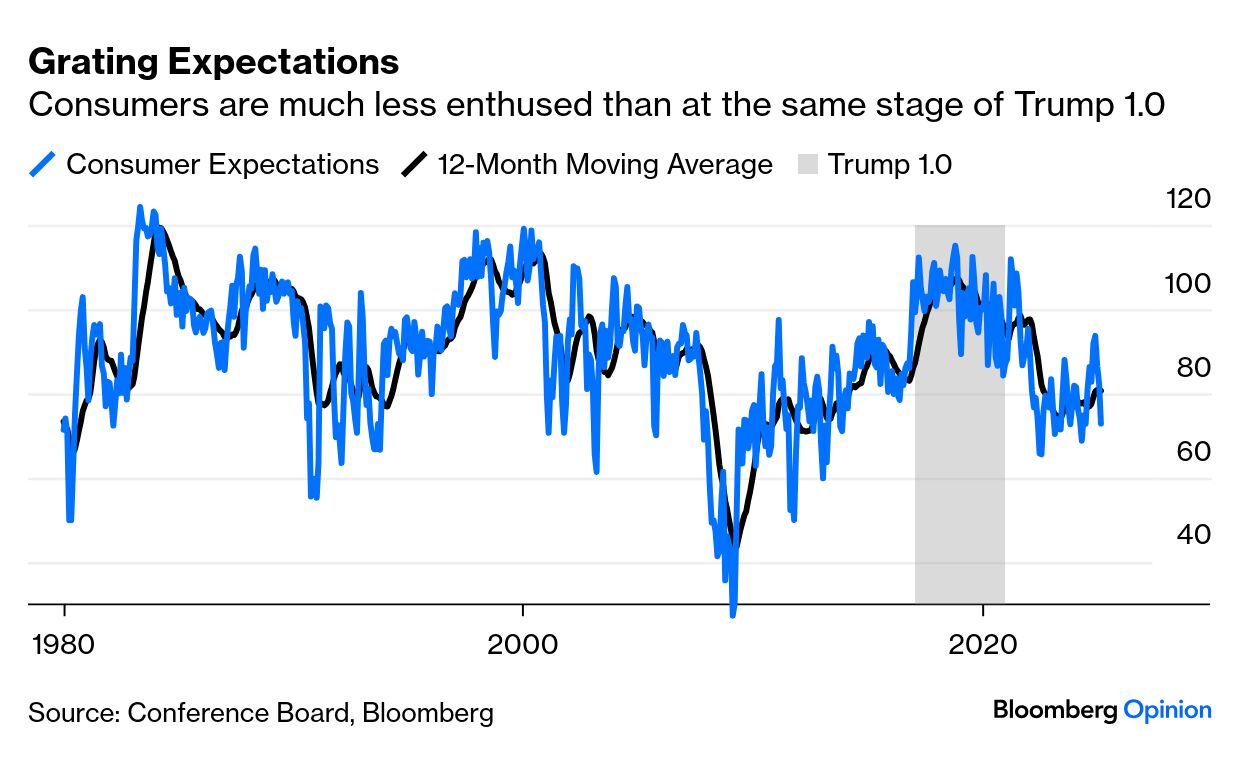

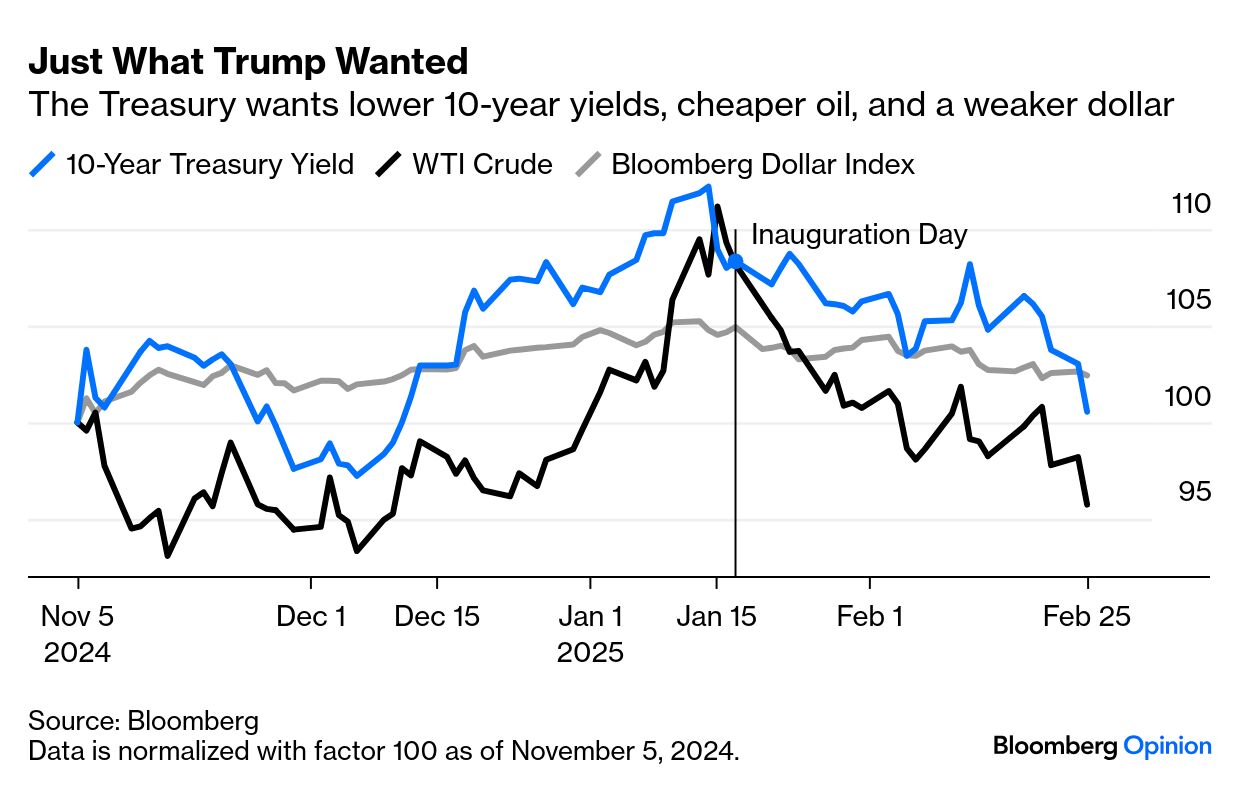

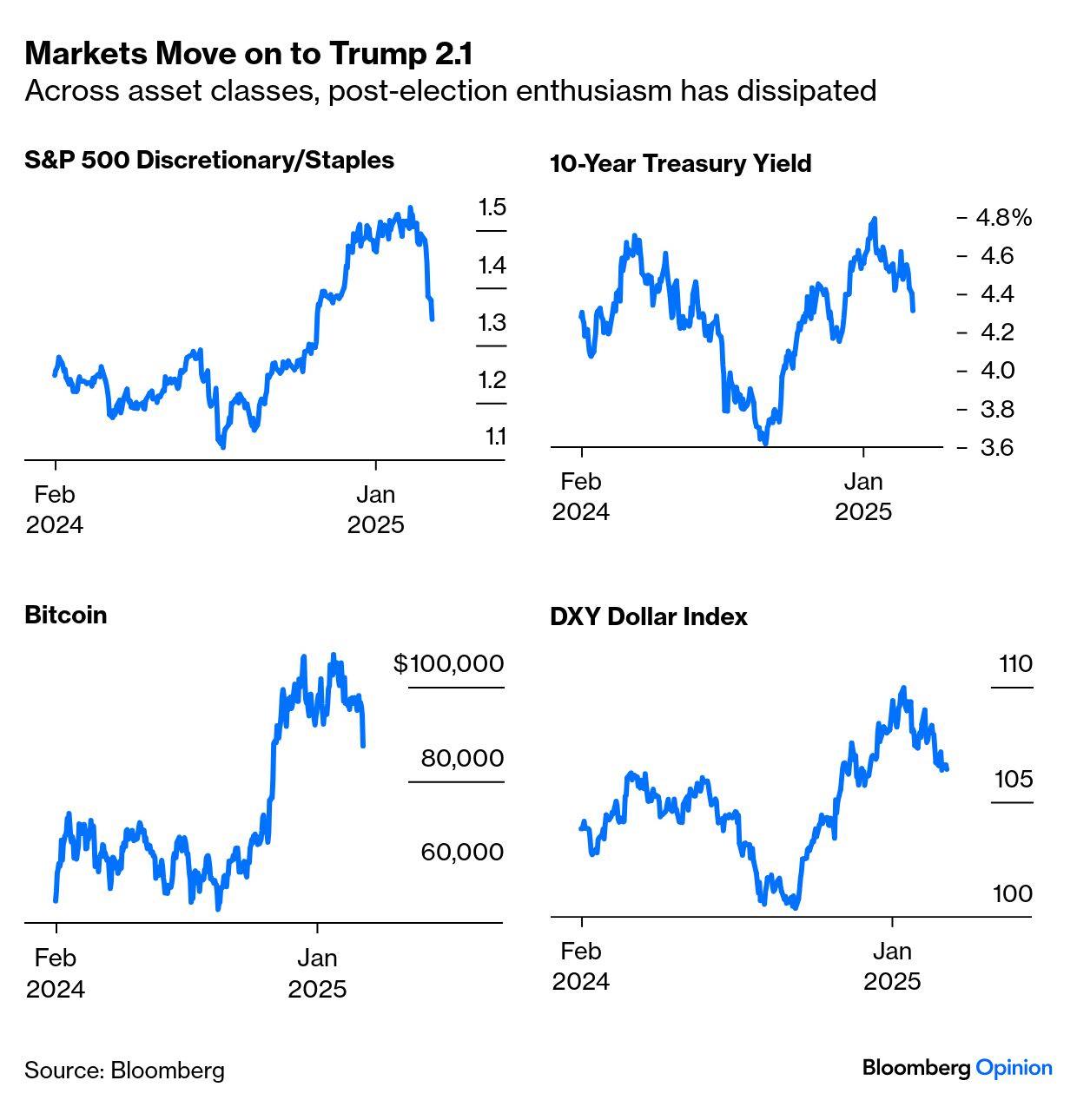

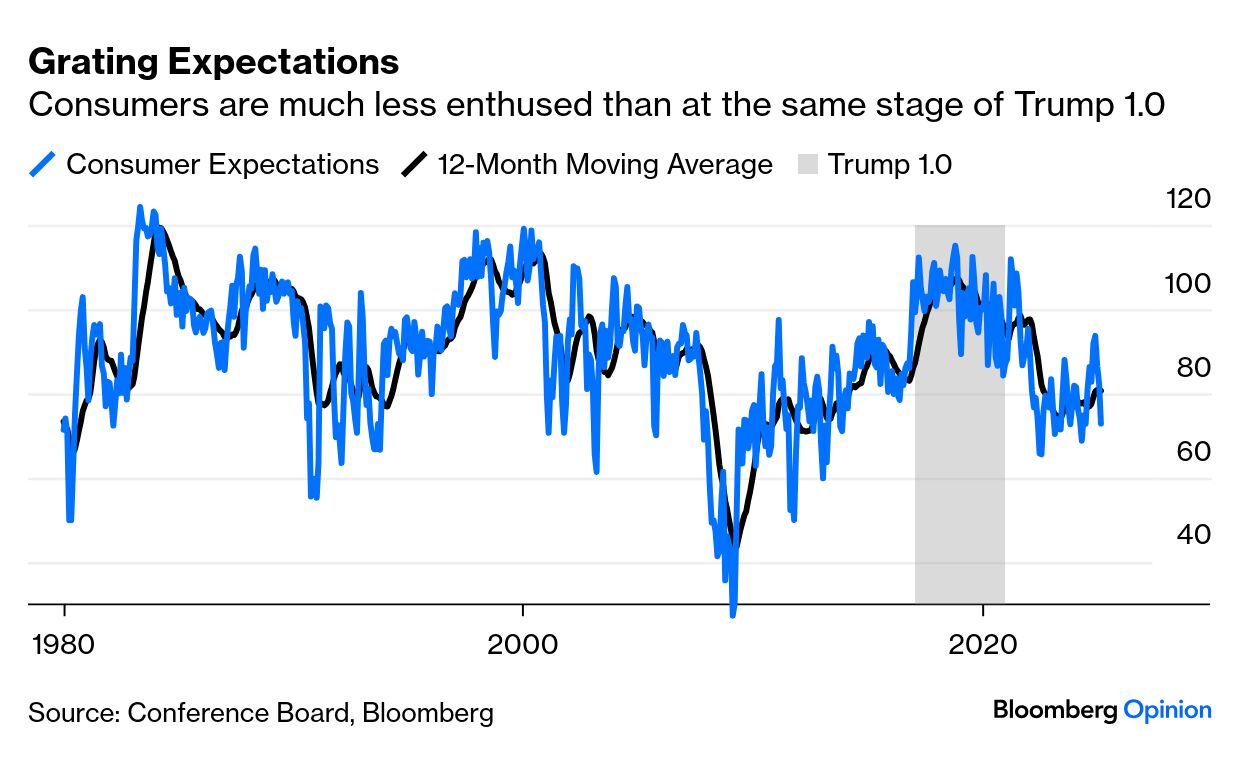

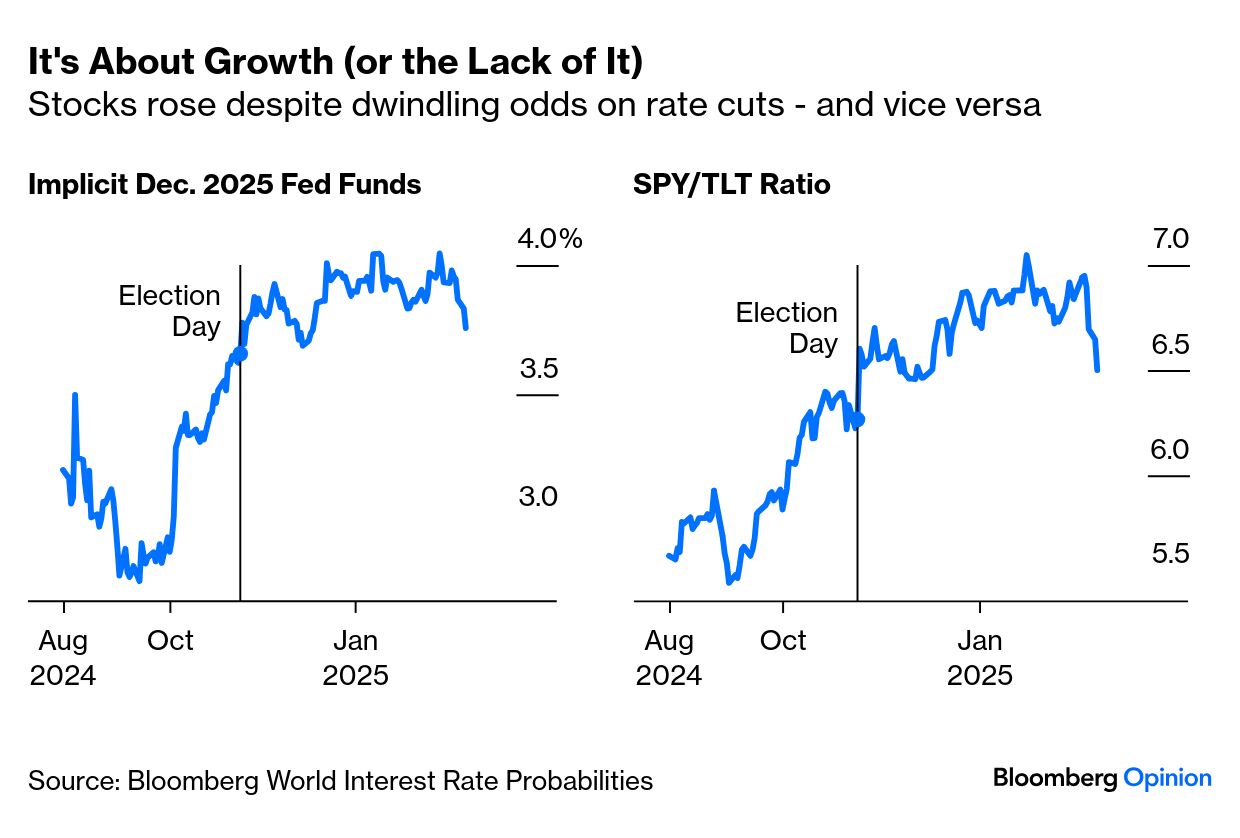

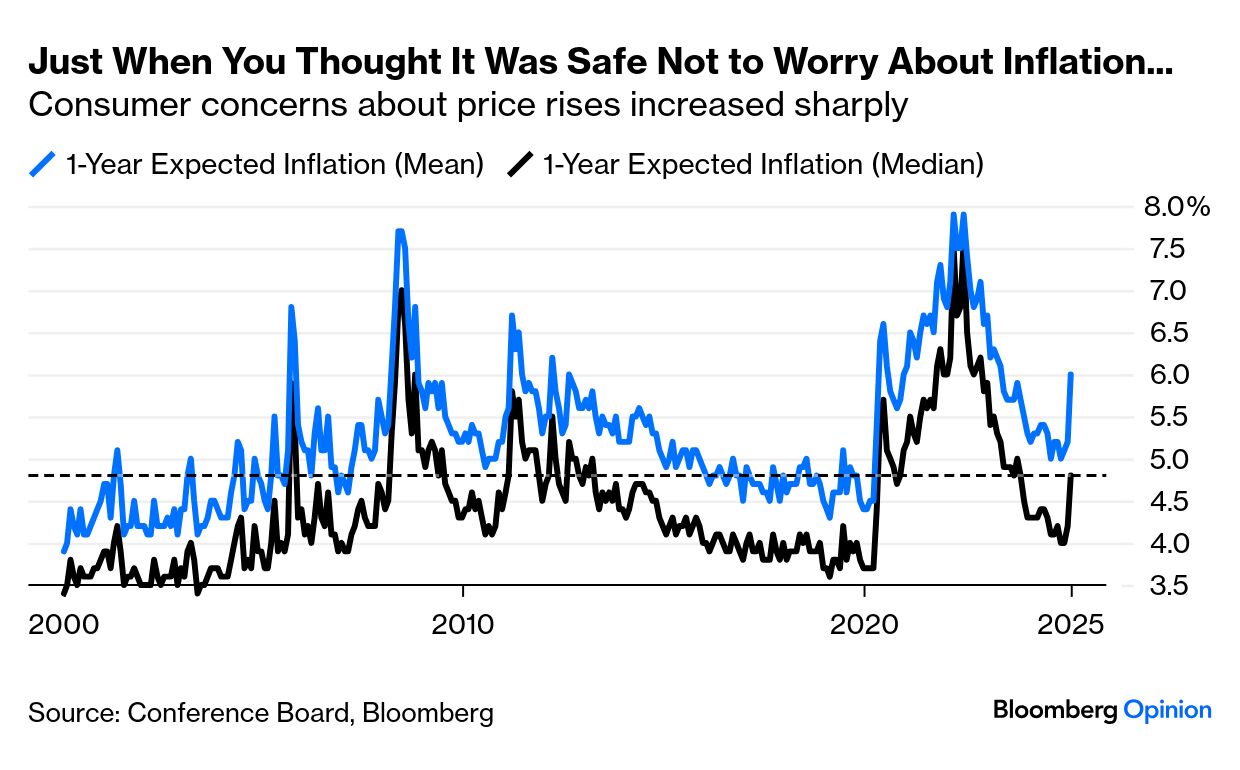

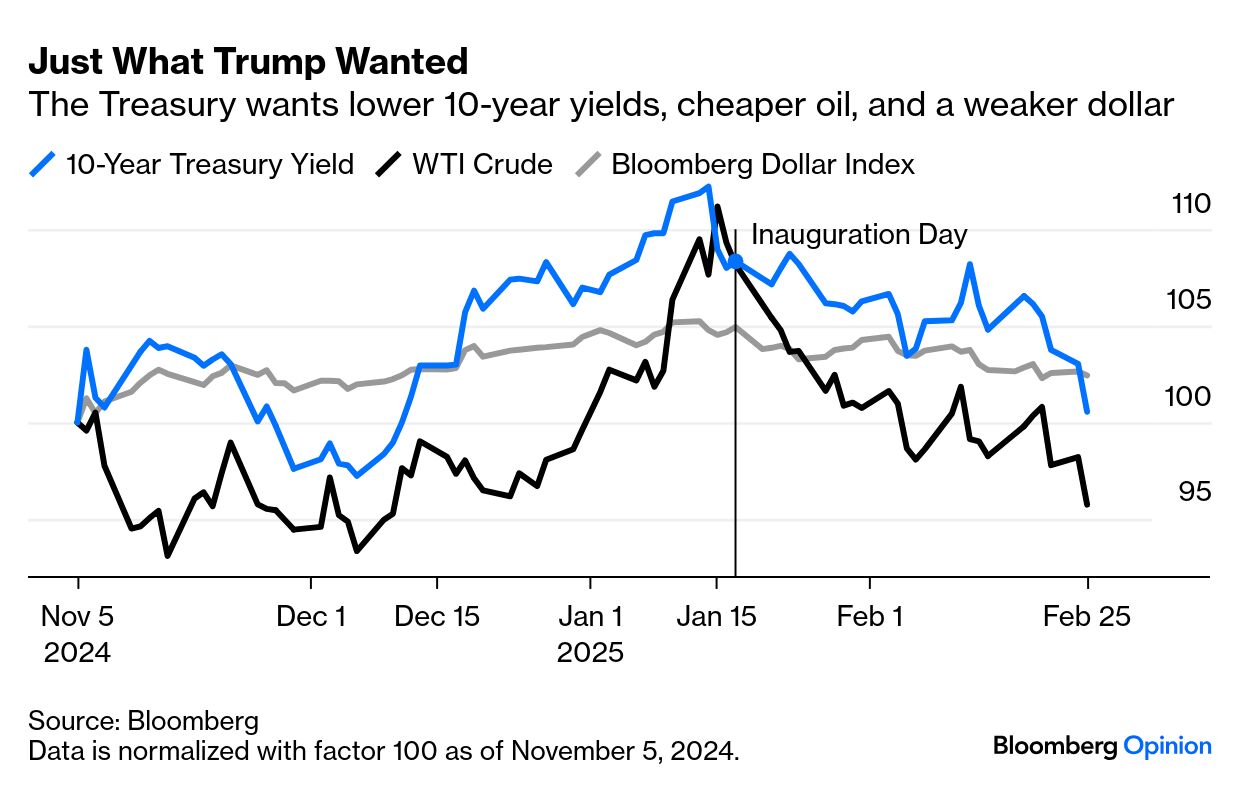

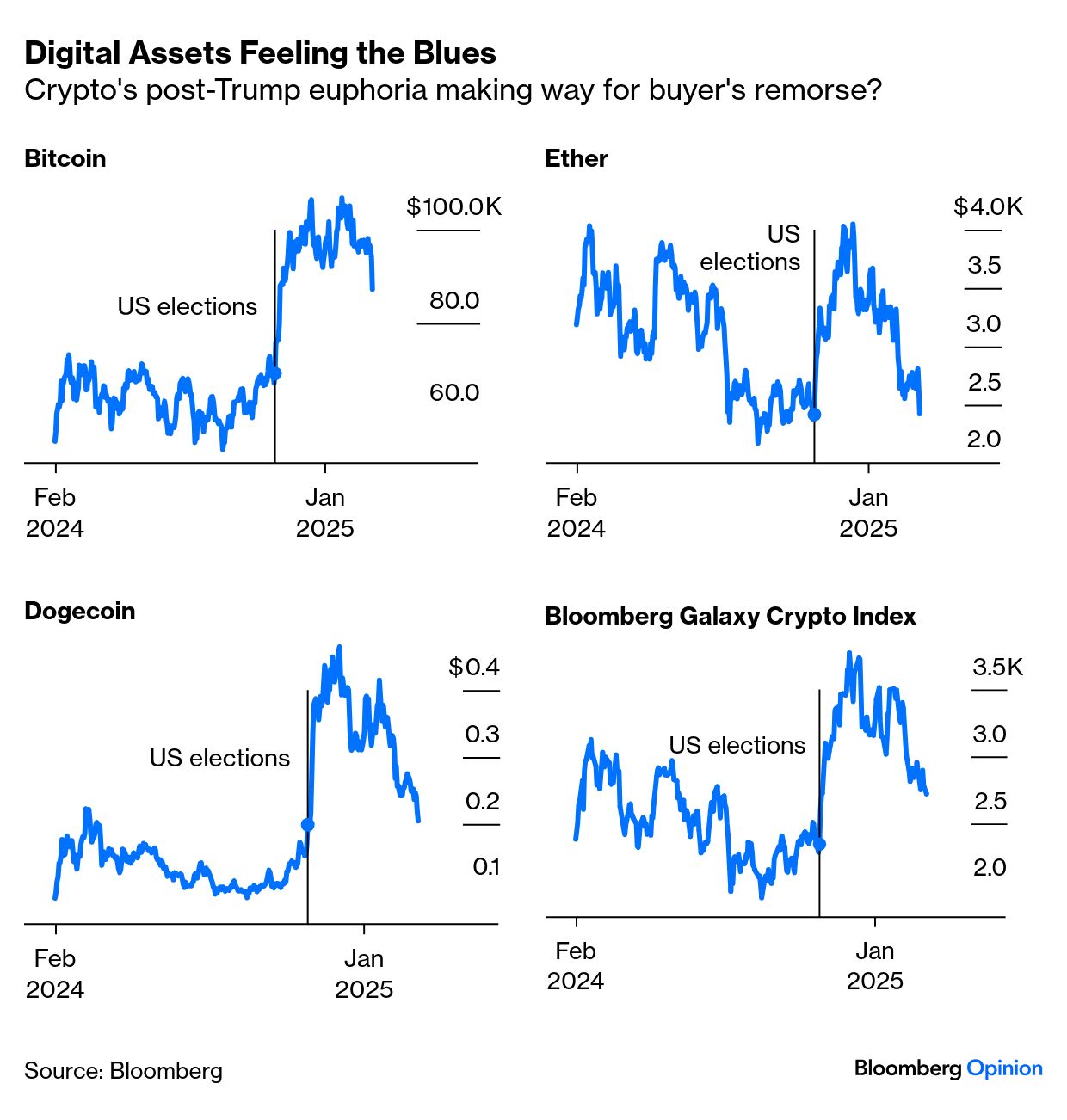

| Whatever happened to the Trump 2.0 American Exceptionalism Trade? With a pro-growth president devoted to deregulation, and bent on asserting US dominance over everyone else, the conventional wisdom was to pile into US assets and crypto, and brace for bond yields and the dollar to surge higher. All that happened in the weeks after the election. But since Donald Trump actually took office on Jan. 20, and particularly in the last week, all the Trump trades have reversed: In large part, this is a renewed growth scare. Angst that the DOGE job cuts could slow the economy in the near term is part of it. Business surveys have been downbeat, while the latest Conference Board survey of consumer sentiment, published Tuesday and the first since Trump took office, dropped sharply. In his first term, expectations rose immediately; this time, even though his arrival in office has been accompanied by far more excitement and action than he generated in the first, it seems consumers are more dubious:  The growth scare has also shown up in a sharp move in rate-cut expectations from the Federal Reserve. The ratio of stocks to bonds (proxied by the popular ETFs SPY and TLT) has moved perfectly in alignment with the futures contracts trying to predict the fed funds rate at the end of this year. Stocks don't appear reliant on rate cuts, as they surged in the last few months of 2024 even as projected December 2025 rates rose by more than a percentage point. What's happening now is plainly a dose of nerves about growth: And yet, inflation expectations are also going up — a move that all else equal would imply that fed funds would have to rise, not fall. This is what just happened to the Conference Board's measure of expected inflation for the next 12 months, on both a mean and median basis: The Conference Board doesn't break down its respondents by political identification — we can assume that Democrats are far more bearish about increasing inflation than Republicans. However, the median could not have risen so much without a significant cohort of Independents and Republicans adjusting their views higher, presumably because of fears of what tariffs will do to prices. There's a name for a growth scare combined with rising inflation expectations. "If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck," comments Vincent Deluard of Stonex Financial. "Similarly, if growth slows, inflation accelerates, gold soars, and the dollar rolls over, then it is probably stagflation." The Road to a Mar-a-Lago Accord: Another View | Alternatively, it's possible to look at what's going on as the success of the Trump plan. The markets expected higher yields and a stronger dollar, because they were the natural consequence of the tariffs and pro-growth policies the president was advertising. But Scott Bessent, the treasury secretary, has been vocal about three aims: lowering the dollar, the 10-year yield, and the oil price. If you can somehow get all of these things while going through with tax cuts, deregulation, and a trade war, then the economy should be in great shape. And indeed, after all three target prices rose uncomfortably after election day, they have come down since inauguration:  To knit all these ideas together, there is the prospect of a Mar-a-Lago Accord, in which the US would somehow convince other countries to engineer a lasting devaluation of the dollar. Points of Return will come back to this. For now, the broad ideas have been laid out by former colleague Gillian Tett in the Financial Times, and Jim Bianco of Bianco Research explained them on the Odd Lots podcast. Such an accord would be very difficult, but the possibility should be taken seriously. Without some such deal, however, it's hard to see how a falling dollar can be sustained if the administration steams ahead with big tax cuts and tariffs. Oxford Economics is clear: "We expect the broad dollar index to pick up steam over the rest of 2025. The belief that US tariffs are a negotiating tool, which led to dollar softness this month, has now become the consensus view." When and if tariffs are raised — and it still seems very likely that they will be — we'll move from Trump 2.1 to 2.2. Bitcoin's biggest monthly loss since April is the sternest test of crypto devotees' belief in the HODL (hold on for dear life) creed since the arrival of an administration that had been predicted to be a boon for the asset class. Since it peaked near $106,000 apiece the day after the inauguration, it has lost nearly a fifth of its value — an unsettling fall from grace for what was thought to be the quintessential Trump trade. That said, the world's biggest cryptocurrency, trading near $87,000, is up by over 30% since November's election eve, and the other major crypto plays are holding on to gains: The correction was more brutal in other digital assets such as ether and dogecoin, the cryptocurrency enthusiastically hyped by Elon Musk, but that doesn't cushion the blow for Bitcoin investors. Crypto is prone to volatility, as its followers are always anxious to point out, but it has become increasingly institutionalized with the arrival of crypto exchange-traded funds and the Trump trade. No longer a totally separate asset class, crypto can interact with equities and bonds. Academy Securities' Peter Tchir notes there has been a correlation between asset growth in Bitcoin ETFs, which have been on offer for just over a year now, and stocks' performance. Since the Securities and Exchange Commission approved Bitcoin ETFs early last year, they have attracted more than $100 billion, and Tchir argues that this can influence portfolio decisions. Michael Saylor's MicroStrategy Inc. (MSTR), a member of the Nasdaq-100 that is primarily a play on Bitcoin, also creates a bridge between the cryptocurrency and equities. Tchir complained that almost 3% of MicroStrategy's float was taken up by a leveraged single-stock ETF: The single-stock leveraged ETFs are not a product I understand the need for, but they can be dangerous on a big move to the downside. MSTR trades at a significant premium to its value in Bitcoin. I think the crypto world is more tied to equities than at any previous time and that is increasingly scary… Between the ETFs and MSTR, we are seeing a lot more correlation and impact on daily trading.

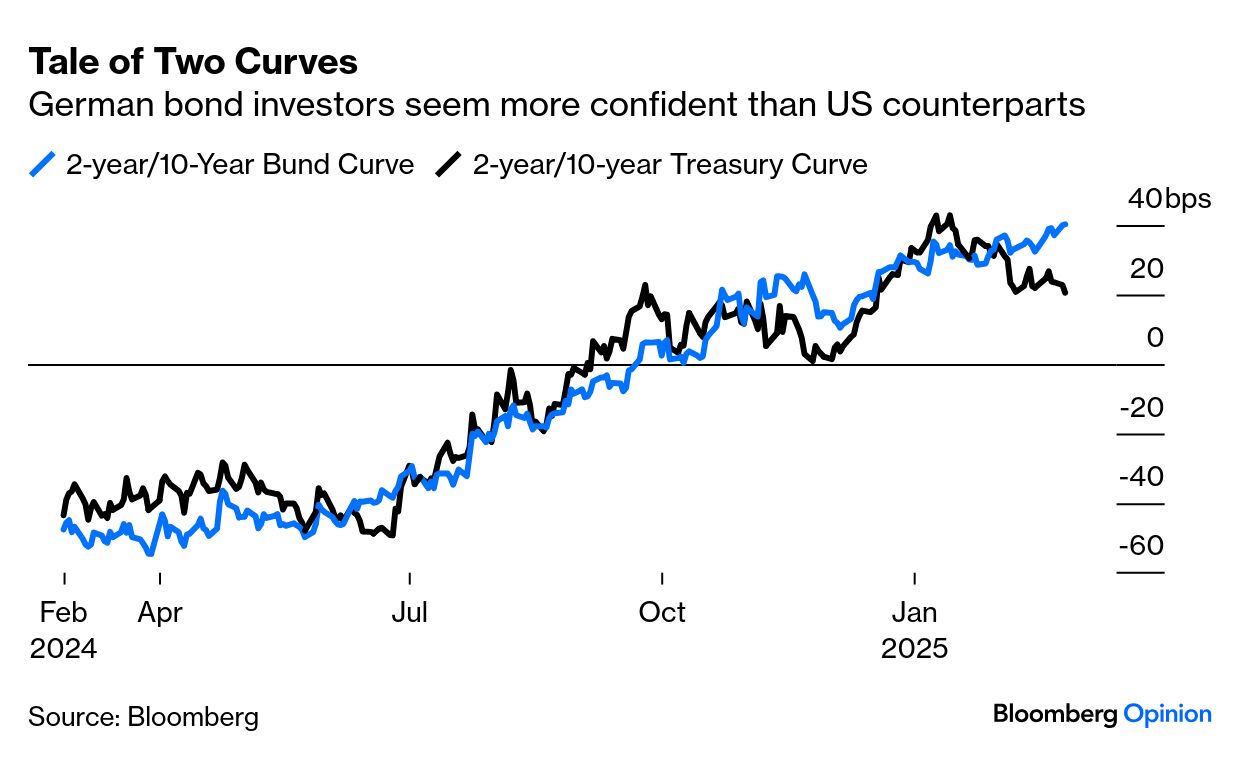

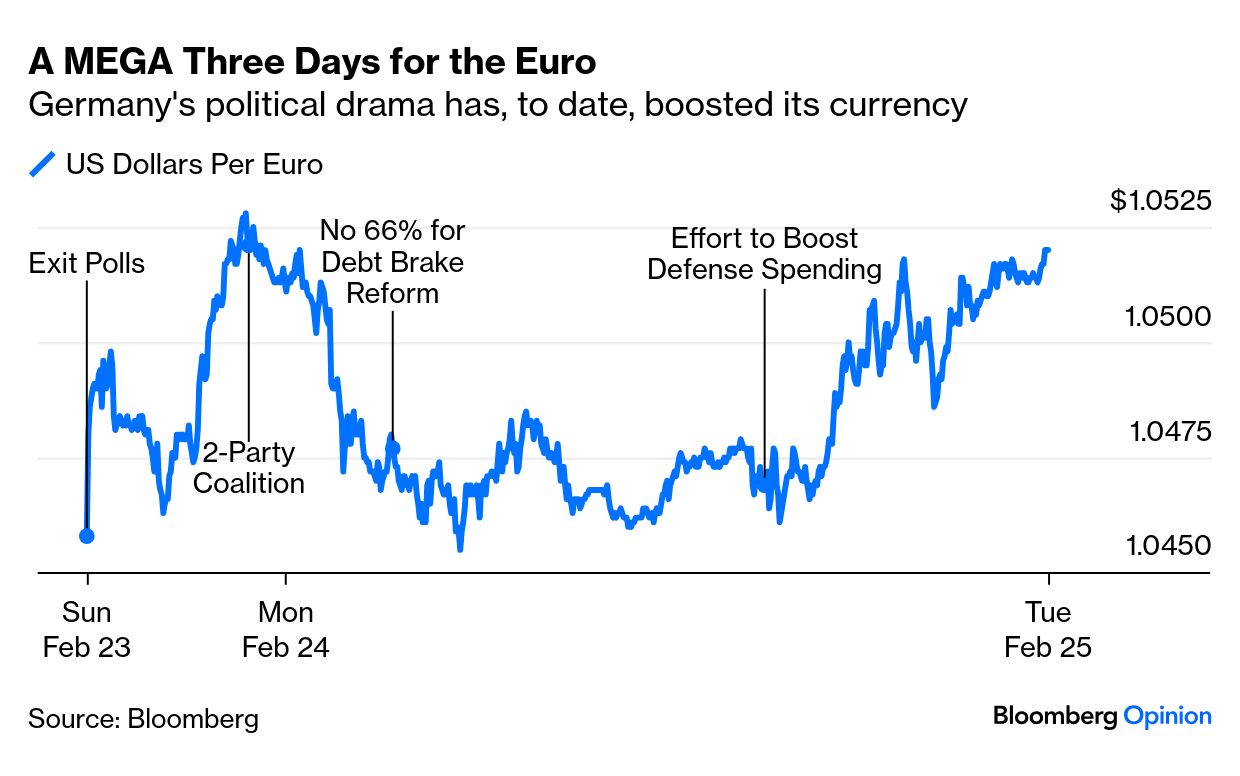

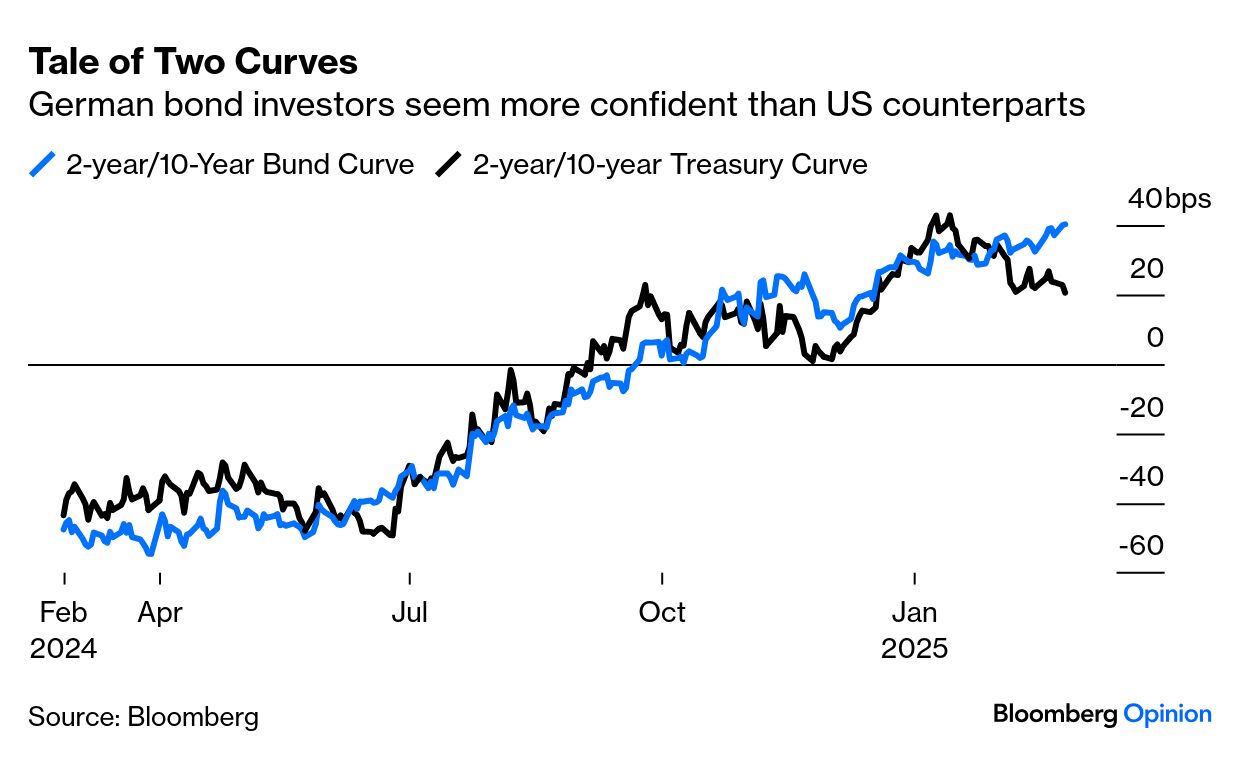

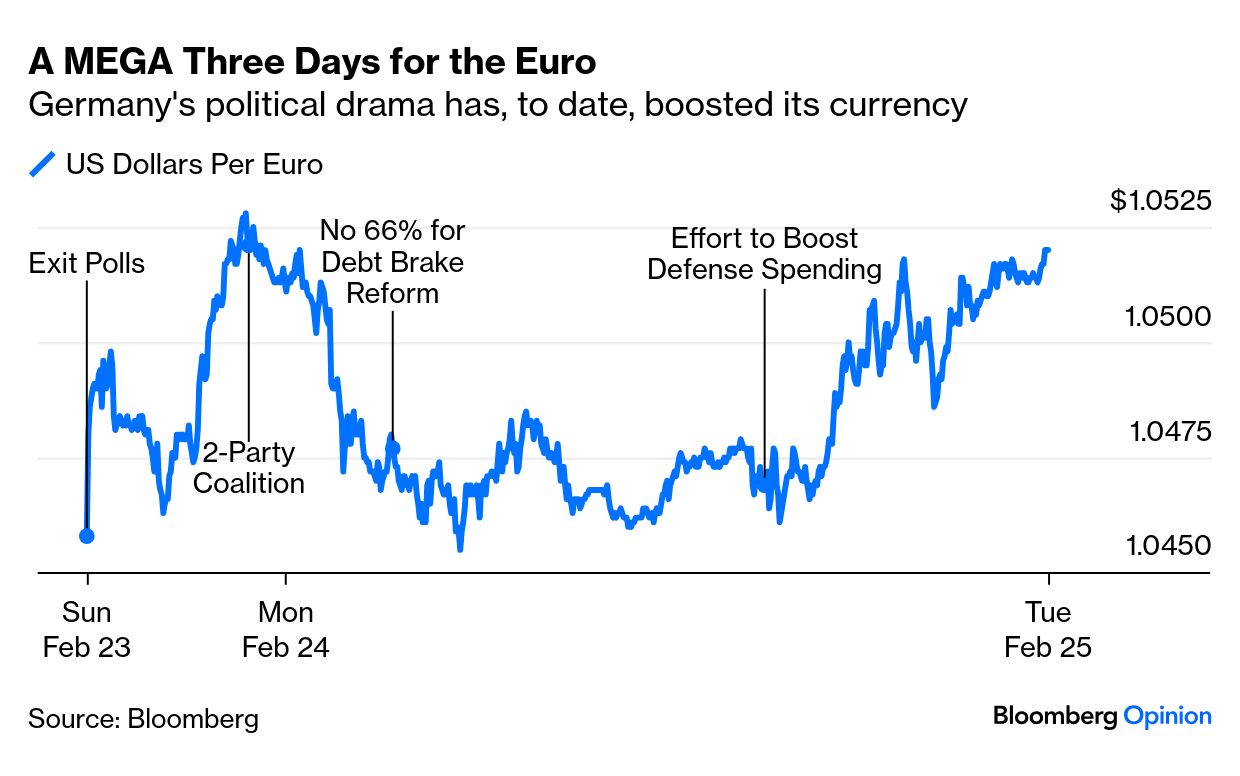

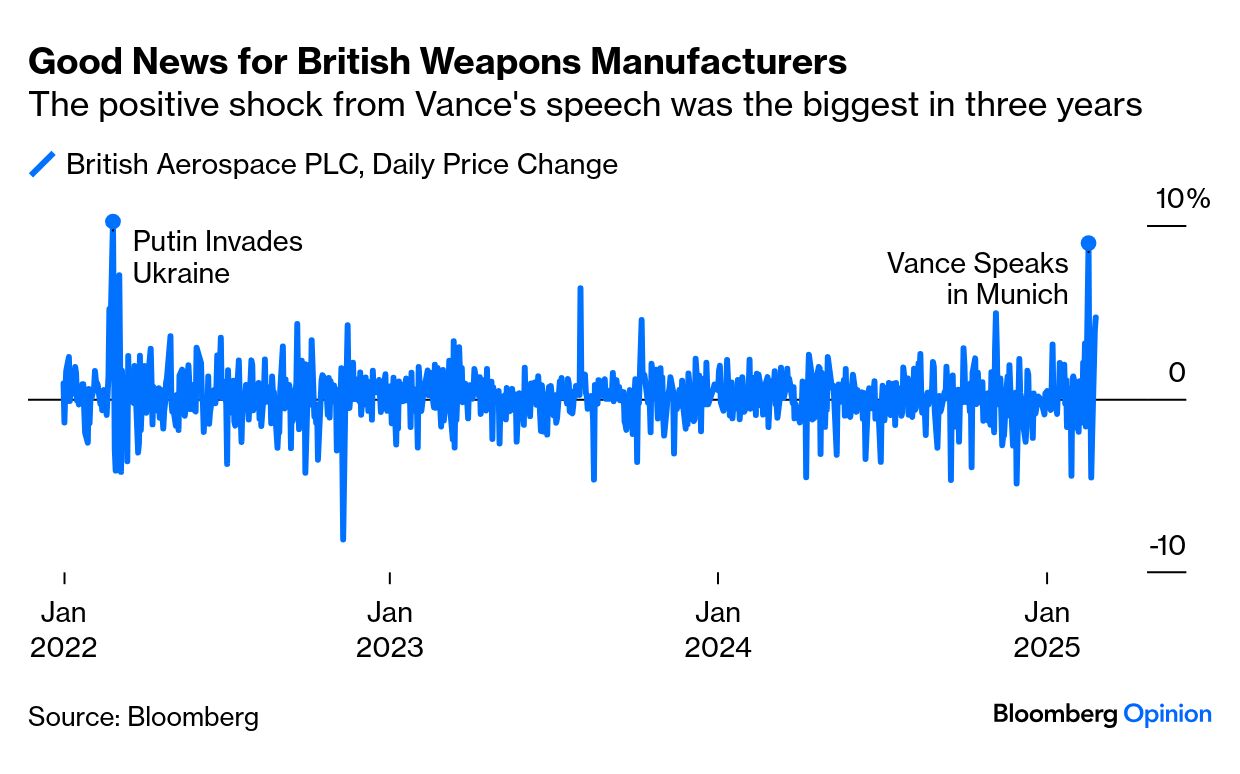

This might explain why US equities have failed to spark over the last month despite a decent earnings season. Tchir argues that portfolio managers may be looking to offload crypto assets and book post-election profits to make up for the lackluster equities returns as they await the dividends of Trump's pro-business agenda. For those who bought into crypto at the top, there is a risk of cascading sales of other assets. — Richard Abbey The America First agenda affects everybody else, and for now there appears to be a belief that the shock from the new US administration will Make Europe Great Again. One clear illustration is in the US and German yield curves (the gap between two- and 10-year bond yields). Both were inverted for a long time and disinverted last year. In the last month, the bund curve has continued to steepen (implying more belief in higher rates ahead) while the US curve has flattened. Despite the widespread consensus that Germany is mired in a slump and the US is a perpetual growth machine, the bond market is behaving as though the German economy is the perkier of the two:  The German election drama has been central to this. Since foreign-exchange markets opened on Sunday, the euro surged as it grew clear that a relatively stable two-party coalition was achievable; tanked again when it grew clear that they wouldn't command the 66.6% of parliamentary votes needed to change Germany's so-called debt brake (listen to this to understand that issue), and then surged when the likely new chancellor, Friedrich Merz, unveiled a plan to push through 200 billion euros ($210 billion) in extra defense spending while the votes could still be found for it in the outgoing lame-duck legislature. This was aggressive behavior, and the currency market loved it:  The effect of US Vice-President J.D. Vance's Munich speech on Feb. 14, which was felt to proclaim the end of US defense guarantees for Europe, has been remarkable. Rheinmetall AG, a big German arms manufacturer, has now far outperformed the Bitcoin vehicle MicroStrategy since the election, with the Vance address acting as a turning point for both: Then there was also the news that the UK prime minister was raising defense spending to 2.5% of British GDP, and funding it by cutting back international aid — a move that he and his party disliked but found unavoidable. The impact of Vance's words on the share price of BAE Systems Plc, the huge British defense manufacturer, is now fully comparable to the boost it received when Russia invaded Ukraine: Some describe the US volte-face on European security as a betrayal, others as exactly the boot up the backside that Europe needs to get its act together. So far, the market seems to prefer the latter. Postscript: Nnext Stop Nvidia | Late Wednesday, Nvidia Corp. announces its quarterly results, in an event that is becoming ever more of a macro moment. In the current environment, this one company could have an impact on the entire US exceptionalism trade, and shift opinion once more on the issue of whether Chinese technology companies can mount a serious challenge for a slice of the AI action. We try to join all the dots in Points of Return, but there aren't usually quite so many dots to join. We'll be back with analysis on it tomorrow. At hectic times like these, it's good to take refuge in nature. Assuming circumstances prevent you from striding out into the wilderness right now, I recommend the website of the Wildlife Photography of the Year competition. The artistry, technical mastery, patience and tolerance for sheer discomfort needed to get some of these images is mind-boggling, and if you click on each photo it gives you the story of how it was taken. For example, how long could it have taken to get this photo, which perfectly juxtaposes a spider and a flamingo? Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Bill Dudley: The Fed Must See What's Wrong To Do Its Job Right

- Noah Feldman: Some of DOGE's Damage Can't Be Undone

- Marc Champion: America's Turning Its Alliances Into a Protection Racket

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment