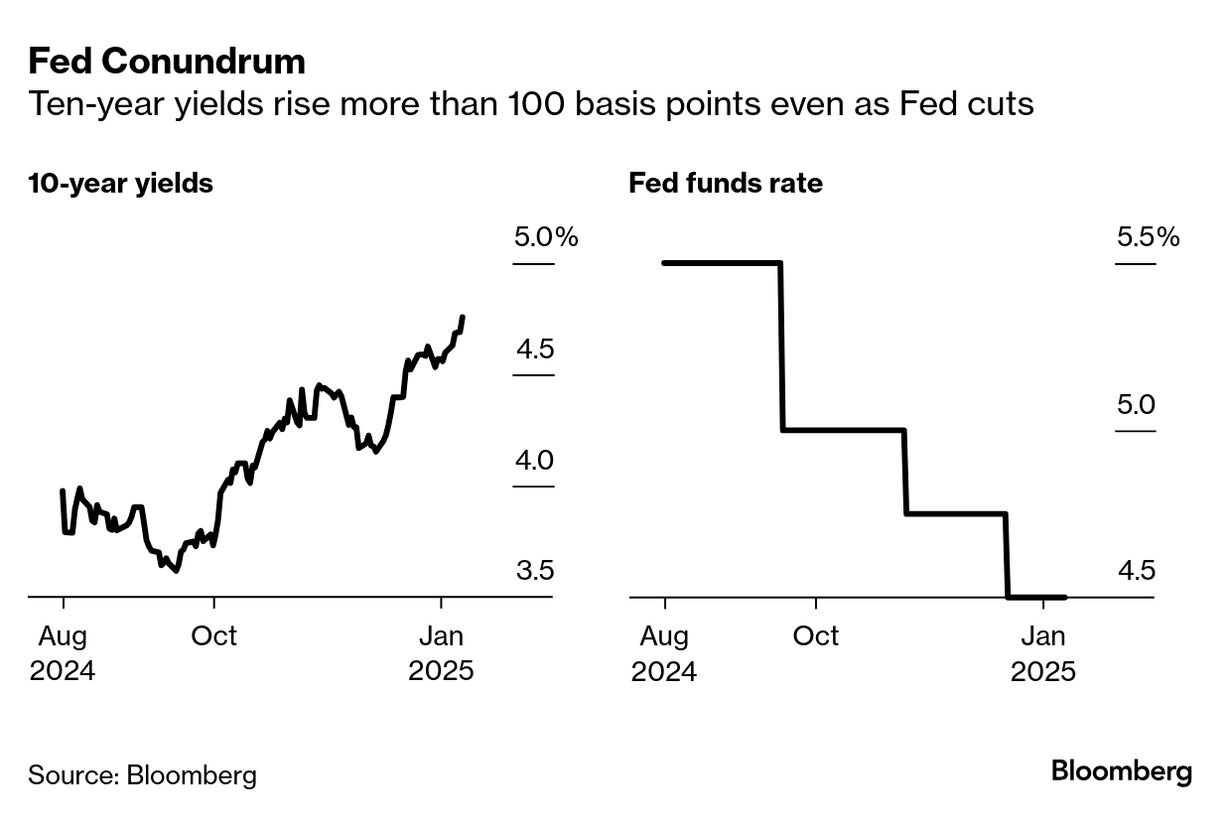

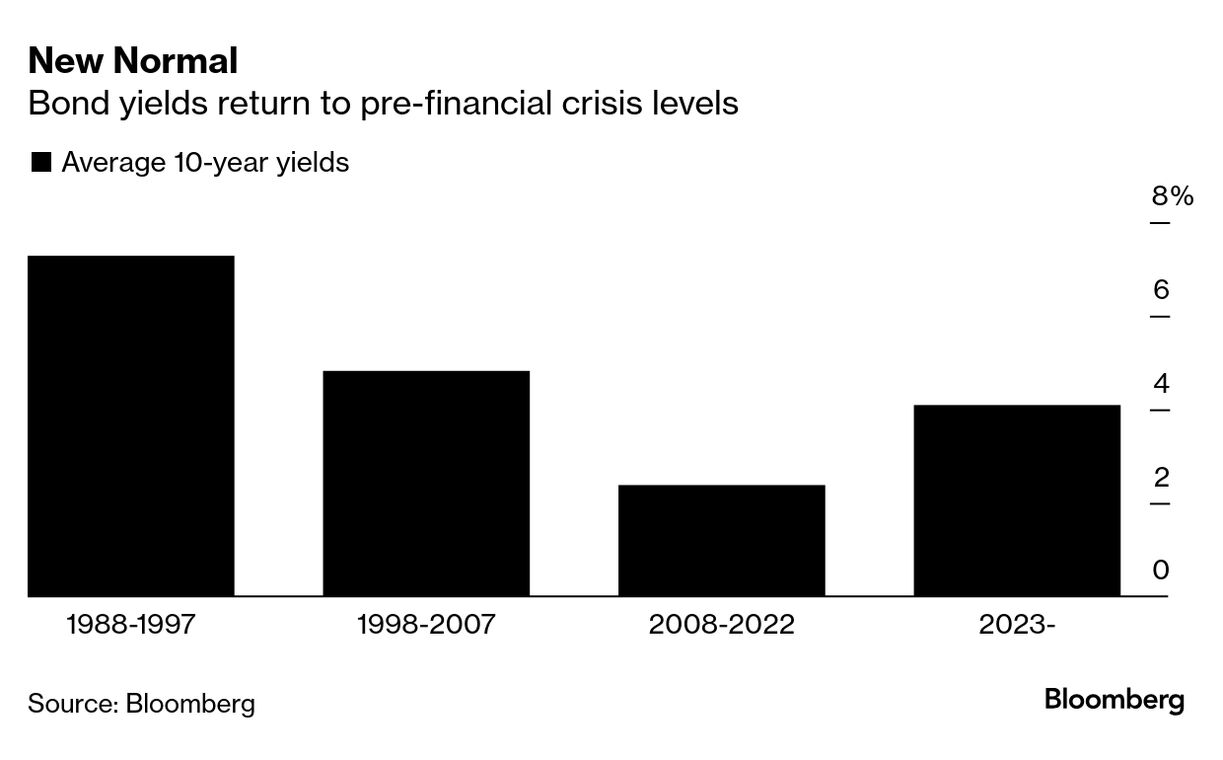

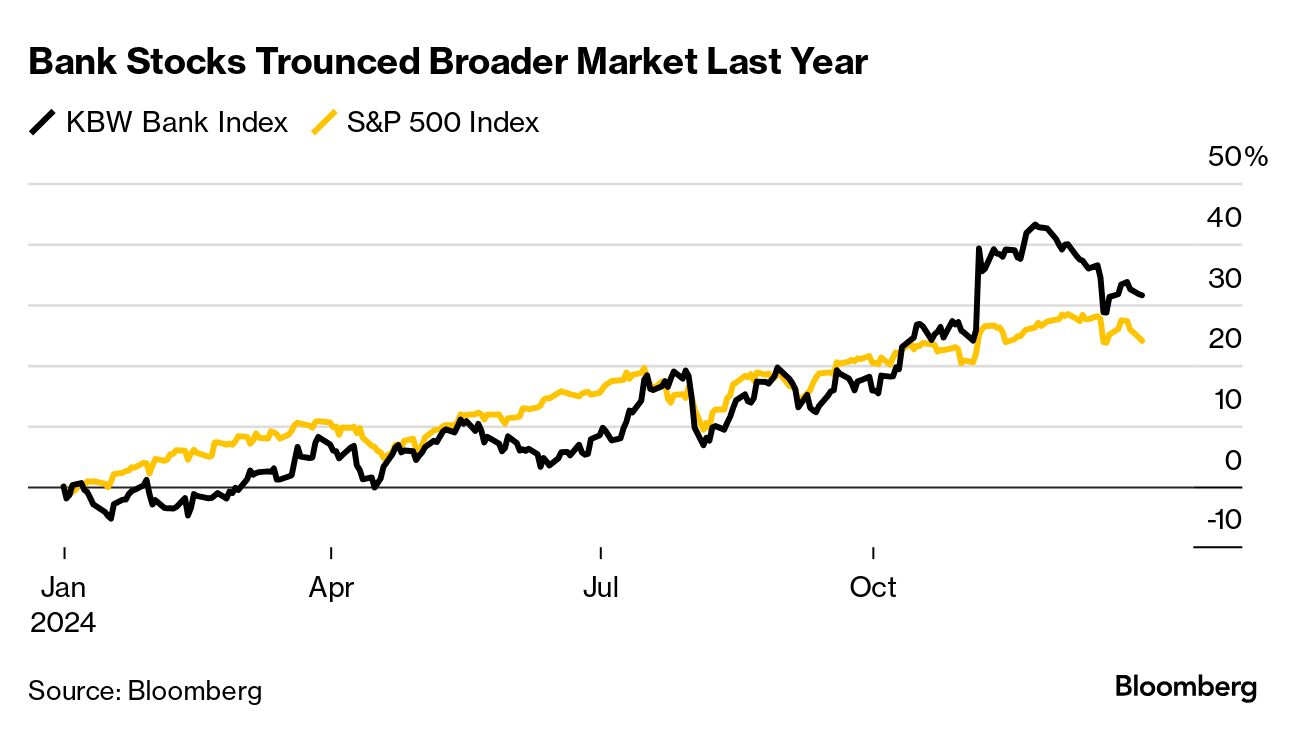

| If strategists at Bank of America are correct, the US bond market is now in the sixth year of the third great bear market since 1790. Few investors would beg to differ after a week in which US Treasury yields soared, propelling the rate on the 10-year note to the brink of the 5% barrier rarely seen since the financial crisis of 2008. Other nations are experiencing a similar exodus from debt. The yield on 30-year UK gilts last week touched the highest since 1998, forcing the new Labour government to start seeking money-saving measures, and UK assets are weak again today. The message from many in markets, and Bloomberg's latest Big Take, is to get used to it: The price of money will be permanently higher as risks to the supposedly safest of assets mount. Friday's blowout jobs report shows the economy continues to power ahead, leaving Bank of America among those on Wall Street now betting the Federal Reserve won't cut interest rates in 2025. Goldman sees two reductions, down from three previously. With data this week set to show inflation is staying sticky (see our week ahead below), central bankers are already signaling they're on hold. And we are now a week away from the second Trump presidency which lands with promises of lower taxes and higher tariffs. That's a recipe, in the opinion of many, for faster inflation and greater debt. A fight also looms over lifting the federal debt limit. Put it all together and it's no wonder the so-called term premium on 10-year notes — the extra yield investors demand to accept the risk of taking on longer-term debt — is now at a decade high. The result is BlackRock, T. Rowe Price and Bianco Research are among those penciling in 5% as a reasonable target for yields amid expectations investors will demand juicier rates to keep buying longer-dated Treasuries. That has implications for other markets, with historians noting the multiple times that higher borrowing costs have accompanied market and economic meltdowns. Stock investors are already nervous the higher yields could bring an end to the tech-led bull run. The spillover in stocks was already apparent Friday as the S&P 500 fell 1.5%. "There is a tantrum-esque type of environment here and it's global," said Gregory Peters, who helps oversee about $800 billion as co-chief investment officer at PGIM Fixed Income. — Michael MacKenzie, Ye Xie, Esha Dey and Bailey Lipschultz |

No comments:

Post a Comment