| Bloomberg Evening Briefing Americas |

| |

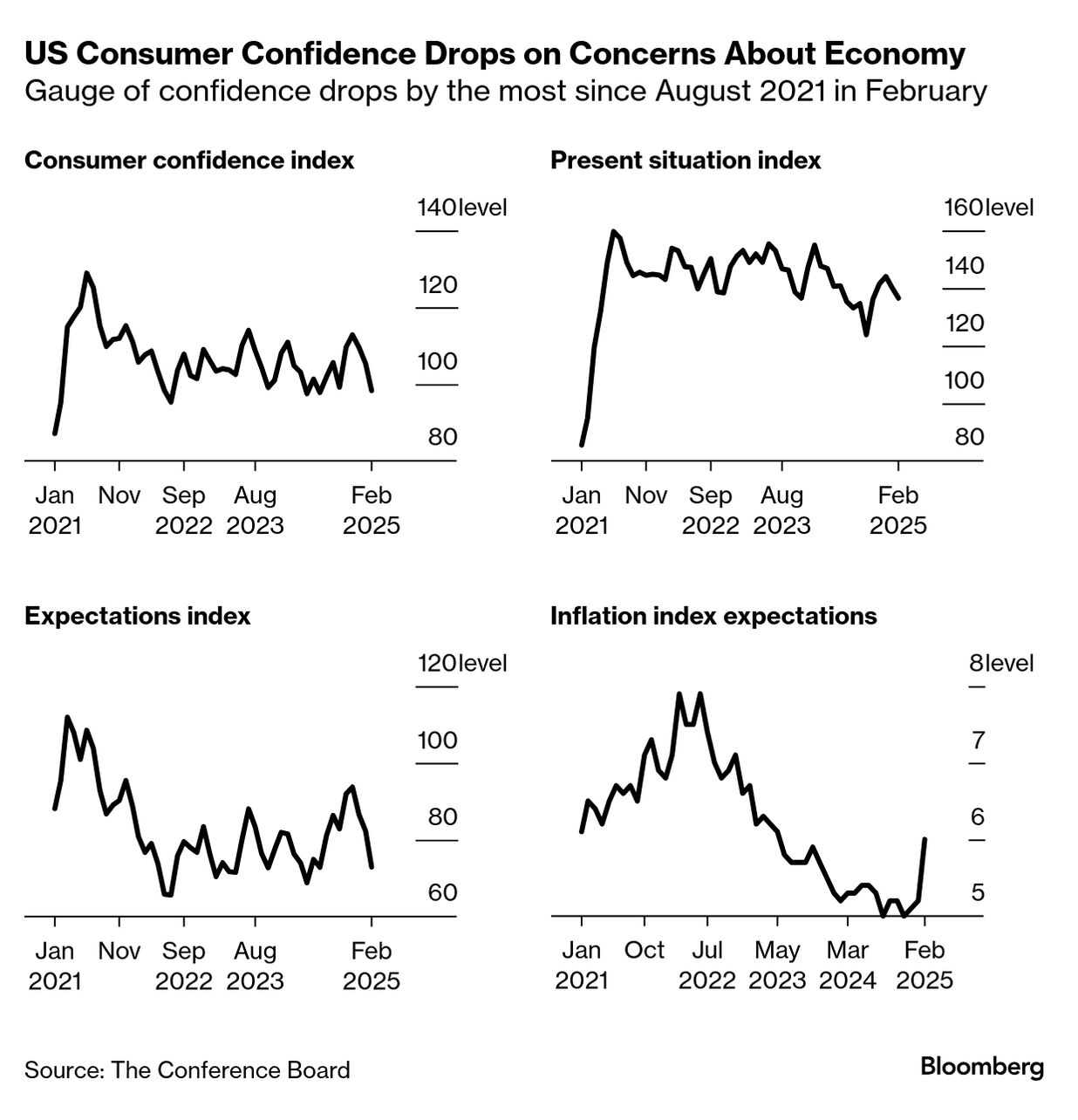

| US consumer confidence fell this month by the most since August 2021 on concerns about the outlook for the broader economy, adding to a growing stack of indicators that uncertainty over President Donald Trump's policies has Americans increasingly worried about their economic future. The Conference Board's gauge of confidence decreased 7 points in February to 98.3, marking the third straight decline, data released Tuesday showed. The figure was below all estimates in a Bloomberg survey of economists. Stocks and bond yields fell after the report. The drop in confidence was broad across age groups and incomes. Consumers were more pessimistic about current and future labor-market conditions as well as the outlook for incomes and business conditions. Perceptions of present and future financial situations worsened and the share of respondents expecting a recession in the next year rose to a nine-month high. That pessimism has Americans cutting back their spending: According to a new study from Wells Fargo, more than half of consumers are delaying major life plans due to uncertainty over the economy and the consequences of Trump's tariff threats. Of those, about a third said they were putting off buying a home while one in six have postponed education plans—and one in eight have pushed back retirement. —Jordan Parker Erb | |

What You Need to Know Today | |

| Things weren't too chipper on Wall Street today as Magnificent 7 stocks slid into a correction. The seven behemoths that powered a 54% surge in US stocks over two years tumbled into a deep red territory Tuesday, highlighting a fraught moment for American equities that have churned near records for most of 2025. The Bloomberg Magnificent 7 Index slid as much as 3.4% Tuesday, extending its drop from a Dec. 17 record past 10%. The group has shed a combined $1.6 trillion in market value in that span. Leading the dive into the well was Tesla, plunging 37%. | |

|

| Wall Street's scramble to accommodate Trump has been on broad display as financial firms and banks flee DEI. Most recently it's been Citigroup and its diversity U-turn that marked the trend. Just two months ago, the bank's head of talent said "DEI is part of our DNA," calling it not only a priority but "a business imperative." But on Thursday, Chief Executive Officer Jane Fraser announced she was ending the diversity, equity and inclusion goals she set less than three years ago, citing an executive order by Trump that banned "illegal DEI" policies by federal contractors.  Jane Fraser Photographer: Hollie Adams/Bloomberg | |

|

| A group of federal workers quit in protest over Elon Musk's efforts to eviscerate portions of the federal government on Trump's behalf. Twenty-one employees of the US Digital Service, the actual government agency taken over by Musk's "Department of Government Efficiency," said they would step down Tuesday. The workers resigned in protest of the billionaire's actions to dismantle federal agencies and dismiss workers. Earlier this month, Trump fired one-third of USDS staff. | |

|

| Ukraine has agreed with the Trump administration on a minerals deal, in what the White House sees as a first step toward reaching a ceasefire with Russia. While the agreement to jointly develop any critical minerals, oil and gas doesn't spell out any specific security guarantees as a quid pro quo, US officials have said that binding Ukraine to the US through economic ties couldn't hurt. Ukraine's Cabinet is expected to recommend on Wednesday that the deal be signed.  British Prime Minister Keir Starmer, right, and Ukrainian President Volodymyr Zelenskiy meet in front of Mariinskyi Palace last month. The UK and Europe are discussing how to better assist Ukraine in its defense against Russia's three-year-old invasion. Photographer: Carl Court/Getty Images Europe | |

|

| Hedge funds are facing fresh watchdog scrutiny over macro wagers. The world's top financial stability regulator is setting up a dedicated taskforce to unmask areas where shadow banks could spark a broader crisis, said Klaas Knot, the chair of the Financial Stability Board (FSB). According to Knot, the carry trade, used by investors to place leveraged bets on interest rates, and the basis trade, a popular wager using financial gearing to exploit price discrepancies in government-bond markets, are "two excellent examples" of areas the FSB could focus on. | |

|

| Unilever has tapped a new leader. After 37 years at the owner of Dove Soap and Ben & Jerry's ice cream, Fernando Fernandez is finally getting his shot at the top job. Currently chief financial officer, the Argentinian is replacing Hein Schumacher, who was abruptly ousted as CEO today after less than two years on the job. Schumacher's departure is potentially a signal that Unilever's board has been dissatisfied with the brand's pace of restructuring—something it hopes Fernandez can supercharge. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment