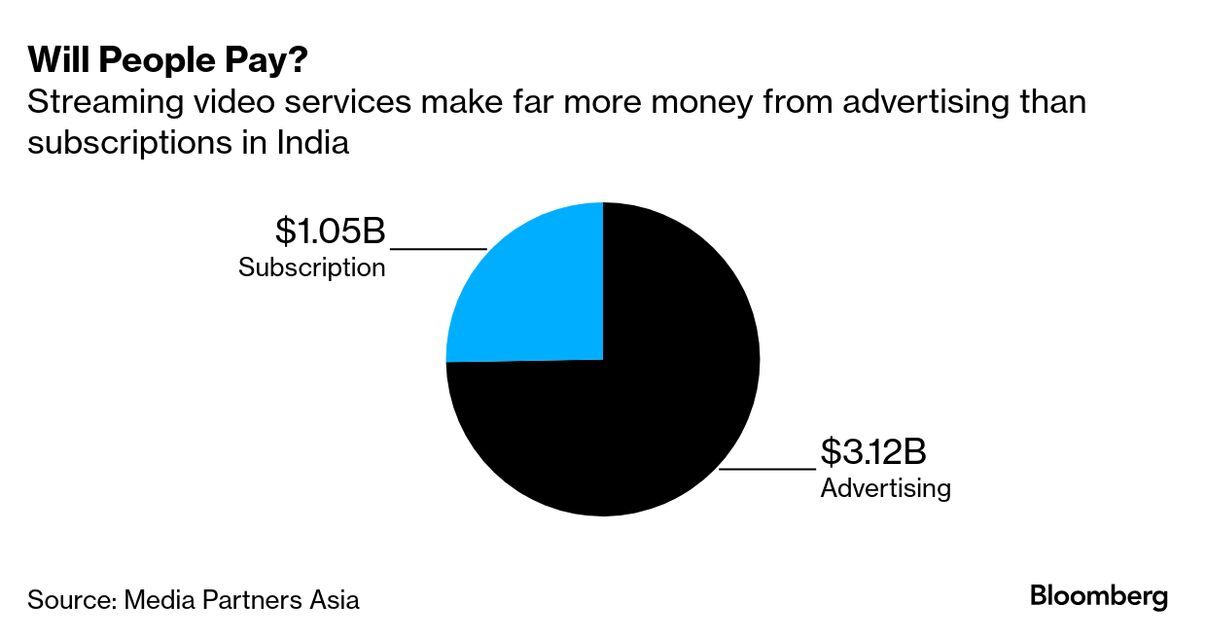

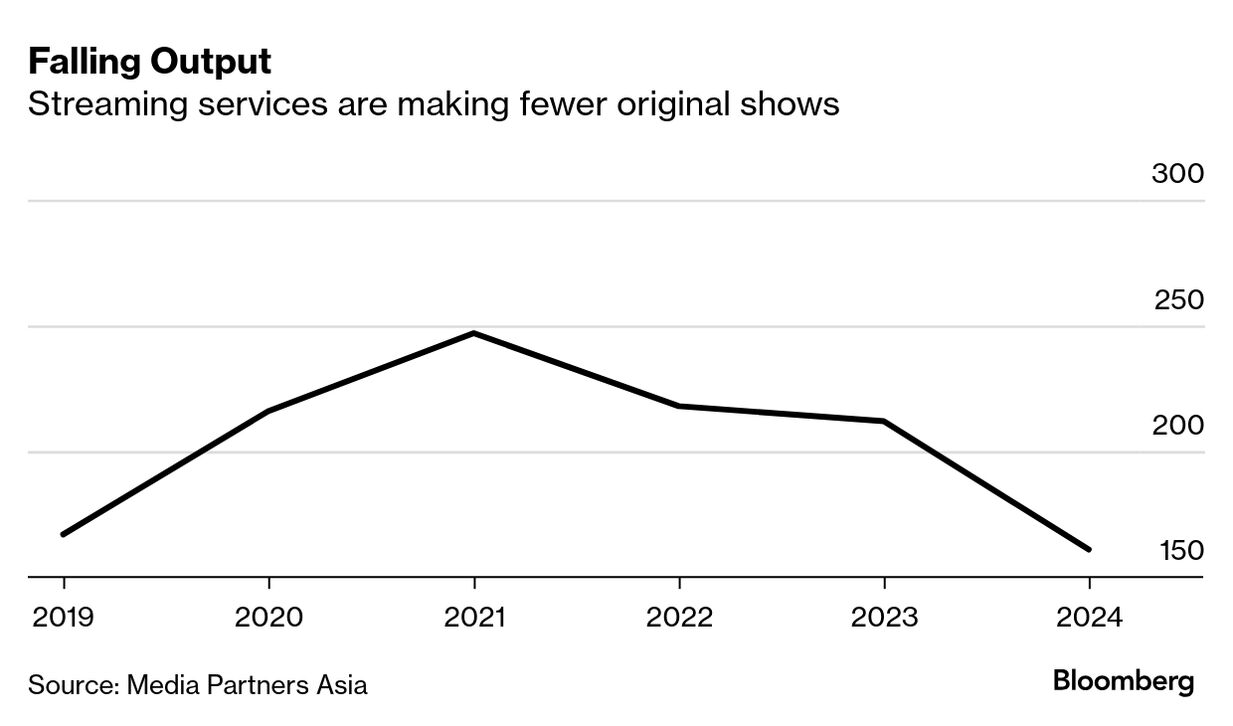

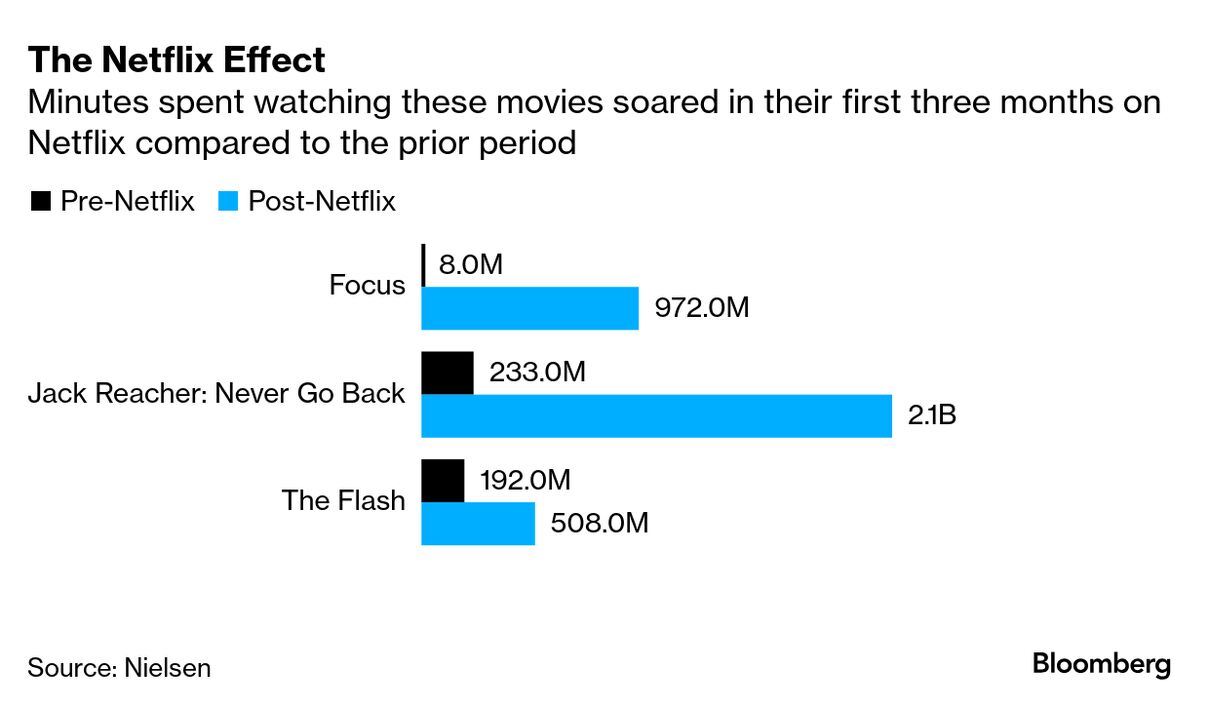

| Mukesh Ambani is out to prove Indians will pay to watch video on the internet. Late last year, Ambani, Asia's richest man, closed a deal with Disney to create the largest entertainment company in his home country. Ambani is its largest shareholder through Reliance — his energy, retailing and telecommunications conglomerate. JioStar, valued at $8.5 billion, owns India's largest collection of TV networks, as well as its most popular paid streaming service, JioHotstar. Daily oversight of the business falls to Uday Shankar, one of the country's leading media executives and investors. This past week, JioHotstar announced it has surpassed 100 million subscribers, the first streaming service in India to top that number. That's a milestone in the country, where the challenge has always been getting people to pay for entertainment. Ambani owes a big thank you to cricket — specifically the Indian Premier League. "This new combination of JioHotstar is trying to change TV," said Vivek Couto, owner of the consulting firm Media Partners Asia. "You have this big industrial juggernaut and a maverick entrepreneur. What does success look like for this business?" International media companies have long been enchanted by the promise of India, home to 1.4 billion people. If you could get even 5% of the country to pay for something, you'd have a business. Paramount, Disney and Time Warner all arrived with big dreams and struggled. They made the wrong hires. They weren't patient. They didn't grasp the diversity of the market. The one executive who really cracked India was Rupert Murdoch – and many would say it was really his son James, working with Uday Shankar. Shankar is now a co-owner and vice chairman of JioStar. Streaming services arrived en masse a little less than a decade ago as a growing number of people gained access to the internet courtesy of Ambani's Jio, which has sold mobile packages for the cost of a cup of coffee in the US. In 2018, two years after introducing Netflix to India, co-founder Reed Hastings predicted his company would one day have 100 million customers in the country. He doubled down on the optimism a year later, committing hundreds of millions of dollars to programming for the market. Still, Netflix struggled to convince more than a few million people to sign up. It was too expensive and competition with rival services was fierce. Yet there are signs that the market is starting to improve, at least among the wealthier part of the population. Netflix now has an estimated 15 million customers, a substantial increase over just a few years ago. Everyone in the market agrees the company has started to find its footing with a mix of licensed movies and local shows. The number of people paying for any music subscription has tripled since 2020. These are still small numbers. Netflix is popular with wealthier Indians eager to see edgier shows that can't be found on local TV. Just a tiny fraction of Spotify and YouTube customers pay for the premium versions of those services. JioHotstar's ambitions are far grander. The service is attempting to compete with Netflix at the top end and YouTube at the low end. It offers thousands of hours of local programming, licensed titles from Disney, HBO, NBCUniversal and Paramount, as well as micro dramas. People can watch the service for free until they reach a certain threshold, at which point they must pay to continue. The average JioHotstar customer pays less than $1 a month, making advertising a big part of management's profitability plan. The streaming video ad market is three times the size of the subscription market, per Media Partners Asia. YouTube, Facebook and Instagram have hundreds of millions of customers in India. It is YouTube's biggest market in terms of users. Shankar has made cricket, which is hugely popular in India, the centerpiece of his strategy. The company is spending more than $1 billion a year for the rights to a two-month tournament, the Indian Premier League, between TV and streaming. JioHotstar will need to sign up 200 million to 300 million customers to justify the cost, Couto estimates. The expense is so high that the company can't make money from just the matches. Management need to bring in enough people who will stick around for general entertainment. The growth of streaming is vital in a market suffering from many of the same challenges as everywhere else in the world. India's pay-TV business is shrinking, and the movie business is in crisis. The entertainment business as a whole grew just 3% last year, according to Ernst & Young, slower than the country's economy overall. "The economy appears to be growing but it's not yet translating into the ad boom everyone was expecting," Couto said. Bollywood, the umbrella term for the Hindi film industry, has lost touch with its audience, surrendering much of its cultural power to filmmakers from the south. Many of the biggest producers are looking to sell their companies to third parties. (To wit, Dharma Productions sold a 50% stake to a pharmaceutical billionaire.) Talk with the average Indian screenwriter or producer, and they might sound a lot like their peers in the US or South Korea. Streaming services are cutting back after spending billions of dollars to chase subscribers. Consolidation means that Netflix, Amazon and JioStar are the only major buyers of most premium programming. The number of local original series has dropped by about 30% from its peak in 2021, per Media Partners Asia. Yet executives here still express more optimism than their counterparts in the US. India's gross domestic product has doubled over the past decade and the country is on the verge of supplanting Japan and Germany to become the world's third-largest economy. While the GDP per capita is low — about $2,500 — an emerging middle class has already produced huge growth in the live entertainment business. The best of Screentime (and other stuff) | The Netflix effect revisited | The most popular TV show in the world right now is the Netflix show Adolescence, a four-part miniseries out of the UK. The program is more popular than new material from Shonda Rhimes, Robert DeNiro and Mindy Kaling, proving once again that nobody knows anything when it comes to predicting hits. While Hollywood studios retreat to safety, commissioning shows from proven filmmakers and stars, Netflix has stumbled on another culture-defining hit that came from filmmakers who aren't famous. (The director's film Boiling Point is excellent, however.) Netflix's greatest trick is creating online hits out of shows and movies that had a limited initial audience. This applies both to new programs (like Adolescence and Baby Reindeer) as well as library titles. Let's consider a few examples, courtesy of the folks at Nielsen. - Movies. Focus, Jack Reacher: Never Go Back and The Flash collectively had just a couple million viewers for months before landing on Netflix. In the three months after they arrived, their viewership took off.

- TV reruns. We all know that Suits became a phenomenon on Netflix. But the extent of the bump is jaw-dropping. People spent more time watching Suits in just six months on Netflix than in its entire eight-year run on TV.

- Shows on cable. TV networks and movie studios learned about Netflix's potential impact more than a decade ago. It's why they started licensing their hits to the company. We know how that ended up. Netflix used those shows to steal their audience. Now many networks and studios are returning to licensing because they hope exposure on Netflix will benefit them in the long run.

The No. 1 album in the US is...Playboi Carti's Music, which topped the charts two weeks in a row. The Ari-Patrick break-upPrivate equity giant Silver Lake Management closed its deal to take Endeavor private – and ended one of the most successful business partnerships in modern media. Ari Emanuel and Patrick Whitesell built Endeavor from a boutique talent agency into a sprawling media concern by swallowing dozens of companies, including the William Morris agency, sports giant IMG and UFC. While skeptics questioned the prices they paid, Silver Lake kept giving them money. Emanuel was the bruising, relentless negotiator who inspired the character Ari Gold on the TV series Entourage, Whitesell was the agent to the stars who smoothed out Emanuel's rougher edges. Yet other investors never understood how all the pieces fit together, prompting Endeavor to spin off its combat sports business into TKO and, ultimately, end the Endeavor public trading experiment all together. What remains of Endeavor is largely an agency called WME. Somewhere during that process Emanuel and Whitesell started to drift apart. Emanuel ran the show and leaned on former ESPN and Six Flags executive Mark Shapiro as his new second-in-command. Whitesell served as chairman of the board of Endeavor and is a friend of Silver Lake's Egon Durban. Now that partnership is officially over. Whitesell will focus on investing Silver Lake's money in sports and media businesses, like Peyton Manning's Omaha Productions. He'll still advise clients like Ben Affleck and Matt Damon. Emanuel will still be chairman of WME and the CEO of TKO, but he's also raised a bunch of money to go buy live events businesses – some of them from Endeavor. While the grand experiment as a publicly traded talent agency didn't pan out, the two partners can't be too sour with one another. Emanuel and Whitesell got very, very rich in the process. Deals, deals, deals - A video-game company owned by Saudi Arabia is on a billion-dollar buying spree. Cecilia D'Anastasio spoke to its co-CEO to understand the strategy.

- Ticketmaster might have broken the law in its sale of Oasis tickets.

- The Sundance Film Festival is moving to Boulder, Colorado after four decades in Utah.

- Advertising sales growth will slow in 2025 due to economic uncertainty, according to Magna Global. Retail search (aka Amazon), streaming and social media will grow while linear TV, local TV and radio are shrinking.

- Warner Bros. canceled plans to expand Hogwarts Legacy, one of its most popular video games ever.

If you have like games, check out Bloomberg's new news quiz, Pointed. And if you like trap music, check out Simiran Kaur Dhadli's Putt Jatt Da. |

No comments:

Post a Comment