| It's been a rough day for crypto and equities—hope everyone's ok.

Remember, it's during periods like these that the best opportunities often emerge.

Avoid any major emotional decisions or revenge trading, though.

Remind yourself: crypto has bounced back from even FTX. this pales in comparison.

Coming to the markets, Trump's hard negotiating tactics via tariff wars are not being well received. This is showing up across all risk-on/risk-off markets—crypto, stocks, and the USD.

All the while, markets had been betting on Trump as a businessman with a vested interest in real estate and rising markets. He's been vocally calling for lower rates—and in his last term, he was practically measuring his presidential success by tweeting SPX prices every day.

Few expected he would follow through with a tough stance that would hurt the stock markets. So when he actually did it, markets began repricing the uncertainty. Right now, Trump can play hardball, which gives him a quick win from a perception standpoint.

It shows he's delivering on the mandate given by the American people and that he's not favoring Wall Street.

He'd rather do it early in his term—any wreckage can then be blamed on the previous administration. Following up his tough words with action also earns him favorable terms with other countries.

When prices dip low enough, he gets to “buy the dip” and save the markets—and he can always say that short-term pain was necessary for long-term benefits.

Negotiating is a game of how far all parties are willing to push and who blinks first.

One thing about Trump is he's unpredictable, volatile, and has thick skin. He can just turn around, declare, "We got the 'best deal'," close the matter, and move on.

Markets might sharply recover afterward, but that’s not something you can count on. so avoid leaning hard on either bullish or bearish outcome. just go with the data. All of these are just macro thoughts with too many variables and path dependencies.

one thing that gets clearer by the day. every time the US flexes its might—and the USD—as a negotiating weapon,

it only strengthens the case for Bitcoin.

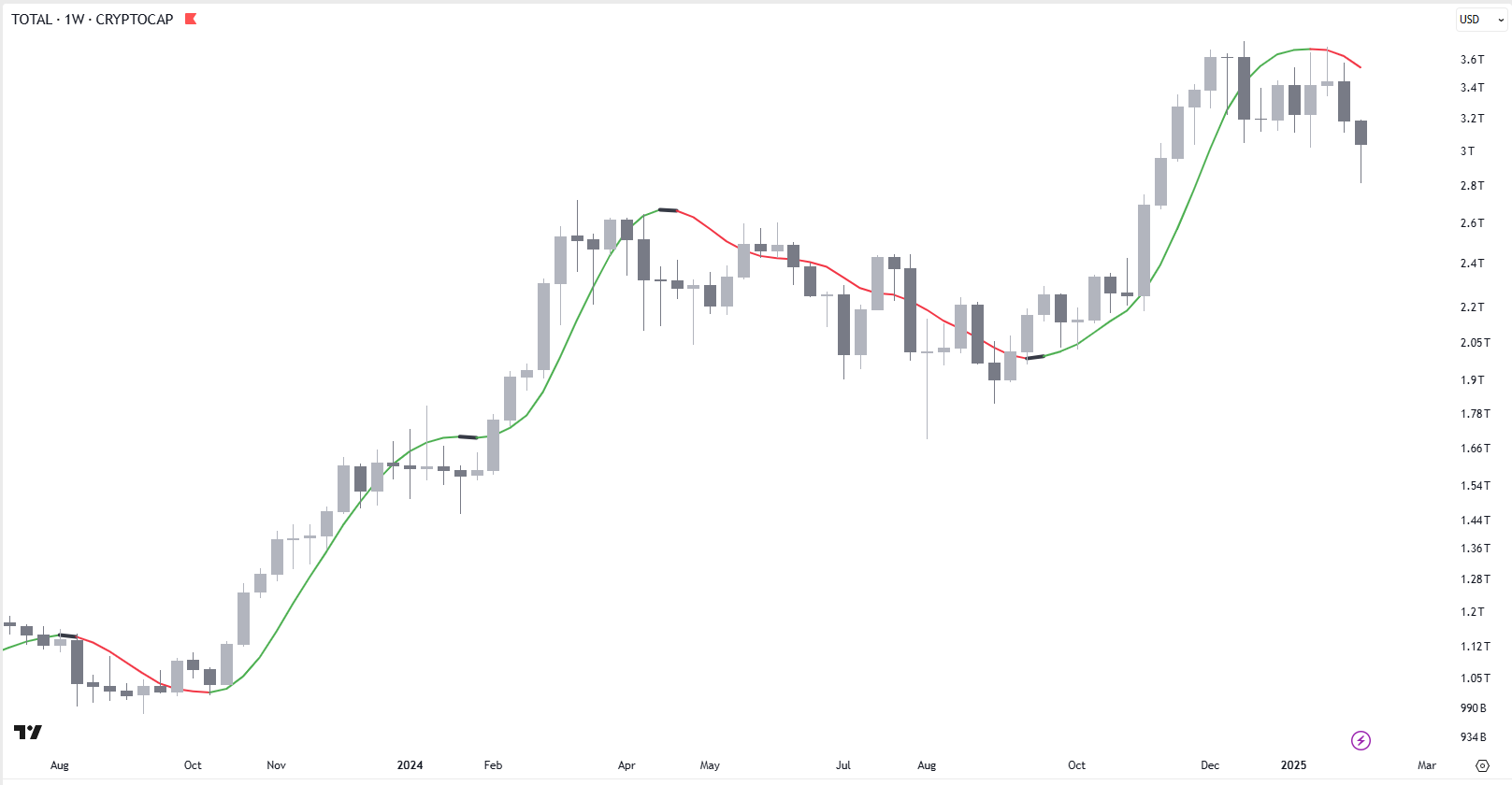

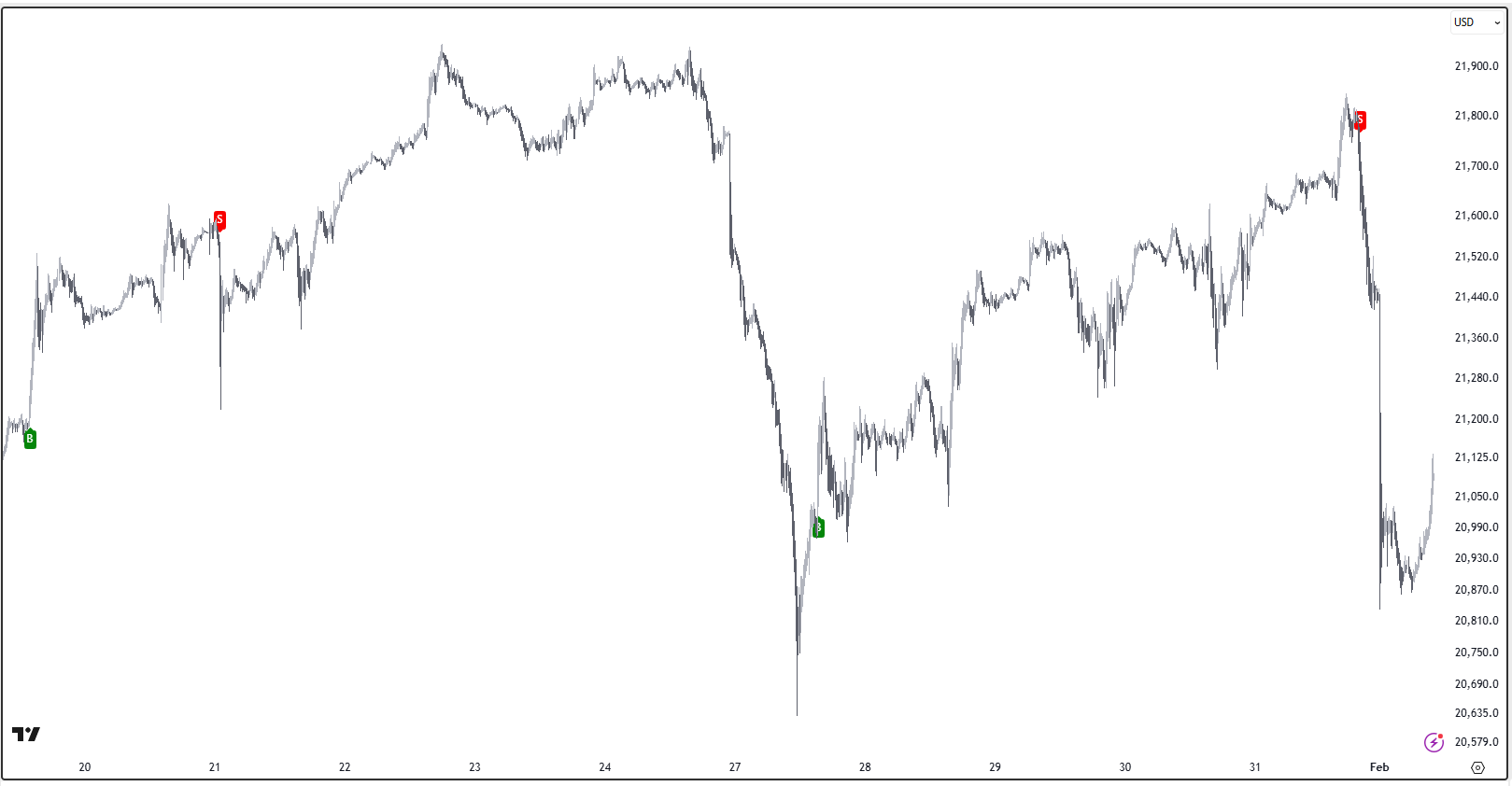

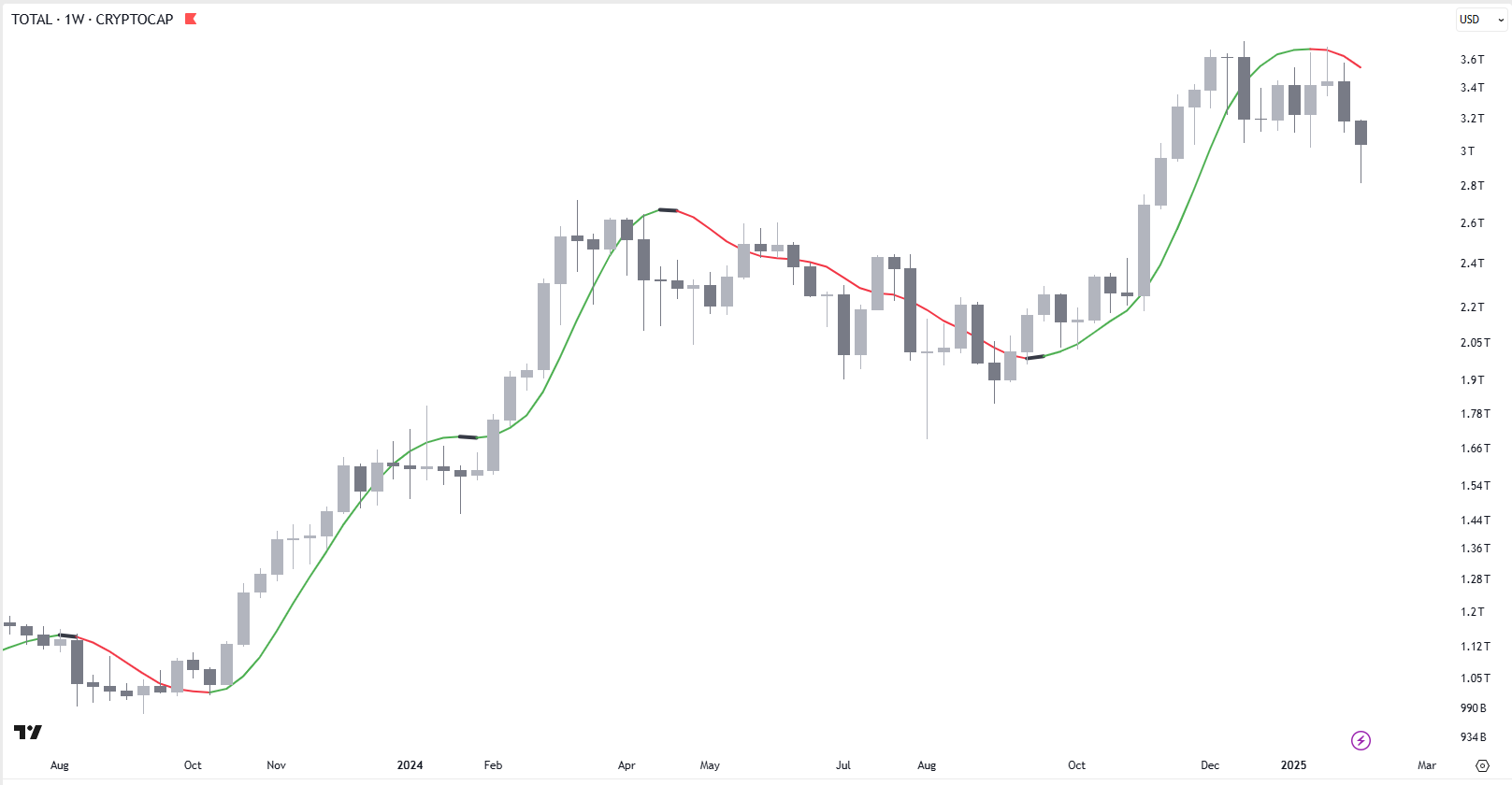

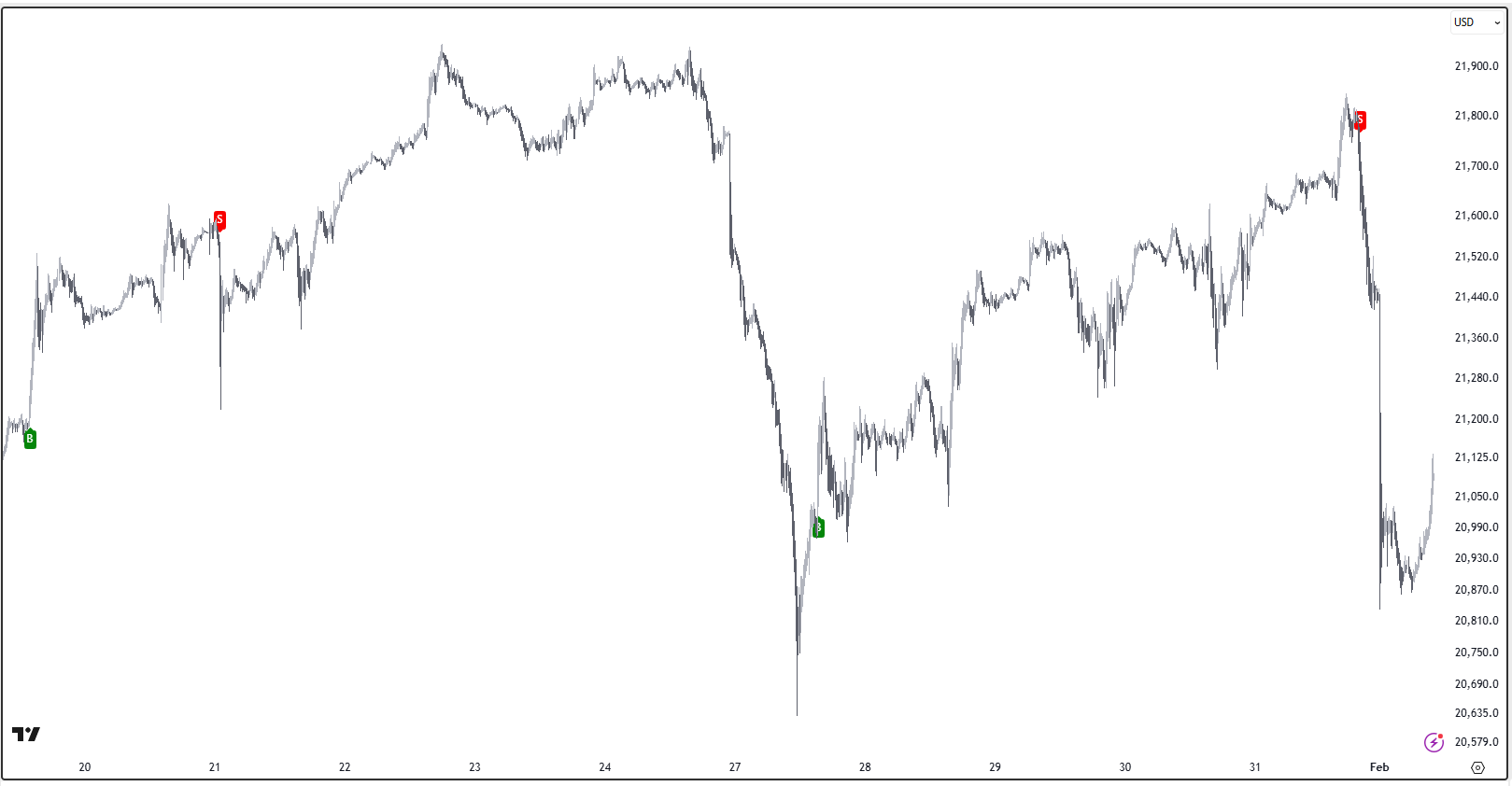

What we have in front of us is price, volume, and flows. Let's see how our systems have done. Starting with the big picture: you can see how when our positional system already indicated that it's turning bearish—for Total Crypto.  Total Crypto While we wait for the big picture to turn favorable, there are plenty of opportunities in the short term. That's when the scalper comes into play. Here's how it's performed recently across very high volume assets and coins: - Nasdaq 100

- USD

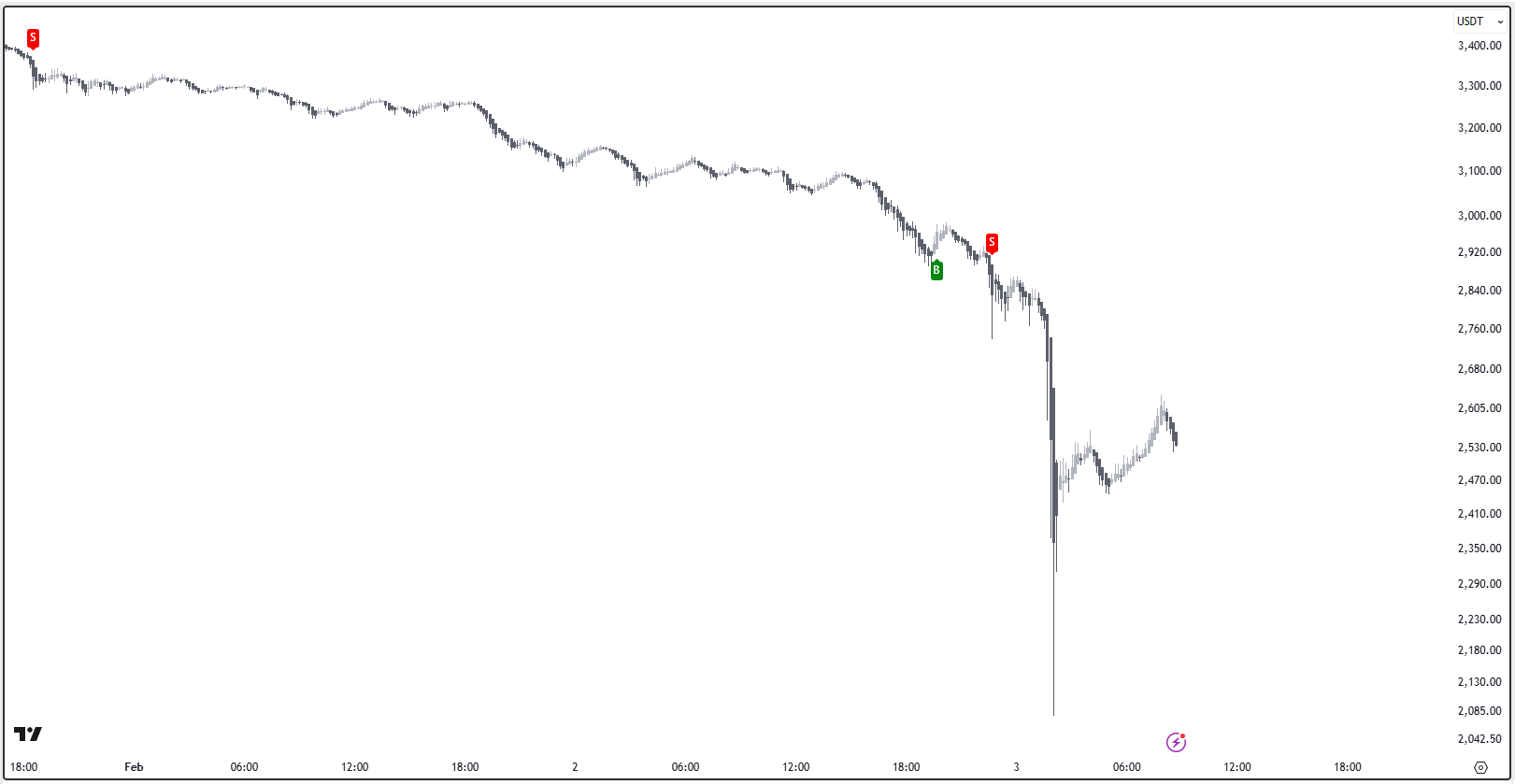

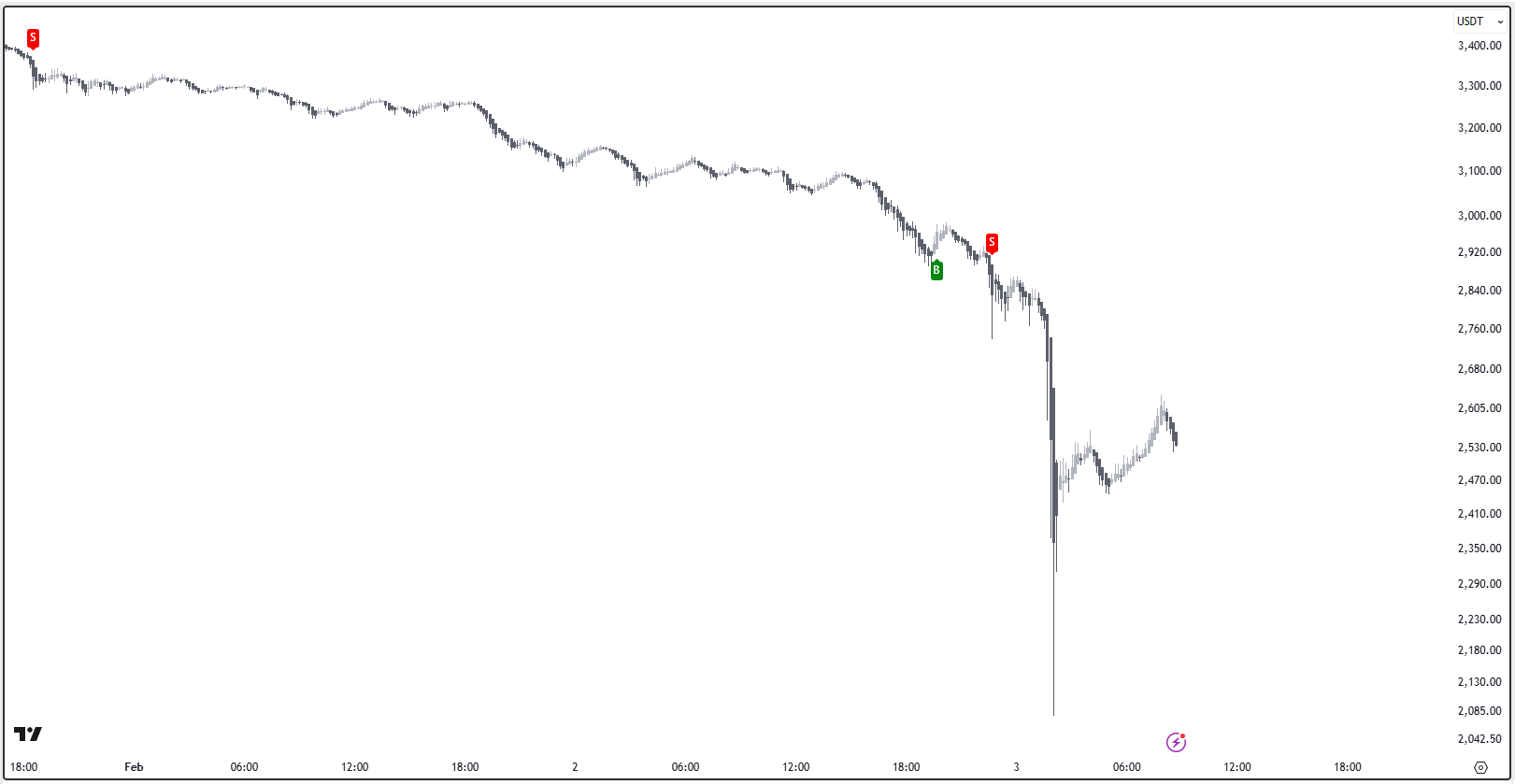

- BTC

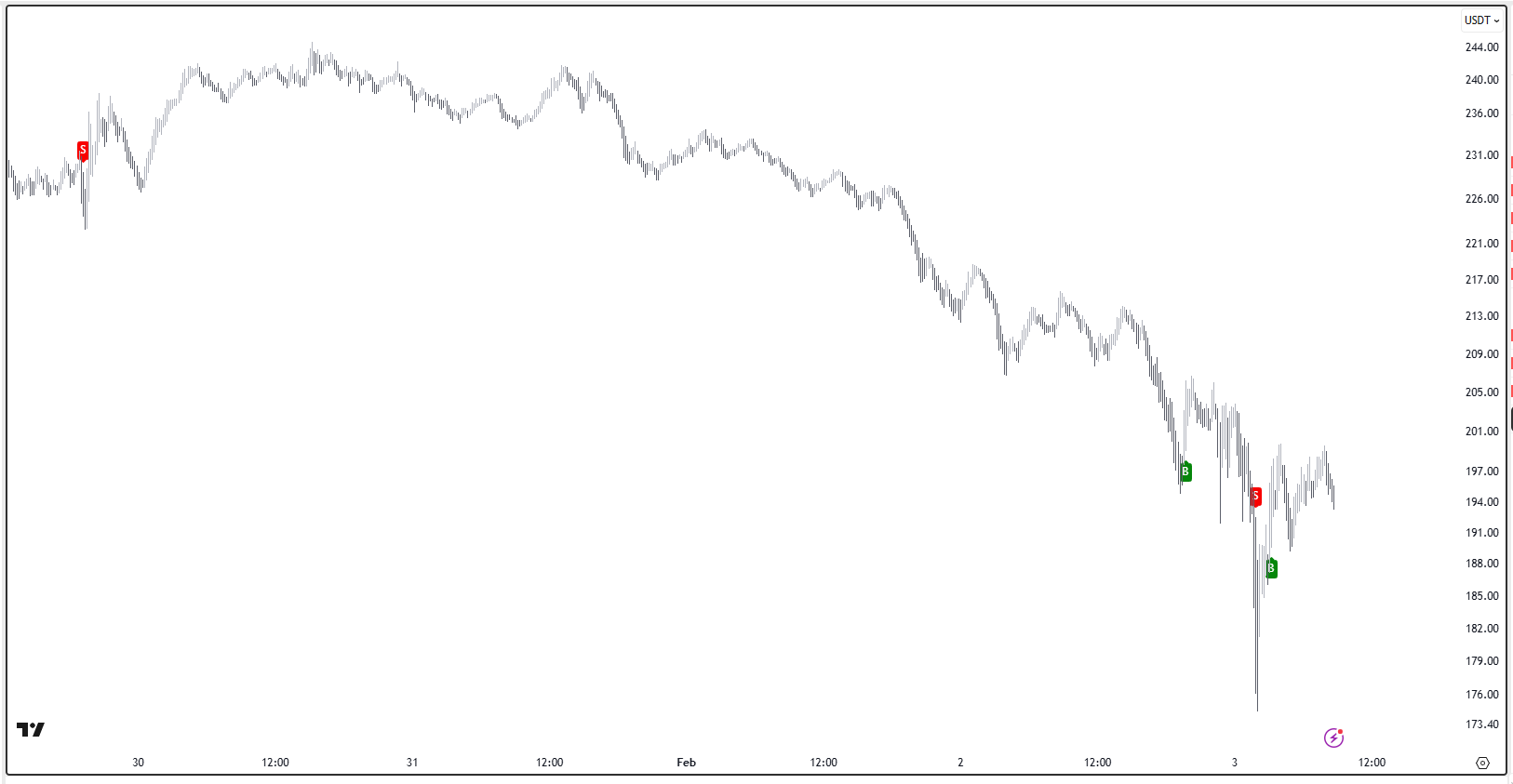

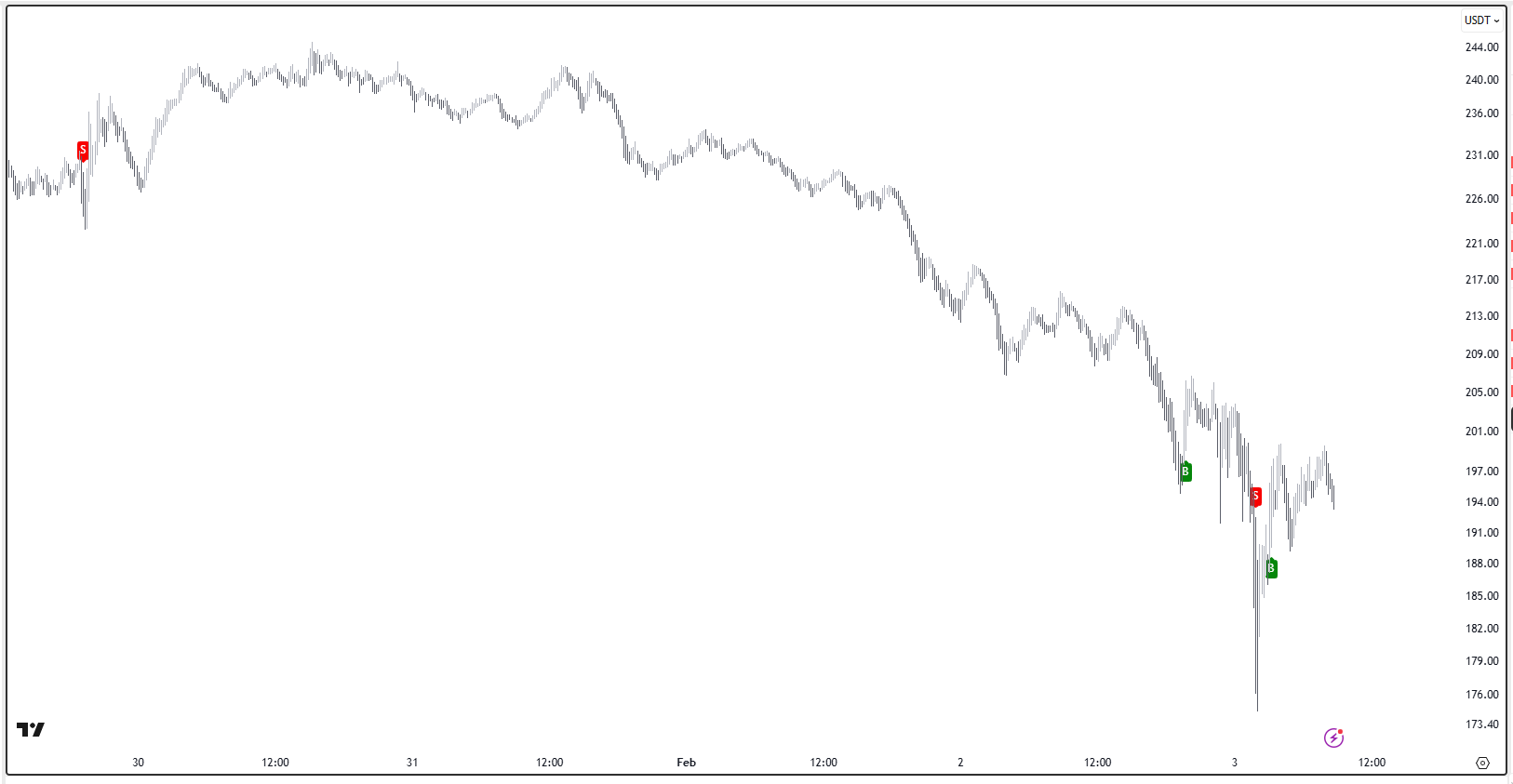

- ETH

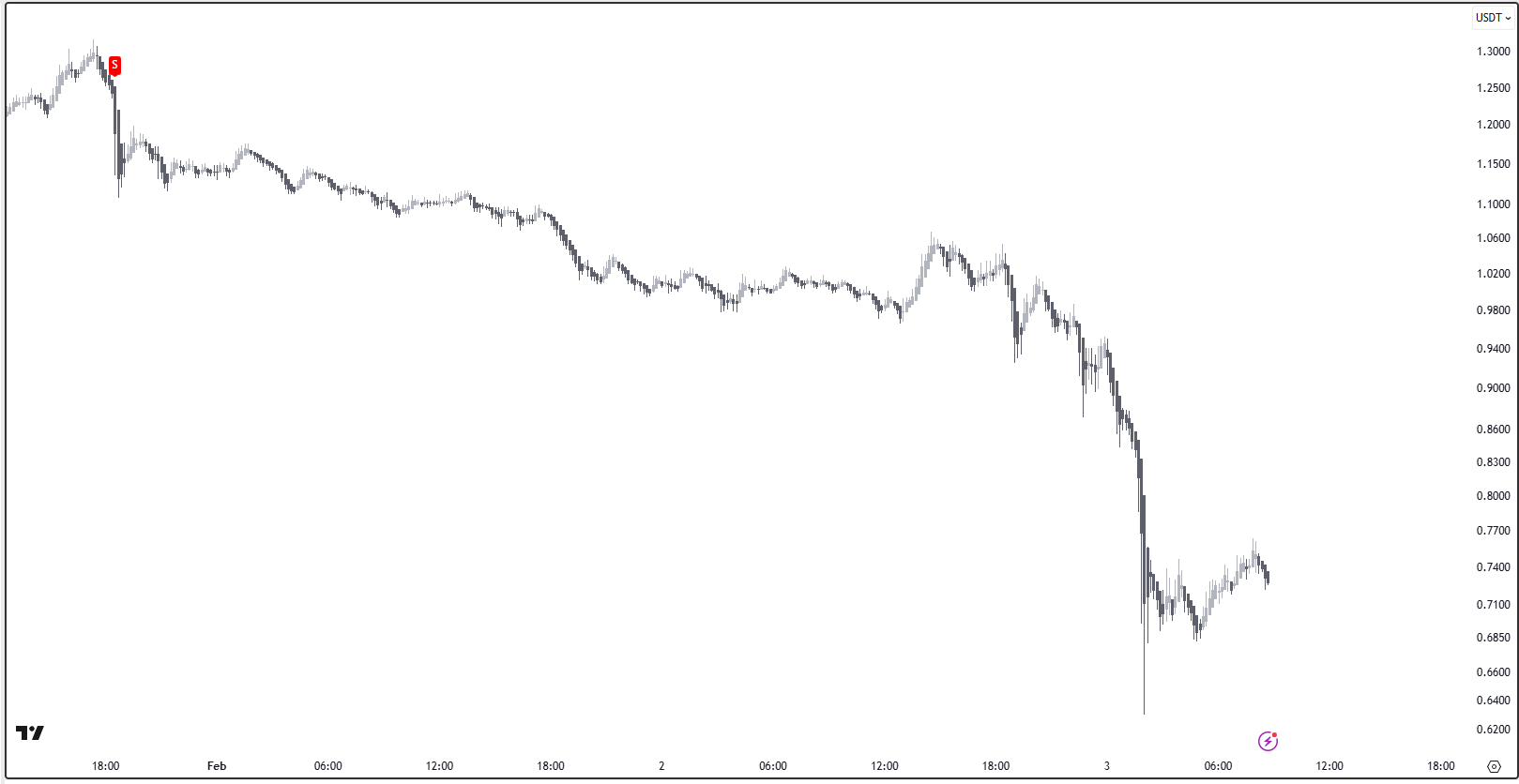

- SOL

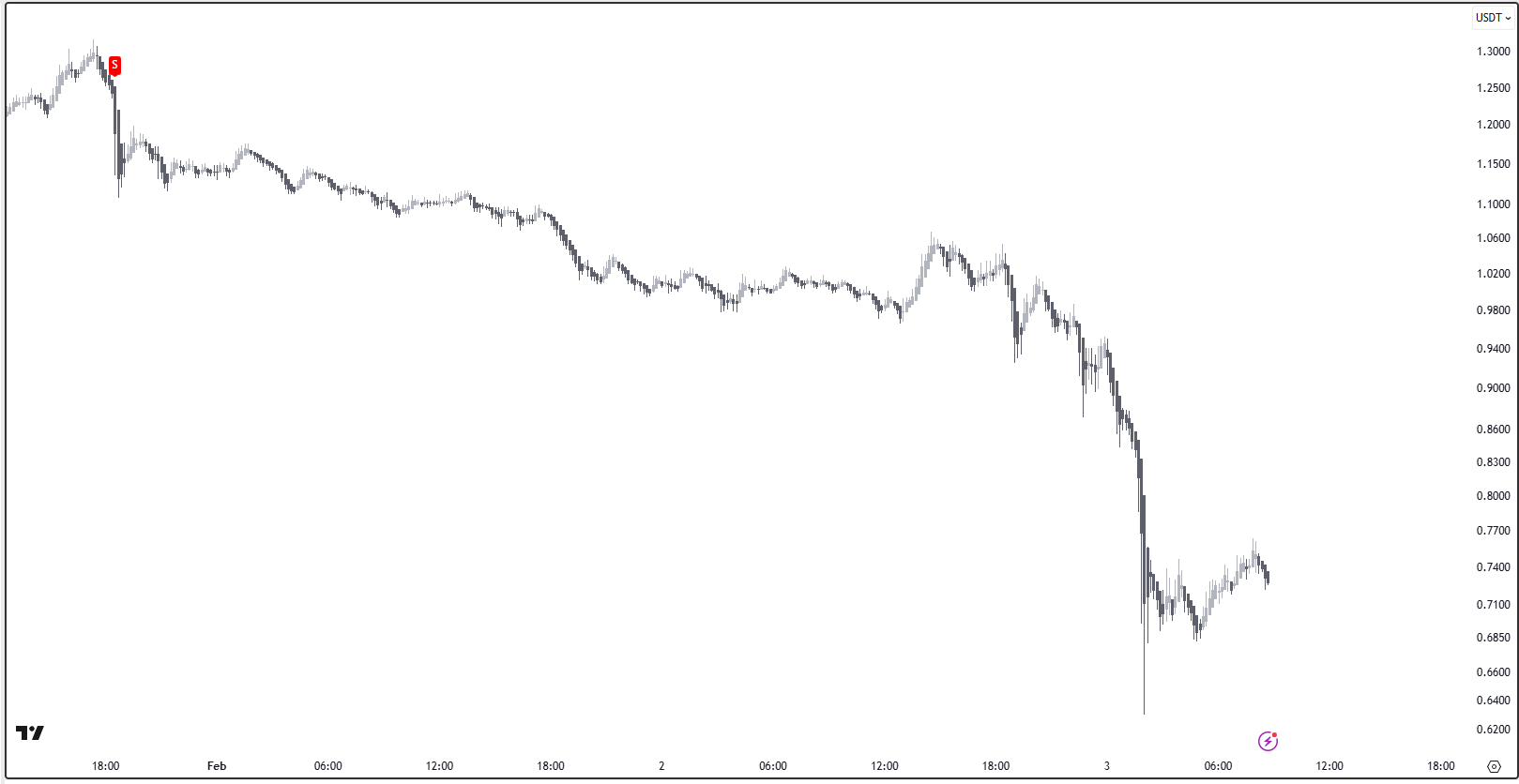

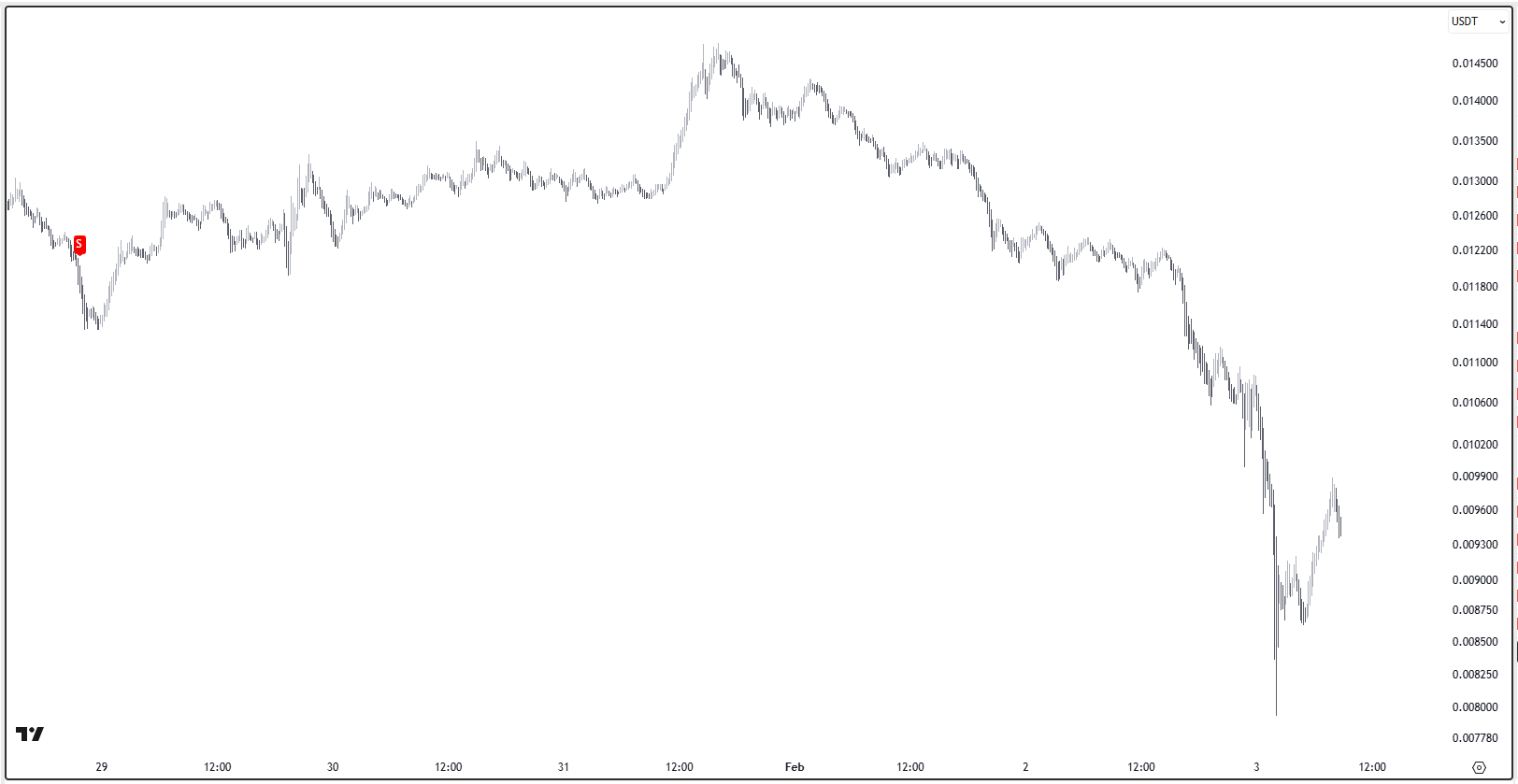

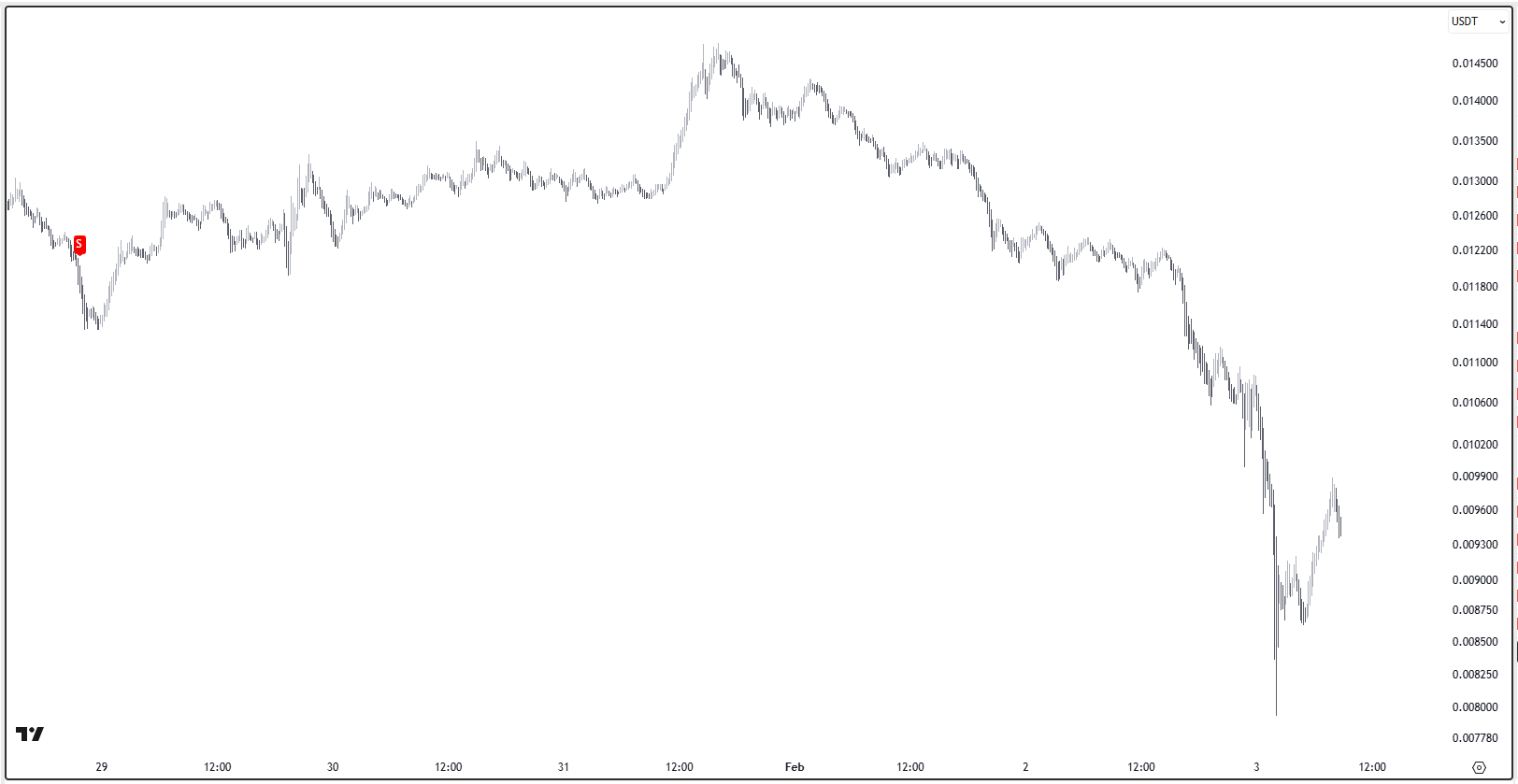

- WIF

- PEPE

Nasdaq 100  USD  BTC  ETH  sol  WIF  pepe see you in the next one. |

No comments:

Post a Comment