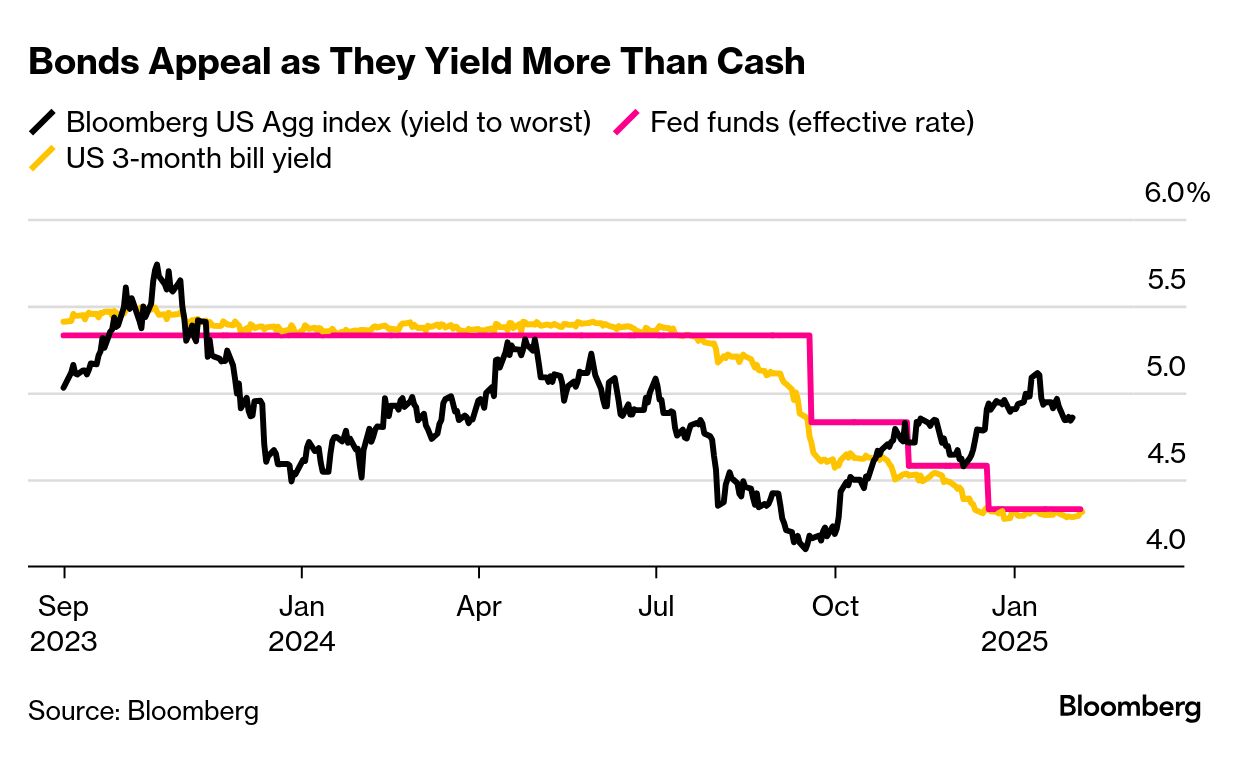

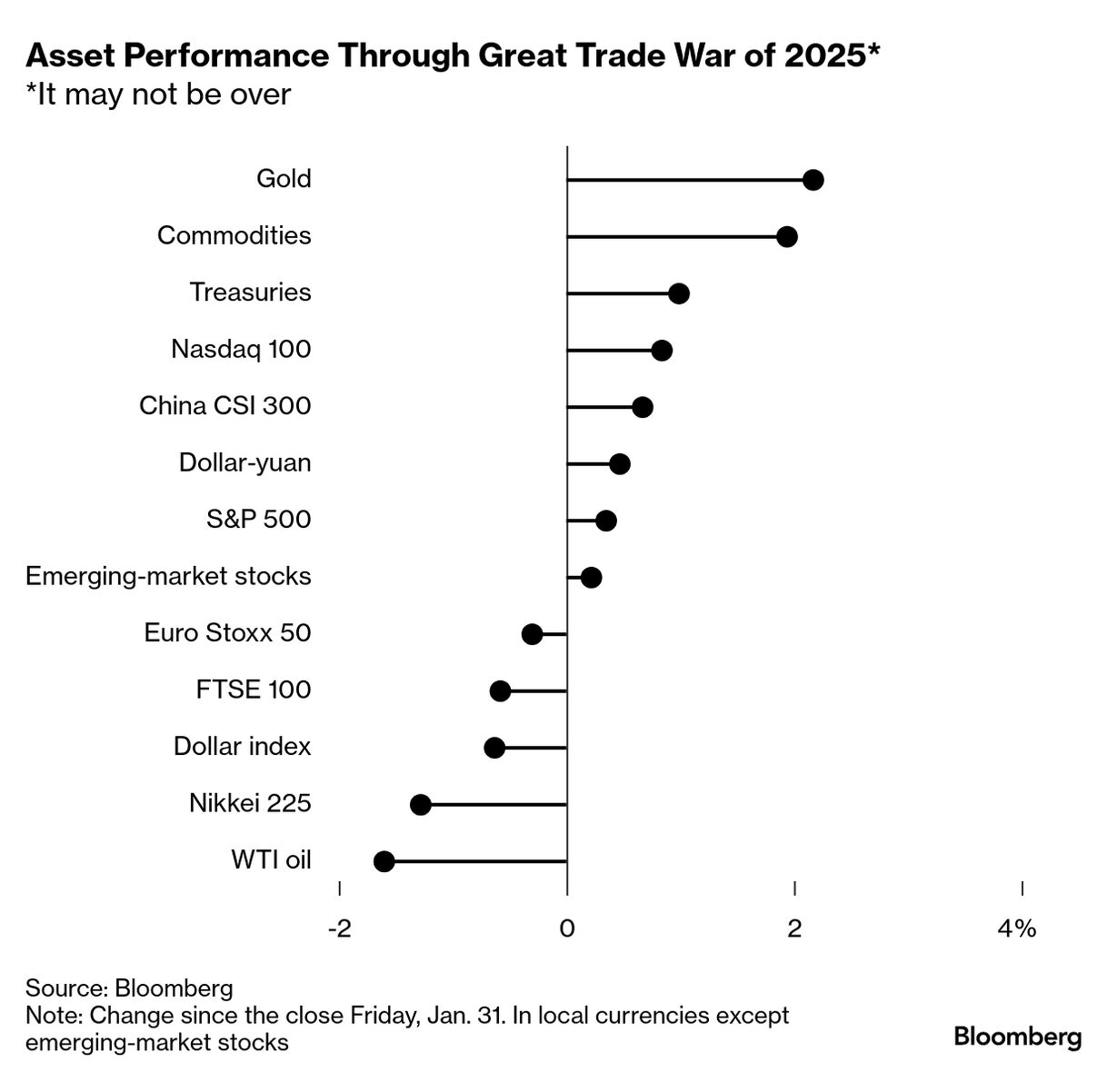

| For all investors' handwringing over Donald Trump's unpredictability, it's worth keeping in mind that market volatility creates all sorts of opportunities — if an asset you're eyeing is too expensive, you may be just a Trump tweet away from a buying opportunity. Just ask Daniel Ivascyn, chief investment officer at bond behemoth Pacific Investment Management Co. "A little bit of volatility, a little bit of fear in markets, for us would likely be a good thing," he said in an interview. "Volatility usually means opportunity for active managers." The Newport Beach, California-based asset manager is betting on five- to 10-year bonds, as they generate solid income, and are prepared to buy more if yields rise back toward 5%. Trump's policies have put traders on their heels and clouded the outlook for the Federal Reserve's next steps for monetary policy. Ivascyn's $175 billion Income Fund has a lot of liquid investments, he says. "If we get a pullback in credit markets, we would look to reduce some of the high-quality stuff and then be more aggressive in the credit market, high-yield and loans," he says. The fund has gained 1.3% this year, outpacing a 0.8% rise in the broad market index and beating 94% of rivals. Pimco, with almost $2 trillion under management, is no run-of-the-mill firm. Under founder Bill Gross, it became the biggest name in fixed-income investing. While clients pulled assets after his departure a decade ago, his successors have steadied the ship. As you can read in today's Big Take, though, some at the firm now fear Pimco has lost its edge as it fails to keep up with the industrywide push into private assets. Pimco began this year making a case for owning Treasuries in the five- to 10-year zone as it saw an unpredictable policy agenda from the new White House burnishing the appeal of high-quality bonds compared with expensive equities and corporate debt. "You've got to be respectful of the uncertainty here," Ivascyn said, while being focused on staying "nimble and generate some pretty good returns." "To the extent that there continues to be this uncertainty around policy that could impact economic fundamentals, we think the Fed's going to be on hold," Ivascyn said, and that's still good for owning longer-dated bonds as they yield more than the current cash rate, around 4.33%. —Michael Mackenzie |

No comments:

Post a Comment