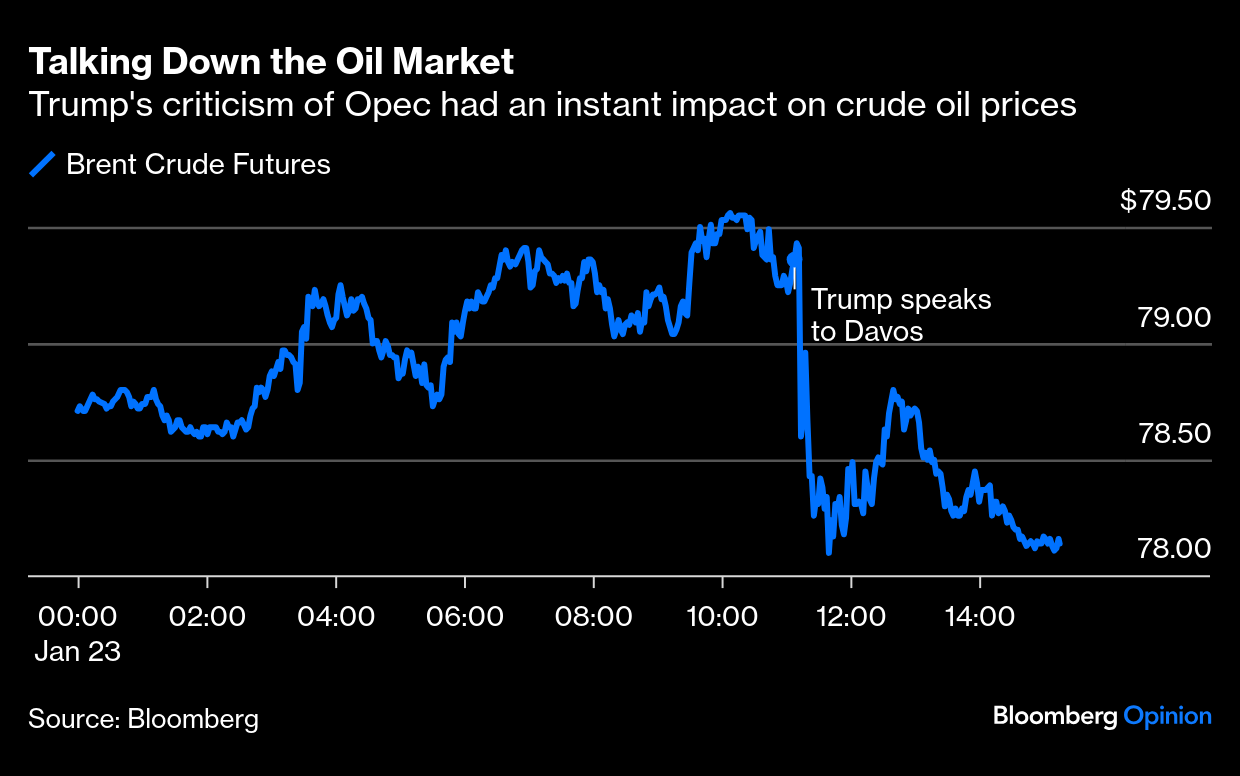

| To get John Authers' newsletter delivered directly to your inbox, sign up here. The newly installed president of the United States has ordered oil prices to come down, and promised that once oil is cheaper, he'll "demand that interest rates drop immediately." He has no formal power to do either of these things, but his words instantly affected oil prices, which fell. This is how the price of Brent crude moved after his comments in an online talk to the World Economic Forum at Davos: We've established, then, that Trump's bark can have a big and immediate effect. The urgent question now is whether his bite will be as bad. On other market-sensitive issues, the president has so far barked more quietly than expected, particularly on tariffs. As US stocks closed Thursday at a first all-time high for the year, a dose of worries apparently vanquished, investors seem to believe that however much he bares his fangs, he won't savage them. Are they right? Economic Uncertainty Trump's latest howl was to address Saudi Arabia and the rest of the Opec oil cartel as follows: You've got to bring it [the oil price] down. With oil prices going down I'll demand that interest rates drop immediately. And likewise, they should be dropping all over the world.

On its face, this is absurd. A US president cannot order a fall in the oil price, which is subject to many forces. Short-term interest rates are set by central banks, and long-term rates by markets. Messaging like this has ratcheted up economic policy uncertainty (as measured by the Baker, Bloom & Davis global index), but somehow without damaging stocks. As the chart shows, uncertainty and the stock market tend to have an inverse relationship, with share prices falling when doubts are high. The only significant exception in recent history was in 2017, the chaotic first year of Trump 1.0, when the S&P 500 sailed through an uneventful rally:  The problem is that early Trump might not be a good precedent, as he has far less leeway this time. "When he came in for his first term, the primary concern was the very slow recovery after the Great Recession," says Will Denyer of Gavekal Economics. "Inflation wasn't really a problem. He correctly recognized that a lot of people felt globalization wasn't working for them. All the Trump 1.0 policies were inflationary. Now it's different. Trump 2.0 might have different policies from Trump 1.0, despite what he's said." That has inspired the bet that he doesn't intend to follow through on his threats. Peter Tchir of Academy Securities pointed to the lack of any clear action on tariffs, his signature policy: It seems obvious to everyone now that this has become a negotiating ploy. He talks about it to rally his supporters but is listening to those who caution him about being too aggressive or too pre-emptive… At this point, it might take actual actions rather than words to move markets.

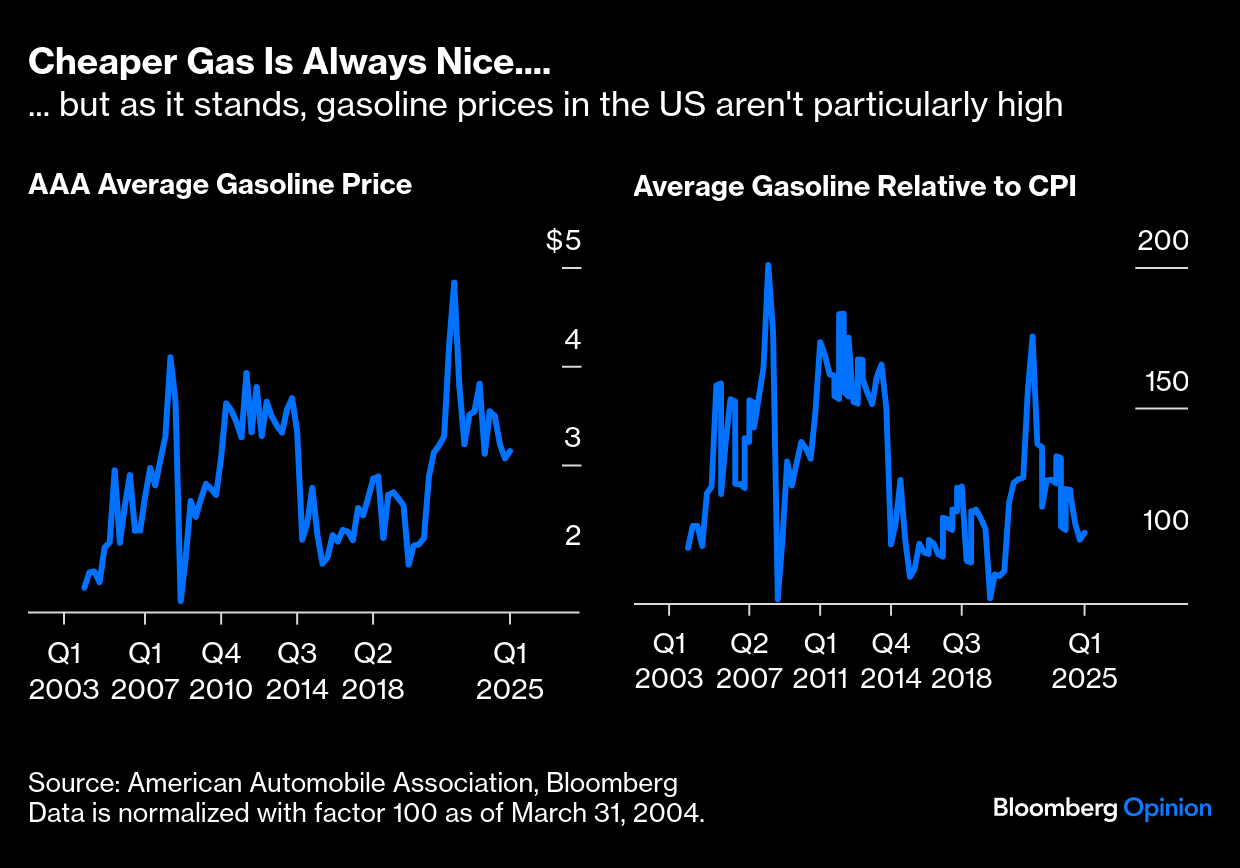

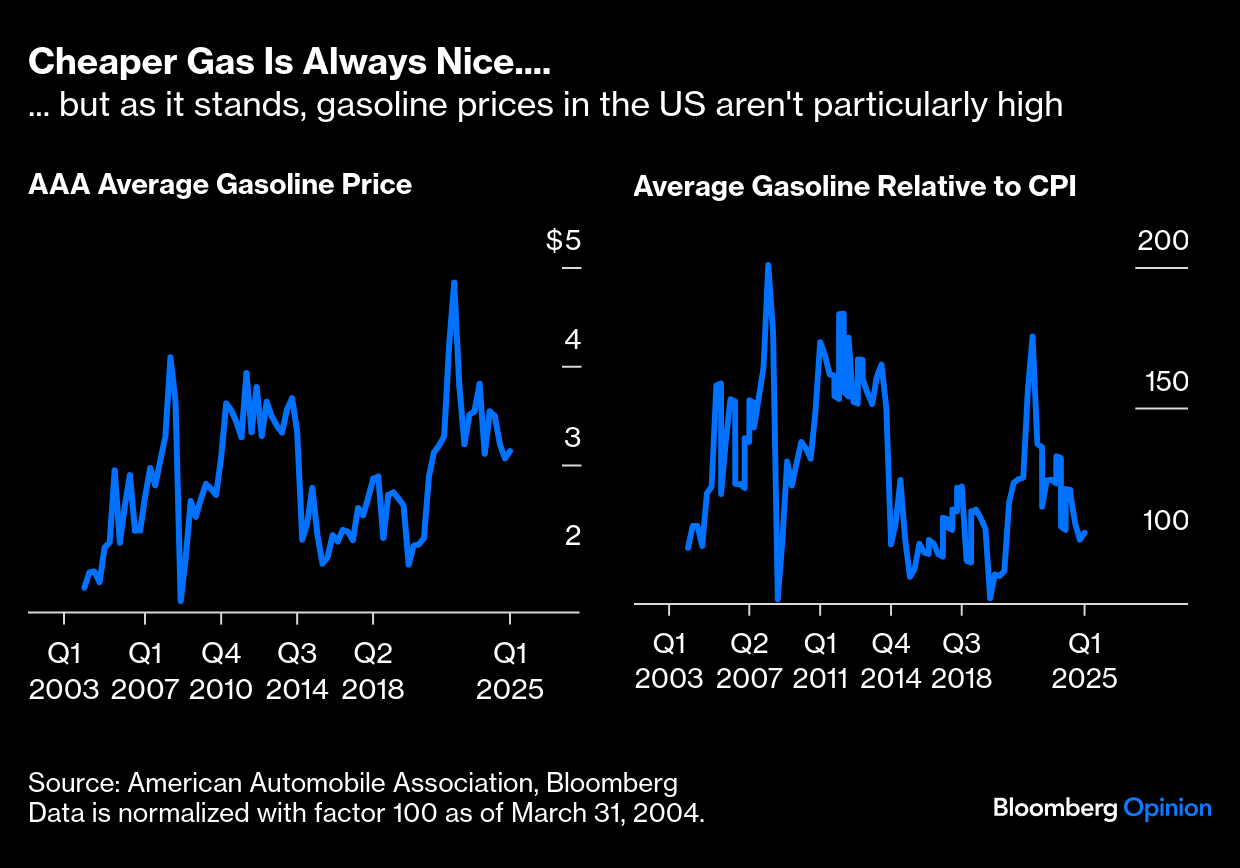

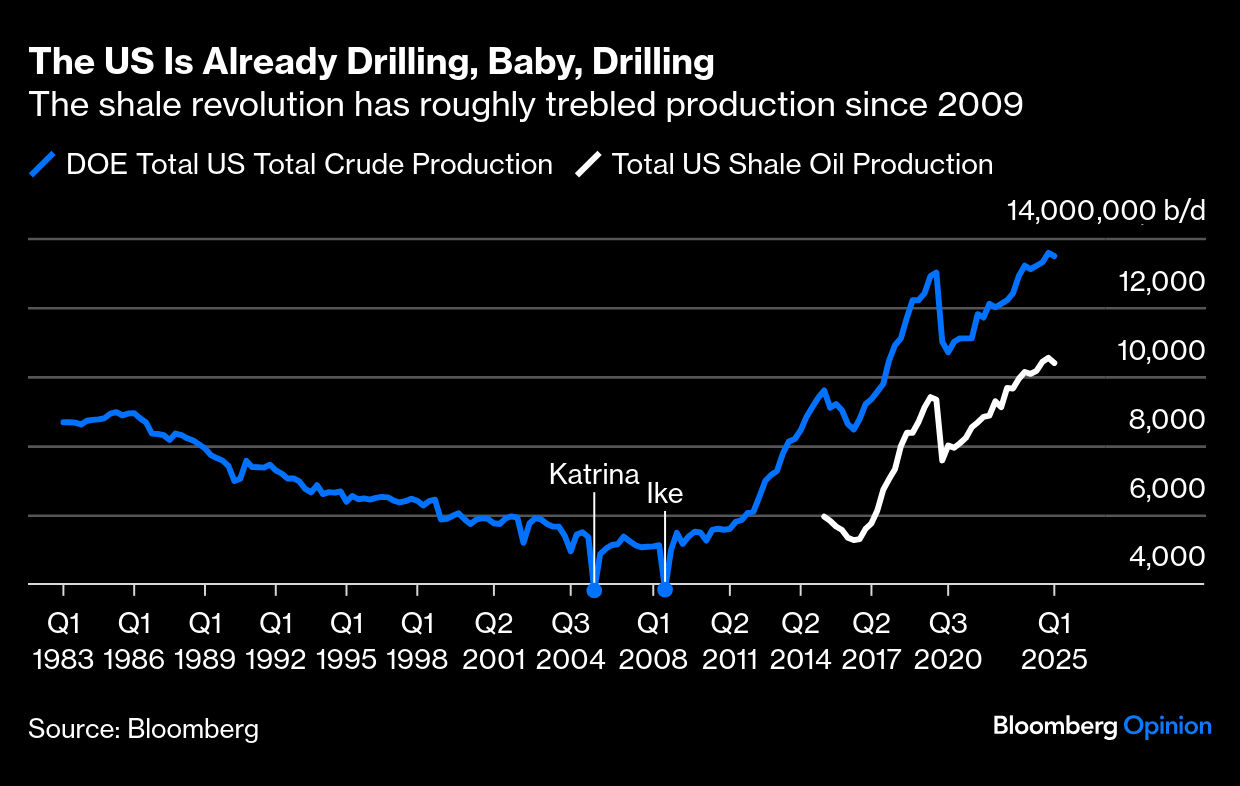

Oil Opec cannot set prices, but it does have the power to exert downward pressure by raising production. This may not be so bad for countries like Saudi Arabia, as it would guard against losing market share. But while cheaper oil makes American voters happier, it's unclear why this is a priority. Hovering at about $3 per gallon, the average gasoline price isn't overextended. Compared to overall inflation, indeed, it is no higher than two decades ago. Recent history shows that in the oil crashes that followed the Global Financial Crisis and the pandemic, the price of a gallon dropped close to $1.50, so there is room to reduce. Maybe it's possible to get to these levels again, but it's an ambitious goal to set as a priority.  Still, it's unclear why the administration is putting so much weight on boosting US production. This is difficult to do unless the price actually rises (as Richard Abbey pointed out earlier this week). In any case, US oil production has never been higher, thanks largely to the shale revolution, which mostly occurred during the Obama presidency (and which has made overall production less vulnerable to hurricanes in the stretch of water formerly known as the Gulf of Mexico). It's difficult to see an "energy emergency" with supply at a record high: As Steve Sosnick of Interactive Brokers said, "The idea of adding supply to an oil market that seems to be adequately supplied at present was not well-received by commodity traders." Rates Apparently referring to Federal Reserve Chair Jerome Powell (appointed by Trump in his first term), Trump told reporters: I think I know interest rates much better than they do, and I think I know it certainly much better than the one who's primarily in charge of making that decision. If I disagree, I will let it be known.

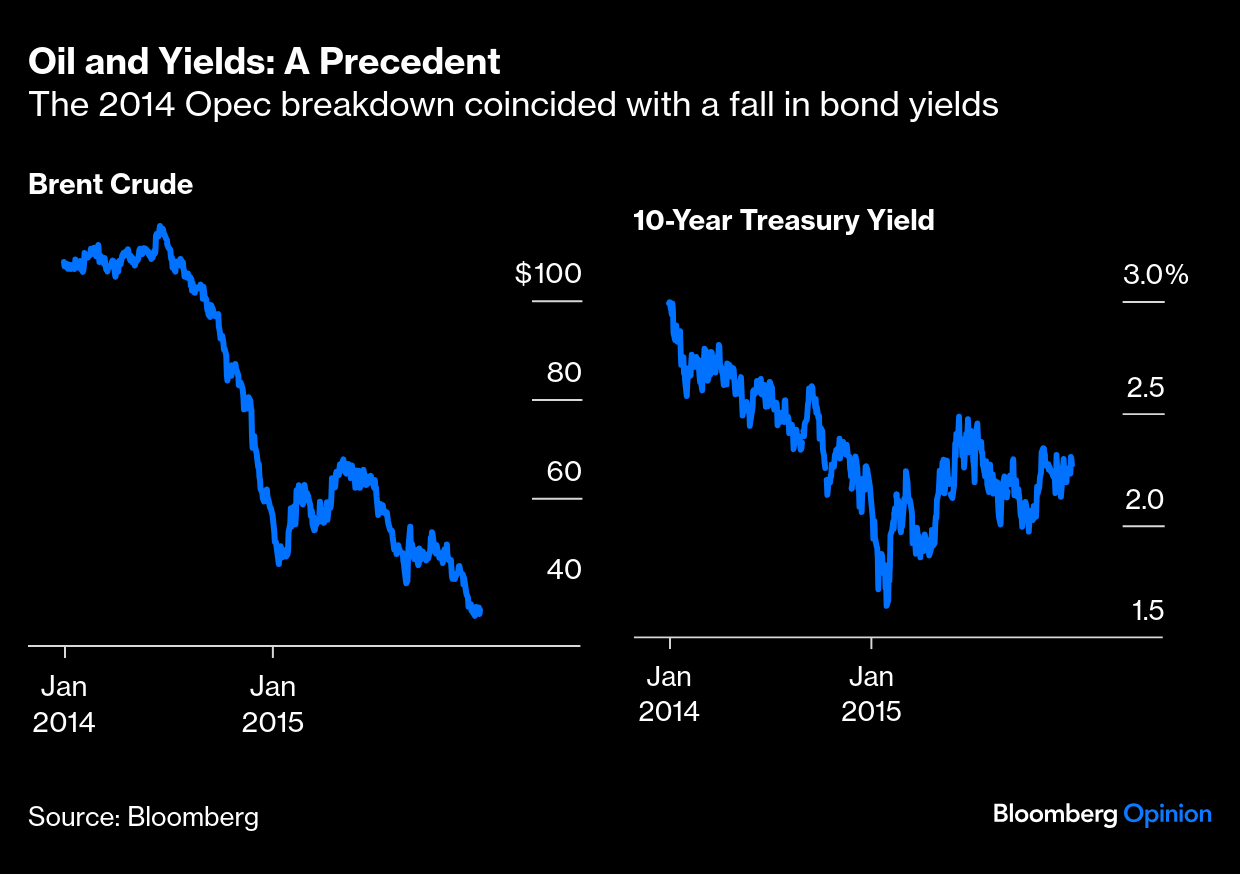

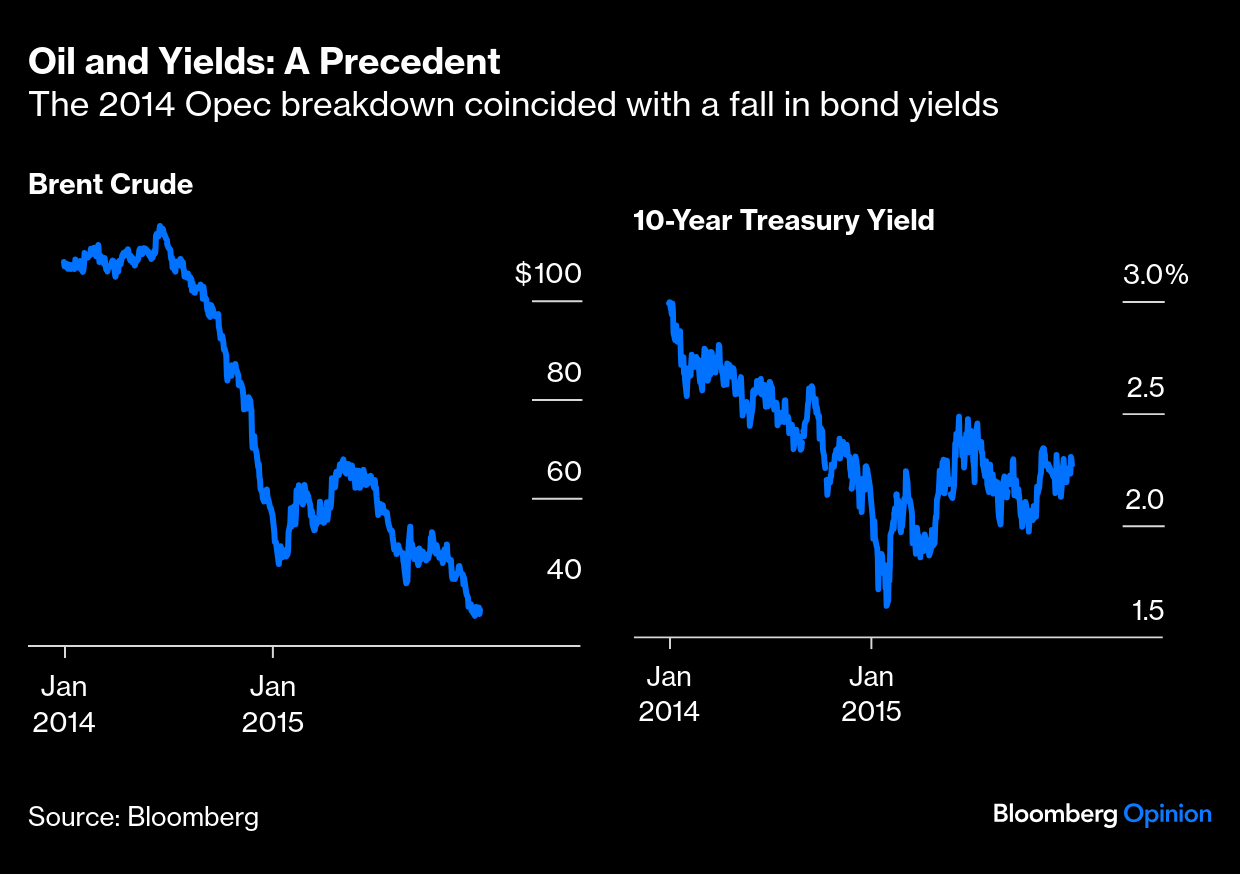

It's true that oil prices and yields tend to move together, with big drops in oil accompanied by falling rates. However, this is often because of a crisis (when both fall together), and both tend to be a function of the broader macro economy. When times are good, both oil and yields will tend to rise. It's not obvious that attacking the oil price in itself will bring down yields, although the case of 2014, when a breakdown in Opec discipline caused a crash in the oil price, is interesting. That time, with the economy not in notably bad shape, yields came tumbling:  Trump would not be the first president to put pressure on the Fed, but his choice of words suggests a looming conflict. Powell's mandate ends in 2026, and the process of replacing him will get underway later this year. For now, Powell can't say much in response. It's also hard for the Fed to set monetary policy without clarity on what's coming from the administration. A growth agenda should make it harder to cut rates, but the central bank can't say that out loud. Vincent Reinhart, chief economist of BNY Wealth and a long-time senior Fed official, put it this way: It's a trapeze-artist problem. You don't leave your platform until your partner has also left their platform. You can't assume political actions that might change policy until they actually happen, because they might not… A politic or cautious Federal Reserve isn't going to raise its head in DC.

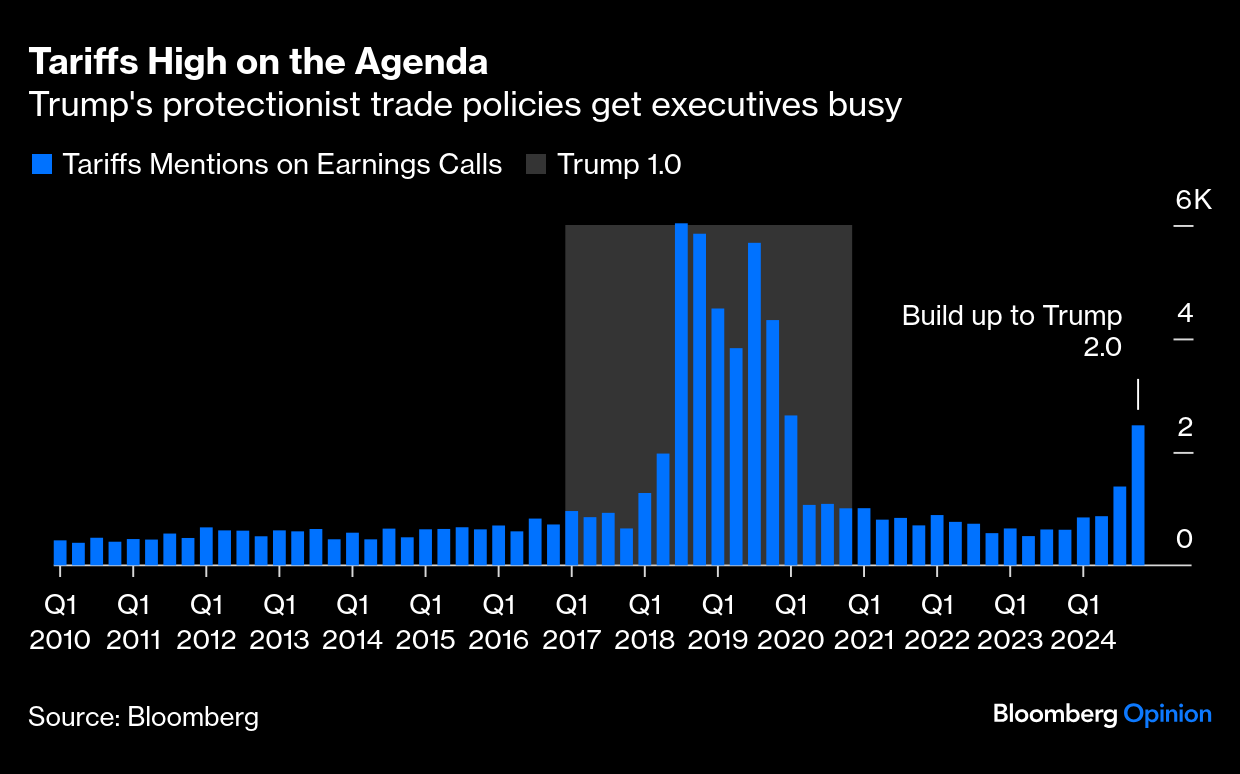

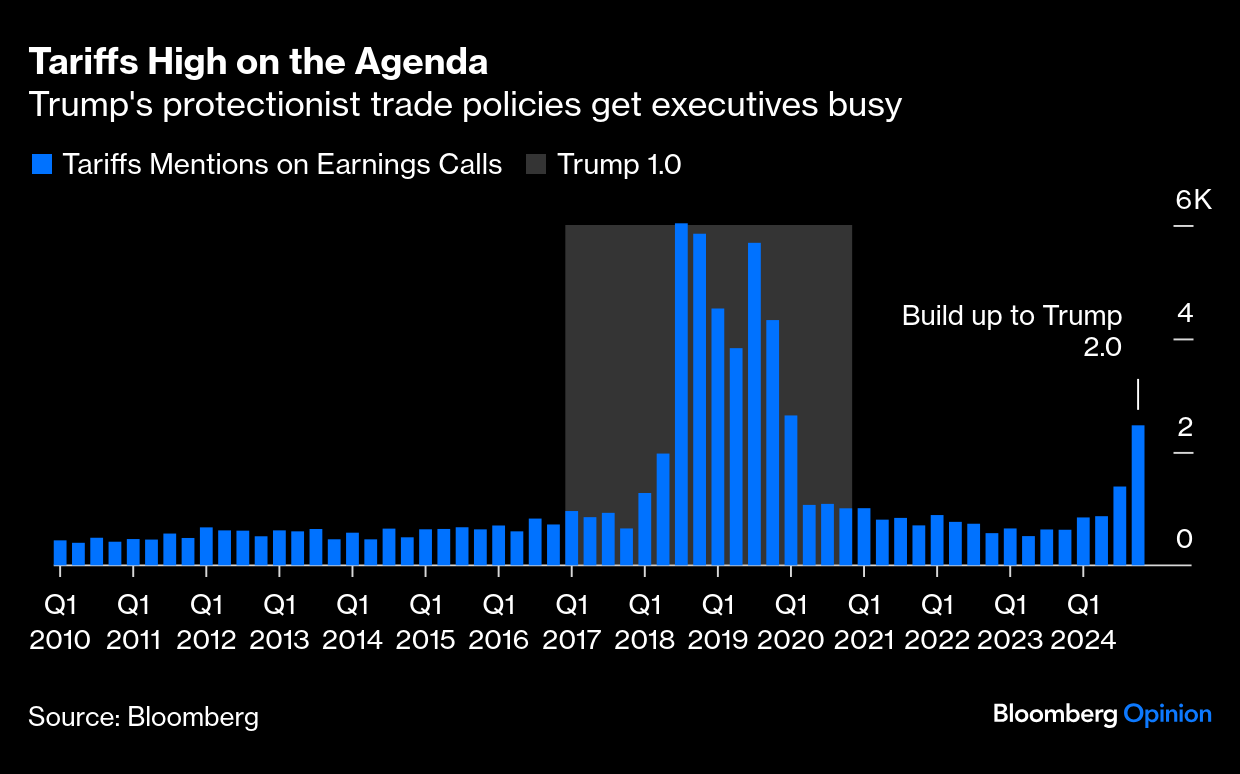

He added that the word "Trump" appears twice in all the transcripts from the two FOMC meetings held since the election. Both times, his name came up from journalists asking questions. It's unlikely the name will come up at next week's meeting either, as Powell will keep his head down. But the risk of a confrontation later this year, which markets would hate, is obvious. Tariffs and Stocks If mean reversion is a thing, then US equities, back to a record, are due for a correction. Timing it, after the S&P 500 set all-time records about 60 times last year, is more difficult. The enthusiastic welcome to Trump suggests that investors believe once more that he'll do the stuff they like (tax cuts and deregulation), but not the stuff they don't — which means a bet that he'll go easy on tariffs, by far the biggest source of uncertainty. To date, he's suggested levies on all of America's top four trading partners, but hasn't backed those threats with any action. Businesses take this seriously. As in his first tenure, executives are starting to talk about it far more:  Under Trump 1.0, tariffs' impact was quite muted, but it might be wishful thinking to predict that again. With inflation higher, imposing tariffs now is not a decision to be taken lightly, and there are signs that even Trump knows this. Nancy Tengler, CEO & CIO of Laffer Tengler Investments, suggests this administration will use tariffs as a rhetorical stick to straighten up its relationships with its largest trading partners. Again, it's sensible to think that as his mandate includes lowering inflation, Trump would not deliberately endanger this: What Trump calls fair vs. free trade. Consequently, we don't expect trade policy to materially drive up already sticky inflation — if at all. It should be noted that on Day 1, Trump announced tariffs on Canada and Mexico (25%) and is talking about 10% on China — not the 60% he was suggesting during the campaign.

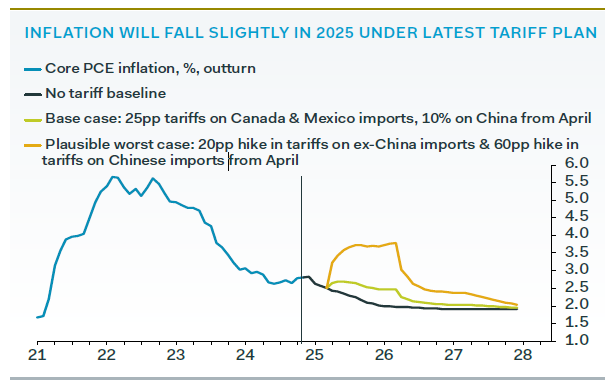

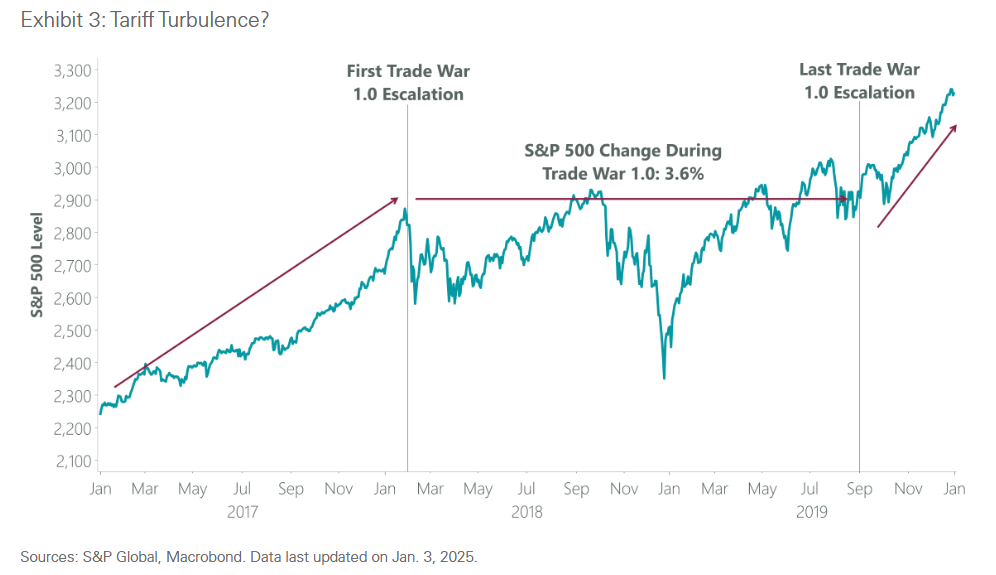

A further argument is that at these levels, tariffs won't make a big impact on inflation — although they are plainly inflationary at the margin. Samuel Tombs, chief economist at Pantheon Macroeconomics, suggests that inflation should fall a bit this year if tariffs stick at 25% on Canada and Mexico and 10% for China — although some of the more extreme numbers Trump has mentioned would have a more drastic effect: Are the concerns about tariffs' impact overblown? Not entirely. In 2018 under Trump 1.0, the S&P 500 had a tough time as tariffs were imposed. Still, Kristina Hooper, Invesco's chief global market strategist, sees their threat as a tool to achieve other policy goals, and expects a different outcome this time. "Tariffs had a temporary impact on the stock market in 2018, so I wouldn't expect new tariffs to impact investors beyond very short time horizons." Further, Trump's deregulation and tax cuts agenda is unambiguously positive for stocks. The problem, argues Jeff Schulze, head of strategy at ClearBridge, is that policy sequencing will be harder, as headwinds from tariffs may become evident well before tailwinds are felt: This progression would be a reversal from the first Trump presidency, when the benefits from deregulation and tax cuts were felt first, before giving way to 18 months of tariff-induced choppiness. Importantly, tariffs should come as less of a surprise to markets this time around, and robust fiscal support to the economy should overpower the tariff drag in subsequent quarters.

The greatest reason for optimism, however, is that markets so far have been able to take the latest Trumpian outbursts in their stride — while always knowing that this president is very keen not to do anything to upset them. As Reams Asset Management's Neil Aggarwal argues, that underlying confidence is in evidence everywhere, and for the time being it is powerful: Both the US strength, the strength of the dollar and US markets, as well as the overall utility within rates markets, as well as earnings, perhaps suggest a volatile ride, but still a bullish or positive outlook for the near term.

Until such point as Trump actually takes a bite out of international trade, rather than barking about it, the rally will probably continue. —Richard Abbey and John Authers It feels a little as though we have been forcibly returned to the 1970s, as the president prioritizes the Panama Canal, picks a fight with Opec, and tries to browbeat the Fed into lower rates. It's not necessarily a happy set of precedents. What were the good things about the 1970s? Well, there was Fawlty Towers, Monty Python, MASH, the Six Million Dollar Man, and the heyday of Saturday Night Live, which is this year celebrating its 50th anniversary. And there was glam rock. Have a good weekend everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Tyler Cowen: How Trump's Protectionism Could Increase Free Trade

- Juan Pablo Spinetto: Trump Will Regret Designating Narcos as Terrorists

- Justin Fox: Are US Taxes Too High or Too Low? Choose Your Chart

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment