| Beijing slapped tariffs on US products and began a probe into Google moments after US President Donald Trump imposed a 10% levy on goods fro |

| |

| Markets Snapshot | | | | Market data as of 06:42 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- Beijing slapped tariffs on US products and began a probe into Google moments after US President Donald Trump imposed a 10% levy on goods from China. Trump granted Canada and Mexico a last-minute reprieve from tariffs.

- US stock futures ticked lower as traders worry about the economic implications of tariffs. The dollar weakened and bond yields rose.

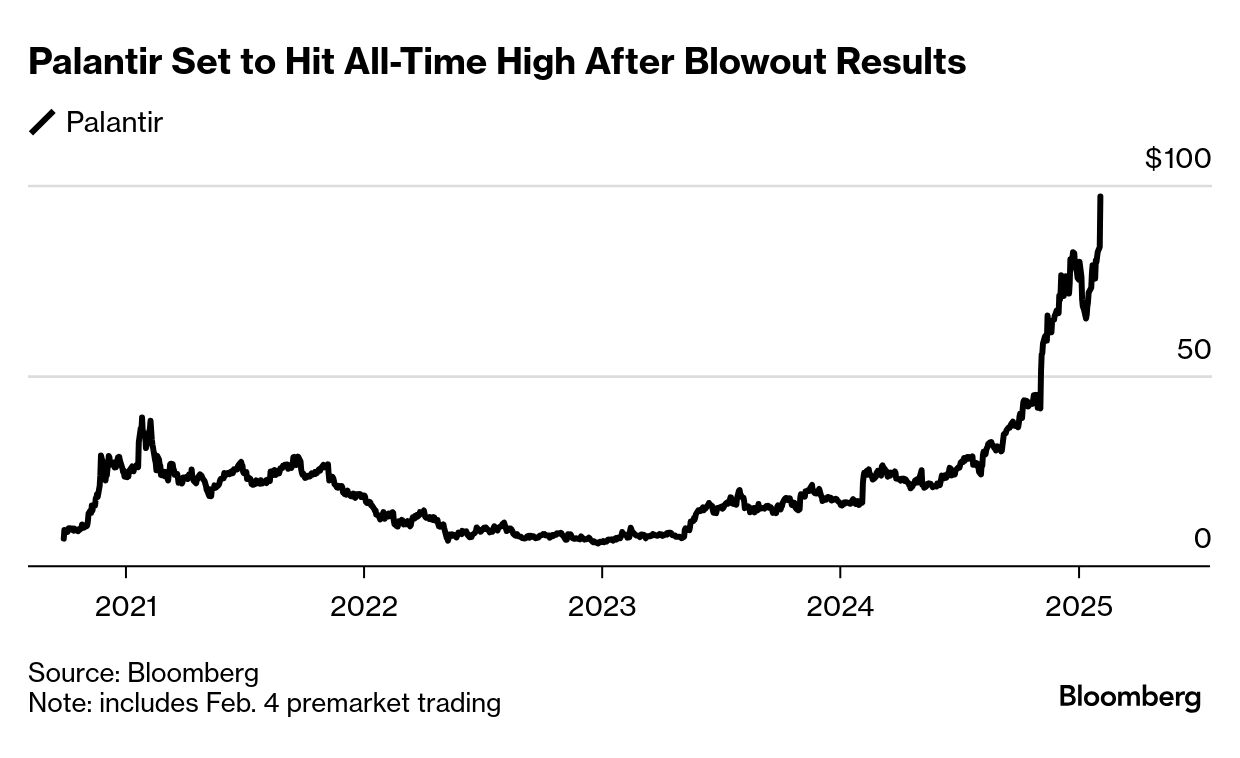

- Palantir shares jumped on a strong revenue forecast, thanks to what the CEO described as "untamed organic growth" in demand for its AI software.

- Diageo slumped 3.6% in London. The British distiller, which makes Don Julio tequila and Crown Royal Canadian whisky, scrapped its sales target as it grapples with a possible tariff battle in the US, its biggest market.

- Oil wiped out all of its gains for the year as the trade war threatened global growth and energy demand. West Texas Intermediate retreated below $72 a barrel after China's retaliatory measures were announced.

| |

'Escalate to de-escalate' | |

| The lack of an enthusiastic relief rally in stock markets given Donald Trump's turnaround on tariffs shows investors are feeling bruised by the events of the past 48 hours. While trade belligerence does indeed look like a negotiating strategy, markets didn't anticipate these shock-and-awe tactics so soon. It's also a reminder that, especially just a week after the DeepSeek drama, investors are edgy about the potential for a correction. US equity valuations remain high and the S&P 500 is only 2% below its record close on Jan. 23. "The markets are not priced for escalating trade war risk, and if Trump's ultimate strategy is to 'escalate to de-escalate,' investors should expect more volatility and pullbacks in the near term," writes Jason Draho, head of asset allocation Americas at UBS Global Wealth Management. In Canada, strategists may need to lower their 2025 targets, says Philip Petursson at IG Wealth Management. They see the S&P/TSX Composite rising to 28,517 points this year, according to data compiled by Bloomberg, which would represent a 13% gain. There's a similar dynamic in currency markets. Yes, the Mexican peso and Canada's dollar rebounded after Trump spoke to the leaders of those two countries and agreed to delay tariffs. But the threat of more surprise action will keep them under pressure. "Our biggest take-away from weekend developments is that irrespective of what happens in coming days, the market will be required to hold a structurally higher risk premium on a trade war across all asset classes,'' Deutsche Bank's George Saravelos wrote. —Phil Serafino | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

- Infineon Technologies surges 10% in Germany. The chipmaker forecast revenue that beat analyst estimates, a bright spot in an industry that's been grappling with a prolonged slump.

- Calvin Klein owner PVH and biotech firm Illumina drop more than 4% in US premarket trading. China placed both on its so-called blacklist of entities in retaliation against Trump's tariffs.

- Merck, Pfizer and Mondelez are on the earnings schedule today. The big event comes after the close when Alphabet reports. Advanced Micro Devices is due after the bell as well. Results are already out from Spotify, which is surging after its forecast for active users topped estimates. —Subrat Patnaik

| |

| |

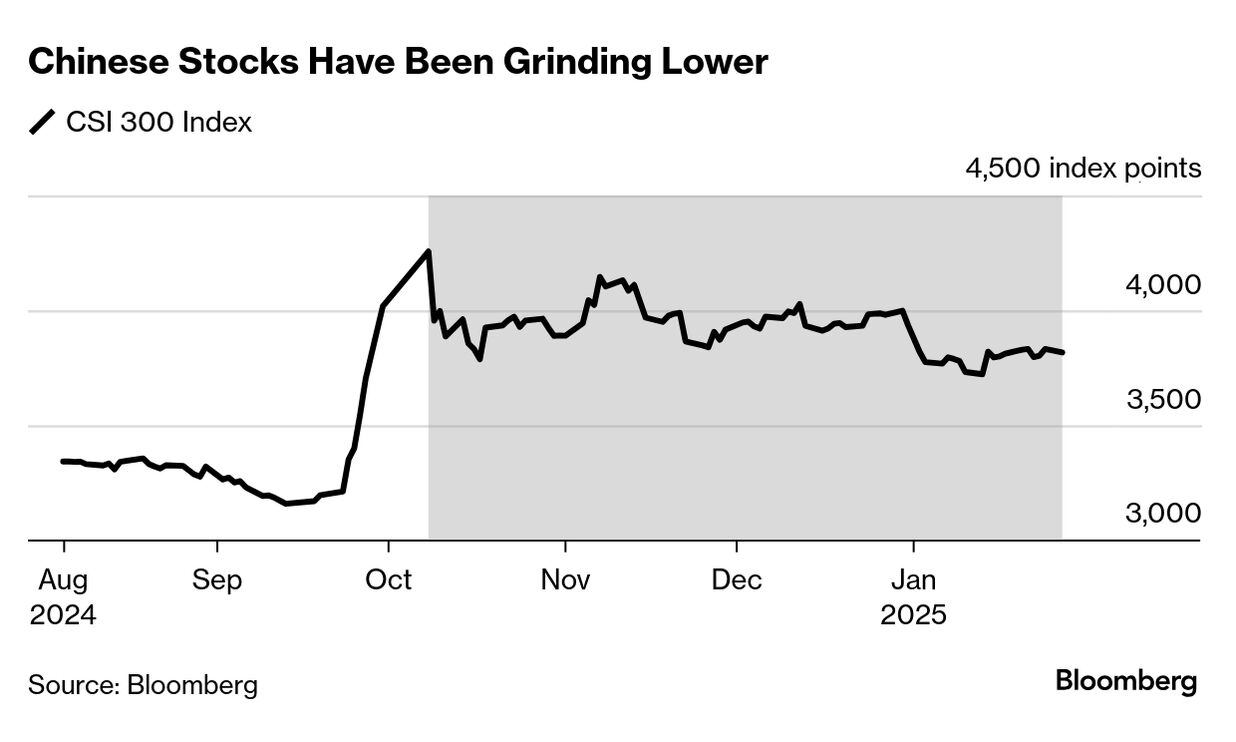

| Stock traders in China coming back to work tomorrow after the week-long Lunar New Year holiday will find a transformed investment landscape. Volatility is set to stay high as investors brace for an escalation in the trade war. The offshore yuan recovered after a knee-jerk slide on Tuesday. Chinese stocks in Hong Kong have displayed surprising resilience as some dismiss the tit-for-tat moves as posturing ahead of real negotiations by Trump and President Xi Jinping. "Any sign that both Xi and Trump have had a good talk or both countries expressed commitment to work on a deal should qualify as a temporary truce," said Christopher Wong, a strategist at Oversea-Chinese Banking Corp.

Others are increasingly bearish. Morgan Stanley analysts told investors to cut holdings of Asian technology. The stocks have around 20% near-term downside should tariffs increase on computer chips and trade tensions re-escalate, analysts including Shawn Kim wrote in a note. —Sangmi Cha and Betty Hou | |

| |

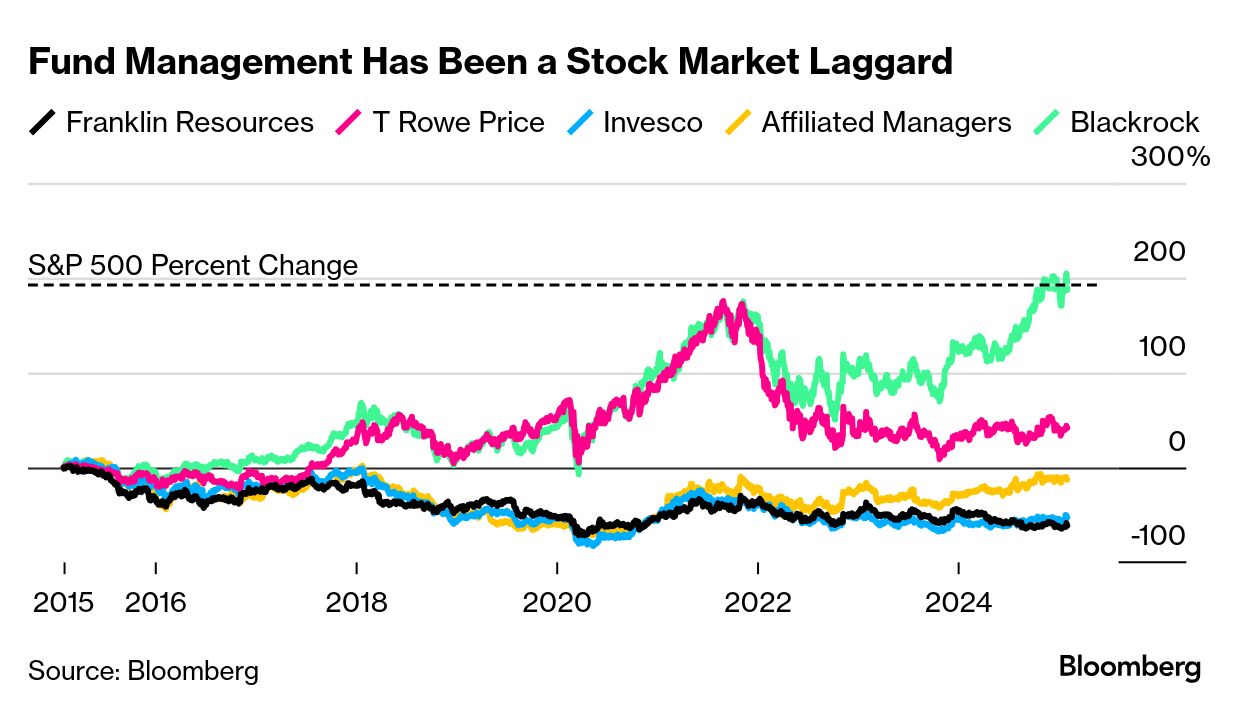

| It's never been easier or cheaper in the US to follow the classic personal finance advice to buy low-cost index funds and hold them: Vanguard yesterday cut the fees for dozens of its mutual funds and ETFs. The firm's average asset-weighted fee is now just 0.07% for its $10 trillion under management, compared with 0.44% for the rest of the industry. The reduction is the largest ever undertaken by Vanguard, which is owned by the investors in its funds. That dynamic explains why owning shares of most publicly traded fund management companies has been a recipe for underperformance for the past decade. —Katie Greifeld and Phil Serafino | |

Word from Wall Street | | "It is not necessarily the tariffs themselves that matter, rather the trade uncertainty that hits economic growth and investment intentions.'' | | Sharon Bell and team European equity strategist, Goldman Sachs | | |

One number to start your day... | | | |

| |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment