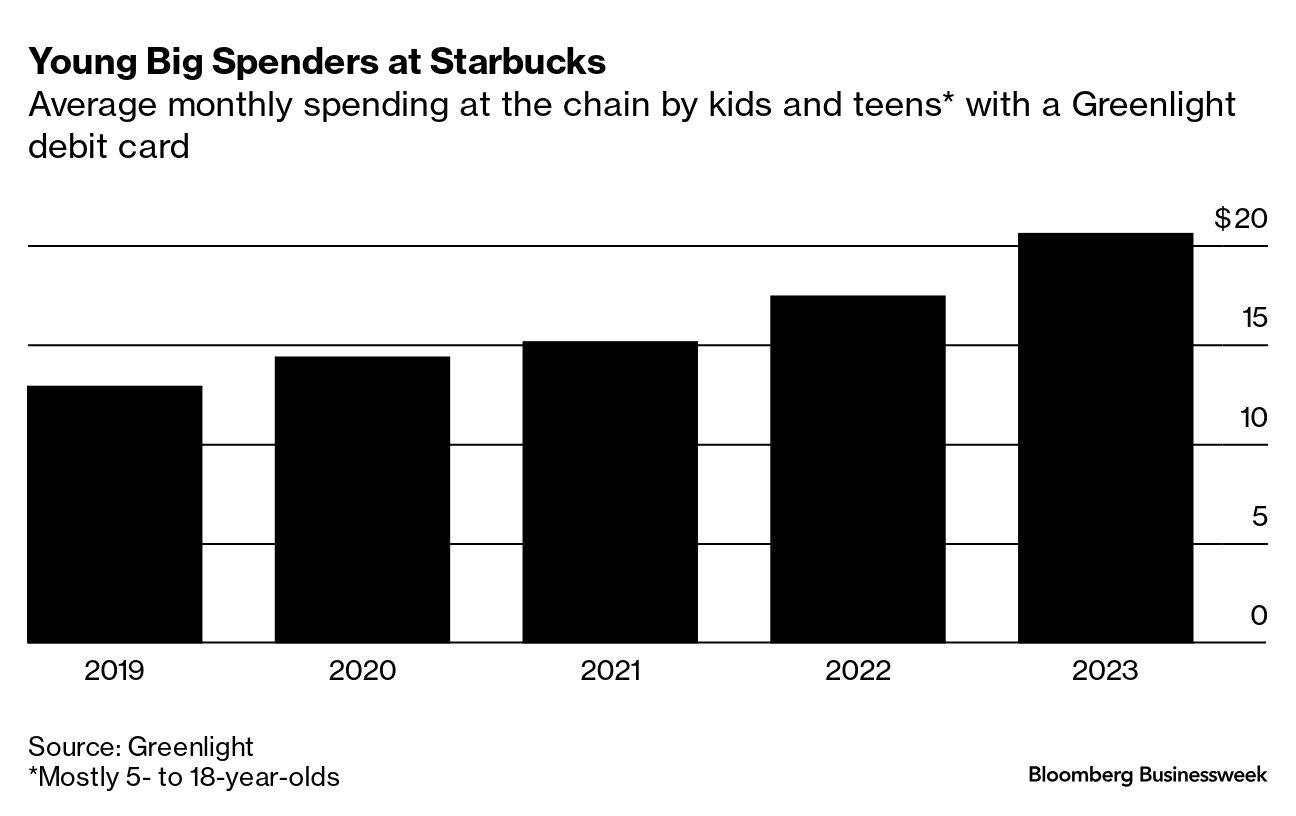

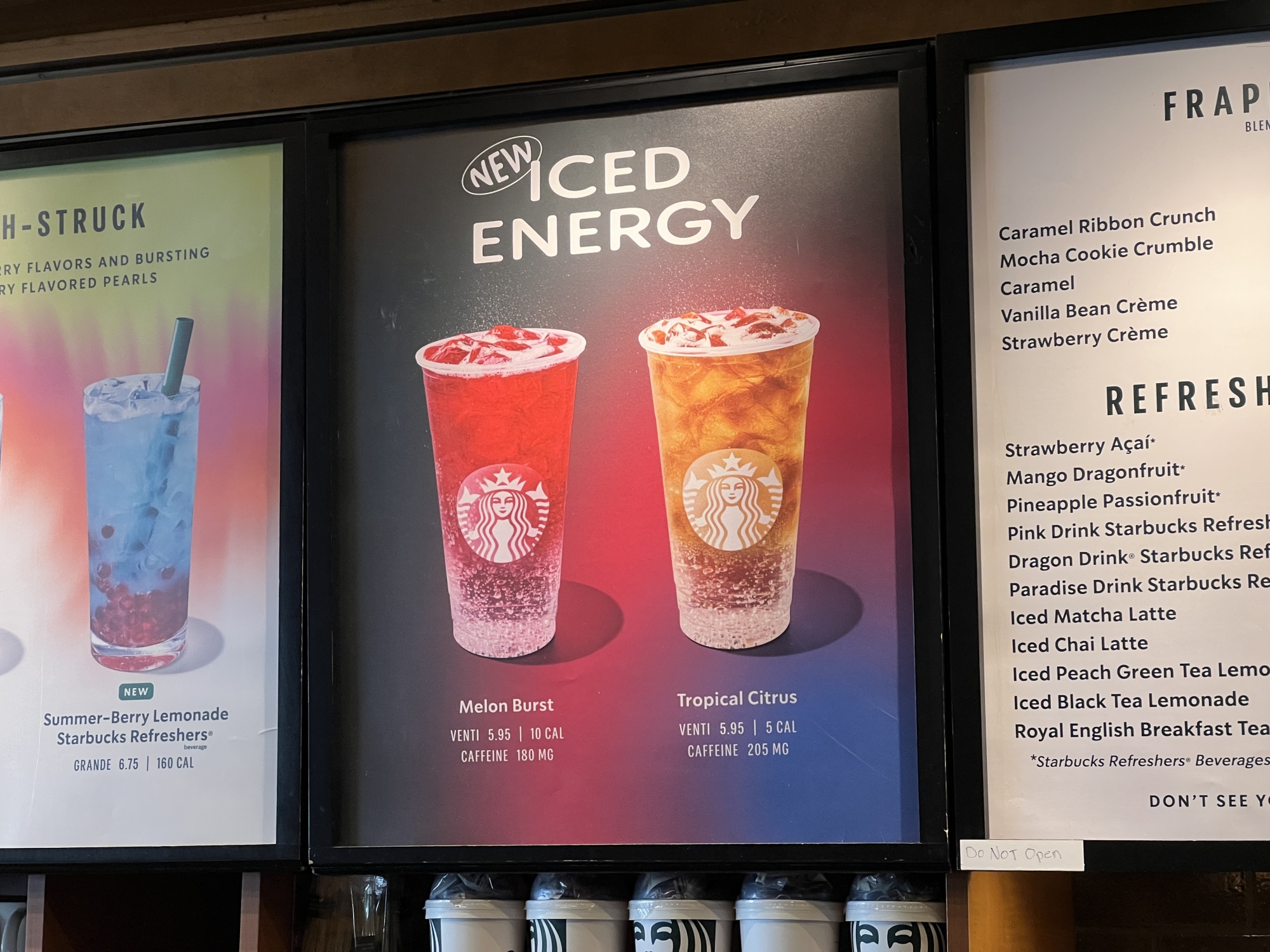

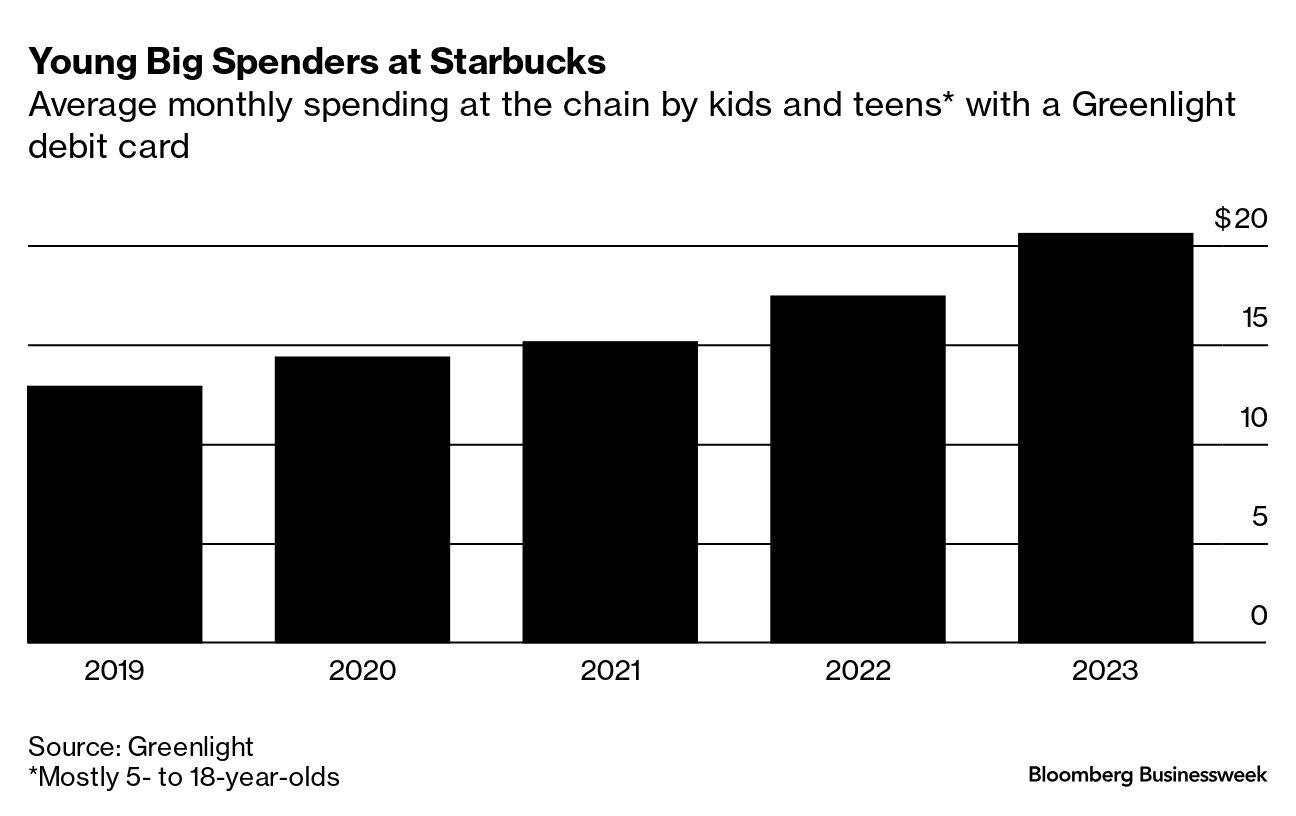

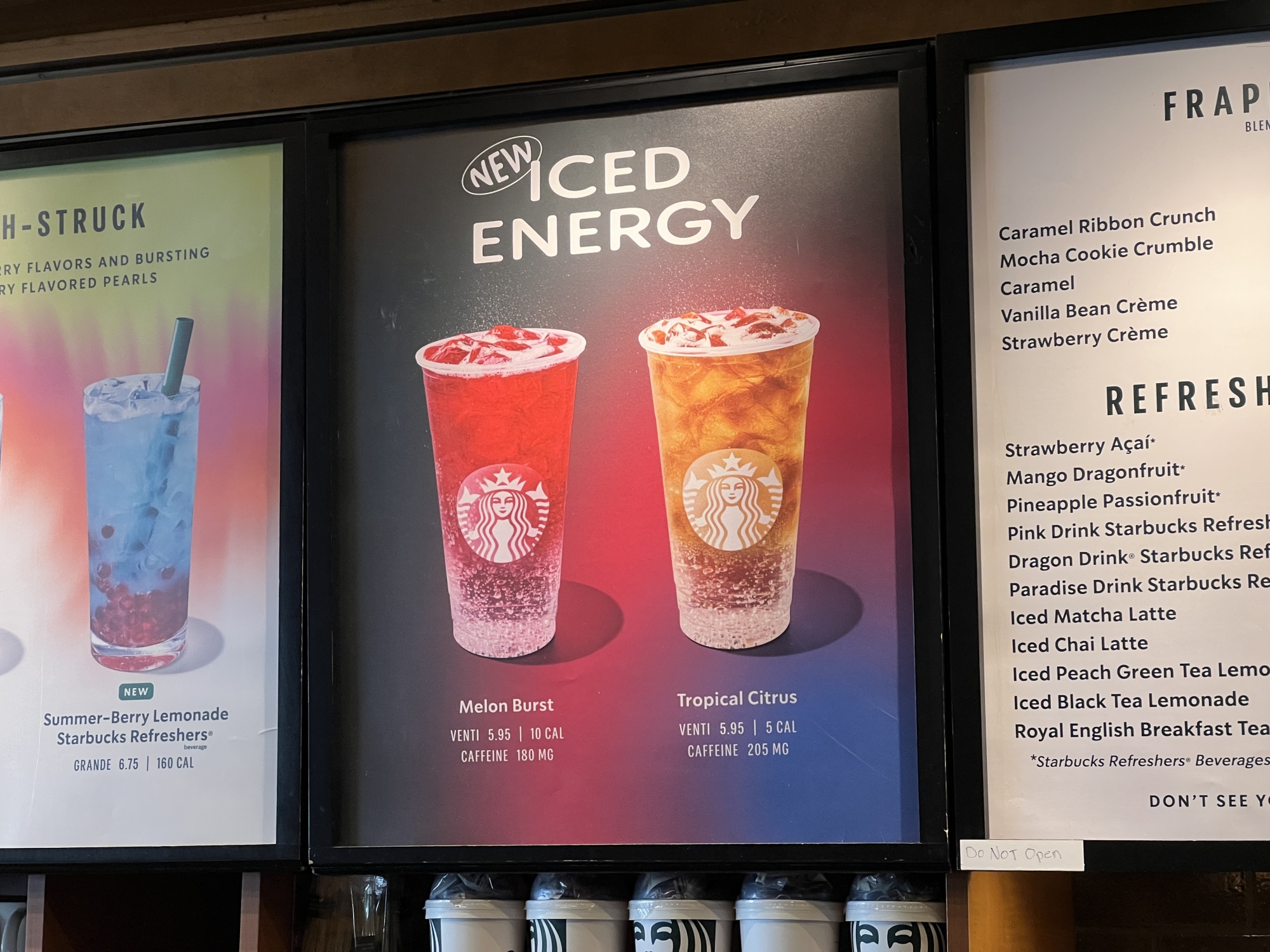

| Welcome to Bw Reads, our weekend newsletter featuring one great magazine story from Bloomberg Businessweek. Last week, Starbucks Corp. rolled out a series of changes aimed at making its cafes more appealing to coffee drinkers who want to hang out a while with a ceramic mug. Not mentioned was whether those changes would be a turnoff for teens, who've been drawn to all its sweet, Instagrammable drinks, as Deena Shanker and Daniela Sirtori wrote for Businessweek in October. (But we do know the free water, without purchase, is gone.) You can find the whole story from the archive online here. You can also listen to it. If you like what you see, tell your friends! Sign up here. Early one afternoon in June at a Starbucks in Brooklyn's Park Slope neighborhood, the kids start to trickle in. First a small group, two girls and a guy. Then two boys in private school uniforms. Victor, 12, stops in once or twice a day, he says, whether for a pastry, a medium no-ice strawberry açaí lemonade Refresher, a cookie Frappuccino or even just free water. Wren and Zoe, both 15, arrive next, with identical orders: venti strawberry açaí lemonade Refreshers and ham and Swiss croissants. Wren says she's been coming since she was 10, while Zoe claims to have started at 2, but both agree it all began with cake pops before they moved up the menu ladder. Wren says her parents used to object, worried it wasn't healthy. But then "everyone started getting it, so my parents would feel bad if I didn't." The girls now come in about four times a week after school. The real rush starts around 3 p.m. In one group of eighth-grade girls, several get a slightly different variation of a grande strawberry açaí Refresher—with the same amount of sugar as a Butterfinger, plus the caffeine of about a half an average cup of coffee. Cold drinks in bright hues and endless configurations are exactly what's in demand among Generation Z, those currently age 11 to 27 as the company defines it and a "key customer cohort for Starbucks," as then-interim Chief Executive Officer Howard Schultz put it on an earnings call a couple of years ago. Customization, he said, was "raising the ticket" and bringing "color and excitement to the Gen Z audience, and they immediately put it on social media." Some of the Park Slope kids work part time to finance their Starbucks habit—babysitting money mostly. Some make regular withdrawals from the Bank of Mom & Dad. "I just beg for money," one says. Others rely on a potent form of teen currency: gift cards. "Everybody knows all I want is Starbucks," says Tessa, 14. "Starbucks does take all our money, but we can't stop," says her friend Maya. "It's addiction," someone else chimes in. "It's consumerism," says another. Maya sums it up: "There's an excuse every day." The conversation turns to the fall, when they'll scatter to different high schools. Each has already gamed out their closest Starbucks. One says she "almost cried" at school when she realized the nearest location would be an 18-minute walk. Her friend quickly corrects her, saying she did cry: "There were tears in your eyes!" A similar tween and teen rush takes place at Starbucks locations across the country. While the Brooklyn kids are mapping out autumn logistics, siblings Aaron, 13, and Aryanna, 15, are camped out with their mom and math tutor at a Starbucks in Dallas. Although they used to be partial to decaf grande mocha Frappuccinos—the caffeine gave them headaches—they've moved on to grande frozen mango dragonfruit lemonade, which has about half the caffeine of the Frap and 33 grams of sugar, the equivalent of more than four Bomb Pop popsicles. In Greenvale, New York, for two kids—an 8-year-old and an 11-year-old—getting their venti summer-berry Refreshers is as easy as a swipe of a smartwatch. One high schooler at the same location says she had a teacher who was kind enough to pick up student orders during lunch. Selling cold, sugary beverages to middle and high schoolers wasn't exactly the original vision when Schultz opened his first coffeehouse, Il Giornale, modeled after Milan's espresso bars, in 1985. But he eventually discovered that catering to the tastes of the American masses would require veering further and further away from that quaint concept. While the vast majority of customers today are adults, Starbucks Corp. also sells a whole lot of sugar and caffeine to tweens and teens. What was begun reluctantly has evolved into a concerted effort to court young people that permeates product development and marketing in a strategic effort to create lifelong customers. "That is very much a long-term game," says Robert Byrne of market-research firm Technomic. Chains such as McDonald's Corp. have long drawn the ire of public-health advocates for using cartoonish mascots and cheap plastic toys to lure families with young children into consuming high-sugar, high-calorie foods. But Starbucks, which now has more US locations than the Golden Arches, has eschewed some of the more overt techniques and has aimed slightly older, allowing it to mostly bypass such criticism, even as it's morphed from a coveted third space for upper-middle-class professionals into a teen emporium. In recent years, Starbucks executives boasted that Gen Z had the highest "brand love" for the coffee chain of any cohort. Greenlight, a debit card company for kids, mostly age 5 to 18, says Starbucks was the fifth-most popular destination for their cardholders last year, falling behind only Amazon.com, Target, Apple and McDonald's. Starbucks gift cards are also the top food or restaurant cards for teens, ahead of both Chick-fil-A and McDonald's, according to market-research group KidSay.  "It is unquestionably 'the destination' " for kids between classes or after school, says Byrne. The habit has been handed down from parents shuttling children from school to soccer to wherever else and reinforced by social media as they get older. Then it gets bankrolled by parents when kids are allowed their first phone as young as age 9, often loaded with ordering apps, according to Technomic research. Dana Pellicano, Starbucks' head of product experience, says parents "want to enable their kids to very easily load up a Starbucks gift card and empower their kids to go in and get something that they believe might be good afternoon fuel." As far as many parents are concerned, at least it's not TikTok or another video game, or an even more expensive hangout like Sephora. The sugar, whatever. "Do you want to know how many times we refill our Starbucks account?" asks Jazha Cabrera, whose 13-year-old son used to go with her and who now brings his own friends. She says she adds $50 to his app every few days, more if he's treating. "If he's doing good and passing his classes, doing all his chores—what am I going to tell him, no?" Kyndra Russell, Starbucks' North American chief marketing officer, says the company's marketing targets 18- to 54-year-olds. "Starbucks does not market to children," the company said in a statement. It also pointed to its commitment to the Children's Rights and Business Principles, standards created with Unicef, Save the Children and the United Nations Global Compact. Those standards include a commitment to "ensuring that products ... to which children may be exposed are safe" and "restricting access to products ... that are not suitable for children." Starbucks said it doesn't share what percentage of its sales are attributable to customers under 18, but the menu is increasingly catering to Gen Z. Cold drinks, which are generally favored by younger customers, according to Starbucks, have consistently accounted for about 70% of the chain's beverage sales for at least the last three years. "The younger you go, the colder the beverage," then-Chief Marketing Officer Brady Brewer said in 2022 of the larger industry trend (he's now the company's head of international).  Menu featuring Starbucks' new Iced Energy drinks at a location in San Francisco. Photographer: Smith Collection/Getty Images As the cold-beverage arms race has heated up in recent years, Starbucks has faced increased competition. Boba tea cafes populate strip malls and city corners, burger spots like Jack in the Box peddle iced churro Creamaccinos, and culty brands including Celsius energy drinks are all the rage at CVS and Target (the latter of which also houses more than 1,700 in-store Starbucks cafes). All that is probably why Starbucks' newest offerings are only getting more frilly and far-out: brightly colored sparkling energy drinks, iced lavender cream oat milk matcha, neon concoctions with boba-tea-inspired pearls. Meanwhile, Starbucks is struggling to attract adults who are balking at $6 lattes. That's as it tries to appease an activist investor, conduct contract negotiations with unionized workers, quell boycotts about its perceived stance in the Middle East and revive its business in China. And for those busy grown-ups who are just fine with $6 lattes, the company can't seem to serve them up fast enough, with instances of 20-plus-minute wait times. In August, met with an overall decline in sales—a situation so rare it's only happened during two periods in the past 30 years, during the 2008 financial crisis and the pandemic—the company ousted its latest CEO in favor of Brian Niccol, who's turned around Chipotle Mexican Grill Inc. and Taco Bell in recent years. Niccol is now faced with the challenge that has dogged Starbucks for decades: mapping out its future as both an oasis filled with the aromas of Veranda blonde roast and a one-stop shop for kaleidoscopic liquid fun, a place where rowdy teens can gather after school without alienating the grown-ups. Plenty is riding on how he navigates that. Even as Starbucks' stock surged with Niccol's appointment, the company's shares were almost unchanged this year through Oct. 7, while the S&P 500 index climbed more than 19%. In September, on his second day on the job, Niccol outlined a plan reminiscent of Schultz's early days, which includes high-quality, handcrafted brew served in an atmosphere that encourages guests to linger as they once did. "It all starts with coffee," the new boss told employees in an internal forum, according to a transcript seen by Bloomberg Businessweek. But Niccol is also the guy who put the "fast" back in fast-casual at Chipotle and transformed Doritos into supersize taco shells at Taco Bell. "I'm not saying we're not going to sell other drinks, OK. We will," he added. "We'll probably have to figure out what is the appropriate amount of other drinks." Keep reading: How Starbucks Became a Sugary Teen Emporium |

No comments:

Post a Comment