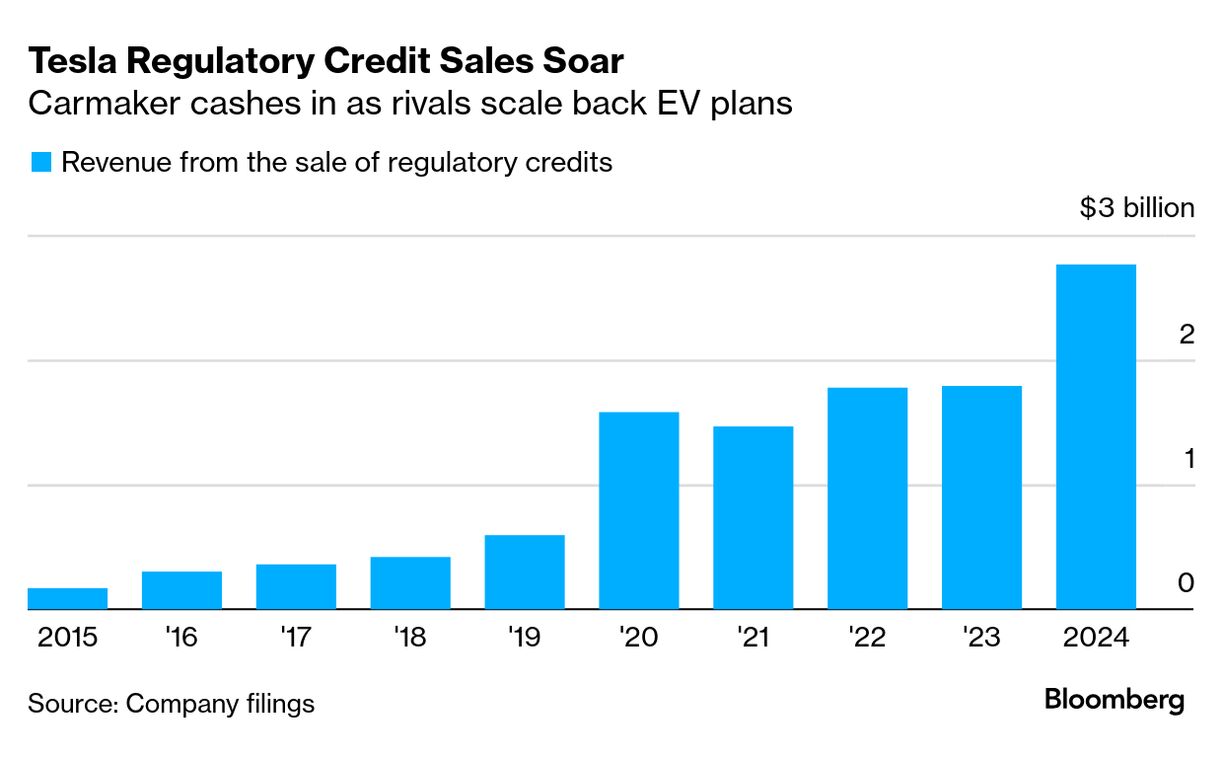

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. A US Senator's Car Crusade | Bernie Moreno's childhood dream was to become chairman of General Motors. He didn't make it to the boardroom, but did get elected to the US Senate, where he's now aiming to wield influence over the auto industry as the chamber's self-proclaimed "car czar." An Ohio Republican who built an empire of auto dealerships, Moreno has his sights on unwinding much of former President Joe Biden's climate agenda: He wants to loosen regulation of the industry where he made his fortune, while also pressuring carmakers to bring more jobs and investment to the US.  Bernie Moreno at a campaign event in October 2024. Photographer: Tom Williams/CQ-Roll Call, Inc. Moreno plans to introduce the Automotive Freedom Act, which would eliminate the leasing loophole for consumer electric-vehicle tax credits while restricting battery production subsidies. He also favors relaxing fuel-economy rules and revoking California's authority to set its own clean air regulations, and said his bill would seek to harmonize fuel-economy and tailpipe pollution limits, creating "one national standard" that extends 10 years. After winning election by positioning himself as an ally of President Donald Trump, he'll champion White House priorities such as pairing corporate tax cuts with tariffs and incentives to encourage domestic manufacturing. Critics worry that Moreno's agenda risks ceding more ground to China in the global shift toward electric vehicles and could worsen climate change. Moreno is keenly aware that blue-collar voters helped power his victory over Democratic incumbent Sherrod Brown and wants to show them he's fighting to deliver on Trump's "America First" vision. That, however, presents a thorny challenge: The tariffs that are a core tenant of Trumpism could push up car prices and sap demand for the auto industry he wants to protect. And while Ohio is a top manufacturer of engines and transmissions, it is also home to major EV and battery factories that could suffer if his proposals were enacted.  GM and LG Energy Solution's Ultium Cells factory in Warren, Ohio. Photographer: Gene J. Puskar/AP Photo His legislative push is hardly assured success: Freshman lawmakers often find it difficult to flex muscle in the Senate, and his party has only slim majorities in Congress. Democrats have little incentive to back a bill that would partially dismantle one of Biden's signature achievements. That leaves Moreno, who spent three decades in the car business, poised for the ultimate test of his salesmanship skills. He's already made outreach to try to build support for the legislation he's crafting, he told Bloomberg in a January interview. That includes conversations with United Auto Workers President Shawn Fain, GM CEO Mary Barra, Ford CEO Jim Farley, and John Elkann and Antonio Filosa, the respective chairman and chief of North American operations for Stellantis. "We're gonna focus like a total laser and President Trump is 100% behind the effort," Moreno said in December while crisscrossing Ohio in a Jeep Grand Wagoneer for a thank-you tour with constituents. "It's his leadership that is leading this movement, which is to have a renaissance of American automobile manufacturing." Moreno's proposal would also eliminate a $7,500 EV tax credit for buyers of new electric cars and a $4,000 credit for used EVs that were part of the Inflation Reduction Act — items many in Washington expect to be debated during a broader budget reconciliation this spring. Moreno said he's offering up his bill as an alternative to the fraught budget battle. "The Democrats have got to make a decision whether they want to see a full repeal of IRA and reconciliation, and maybe that happens either way," he said last week. "But the point of putting it into my bill is that you have a fully comprehensive bill that actually looks to restore automotive manufacturing here in America." His opposition to EV subsidies is shared by many of his party's conservatives. But it could face resistance from some Republicans who have EV factories being built or planned in their districts.  LG Energy Solution and Honda's battery plant under construction in Jeffersonville, Ohio, in August 2023. Photographer: Maddie McGarvey/Bloomberg Courting Democrats could prove even trickier. Moreno also must tread carefully given the potential economic implications for his state. That may explain why he wants to spare the IRA production tax credits known as 45X, but make it harder for companies to qualify by extending the application of restrictive content rules that block materials imported from China. He also indicated he's open to a gradual phaseout of the EV tax credit — a nod to dealers' and automakers' concerns that an abrupt change could saddle them with EVs that become more expensive overnight. Moreno is "somebody who has been there, invested capital, taken risk and understands those competitive dynamics intuitively," said John Bozzella, president of the Alliance for Automotive Innovation, which lobbies for most automakers. Moreno, who was born to a wealthy Colombian family and immigrated to the US when he was four, was fixated on cars long before he joined the industry. When he was 14, Moreno wrote a letter to then-GM Chairman Roger Smith offering bullet-point suggestions for how to fix the company and pledged to someday take the executive's job. Smith was amused enough to reply with a rebuttal, which the senator keeps in a frame. One advantage he brings to Capitol Hill is a close relationship with Vice President JD Vance. Moreno competed for the GOP nomination in the 2022 Ohio Senate race that Vance eventually won. After Trump endorsed Vance, Moreno threw his support behind his onetime rival. He hosted fundraisers for Vance and even played the part of Democratic opponent Tim Ryan during debate prep, recalled Jai Chabria, who was chief strategist for Vance's campaign. Moreno has shown he's not afraid to knock corporate America to prove his MAGA bona fides. In December, he excoriated Stellantis' leadership for mismanaging the company and laying off workers, demanding they spin off their US brands. Industry stakeholders have taken note of that populist streak. "We're looking forward to working with Senator Moreno and anyone else, from any party, who is serious about standing with American auto workers for a better life and a stronger auto industry," Fain said in an email.  UAW President Shawn Fain. Photographer: Tierney L. Cross/Bloomberg Moreno insists he's not against EVs — he says he's for consumer choice and letting the market, not the government, decide what automakers should sell. Others in the auto industry worry that policies that hamper EV adoption stateside will only help China extend its lead over incumbent automakers, who are struggling to gain enough scale to make EVs profitably. Jim Renacci, a former Chevrolet dealer and early Trump supporter who represented Ohio in the House from 2011 to 2019, said Moreno will face an uphill battle in Washington. "When it comes to members of Congress, they all go in with good intentions," Renacci said. "Even though you might believe you're the smartest guy, the best guy, it's so difficult to move things. Because in the Senate, you've got 99 other people who think they are, too." — By Gabrielle Coppola and Steven T. Dennis Since it's been making EVs, Tesla has raked in almost $12 billion straight from the coffers of its competitors. The revenue in question comes from the regulatory credits Tesla generates by selling EVs that comply with increasingly stringent pollution standards governments have set around the world. Automakers that don't sell as many plug-in cars can buy these credits to count toward their compliance. Tesla's regulatory credit business has never been better, with the automaker having just disclosed that it generated a record $2.76 billion in revenue last year alone. This was up 54% from 2023 and driven by demand for credits in North America, the company said Thursday, as other manufacturers scaled back their EV plans. If Donald Trump gets his way, that revenue stream won't flow quite as quickly the next few years. Read More: Tesla's supercharged narrative shreds valuation models. |

No comments:

Post a Comment