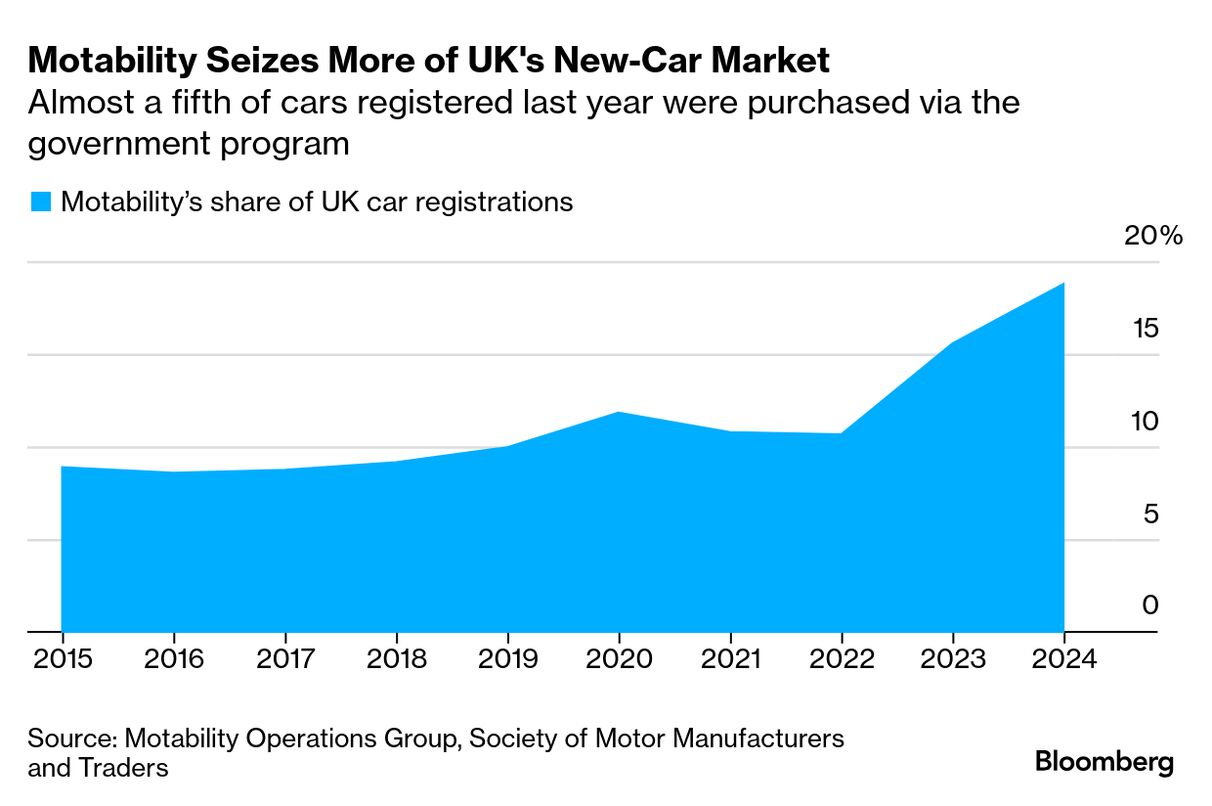

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story online here. Welfare Cuts May Slow the UK's Transition | Plans to cut UK welfare spending by billions of pounds could have an unexpected consequence: undermining the country's push to increase sales of zero-emission vehicles. A review of the benefits system announced in recent days could hit a car-financing program called Motability, which provides vehicles to disabled customers on mobility benefits. Motability accounted for almost one in five new car sales in the UK last year and is one of the country's biggest buyers of electric vehicles. Any drop in sales through the program risks holding back automakers as they try to hit the government's zero-emission vehicle mandate. Fully electric cars must make up 28% of their sales this year to avoid penalties. "There's no doubt that the Motability scheme is helping to drive the sale of new electric vehicles, and any changes on access to the scheme would inevitably have an impact on that," said Ginny Buckley, chief executive officer of Electrifying, a website that rates and sells EVs. Motability was set up by the government in 1977. Its influence has surged in recent years and the company today has more than 800,000 customers, including over 70,000 EV drivers. Motability Operations, the private firm that runs the program, has drawn scrutiny at a time when the UK is seeking to find savings to shore up its finances. Critics have argued that too many people who don't necessarily need the financial help have access to the program, which allows them to lease a new car every three years using their taxpayer-funded mobility allowance. The program also covers free road tax, servicing, insurance and charging installation, which makes purchasing an EV attractive. The UK's welfare cuts are aimed at saving around £5 billion ($6.47 billion), but threaten to undermine Labour's efforts to reduce transport emissions. While the mobility element of the benefits — they're called Personal Independence Payment — isn't being cut for now, the government has kicked off a wider review of PIP assessments that could hit purchases through the mobility program. Motability does not decide who is eligible; it only enables those who are given the allowance. A spokesman said Motability is expanding the number of EVs available on the program to give customers a wide range of accessible options.  Electric vehicles charging at a BP Pulse hub in Birmingham. Photographer: Hollie Adams/Bloomberg Carmakers don't earn a lot of money through Motability because of the small margins offered, but the program helps boost their EV sales, said a dealer who asked to remain anonymous. A drop in Motability users will make hitting the UK electrification targets even harder, the person said. In the European Union, demand for EVs — which tend to cost more than their combustion engine-powered equivalents — declined last year amid disappearing subsidies and higher costs of living that have put off less wealthy drivers. Sales rose in the UK, with EVs accounting for nearly a fifth of cars registered in 2024 — still shy of the 22% mandate. Welfare cuts could also dent Motability's purchases of models with a combustion engine, according to Quentin Willson, founder of EV campaign group FairCharge. "It's going to make a motor industry that's really struggling even worse," he said. The EV sales mandate is currently being reviewed by the government, which just finished taking submissions as part of a consultation. That could lead to increased flexibility to help carmakers avoid fines of up to £15,000 per vehicle for falling short of the targets. Yet it could take months before any changes are implemented. "The concern at the minute is it's just taking a really long time," Lisa Brankin, Ford's UK chair, said at a Society of Motor Manufacturers and Traders event this month. She called for a review as speedy as the one conducted by the European Union, which has agreed to give automakers more time to achieve the bloc's emissions targets. — By Jamie Nimmo  President Donald Trump speaking in the Oval Office of the White House on Friday. Photographer: Yuri Gripas/Abaca President Donald Trump's coming wave of tariffs is poised to be more targeted than the barrage he has occasionally threatened, aides and allies say, a potential relief for markets gripped by anxiety about an all-out tariff war. Trump is preparing a "Liberation Day" tariff announcement on April 2, unveiling so-called reciprocal tariffs he sees as retribution for tariffs and other barriers from other countries, including longtime US allies. While the announcement would remain a very significant expansion of US tariffs, it's shaping up as more focused than the sprawling, fully global effort Trump has otherwise mused about, officials familiar with the matter say. Trump will announce widespread reciprocal tariffs on nations or blocs but is set to exclude some, and — as of now — the administration is not planning separate, sector-specific tariffs to be unveiled at the same event, as Trump had once teased, officials said. |

No comments:

Post a Comment