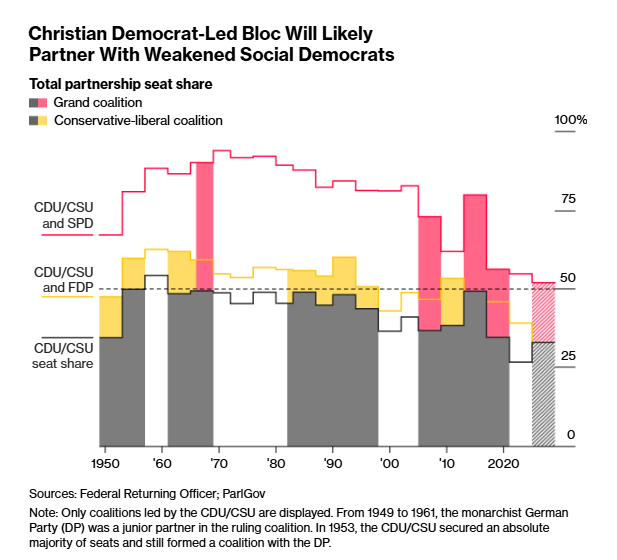

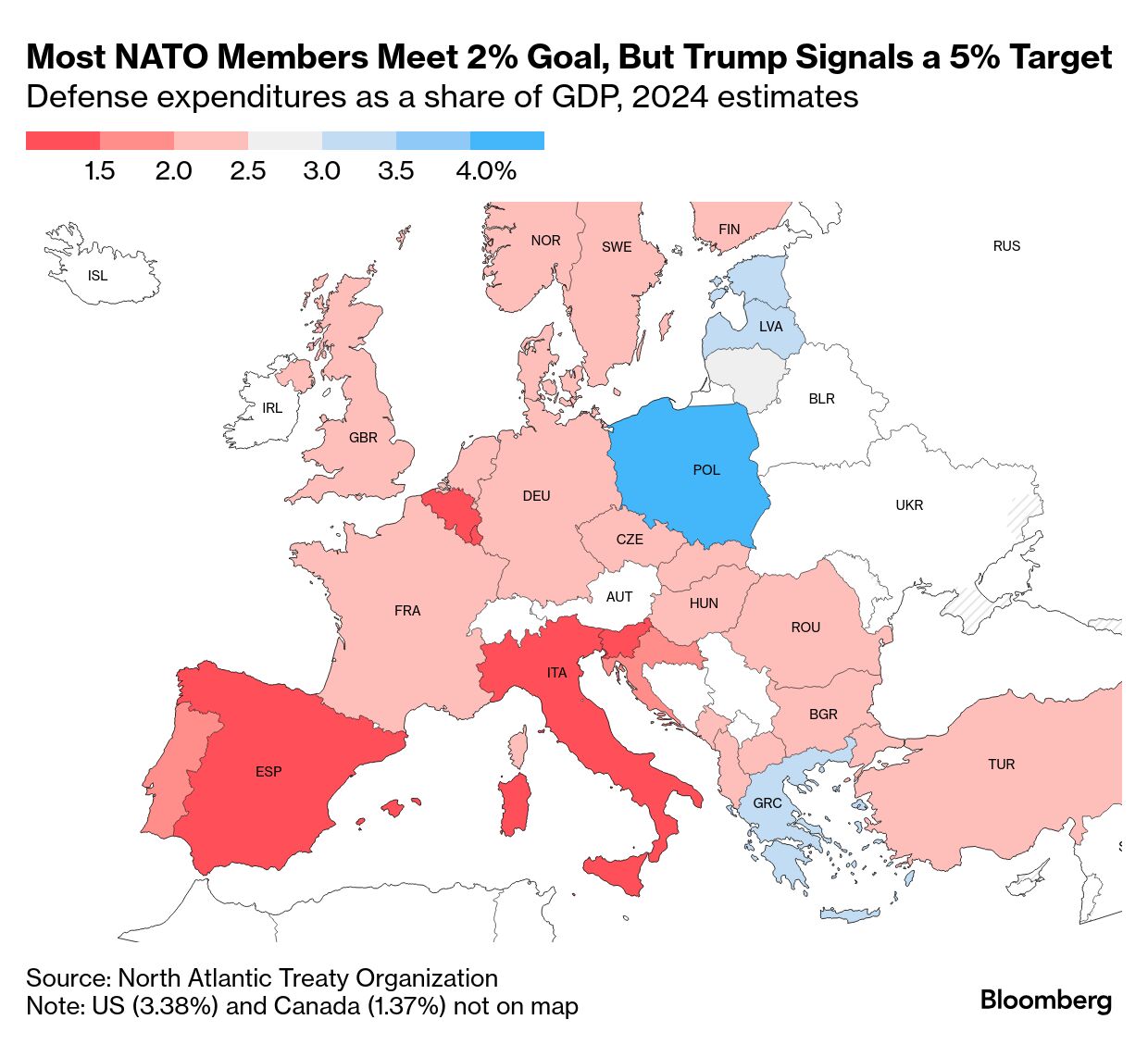

| I'm Zoe Scheeweiss, an economics editor in Frankfurt. Today we're looking at the fiscal constraints a new German government faces on defense spending. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. Confronting Electoral Realities | Germany's two mainstream parties embarked today on exploratory talks to form a coalition, with defense spending among the top issues. The strong showing of fringe parties in Sunday's election means that winner Friedrich Merz of the conservative CDU/CSU bloc has only one viable partner: the center-left Social Democrats. That coupling, known as a "grand coalition," has ruled repeatedly in the past, though this time it will have a relatively thin majority of 52% of seats — far below the 80‑90% "supermajorities" the parties used to command. More importantly, the far-right AfD and far-left Linke have a blocking minority on any tinkering with the constitution. Nowadays that means changes to Germany's so-called debt brake, which limits structural budget deficits to 0.35% of gross domestic product. While Merz has already voiced a preference for finding cost savings and boosting economic expansion over a sweeping reform of the debt brake, his lack of seats means that any plans to ramp up military outlays will face a major obstacle once the new parliament convenes in late March. To avoid that, officials from Merz's Christian Democrats and the SPD are already discussing ways to get around the tight borrowing restrictions. They're considering pushing a vote through the outgoing parliament, with a €200 billion special defense fund among the options, sources told us. Germany finally managed to reach NATO's goal to spend 2% of GDP on defense last year, but it will be very difficult to maintain that level once a special €100 billion fund expires at the end of 2027. With Trump now pushing for heftier military expenditure, European leaders have realized they must be able to defend themselves. As Antonio Barroso and Martin Ademmer of Bloomberg Economics put it, none of the options look easy for Merz. - While calling the back the old parliament "might be legally feasible — and there's some precedent — it would be politically problematic."

- Negotiating with the new parliament would mean Merz would have to win over the Linke, which opposes military spending.

- An emergency suspension of the debt brake — which only requires a simple majority — "provides only a temporary solution, increasing flexibility for the 2025 budget but leaving the question of next year unclear."

The Best of Bloomberg Economics | - As the US president lashes out at government agencies across Washington, one of his favorite first-term targets – the Fed – has been getting a relatively easy ride.

- Trump sees the potential for a US-UK trade deal, with Britain looking to negotiate a narrow agreement focused on technology and AI.

- Bank of England Deputy Governor Dave Ramsden said policymakers will have to take "great care" when cutting rates, dropping his formerly dovish bias.

- India and the European Union will try to seal a trade deal this year.

- Turkey emerged from a recession in the fourth quarter, while India's economy rebounded in the period.

- Singapore's leader wants to give cash to residents to help with the rising cost of living. Now he's facing heat from the opposition for it.

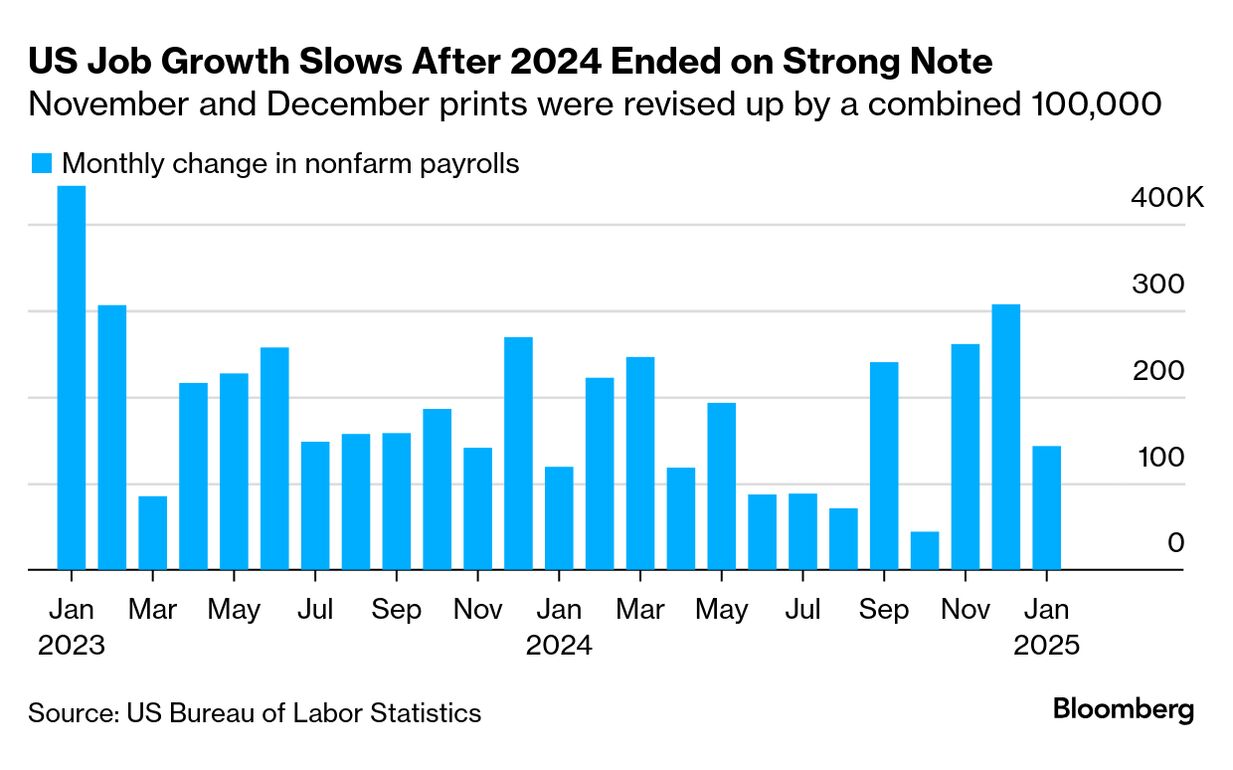

The Bloomberg Economics team sees an increasing risk that the drive by the Trump administration's DOGE group to shrink federal payrolls will have a significant impact on the US job market this year. "If attrition and DOGE-related cuts continue, the total direct and indirect job losses from DOGE efforts could reach 535,000 by year-end," Anna Wong, chief US economist, wrote this week. "We think laid-off federal workers will face a slow absorption into the private sector, foreshadowing a rise in the unemployment rate." The jobless rate could get pushed up to 4.5% in the fourth quarter, versus the current consensus baseline forecast of 4.2%, Wong wrote. After running scenarios through an economic-shock model, she said "this exercise shows it's entirely plausible — even likely — that DOGE cuts could neutralize the additional inflation from tariffs." And that in turn would suggest the Fed might lower rates more than financial markets are anticipating, she wrote. - For the full note on the Bloomberg terminal, click here.

|

No comments:

Post a Comment