| US stocks futures rose with investors waiting to see if earnings results from Nvidia can renew the artificial intelligence-driven rally. Nvi |

| |

| Markets Snapshot | | | | Market data as of 06:35 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- US stocks futures rose with investors waiting to see if earnings results from Nvidia can renew the artificial intelligence-driven rally. Nvidia shares rose about 3% in premarket trading, signaling a recovery from yesterday's slump.

- Ukrainian President Volodymyr Zelenskiy aims to meet with Donald Trump in Washington this week to sign an agreement giving the US control over half of the war-battered country's natural resources, according to people familiar with the plans.

- Trump also signed an executive action directing the Commerce Department to examine possible copper tariffs, the latest in a string of measures aimed at imposing sector-specific levies that could reshape global supply chains.

- China plans to re-capitalize several of its biggest banks in the coming months, with authorities looking to inject at least 400 billion yuan ($55 billion) of fresh capital into the first batch of lenders. The move is a follow through on a broad stimulus package unveiled last year to shore up the struggling economy.

- Chances for early action on Trump's tax cut plans are improving after House Republicans passed a budget blueprint on Tuesday calling for deep cuts in safety-net programs such as Medicaid.

| |

| |

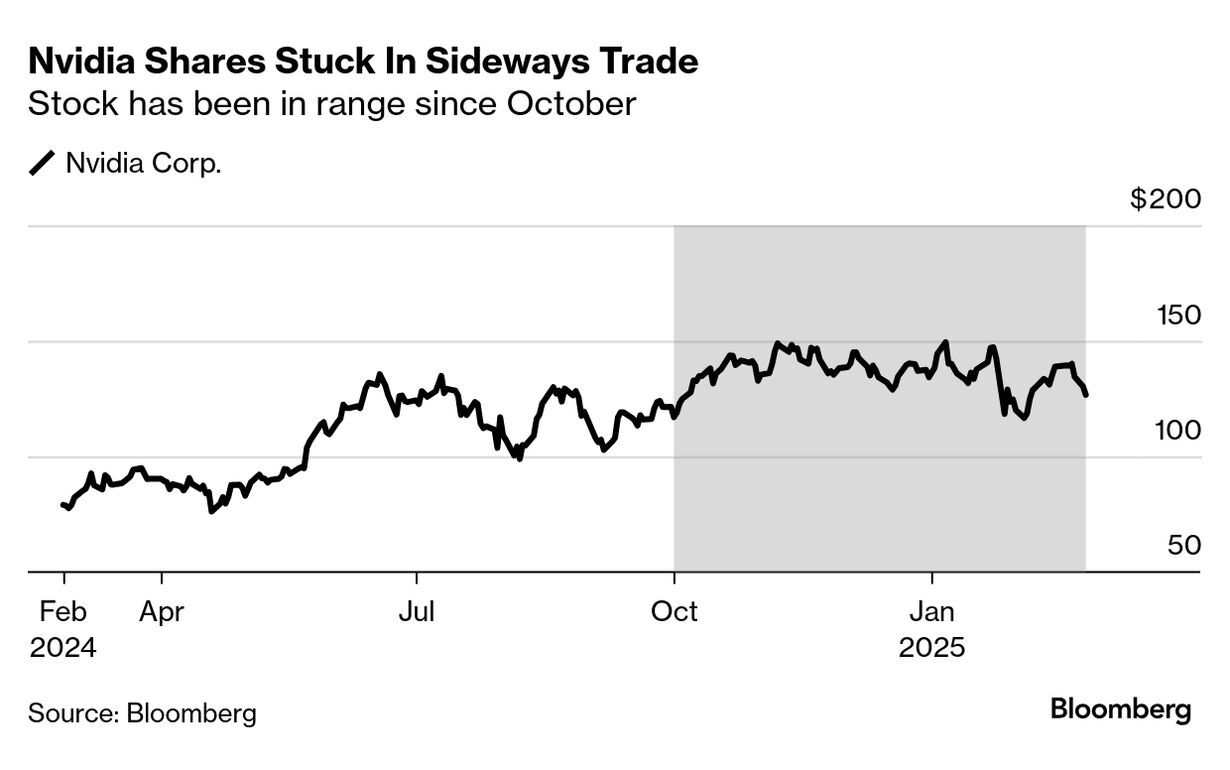

| Nvidia earnings have become some of the most important events of the year for Wall Street. And it's latest results may be its most critical yet, coming after DeepSeek scrambled the outlook for AI infrastructure. While Nvidia shares had been trending higher this month, they remain below their pre-DeepSeek levels. Investors have been more reluctant to buy this dip than previous selloffs, and hedge funds have sold tech of late. It's also the first time since 2022 that Nvidia will report earnings with shares down since its last report. "DeepSeek opened our eyes to the fact that Nvidia is not invincible," said Shana Sissel, chief investment officer at Banrion Capital Management, who expects muted results from the chipmaker this quarter. Options data show the implied move around the report is about 8.5% in either direction.

"The other tech companies that have reported have been broadly pessimistic and the AI parts of the business were in some cases the most negative parts," she added. DeepSeek's emergence in January blew a hole in what had been one of Wall Street's sturdiest trades: that developing AI would require massive investments in computing power and related infrastructure, notably the kind of chips Nvidia specializes in. The latest hiccup came after TD Cowen wrote that Microsoft has begun canceling leases for US datacenter capacity, a move that may reflect concerns about whether it's building more AI computing than it will need over the long term. Still, a key theme of megacap tech reports this earnings season — including from Nvidia customers Microsoft, Amazon, Alphabet, and Meta — is that they all affirmed or notably boosted their capex plans, suggesting they're not primed to turn off the spigot to Nvidia products. —Ryan Vlastelica and Carmen Reinicke | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

- Tesla is rising 1.9% in premarket trading, recovering from a drop yesterday that pushed the electric-vehicle maker's market value below $1 trillion amid a slowdown in car sales in Europe.

- Super Micro Computer gains 24% after the beleaguered server maker submitted outstanding financial reports that allow it to keep its Nasdaq listing.

- Lucid jumps 10% after the EV maker reported better-than-expected quarterly revenue and said it will begin a search for a new CEO.

- Workday rises 13%. The human-resources software company's fourth-quarter results beat expectations, boosted by strong growth in its subscription backlog.

- Anheuser-Busch InBev surged 9.9% in Brussels, the most in more than three years, as the key US beer market showed signs of recovery, with increased marketing driving sales of its biggest brands.

- Cava rises 1.2%. The Mediterranean restaurant chain's fourth-quarter sales and earnings beat estimates even as its outlook for the year disappointed some analysts.

- Intuit gains 6.3% after the tax-software company's results beat expectations. Morgan Stanley upgraded the stock to the equivalent of buy, saying the company is showing momentum with small-business customers.

- Instacart falls 9.8% after the online grocery delivery company posted disappointing revenue and projected lower-than-expected earnings this quarter. —Subrat Patnaik

| |

| |

| Copper is the latest metal to come under US tariff threats, with prices surging in late trading on Tuesday.

It's more evidence that commodities live at the heart of Donald Trump's desire to remake global trade. The moves to use such levies are already having an impact inside the US — recent consumer sentiment surveys show a softer outlook plus increased expectations for higher prices. Copper futures traded on the Comex in New York rose as much as 4.9%. Shares of US-traded copper miners also climbed, with Freeport-McMoRan jumping 6% in after-market trading. The process of imposing tariffs is set to be drawn-out and messy, but stands to have reads across for equity and bond markets. In stocks, higher costs and less-confident consumers pose a risk to valuations. For Treasuries, trends that stoke inflation can feed higher yields, and ask far trickier questions of the Federal Reserve. —Yvonne Yue Li and Jake Lloyd-Smith | |

Word from Wall Street | | "Nvidia's numbers could well be a make-or-break event for the market, at least in the short term." | | Tim Waterer Chief market analyst at KCM Trade in Sydney | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Going Private for coverage of private markets and the forces moving capital away from the public eye

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment