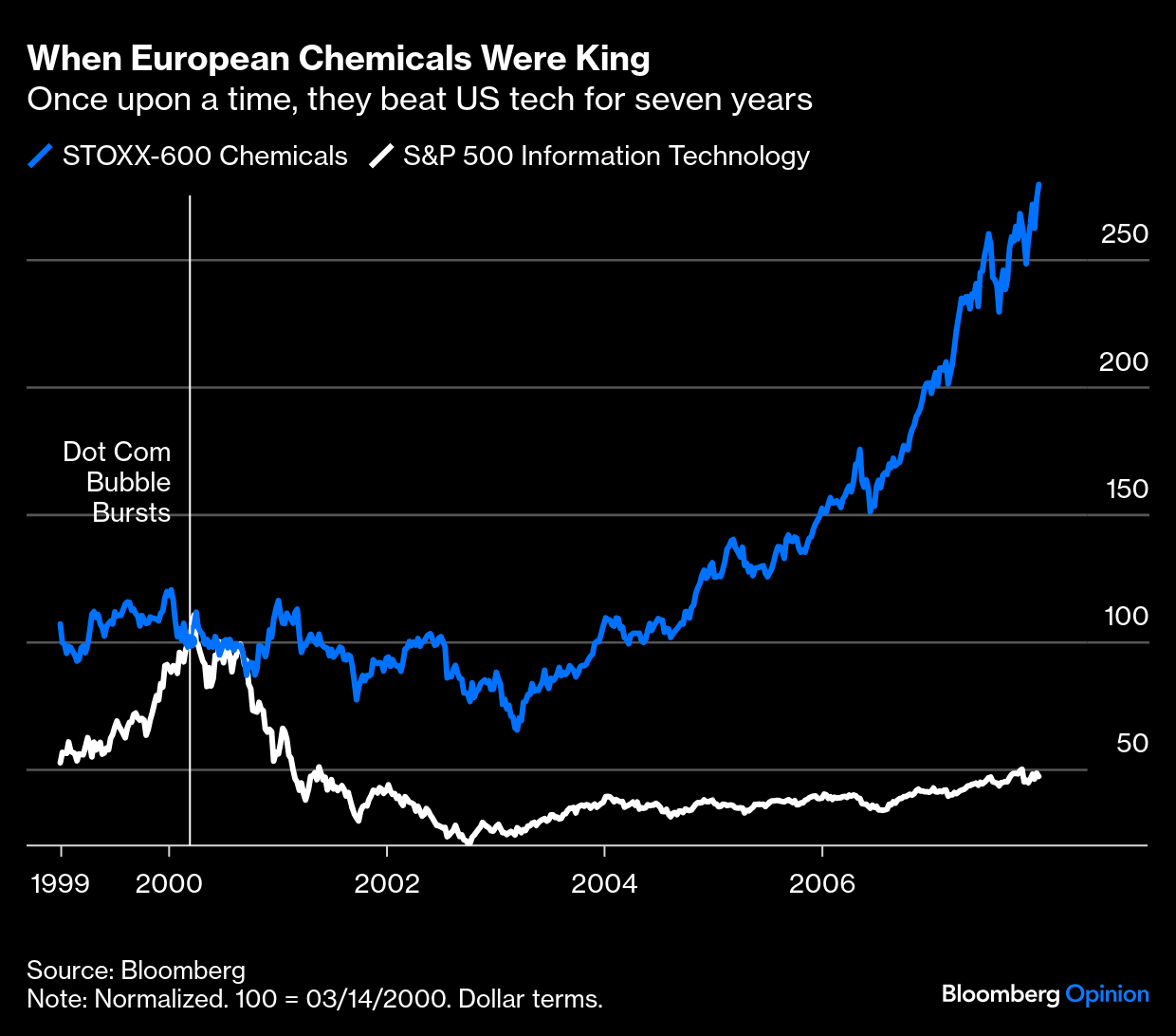

Getting tax changes in place before he continues with that agenda looks like a better idea. —Richard Abbey The transatlantic turnaround of the last three months is one for the record books. For years, European stocks had looked cheap. This latest rally has been dominated by the cheapest stocks — investors are swooping to buy anything that looks good value on either side of the pond. This chart shows how long-short strategies based on value and growth styles have worked this year, using Bloomberg Factors To Watch data: Amid the geopolitical excitement, another crucial development has seen positive earnings revisions for European stocks (and also Japan), while US forecasts have trended downward. People haven't been paying attention to Europe for a while, and as soon as they did saw that earnings were more solid than they'd thought. That's illustrated in this chart from Morgan Stanley: Valuation meant that this was a turnaround waiting to happen, and geopolitics at last triggered it. The extent is phenomenal. Since Christmas Eve, European value stocks have outperformed US growth by 37%, according to MSCI indexes: It's reasonable to ask if this can be sustained. For one of the more dramatic changes, this chart shows how European defense stocks have fared compared to US tech. On the face of it, it looks unsustainable: But when markets start from an over-extended position, rallies can last a while. Everyone remembers that the dot-com bubble burst in early 2000 and was bad news for US tech. Less remembered is that companies that had been underpriced and starved of capital as money poured into internet startups then had a fantastic seven-year rally. Andrew Lapthorne of Societe Generale SA points out that European chemicals went on a rally for the ages: Yes, that was in the fallout from arguably the biggest stock market bubble of all time. Market conditions at present are strange indeed, but they're not as wildly overextended as they were then. Except if we bring the chart to the present day, we find that European chemicals groups have now given up all the ground they made on US tech and gone full circle: Could it happen again? The mere possibility has been enough to spark quite a rally, and it may well not be done yet. It turns out I need to explain a headline. Bigmouth Strikes Again is one of my favorite Smiths songs, and it does service every time a quote by a public official causes a market selloff. It's not meant as a criticism of Trump or anyone else, just as a joke to leaven some often difficult fare. Other staples that come in handy time and again include the Smiths' Panic, When Doves Cry and 1999 ("Two Thousand Zero Zero, Party's over oops, out of time/So tonight I'm going to party like it's 1999") by Prince, It's the End of the World as We Know It by REM, and Crash by The Primitives.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Marc Champion: Putin's Faced Some Tough US Presidents. Not This One.

- Claudia Sahm: The War on Government Statistics Has Quietly Begun

- David Fickling: Musk Has Bigger Problems in the Land 'Tesla Takedown' Forgot

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment