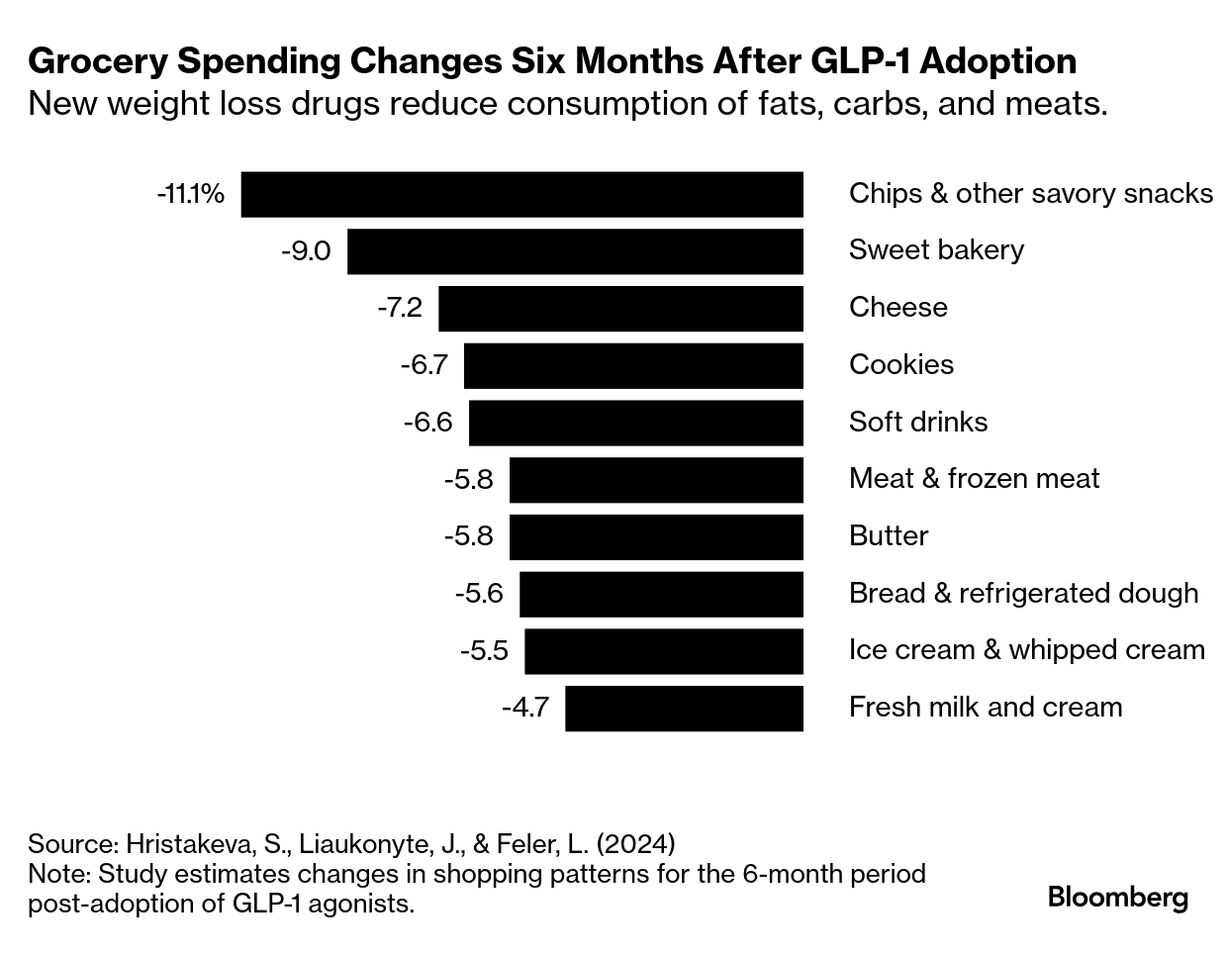

| The two biggest names in the obesity-drug market, Eli Lilly & Co. and Novo Nordisk A/S are reporting earnings this week. While Wall Street's enthusiasm for weight-loss shots has helped make them two of the most valuable companies in the world, Lilly and Novo's rapid ascent has been losing steam amid higher expectations, rising competition and a shift in focus to newer drugs. Investors will be closely watching for signs of a peak in demand for their blockbuster obesity and diabetes drugs as well as comments on the next generation of weight-loss medications. Here are five things to look out for: A number of quarterly misses in 2024 left investors pondering if demand is slowing or if their expectations are just becoming too high. So, the drugmakers' projection for sales in 2025 will be important, especially after Lilly flagged slower-than-expected demand for its fourth quarter. Additionally, the companies' progress on their next-generation obesity drugs will be in focus as they fight to maintain their current dominance in the red-hot obesity market. Disappointing data from Novo's CagriSema trial in December dented optimism but hopes have been revived following successful results for its once-weekly amycretin shot in mid-January. Rivals with a crop of experimental drugs — ranging from Viking Therapeutics Inc. and Amgen Inc. in the US to Roche Holding AG and Zealand Pharma A/S in Europe — are racing to replicate Lilly's and Novo's success. Any updates on how the current duopoly plans to position themselves against impending competition will be important. Novo's recent win for Ozempic's use treating kidney disease will put attention on both companies' efforts to expand approval for their weight-loss shots. To boost insurance coverage and sales, both are conducting trials of their obesity drugs in a range of disorders from heart and liver diseases to controlling addictive behaviors like alcohol abuse, smoking and drug addiction. Lastly, there's drug pricing. The eligibility of Ozempic and Wegovy for Medicare price cuts earlier in January raises the possibility that price changes for Novo's drugs could affect others in the same class. — Angel Adegbesan, Bloomberg News (Chart by Aaron Clark) |

No comments:

Post a Comment