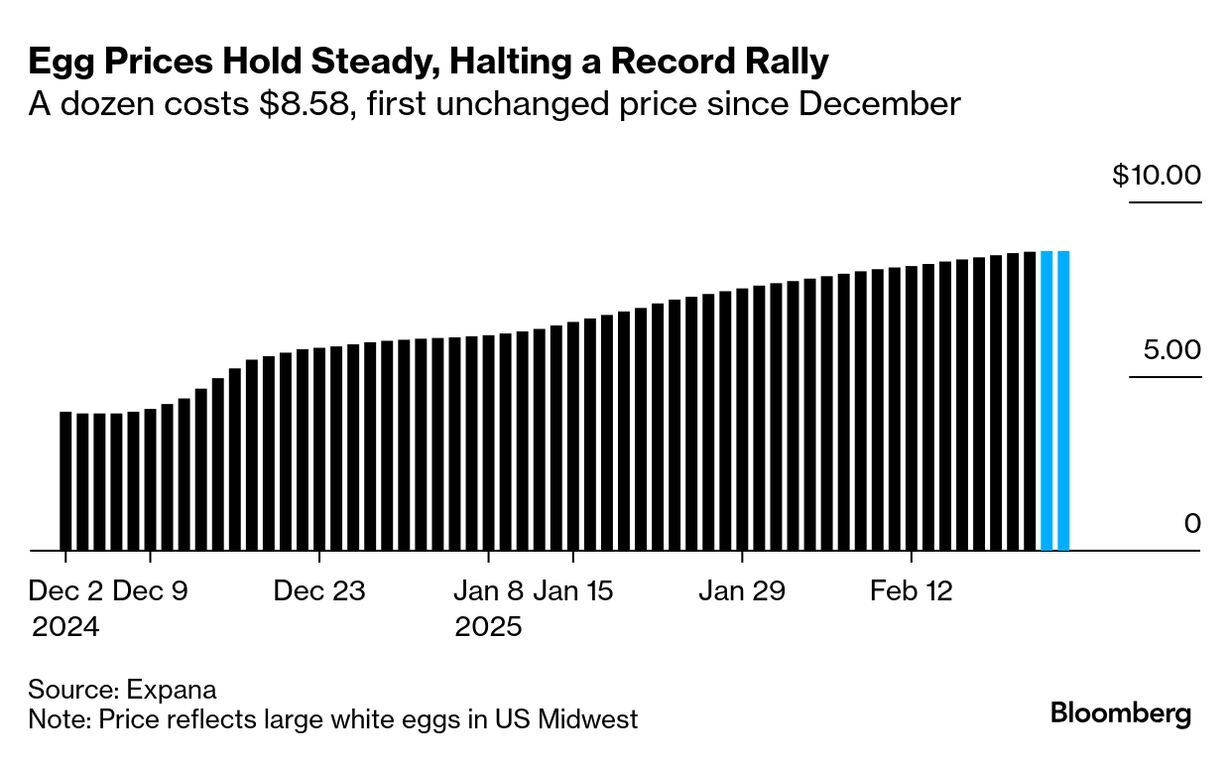

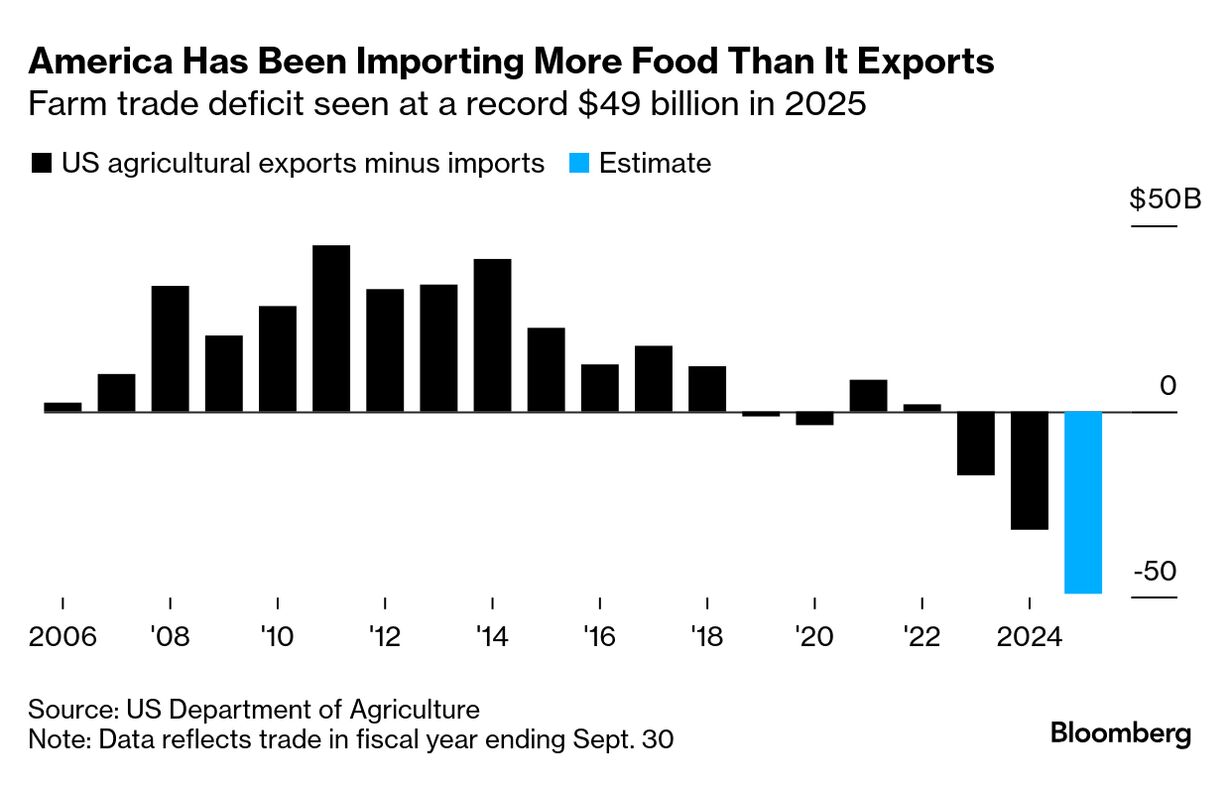

| US President Donald Trump this week summed up the extent of the egg crisis when he called it a "disaster." Across the country, grocery stores are limiting customer purchases, restaurants are adding surcharges and border control agents are battling egg smuggling. Even comedians and social media influencers have been rolling out musings on a daily basis. Prices have soared to a record of over $8 a dozen, driven by the worst-ever outbreak of avian flu in the US and contributing to broader inflation pressures. Millions of birds have been killed in just a few months as egg-laying farms get hit from California to North Carolina, forcing the government to take steps to tackle the problem. "Eggs are a disaster," Trump said during a Cabinet meeting on Wednesday. "We have to get the prices down, get the inflation down, the prices of eggs and various other things." As Bloomberg Opinion's Patricia Lopez writes, the crisis is now Trump's to deal with. But she says his administration has only made matters worse with mass firings that included an unconfirmed number of people working on the bird flu response. Prices could jump 41% this year, the US Department of Agriculture says. America is now looking to other countries to come to the rescue. It will try to import between 70 million and 100 million eggs in the next month or two, the USDA said this week as it announced a $1 billion plan to address bird flu. The situation in the US is already causing ripples elsewhere. Turkey — one of the world's biggest egg shippers — introduced a tax on exports to help control domestic prices, as bird flu outbreaks squeeze global supplies. Eggs have become more expensive in other regions as well, albeit for different reasons. In the past five years, prices surged across Europe, South Africa, India and Brazil to name a few, according to Rabobank. Demand for eggs remains strong, said Nan-Dirk Mulder, Rabobank's senior global specialist for animal protein. While bird flu is an important driver of prices, the rise of egg-based breakfast sales, high animal-feed costs and a shift to cage-free farming are also factors, he said. Tune In for More Listen to this Big Take podcast where farmer Jim Hayes and Bloomberg's Tracy Alloway and Joe Weisenthal talk about bird flu and egg prices. Watch Bloomberg TV on the success of the McDonald's Egg McMuffin. And for more chicken musings, catch up on the Odd Lots' Beak Capitalism three-part podcast series. —Agnieszka de Sousa in London |

No comments:

Post a Comment