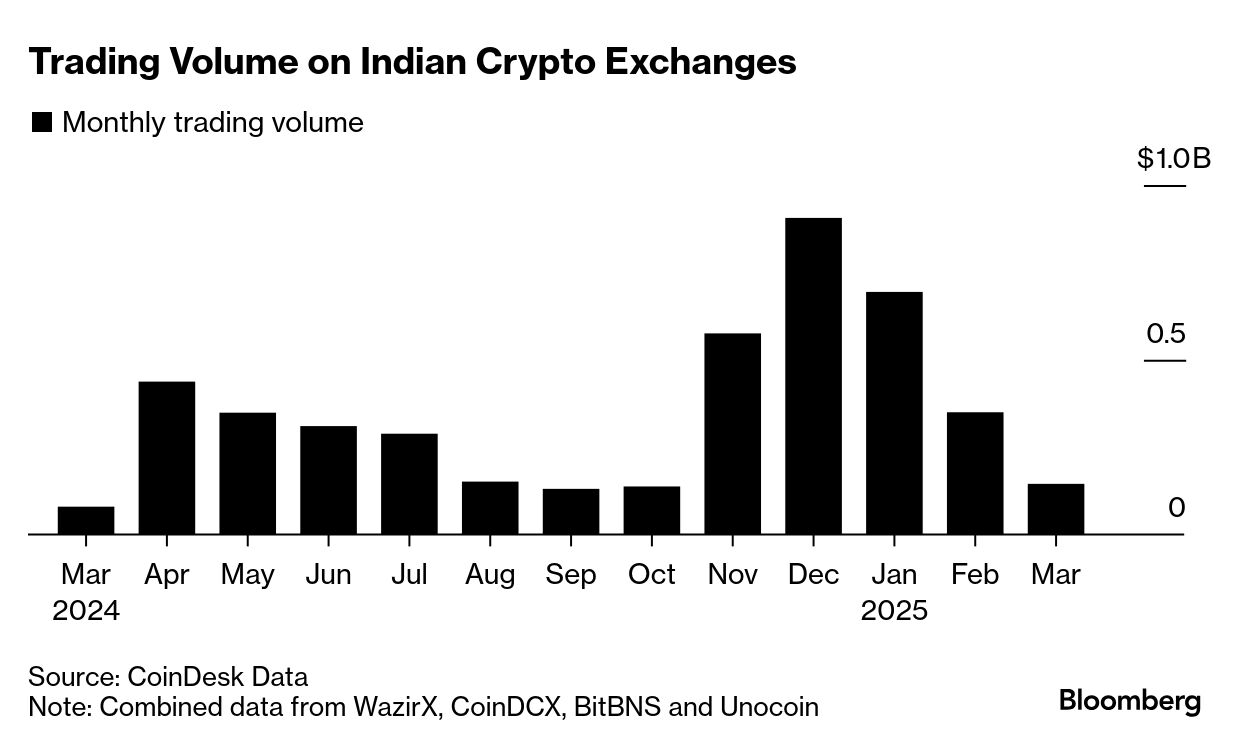

| Major crypto players are returning to India in a calculated bet that regulators may ease restrictions on digital-asset trading. Coinbase Global Inc., the US exchange, recently registered with India's Financial Intelligence Unit (FIU) as part of a plan to roll out its retail trading platform and boost investments in the country. The move, which comes after local registrations by rivals Binance, Bybit and KuCoin, underscores a renewed interest in the Indian market. The world's most populous country had hoped to release a consultation paper on crypto regulation following its G20 presidency in 2023, but hasn't yet followed through. It's now revisiting the issue as shifts in the global policy landscape — led by Donald Trump's pro-crypto agenda in the US — prompt a rethink. "In the last 12 months, more than one jurisdiction has changed their stance significantly," Ajay Seth, secretary of India's Department of Economic Affairs, said at a recent roundtable. He noted the risks posed by using digital assets such as stablecoins and the potential for crypto to facilitate multilateral capital flows, which could impact emerging economies like India. "We were ready with a discussion paper, but we now need to recalibrate it due to these changes," he added. Despite local restrictions, India has emerged as a critical hub for blockchain development, with its global share of specialized developers increasing from 4% in 2018 to 12% in 2024, second only to the US, according to Electric Capital. Crypto exchanges including Coinbase and Gemini have engineering hubs in India. "India is a huge market, and you can't ignore it if you have a long-term view on crypto," said Edul Patel, CEO of crypto investment platform Mudrex. Its appeal remains despite the the Indian government's decision to introduce a 30% tax on income from digital assets and a 1% tax deducted at source (TDS) in 2022, significantly curtailing trading volumes. High-frequency traders and market makers fled local exchanges, and many international players reassessed their operations in India. Prior to the tax regime, India was one of the fastest-growing crypto markets, driven primarily by retail investment. Daily trading volumes on WazirX peaked at $493 million in November 2021. Today, combined monthly volumes across multiple local exchanges struggle to reach that level. While profitability in the country remains a challenge due to the onerous tax regime, crypto firms are hopeful that the government will ease restrictions over time — handing a windfall to operators that rolled the dice on an Indian comeback. |

No comments:

Post a Comment