| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Lunar New Year is usually a pretty sleepy time for car dealerships in China, as people stop work and head home for the lengthy holiday. This year could be different. That's because this Lunar New Year, which arrives earlier than usual on Jan. 29, coincides with an extension by the government of subsidies encouraging consumers to trade in older, less fuel-efficient vehicles. The policy was in place for much of last year but expired in December, and there wasn't much visibility around whether it would be renewed. Over a dozen carmakers, including Li Auto, Xpeng and IM Motors are now offering even more attractive deals and incentives after more than a year of aggressive price cuts. Over the course of 2024, some 227 vehicle models were discounted, with an average decrease in price of 8.3%, or around 16,000 yuan ($2,200), Cui Dongshu, secretary general of China's Passenger Car Association, said last week. By comparison, carmakers cut sticker prices of 148 models in 2023. The government is extending subsidies in a bid to spark sales as China's economy is threatened by deflationary risks and a seemingly endless housing slump.  A showroom for IM Motors in Shanghai. Photographer: Raul Ariano/Bloomberg It's not just car purchases that Beijing is trying to support. Last week, the government said consumers will this year qualify for a 15% subsidy for buying new mobile phones, tablets and smartwatches under 6,000 yuan. Authorities will also expand the types of home appliances eligible for state support to 12, from eight, to include products such as dishwashers and rice cookers. According to PCA, the cash-for-clunkers program spurred over 3.7 million vehicle purchases last year. My mom happened to be one of them. When I went home for Christmas, we spent the last few days of December looking around car dealerships in Nanjing, a city in eastern China that's home to about 7 million people. Interestingly, despite all the stories that have been written about foreign legacy automakers struggling in China, the showrooms for BMW, Mercedes-Benz and Audi were bustling, with customers eager to explore the potential value of their existing car and learn how they could use that to offset the cost of a new luxury vehicle. That was before the trade-in subsidy was extended, so salespeople were heaping quite a bit of pressure on prospective buyers, warning the policy may be phased out. Generous discounts were being touted too, some as steep as 50%. Unlike Shanghai or Beijing — where battery-electric car buyers are offered free plates, while gasoline-powered vehicle shoppers have to wait under a lottery system and pay a high premium — residents in smaller cities like Nanjing aren't as financially incentivized to go electric. It was surprising to me to see the showrooms of EV makers in the same vicinity quite empty. Another sales tactic on display was touting the risks of buying an EV. A few salespeople pointed to the road congestion during the last Lunar New Year, when EV drivers contended with unexpected battery depletion or lined up for hours to charge amid freezing temperatures. You wouldn't want that to happen to you, they cautioned, as they nudged my mom toward their internal combustion engine cars.  A traffic jam on the Huaian Bridge on the Changzhou-Shenzhen Expressway last Lunar New Year. Photographer: CFOTO/NURPHO Despite such rhetoric, China's EV transition continues to march on. Nationwide, around half the cars sold last year were electric or plug-in hybrids, compared to just 5% in 2019. In the end, my mom settled for a European brand, and the switch to electric will have to wait. But with EVs gaining traction — a recent note from HSBC estimated new-energy vehicles will account for 99% of all car sales in China by 2030 — it won't be long. — By Chunying Zhang - CATL poised to pick banks for second listing in Hong Kong.

- Europe's top pension fund sold Tesla stake over Musk's pay.

- Stellantis puts production decisions on hold due to Trump.

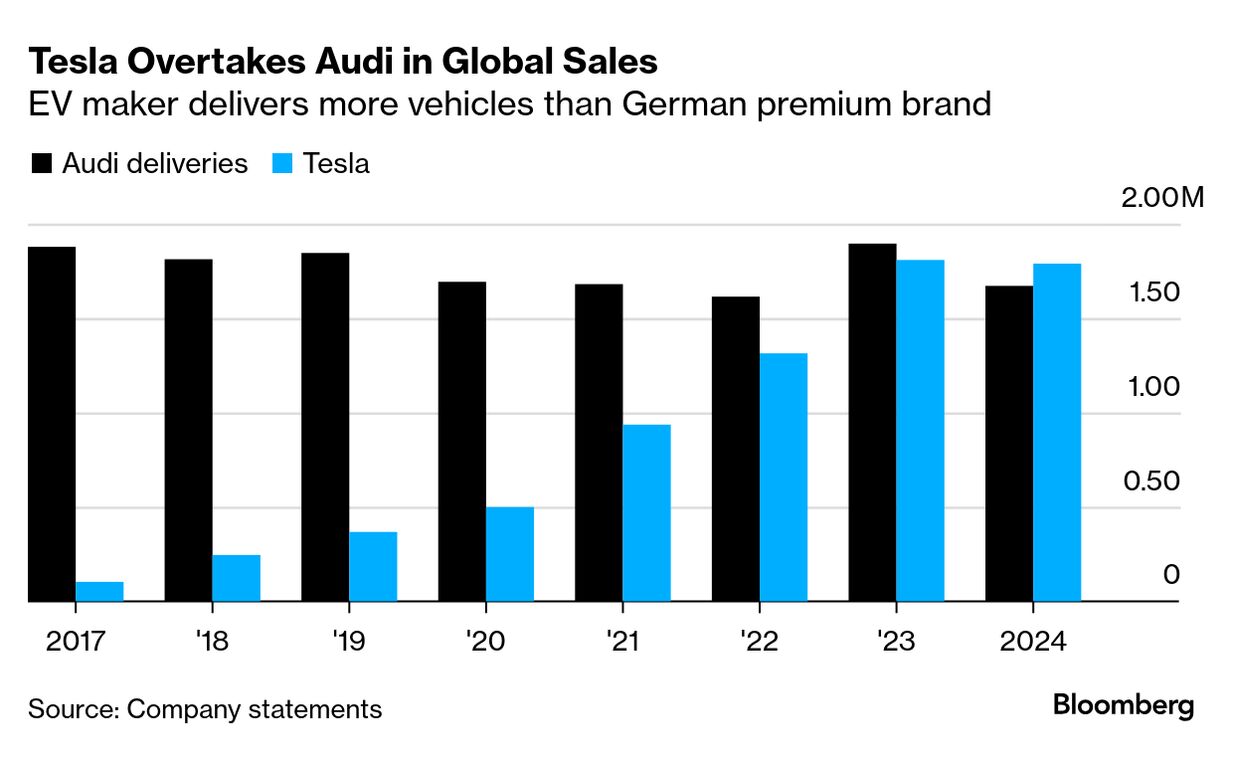

Tesla surpassed Audi last year despite selling fewer vehicles than expected. Audi delivered 1.67 million vehicles in 2024, down 12% from a year earlier. Its struggle with intensifying competition in Europe and China and weak demand for its electric models dropped the brand behind Elon Musk's Tesla, which delivered 1.79 million vehicles. |

No comments:

Post a Comment